Trump’s Truth Social Takes a Bold Leap: Is This the Future of Crypto ETFs?

Trump Truth Social ETF, Cryptocurrency Investment Opportunities, Digital Asset Portfolio Management

—————–

Trump’s Truth Social Files S-1 for Revolutionary Crypto ETF

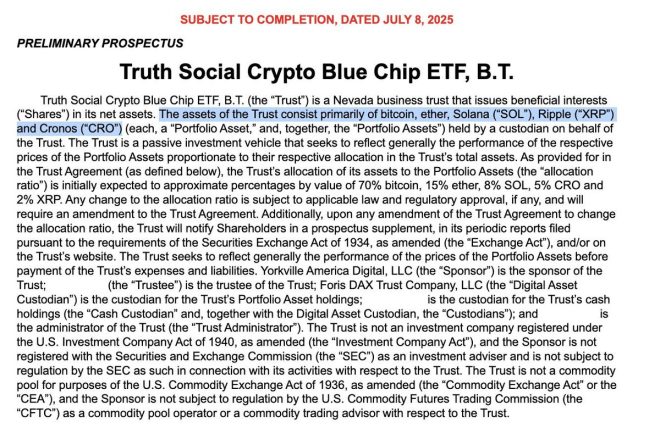

In a groundbreaking development for the cryptocurrency market, Truth Social, the social media platform founded by former President Donald trump, has officially filed an S-1 registration statement for a new exchange-traded fund (ETF). This ETF is being touted as a “Crypto Blue Chip” fund, which aims to hold prominent digital assets, including Bitcoin ($BTC), Ethereum ($ETH), Solana ($SOL), Ripple ($XRP), and Crypto.com Coin ($CRO). This move is poised to shake up the investment landscape, allowing traditional investors to gain exposure to cryptocurrencies through a regulated financial vehicle.

Understanding the Crypto Blue Chip ETF

The term "blue chip" typically refers to well-established companies with proven track records of stability and reliability. By applying this concept to cryptocurrencies, the newly proposed ETF aims to capture the most reputable and widely adopted digital currencies. The ETF’s focus on major cryptocurrencies indicates a strategic approach to mitigate risks while maximizing potential returns in the volatile crypto market.

Reasons Behind the Move

This filing comes at a time when investor interest in cryptocurrencies is surging, with many looking for ways to diversify their portfolios. The ETF format offers a unique advantage by allowing investors to gain exposure to the cryptocurrency market without having to manage the complexities of purchasing and storing digital assets themselves. Additionally, the backing of Truth Social, a platform that has garnered significant attention, could attract a new wave of investors who may be hesitant to enter the crypto space directly.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Key Features of the ETF

The proposed ETF plans to include a basket of cryptocurrencies that are considered blue chips, such as:

- Bitcoin ($BTC): The first and most valuable cryptocurrency, often referred to as digital gold.

- Ethereum ($ETH): Known for its smart contract functionality and widespread use in decentralized applications.

- Solana ($SOL): Recognized for its high-speed transactions and lower fees, making it a favorite among developers.

- Ripple ($XRP): Aimed at facilitating cross-border payments, XRP has established partnerships with numerous financial institutions.

- Crypto.com Coin ($CRO): The native token of the Crypto.com platform, which offers a wide range of cryptocurrency services.

Implications for Investors

The introduction of a Crypto Blue Chip ETF could significantly alter the investment landscape for both individual and institutional investors. It provides an easier entry point into the cryptocurrency market and enhances the legitimacy of digital assets in the eyes of traditional investors. Furthermore, it opens the door for future ETFs that might cater to specific niches within the crypto ecosystem, such as DeFi or NFT-focused funds.

Conclusion

The filing of the S-1 registration statement by Truth Social marks a pivotal moment in the evolution of cryptocurrency investment options. By combining the foundational elements of a blue-chip strategy with the dynamic world of crypto, this ETF has the potential to attract a diverse range of investors while promoting wider acceptance of cryptocurrencies in mainstream finance. As developments unfold, it will be crucial for investors to stay informed and consider the implications of this innovative financial product on their investment strategies.

Stay tuned for more updates on this exciting new venture in the cryptocurrency landscape!

BREAKING $news: TRUMP’S TRUTH SOCIAL FILES S-1 FOR ‘CRYPTO BLUE CHIP’ ETF, WILL HOLD $BTC, $ETH, $SOL, $XRP, AND $CRO pic.twitter.com/uPC32DdEFU

— blockchaindaily.news (@blckchaindaily) July 8, 2025

BREAKING $NEWS: TRUMP’S TRUTH SOCIAL FILES S-1 FOR ‘CRYPTO BLUE CHIP’ ETF

The financial world is buzzing with excitement as former President Donald Trump’s Truth Social platform has officially filed an S-1 registration for a new exchange-traded fund (ETF) focused on what they are calling ‘crypto blue chips.’ This groundbreaking move is not just a play for the crypto market; it signifies a broader acceptance of cryptocurrencies within traditional finance. The ETF is set to hold major cryptocurrencies including $BTC (Bitcoin), $ETH (Ethereum), $SOL (Solana), $XRP (XRP), and $CRO (Crypto.com Coin).

