Trump Proposes Controversial Tax Cuts: Who Really Benefits from $150K Plan?

tax reform proposals, income tax relief, economic policy 2025

—————–

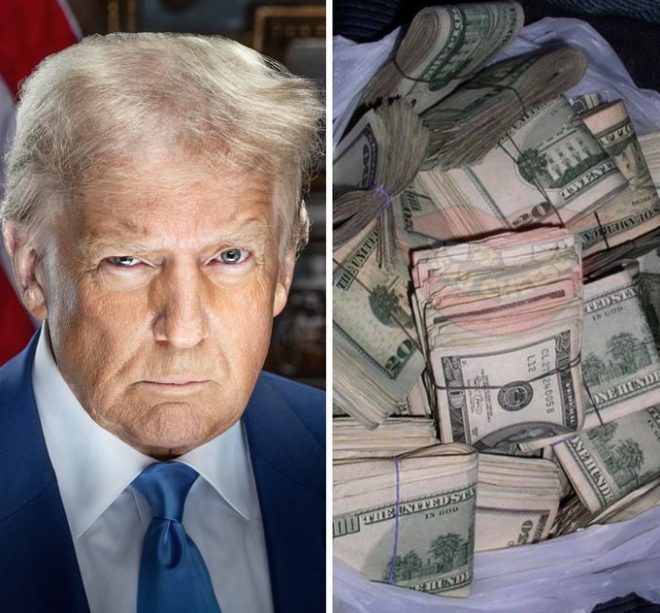

President trump‘s Proposal to Eliminate Taxes for Low-Income Earners

In a recent tweet from a parody account, a bold assertion regarding President Donald Trump’s tax policy has surfaced, claiming he wants to eliminate taxes for individuals earning less than $150,000 a year. This proposal, which has sparked a significant reaction across social media platforms, raises critical questions about tax reform, economic impact, and the political landscape as the nation approaches an election cycle.

The Proposal Explained

The suggested tax elimination for those earning under $150,000 aims to alleviate financial burdens on middle and lower-income families. Advocates argue that such a move could stimulate economic growth by increasing disposable income, allowing families to spend more on goods and services. This economic boost could, in theory, lead to greater job creation and a healthier economy.

However, the proposal also raises concerns about the implications for government revenue. Tax cuts of this nature would significantly reduce federal income, potentially leading to cuts in essential services and programs that many low-income individuals rely on. Critics argue that while the intent may be to help those struggling financially, the long-term consequences could hinder the government’s ability to fund vital infrastructure, education, and healthcare services.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Social Media Reactions

The tweet has garnered a mix of support and skepticism from followers. Some users expressed enthusiasm, viewing the proposal as a significant step towards economic equity. They argue that eliminating taxes for lower earners could help bridge the wealth gap and provide relief to those facing financial challenges.

Conversely, others have criticized the proposal as unrealistic or politically motivated, suggesting that such tax cuts could be merely a tactic to garner support ahead of upcoming elections. The discussion has ignited debates on social media, with users expressing their viewpoints through a flurry of comments and shares.

Economic Context

Understanding the broader economic context is crucial when evaluating the potential impacts of Trump’s tax proposal. The U.S. economy has faced numerous challenges in recent years, including inflation, job market fluctuations, and the aftereffects of the COVID-19 pandemic. A tax elimination for lower-income earners could provide immediate relief but may also necessitate a re-evaluation of how essential government services are funded.

Economic experts warn that while tax cuts can offer short-term relief, the long-term fiscal health of the nation must be considered. A balanced approach that addresses the needs of low-income families while ensuring sustainable government revenue is essential for fostering a stable economic environment.

Conclusion

In summary, President Trump’s proposal to eliminate taxes for individuals earning under $150,000 has prompted varied reactions and discussions about its feasibility and implications. While it offers a potential avenue for economic relief for many, the broader consequences on government revenue and essential services cannot be overlooked. As the political landscape evolves, this proposal may shape future tax reform discussions, highlighting the ongoing debate between economic growth and fiscal responsibility.

As the nation continues to grapple with economic challenges, understanding the complexities of such tax policies will be critical for voters and policymakers alike. The conversation surrounding this proposal is likely to persist, influencing public opinion and political strategies in the months ahead.

BREAKING: President Donald Trump wants to eliminate taxes for anyone who makes less than $150,000 a year.

What’s your reaction? pic.twitter.com/O5MJ775qdK

— Donald J. Trump – Parody (@trumprealparody) July 6, 2025

BREAKING: President Donald Trump wants to eliminate taxes for anyone who makes less than $150,000 a year.

