“Shockwaves as Top Firm Withdraws Tesla Support Amid Musk’s Political Move!”

investment firm news, Tesla ETF delay, Elon Musk political party

—————–

Major Investment Firm Withdraws Support from Tesla Following Elon Musk’s Political Party Announcement

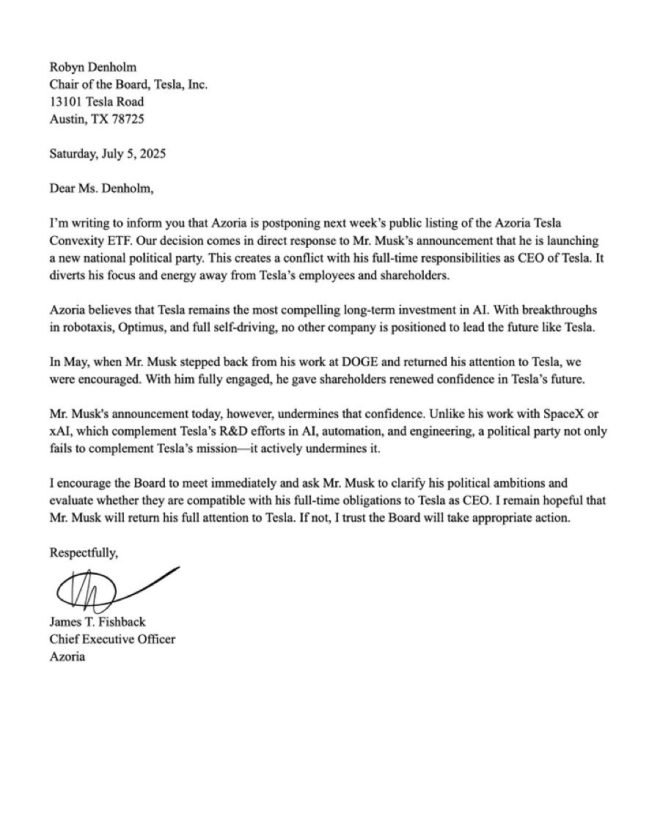

In a significant development within the financial and tech sectors, a leading investment firm has opted to withdraw its support from Tesla and its CEO, Elon Musk. This decision comes on the heels of Musk’s recent announcement regarding the formation of a new political party, which has sparked widespread discussion and concern among investors. The firm’s move has also resulted in the delay of the highly anticipated public listing of the Azoria Tesla Convexity ETF, a financial product that was expected to draw substantial investor interest.

Elon Musk, known for his controversial statements and actions, has always been a polarizing figure in both the tech industry and the political landscape. His foray into politics, particularly with the establishment of a new political party, has raised eyebrows and prompted reactions from various stakeholders. The announcement has not only affected public perception but has also had tangible repercussions in the financial markets. Investors are often wary of political affiliations and their potential impact on corporate governance and stock performance, which likely influenced the investment firm’s decision to withdraw support.

The Azoria Tesla Convexity ETF was designed to leverage Tesla’s growth potential while providing investors with a unique opportunity to diversify their portfolios. The ETF aimed to capitalize on Tesla’s innovations in electric vehicles, energy solutions, and autonomous driving technology. However, the recent political developments surrounding Musk have led to uncertainty about the future trajectory of Tesla as a company, prompting the investment firm to rethink its strategy.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

This withdrawal highlights the intricate relationship between political movements and corporate investments. Investors are increasingly focused on the broader implications of corporate leadership decisions, particularly when those decisions intersect with political ideologies. The hesitation to proceed with the Azoria Tesla Convexity ETF listing reflects a growing trend among investors to assess not only the financial viability of a company but also its political affiliations and the potential risks associated with them.

Impact on Tesla and Future Outlook

The ramifications of this decision are vast. For Tesla, losing the backing of a major investment firm could lead to a decrease in stock prices and investor confidence. This could also hinder the company’s ability to raise capital for future projects and innovations. As Tesla continues to push boundaries in the electric vehicle market, maintaining investor trust will be crucial for its sustained growth.

Looking ahead, the future of both Tesla and the Azoria ETF will largely depend on how Musk navigates his new political venture and its implications for the company. Should he manage to reconcile his political ambitions with the interests of investors, it could pave the way for renewed support and investment. Conversely, if the political landscape continues to create uncertainty, Tesla may face more significant challenges in attracting investment.