This move positions Truth Social at the intersection of social media and finance, potentially attracting a new wave of investors who are eager to dip their toes into the world of digital currencies. With Trump’s backing, the ETF could draw significant attention, especially from his base, who may be more inclined to invest in a product associated with him.

What is an ETF and Why Does it Matter?

For those unfamiliar, an ETF, or exchange-traded fund, is a type of investment fund that is traded on stock exchanges much like stocks. ETFs hold assets such as stocks, commodities, or bonds and generally operate with an arbitrage mechanism to keep trading close to its net asset value, though deviations can occasionally occur.

The introduction of a cryptocurrency ETF could make it easier for average investors to gain exposure to the crypto market without having to navigate the complexities of buying, storing, and securing cryptocurrencies directly. It simplifies the process and makes investing in digital currencies more accessible to those who might be intimidated by the technology.

What Cryptocurrencies Will the ETF Hold?

The cryptocurrencies mentioned in the filing are some of the most prominent in the market today. Each has its unique characteristics and potential for growth:

– $BTC (Bitcoin): The first and most well-known cryptocurrency, Bitcoin has established itself as a digital gold, serving as a store of value and an investment asset.

– $ETH (Ethereum): Known for its smart contract functionality, Ethereum has become a favorite among developers and businesses looking to build decentralized applications.

– $SOL (Solana): This fast and scalable blockchain has gained popularity for its ability to handle high transaction volumes efficiently, making it a top choice for many DeFi projects.

– $XRP (XRP): Designed for facilitating cross-border payments, XRP aims to provide a faster and cheaper alternative to traditional banking systems.

– $CRO (Crypto.com Coin): This token is integral to the Crypto.com platform, which offers a wide range of cryptocurrency services, including trading, staking, and payment solutions.

Each of these cryptocurrencies has shown a remarkable ability to capture market attention, and their inclusion in the Truth Social ETF could enhance the fund’s appeal.

The Impact of Trump’s Involvement

Donald Trump is a polarizing figure, and his involvement in the crypto space through Truth Social adds an intriguing layer to this ETF. With millions of followers and a loyal base, Trump’s endorsement could lead to significant interest in this financial product.

Given the controversies surrounding cryptocurrencies and their regulation, having a high-profile figure like Trump behind this initiative could also help navigate potential regulatory challenges. It might even encourage more traditional investors to consider crypto as a legitimate asset class.

Moreover, Trump’s history with social media and his known interest in leveraging technology for business could play a vital role in promoting the ETF. This could potentially lead to increased visibility and credibility within the crypto market.

What’s Next for the Truth Social ETF?

As the S-1 filing progresses, there are several steps that Truth Social must undertake before the ETF can officially launch. This includes obtaining approval from the Securities and Exchange Commission (SEC) and addressing any regulatory concerns.

If approved, the ETF could open its doors to investors, allowing them to invest in a diversified portfolio of cryptocurrencies without the need for extensive knowledge of the crypto market. This could democratize access to digital assets and attract a broader audience, including institutional investors who have been cautious about diving into the crypto waters.

It’s essential to keep an eye on how the market responds to this news. If the ETF performs well, it could pave the way for additional cryptocurrency-focused ETFs, further legitimizing the digital currency sector and making it a staple in investment portfolios.

Potential Risks and Considerations

While the launch of a cryptocurrency ETF associated with Truth Social has the potential to be transformative, it’s not without its risks. The volatility of cryptocurrencies is well-documented, and investing in them can lead to significant financial fluctuations.

Moreover, regulatory scrutiny is a constant in the crypto space. As governments worldwide are still figuring out how to approach cryptocurrencies, there is always a chance that new regulations could impact the performance of the ETF. Investors should be aware of these factors and consider them before committing their funds.

Additionally, the reputation of Truth Social and Trump himself could influence the ETF’s performance. If public sentiment shifts or if there are controversies surrounding the platform, it could impact investor confidence and participation in the ETF.

Final Thoughts

The filing of an S-1 for a cryptocurrency ETF by Trump’s Truth Social marks a significant moment in the evolution of digital assets within the financial landscape. With a focus on major cryptocurrencies like $BTC, $ETH, $SOL, $XRP, and $CRO, this ETF could reshape how investors approach digital currencies.

As we wait for further developments, one thing is clear: the intersection of social media and finance is becoming increasingly blurred, and the implications of this ETF could be felt across the investment world for years to come.