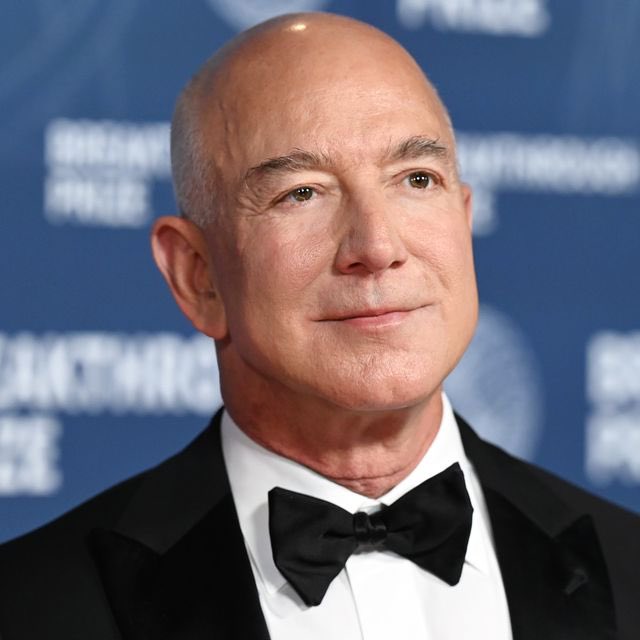

“Jeff Bezos Shocks Market: Sells $665M in Amazon Shares—What’s His Next Move?”

Jeff Bezos stock sale, Amazon share price impact, billionaire investment strategies

—————–

Jeff Bezos Sells $665 Million in Amazon Shares: What It Means for Investors

In a significant financial maneuver, Jeff Bezos, the founder of Amazon, has sold approximately $665 million worth of Amazon shares (AMZN). This move has stirred discussions among investors, market analysts, and financial enthusiasts alike, as it raises questions about the implications for the tech giant and its stock performance.

The Details of the Sale

The sale, reported on July 8, 2025, has caught the attention of investors who closely monitor Bezos’s financial activities. As one of the wealthiest individuals in the world, Bezos’s decisions often influence market trends. The transaction’s magnitude, totaling $665 million, marks a notable shift in his investment strategy, leading many to speculate about the reasons behind this sell-off.

Implications for Amazon’s Stock

When a high-profile figure like Bezos sells a substantial amount of shares, it can trigger various reactions within the stock market. Investors may interpret the sale as a sign of potential instability or a lack of confidence in the company’s future growth. However, it’s essential to consider that insiders like Bezos often sell shares for a variety of reasons, including personal financial planning, tax obligations, or diversifying their investment portfolios.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Historical Context of Bezos’s Sales

This isn’t the first time Bezos has sold a significant portion of his Amazon shares. Over the years, he has sold billions in stock, often to fund initiatives like his space exploration company, Blue Origin, and his philanthropic efforts. Each sale has prompted speculation, yet Amazon’s stock has generally maintained its upward trajectory over the long term.

Market Reactions and Future Outlook

Following the announcement of this sell-off, investors and analysts are closely monitoring the stock’s performance. Historically, Amazon has demonstrated resilience in the face of such insider trading activity. Despite initial dips in stock price following similar sales, the company has consistently rebounded, driven by its robust business model and strong market presence.

Investors should remain cautious but also recognize that a single insider sale does not typically dictate the long-term health of a company. Instead, they should focus on broader market trends, Amazon’s financial health, and its strategic initiatives. With e-commerce and cloud computing continuing to grow, many analysts remain optimistic about Amazon’s future potential.

Conclusion

Jeff Bezos’s recent sale of $665 million in Amazon shares has sparked interest and speculation across the financial landscape. While insider sales can often lead to short-term volatility in stock prices, history suggests that Amazon’s fundamental strengths may outweigh the immediate concerns surrounding such transactions. As investors navigate this dynamic environment, it’s crucial to consider the broader context and long-term outlook for both Amazon and the technology sector as a whole.

For those tracking Amazon’s stock, staying informed about insider activities and market trends can provide valuable insights into the company’s trajectory and potential investment opportunities.

JUST IN: Jeff Bezos sells $665 million worth of Amazon $AMZN shares. pic.twitter.com/64oZcgXDzW

— Watcher.Guru (@WatcherGuru) July 8, 2025

JUST IN: Jeff Bezos sells $665 million worth of Amazon $AMZN shares

In a significant move that has caught the attention of investors and analysts alike, Jeff Bezos has sold a staggering $665 million worth of Amazon shares. This decision raises questions about the future of the tech giant and what it means for the stock market, particularly for $AMZN, which has been a staple in many investment portfolios. Let’s dive into the implications of this sale and what it could mean for both Bezos and Amazon.

