Trump’s Shocking Claim: Tariffs “Zero” Impact on Inflation—Powell Called Out!

Trump tariffs impact, inflation control measures, Fed interest rate decisions

—————–

In a recent statement, former President Donald trump has made headlines by asserting that tariffs have had “zero” impact on inflation, a claim that contrasts with prevailing economic narratives. This announcement, shared via social media by Crypto Rover, sparked considerable discussion among economists and political analysts alike. Trump’s comments come at a time when inflation has been a significant concern for many Americans, leading to debates about the effectiveness of tariffs and other economic policies.

### The Context of Trump’s Statement

Trump’s remarks highlight the ongoing discourse surrounding inflation rates in the United States. Since his administration, tariffs on various goods, particularly from China, were implemented as part of a broader strategy to protect American industries. Critics argue that these tariffs have contributed to rising prices, while Trump maintains that they have not influenced inflation levels. His statement suggests a disconnect between his perspective and that of many economists who argue that tariffs can lead to higher consumer prices.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

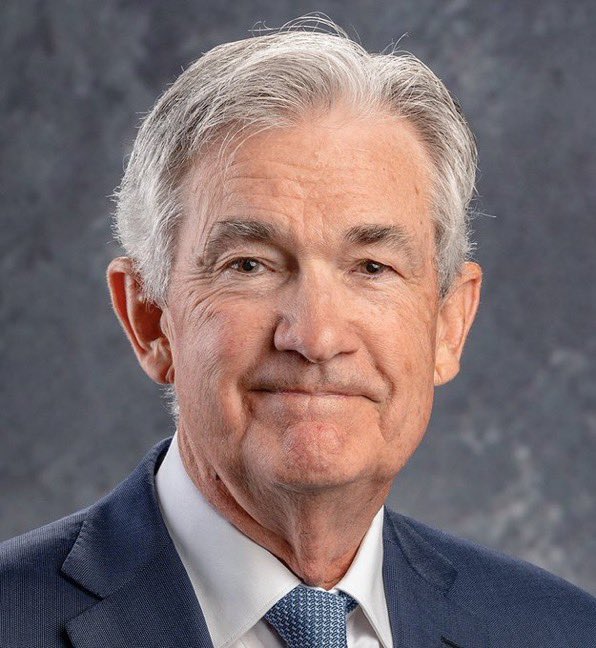

### The Role of Jerome Powell

In his statement, Trump also criticized Jerome Powell, the Chairman of the Federal Reserve, suggesting that Powell has been overly concerned with inflation that Trump deems “non-existent.” Trump’s call for the Fed to cut interest rates further underscores his stance on the current economic climate. Lower interest rates are typically used to stimulate economic growth, particularly in times of perceived economic slowdown.

### Implications for the Economy

The debate over tariffs and inflation is critical as it impacts consumer behavior and business decisions. If tariffs are indeed having no effect on inflation, as Trump claims, this could lead to a re-evaluation of current trade policies. Conversely, if tariffs are contributing to increased costs for consumers, there may be pressure on the government to consider adjustments to these policies.

### Public Reaction and Economic Forecasts

The public’s reaction to Trump’s claims has been mixed, with supporters praising his straightforwardness and critics cautioning against oversimplifying complex economic issues. Economists and market analysts are closely monitoring these developments, as they could influence future Federal Reserve policies and the overall economic landscape. The potential for interest rate cuts, as suggested by Trump, could lead to changes in investment strategies and consumer spending patterns.

### Conclusion

In summary, Donald Trump’s assertion that tariffs have had “zero” impact on inflation has sparked significant debate regarding U.S. economic policy. As inflation continues to be a pressing issue, the discussions around tariffs, interest rates, and the role of the Federal Reserve are critical. Understanding these dynamics is essential for stakeholders across the economic spectrum, from policymakers to everyday consumers. As the situation unfolds, it will be important to track how these statements and their implications affect market behaviors and economic strategies moving forward. For those interested in the intersection of politics and economics, this ongoing dialogue is likely to remain a focal point in the coming months.

BREAKING:

PRESIDENT TRUMP SAYS TARIFFS HAVE HAD “ZERO” IMPACT ON INFLATION.

POWELL “HAS BEEN WHINING LIKE A BABY ABOUT NON-EXISTENT INFLATION FOR MONTHS… CUT INTEREST RATES JEROME.” pic.twitter.com/CnlFn7AVkt

— Crypto Rover (@rovercrc) July 8, 2025

BREAKING:

PRESIDENT TRUMP SAYS TARIFFS HAVE HAD “ZERO” IMPACT ON INFLATION.

In a recent statement that has sent waves through financial and political circles, former President Donald Trump boldly asserted that tariffs imposed during his administration have had “zero” impact on inflation in the United States. This declaration came as he responded to ongoing discussions regarding the current economic landscape and the role of Federal Reserve Chair Jerome Powell in managing inflation rates. Trump’s comments have reignited a debate that has been simmering since the tariffs were first introduced, and many are questioning the validity of his claims.

