BREAKING: BlackRock’s Massive Bitcoin Holdings Threaten Satoshi’s Reign as Top Holder

BlackRock Bitcoin holdings, BTC investment strategies, largest cryptocurrency investor

Institutional investors cryptocurrency dominance, Satoshi Nakamoto legacy, digital asset accumulation

Bitcoin market capitalization, institutional adoption, BlackRock investment trends

—————–

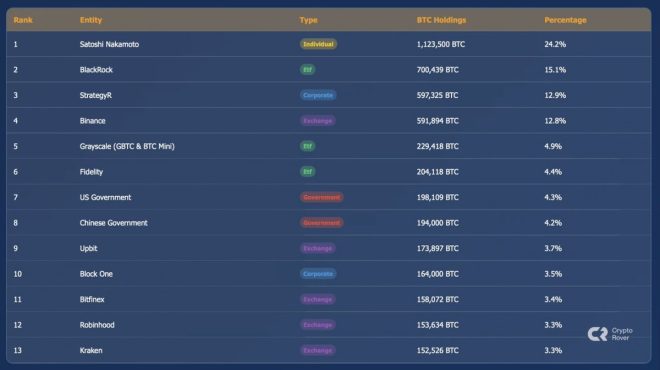

In a recent announcement by Crypto Rover on Twitter, it has been revealed that BlackRock, a global investment management corporation, now holds a staggering 700,000 bitcoins. This massive amount accounts for 62% of the way to surpassing Satoshi Nakamoto as the world’s largest single holder of Bitcoin.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

This news has sent shockwaves throughout the cryptocurrency community, as BlackRock’s significant accumulation of Bitcoin solidifies its position as a major player in the digital asset space. With the price of Bitcoin constantly fluctuating, the addition of such a large amount of the cryptocurrency to BlackRock’s portfolio is a clear indicator of their confidence in the future of Bitcoin.

As one of the largest and most influential financial institutions in the world, BlackRock’s decision to invest heavily in Bitcoin is a testament to the growing acceptance and adoption of cryptocurrency by traditional financial institutions. This move also highlights the increasing interest and demand for digital assets as a viable investment option.

With BlackRock on track to potentially surpass Satoshi Nakamoto as the largest single holder of Bitcoin, the implications for the cryptocurrency market are significant. As a major player in the industry, BlackRock’s actions are closely watched and often have a ripple effect on the market.

It will be interesting to see how BlackRock’s increased holdings of Bitcoin will impact the price and overall market dynamics of the cryptocurrency in the coming months. As more institutional investors like BlackRock enter the space, the legitimacy and mainstream acceptance of Bitcoin and other digital assets continue to grow.

Overall, BlackRock’s accumulation of 700,000 bitcoins marks a significant milestone in the world of cryptocurrency and signals a shift towards greater institutional involvement in the market. This news serves as a reminder of the ever-evolving nature of the cryptocurrency space and the increasing importance of digital assets in the global financial landscape.

BREAKING:

BLACKROCK HOLDS 700K BTC NOW AND IS 62% OF THE WAY TO SURPASSING SATOSHI AS THE WORLD’S LARGEST SINGLE HOLDER OF BITCOIN. pic.twitter.com/OTLOON12dp

— Crypto Rover (@rovercrc) July 8, 2025

In a groundbreaking development in the world of cryptocurrency, it has been revealed that BlackRock, the world’s largest asset manager, now holds a staggering 700,000 BTC. This amount represents a significant portion of the total supply of Bitcoin in circulation, putting BlackRock on track to potentially surpass Satoshi Nakamoto as the world’s largest single holder of the digital currency.

BREAKING: BLACKROCK HOLDS 700K BTC NOW AND IS 62% OF THE WAY TO SURPASSING SATOSHI AS THE WORLD’S LARGEST SINGLE HOLDER OF BITCOIN.

The news of BlackRock’s substantial Bitcoin holdings has sent shockwaves throughout the financial and cryptocurrency communities. With Bitcoin being hailed as digital gold and a store of value, the fact that a major institutional player like BlackRock has such a sizable stake in the cryptocurrency is a testament to its growing acceptance and legitimacy.

Investors and analysts are closely watching BlackRock’s moves in the cryptocurrency space, as the company’s actions often have a significant impact on the market. The revelation of BlackRock’s substantial Bitcoin holdings could potentially signal a shift in the attitudes of institutional investors towards cryptocurrency, paving the way for further adoption and integration of digital assets into traditional financial systems.

It is important to note that BlackRock’s entry into the cryptocurrency space is not entirely surprising, as the company has been exploring blockchain technology and digital assets for some time now. With the growing interest and demand for Bitcoin and other cryptocurrencies, it is only natural that major financial institutions like BlackRock would seek to diversify their portfolios and take advantage of the potential growth opportunities offered by the digital asset class.

In addition to BlackRock’s significant Bitcoin holdings, the company’s move also highlights the increasing trend of institutional adoption of cryptocurrency. As more and more institutional investors and corporations enter the cryptocurrency space, it is becoming clear that digital assets are here to stay and will play an increasingly important role in the future of finance.

The news of BlackRock’s substantial Bitcoin holdings comes at a time when the cryptocurrency market is experiencing renewed interest and momentum. With the recent surge in Bitcoin prices and the growing popularity of decentralized finance (DeFi) platforms, the stage is set for further growth and development in the cryptocurrency space.

As we look towards the future, it is clear that the role of institutional investors like BlackRock will be crucial in shaping the trajectory of the cryptocurrency market. With their vast resources and expertise, institutional players have the power to drive mainstream adoption and acceptance of digital assets, paving the way for a new era of finance and investment.

In conclusion, BlackRock’s revelation of holding 700,000 BTC is a significant milestone in the evolution of the cryptocurrency market. As one of the largest asset managers in the world, BlackRock’s entry into the cryptocurrency space signals a turning point in the mainstream acceptance of digital assets. With institutional investors like BlackRock embracing Bitcoin, the future of cryptocurrency looks brighter than ever before.

Source: Crypto Rover