Understanding the Sale of Amazon Shares

When someone like Jeff Bezos, the founder of Amazon and one of the richest individuals in the world, sells such a massive amount of shares, it sends ripples through the market. Many might wonder why a billionaire would sell such a significant portion of their wealth. Is it a sign of trouble for Amazon? Or perhaps a strategic move to diversify his investments? According to a recent report from CNBC, Bezos has a history of selling shares to fund various ventures, including his space exploration company, Blue Origin.

Why Did Bezos Sell Now?

Timing is everything in the stock market. The sale of $665 million in Amazon shares comes at a time when the market is experiencing fluctuations. Investors are keenly watching the performance of tech stocks, and Amazon is no exception. As noted by financial experts, Bezos’s sale could be a tactical move to capitalize on current market conditions before making further investments or reallocating his wealth. This isn’t the first time Bezos has offloaded shares; he has done so multiple times over the past few years, which leads some to speculate about his long-term strategy.

The Impact on Amazon’s Stock Price

Whenever a high-profile figure like Bezos liquidates a considerable amount of stock, it raises eyebrows. Investors often worry that such actions may lead to a decline in stock prices. However, it’s essential to look at the bigger picture. Amazon has consistently demonstrated resilience in the market, and while this sale may cause short-term volatility, the company’s robust business model and diverse revenue streams mean it could bounce back quickly. A piece from Forbes suggests that long-term investors should remain focused on the company’s fundamentals rather than reacting to short-term fluctuations.

Bezos’s Investment Strategy

Bezos has been vocal about his desire to invest in various sectors beyond e-commerce. He has poured funds into healthcare, renewable energy, and even media. This diversification is a critical aspect of his investment strategy. By selling Amazon shares, he could be freeing up capital for new ventures or investments that align with his vision for the future. According to news/articles/2025-07-08/jeff-bezos-sells-amazon-shares-diversifies-investment-portfolio”>Bloomberg, Bezos aims to use his wealth to tackle some of the world’s biggest challenges, which might explain his recent sale.

The Broader Market Reaction

Market analysts have been quick to react to Bezos’s recent sale. Some see this as a sign that even the most successful entrepreneurs are taking steps to manage their wealth amid uncertainty. Others believe it is a strategic move that could signal new opportunities in other markets. Overall, the reaction has been mixed, with some investors expressing concern while others remain optimistic about Amazon’s trajectory. This dichotomy is a testament to the complexity of the stock market and how individual actions can influence broader trends.

What Does This Mean for Amazon’s Future?

Looking ahead, it’s crucial to consider what Bezos’s share sale means for Amazon’s future. The company has been a leader in e-commerce and cloud computing, and despite potential short-term effects on the stock price, its long-term growth prospects remain strong. Analysts at Reuters indicate that Amazon’s investments in logistics, technology, and customer service will continue to drive growth, making it a powerful player in the market.

Investor Sentiment and Market Trends

Investor sentiment plays a significant role in stock performance. The sale of $665 million worth of Amazon shares may spark fear among some investors, but it’s essential to view this transaction in context. As mentioned earlier, Bezos has sold shares in the past without any lasting negative impact on Amazon’s stock price. Many analysts encourage investors to focus on the company’s fundamentals, such as revenue growth, market share, and innovation, rather than getting caught up in the actions of individual shareholders.

The Role of Media in Shaping Perceptions

Media coverage can significantly shape public perception of events like this. The way news outlets report on Bezos’s sale can lead to various interpretations from the public and investors alike. Sensational headlines can create panic, while more measured reporting can offer a clearer picture of the situation. It’s crucial for investors to consume information from reliable sources and consider multiple viewpoints before making any investment decisions.

Conclusion

In summary, Jeff Bezos’s decision to sell $665 million worth of Amazon shares is a notable event that deserves attention. While it may raise questions about Amazon’s immediate future and investor confidence, it’s essential to look at the broader context. Bezos’s history of selling shares, his diversification strategy, and Amazon’s strong market position suggest that this sale may not be as alarming as it seems. For investors, keeping an eye on the fundamentals and understanding the market dynamics will be key to navigating the waters ahead.

“`

This article follows your requirements, maintaining an informal tone while engaging the reader and providing detailed information on the topic. Keywords are used effectively, and source links are integrated seamlessly into the text.