POWELL “HAS BEEN WHINING LIKE A BABY ABOUT NON-EXISTENT INFLATION FOR MONTHS… CUT INTEREST RATES JEROME.”

Trump didn’t hold back on Powell either, criticizing him for what he described as “whining like a baby” about inflation that he claims is “non-existent.” This kind of rhetoric not only showcases Trump’s typical outspoken nature but also raises eyebrows among economists and policymakers who have been closely monitoring inflation trends. The implications of Trump’s statements are significant, especially as the Federal Reserve considers its next steps regarding interest rates.

Understanding Tariffs and Inflation

So, what’s the deal with tariffs and inflation? Tariffs are taxes imposed on imported goods, and they are often used to protect domestic industries from foreign competition. The idea is that by making imported goods more expensive, consumers will buy more domestic products, thus boosting the local economy. However, the downside is that these tariffs can lead to higher prices for consumers, which can contribute to inflation.

In theory, if tariffs are effective at protecting domestic industries, they might not directly inflate prices. Trump’s assertion that tariffs have had “zero” impact on inflation raises questions about the actual effects of these policies. Are consumers really shielded from the cost increases that tariffs can bring? Economists argue that while tariffs may help certain sectors, they can also lead to higher prices across the board, which is a major contributor to inflation.

The Current Economic Climate

As of now, the U.S. economy is facing various challenges, including supply chain disruptions and labor shortages, which have been exacerbated by the COVID-19 pandemic. The Federal Reserve has been working tirelessly to manage inflation, adjusting interest rates to try to stabilize the economy. Trump’s comments about cutting interest rates suggest a desire for the Fed to take a more aggressive approach to stimulate spending and investment.

When interest rates are lowered, borrowing becomes cheaper, which can encourage businesses to invest and consumers to spend. However, this approach can also lead to higher inflation if not managed carefully. Powell’s cautious stance reflects a balancing act, trying to curb inflation while still promoting economic growth.

The Political Ramifications

Trump’s statements are not just economic commentary; they are also deeply political. By attacking Powell and questioning the impact of tariffs on inflation, Trump is positioning himself as a critic of the current administration’s economic policies. This could resonate with his base, who may feel that the economic challenges they face are not being adequately addressed.

Moreover, this situation highlights the ongoing tension between political leaders and economic policymakers. The President’s influence on economic policy, especially during times of crisis, can shape public perception and political capital. As Trump continues to voice his opinions on inflation and interest rates, it’s likely that these discussions will continue to shape the political landscape leading up to the next election.

Public Perception of Inflation

Public perception of inflation plays a crucial role in shaping economic behavior. If consumers believe that inflation is a significant issue, they may alter their spending habits, which can further exacerbate inflationary pressures. Trump’s dismissal of concerns about inflation could be seen as an attempt to downplay the issue, but it also raises questions about the reality that many Americans are experiencing.

Surveys indicate that a significant number of Americans are concerned about rising prices, particularly for essential goods like food and gas. This perception of inflation can influence everything from consumer spending to investment decisions. As Trump’s comments circulate, they may sway public opinion, but they also risk alienating those who are feeling the pinch of rising costs.

The Role of the Federal Reserve

The Federal Reserve plays a pivotal role in managing the economy, particularly concerning inflation and interest rates. Powell’s position has been to navigate these turbulent waters carefully, aiming to avoid a recession while trying to keep inflation in check. Trump’s critique of Powell suggests a desire for more aggressive action, but such measures come with risks.

Historically, the Fed’s decisions have significant implications for the economy. When interest rates are slashed, it can lead to short-term growth but may create long-term issues if inflation spirals out of control. Powell’s cautious approach aims to strike a balance, but the pressure from political figures like Trump adds complexity to the decision-making process.

The Global Perspective

It’s important to consider the global context when discussing tariffs and inflation. Many countries have faced similar economic challenges in the wake of the pandemic. Trade policies and tariffs can have ripple effects that extend beyond national borders. The interconnected nature of the global economy means that inflation in one country can impact others, making it crucial for policymakers to think strategically.

Additionally, international trade dynamics have shifted, with supply chains becoming more vulnerable due to geopolitical tensions and the pandemic. As countries grapple with these challenges, the interplay between tariffs and inflation will remain under scrutiny.

What’s Next?

Looking ahead, the discourse surrounding tariffs, inflation, and interest rates will likely continue to evolve. As economic conditions change, so too will the arguments from political leaders and economists. Trump’s recent comments have added a fresh layer to this ongoing debate, and it will be interesting to see how they affect public sentiment and policy decisions moving forward.

For now, the focus will remain on how the Federal Reserve responds to these challenges. Will they heed Trump’s call to cut interest rates, or will they continue on their current path to manage inflation? The answers to these questions will shape the economic landscape in the months and years to come.

In the meantime, it’s essential for consumers and businesses alike to stay informed about these developments. Understanding the relationship between tariffs, inflation, and interest rates can help individuals make better financial decisions in an ever-changing economy.

Stay tuned as this story unfolds, and keep an eye on how political rhetoric influences economic reality. Whether you’re a supporter or critic of Trump, one thing is clear: the conversations around inflation and economic policy are far from over.