In a surprising announcement that has quickly taken social media by storm, former President Donald Trump has proposed a bold plan to eliminate taxes for individuals earning under $150,000 annually. This proposal, shared via the Twitter account of a parody account, has sparked a heated debate among citizens, economists, and political analysts alike. But what does this really mean for the average American? And how might it reshape the landscape of American taxation?

What’s Your Reaction?

Reactions to Trump’s tax elimination plan have been mixed, with some people celebrating the potential relief it could offer to middle-class families, while others raise concerns about the broader implications for government revenue and social services. Many Americans are likely asking themselves: How would this affect my finances? Would it actually improve my quality of life? These are important questions that deserve a closer look.

The Potential Economic Impact

Eliminating taxes for earners below $150,000 could provide a significant boost to disposable income. For families trying to make ends meet, every dollar counts. The extra money could mean more spending on essentials, saving for a home, or even investing in education. According to a recent CNBC article, such tax cuts could incentivize consumer spending, which has a ripple effect on the economy.

However, there’s a flip side. Critics argue that cutting taxes for a large portion of the population could severely limit government funding for critical services such as education, healthcare, and infrastructure. If the government collects less revenue, how will it fund programs that many Americans rely on? This is a vital aspect to consider when weighing the pros and cons of Trump’s proposal.

Political Ramifications

Trump’s tax plan is sure to be a hot topic as the 2025 election draws near. Supporters might see this as a way to galvanize his base, especially among working-class voters who could benefit directly from such a policy. On the other hand, opponents might frame this as a reckless maneuver that prioritizes the wealthy and undermines public services. The political landscape is already polarized, and this proposal could widen the divide even further.

Historical Context of Tax Cuts

To better understand the implications of Trump’s tax proposal, it’s useful to look at historical precedents. Tax cuts have been a recurring theme in American politics. For instance, during Ronald Reagan’s presidency in the 1980s, significant tax cuts were implemented with the promise of stimulating economic growth. While some argue that these cuts helped boost the economy, others claim they contributed to increasing income inequality.

In more recent times, the Tax Cuts and Jobs Act of 2017, which reduced corporate tax rates and provided temporary cuts for individuals, faced similar scrutiny. Critics pointed out that while the tax cuts did provide immediate relief, they also led to increased federal deficits and a growing national debt. The challenge with any tax policy is balancing the need for economic growth with the responsibility of funding government services.

The Voices of Everyday Americans

As Trump’s proposal gains traction, it’s essential to consider the voices of everyday Americans. Many individuals earning less than $150,000 may feel a sense of optimism at the prospect of eliminating their tax burden. This demographic often feels squeezed by rising living costs, stagnant wages, and increasing debt. A tax break could feel like a breath of fresh air, providing immediate financial relief.

However, it’s important to listen to the concerns of those who worry about the long-term effects of such a policy. Will the government be able to maintain essential services without adequate funding? Will the wealthy benefit more from this plan than the average worker? These are questions that need to be addressed to create a comprehensive understanding of the proposal’s impact.

Public Opinion Polls

Polling data could provide insight into how the American public feels about Trump’s tax elimination plan. According to a Pew Research Center survey, many Americans are in favor of tax cuts, especially for the middle class. However, when it comes to cutting taxes for higher earners or eliminating taxes altogether, opinions become more divided. Public sentiment is often influenced by political affiliation, income level, and geographical location.

Long-term Economic Strategies

While eliminating taxes for those earning less than $150,000 may seem appealing, it raises a fundamental question about long-term economic strategy. Is this a sustainable solution, or merely a quick fix? Experts argue that a comprehensive approach to tax reform should involve not only cuts but also a reevaluation of tax brackets, corporate taxes, and loopholes that benefit the wealthy. A well-structured tax system can promote fairness and encourage economic growth.

The Role of state Taxes

It’s also important to consider the role of state taxes in this discussion. Many states have their own tax structures, which could complicate the implications of a federal tax elimination plan. For instance, some states have high income taxes that could offset the benefits of federal tax cuts. Understanding the interplay between federal and state taxes is crucial for assessing the overall impact of Trump’s proposal on American households.

Looking Ahead

As discussions around Trump’s tax elimination plan continue to unfold, it’s clear that this is just the beginning of a broader conversation about taxes in America. Whether you support the idea or have reservations, it’s essential to stay informed about the potential consequences. Engaging in discussions with friends, family, and community members can help shape your perspective and contribute to a more nuanced understanding of the issue.

Ultimately, the question remains: How will this proposed tax elimination shape the future of American society? Only time will tell, but one thing is for sure: the conversation is just getting started, and every American has a stake in it.