In conclusion, the withdrawal of support from a major investment firm underscores the delicate balance between business and politics. As Elon Musk embarks on this new political journey, stakeholders will be closely monitoring the implications for Tesla and its financial products. Investors will need to remain vigilant and adaptable in response to the evolving landscape surrounding one of the most influential figures in the tech industry.

BREAKING: Major investment firm pulls support from Tesla and Elon Musk, delaying the Azoria Tesla Convexity ETF public listing after his new political party announcement. pic.twitter.com/2EkOfSXLvW

— Officer Lew (@officer_Lew) July 6, 2025

BREAKING: Major investment firm pulls support from Tesla and Elon Musk, delaying the Azoria Tesla Convexity ETF public listing after his new political party announcement

In a surprising twist that has sent shockwaves through the investment community, a major investment firm has decided to withdraw its support from Tesla and its CEO, Elon Musk. This decision comes on the heels of Musk’s recent announcement regarding the formation of a new political party. As a result, the public listing of the Azoria Tesla Convexity ETF has been delayed, leaving many investors and analysts speculating about the future of Tesla and its leadership.

The Impacts of the Withdrawal

The withdrawal of support from a significant investment firm can have massive implications for Tesla. Investors often view such moves as red flags, which can lead to stock price volatility. For Tesla, a company that has been a darling of the stock market, any indication of instability can trigger a cascade of sell-offs. This is especially concerning now, given the growing competition in the electric vehicle sector and the increasing scrutiny on Musk’s leadership style.

Elon Musk’s New Political Party Announcement

Elon Musk’s foray into politics has been a hot topic for some time, but the specifics of his new political party have not been widely discussed until now. His announcement suggested a vision for a party that prioritizes innovation, technology, and perhaps, a more libertarian approach to governance. While some applaud Musk for stepping into the political arena, others are concerned about the potential conflicts of interest that may arise, especially for a CEO of a major publicly-traded company like Tesla.

What is the Azoria Tesla Convexity ETF?

The Azoria Tesla Convexity ETF is designed to capitalize on Tesla’s fluctuating stock price by providing investors with a new way to engage with the company. ETFs, or exchange-traded funds, allow investors to buy a collection of assets in a single transaction, making them an appealing option for many. However, the delay in the ETF’s public listing raises questions about its future viability and how investors will react to the news.

Market Reactions to the News

Following the news of the withdrawal, the stock market’s reaction was immediate. Tesla’s stock saw a slight dip as investors reacted to the uncertainty surrounding Musk’s political ambitions and the ETF delay. Many analysts believe this could signal a shift in how investors view Musk’s leadership. The market sentiment is crucial, particularly in a space as volatile as electric vehicles.

Elon Musk’s Leadership Style Under Scrutiny

Elon Musk’s leadership style has always been a topic of discussion. Known for his bold statements and ambitious goals, he has garnered both admiration and criticism. His recent political ambitions could further complicate his role at Tesla. Many investors are now questioning whether his focus on politics might detract from his responsibilities at Tesla, a company that requires constant innovation and leadership to stay ahead.

The Future of Tesla Without Investment Firm Support

With one investment firm pulling out, the future of Tesla seems uncertain. The company has relied heavily on institutional investors for funding and support in its ambitious growth plans. Without this backing, Tesla may need to explore alternative funding avenues, which could come with their own set of challenges. The potential delay in the Azoria Tesla Convexity ETF could also impact Tesla’s ability to raise capital through public markets.

The Electric Vehicle Market Landscape

The electric vehicle market is becoming increasingly crowded, with numerous competitors vying for a share of the pie. Companies like Rivian, Lucid Motors, and traditional automakers ramping up their EV offerings pose a challenge to Tesla’s dominance. In this competitive landscape, any sign of instability or uncertainty can have far-reaching effects on a company’s market position. Investors are keeping a close eye on Tesla’s moves and how they align with broader market trends.

Public Perception of Musk’s Political Aspirations

Public perception plays a significant role in how companies like Tesla are viewed. Elon Musk’s political aspirations could polarize opinions about him and, by extension, Tesla. While some supporters may appreciate his focus on innovation and technology, others may view his political involvement as a distraction. As public sentiment shifts, it could have a direct impact on Tesla’s brand image and consumer trust.

Analysts Weigh In

Industry analysts are divided on the implications of this news. Some believe that Musk’s political ambitions could lead to a loss of focus on Tesla, which might hinder its growth trajectory. Others argue that Musk’s innovative mindset could bring fresh ideas to the political landscape, potentially benefitting Tesla in the long run. The truth likely lies somewhere in between, and only time will tell how this situation unfolds.

Investor Considerations

For current and potential investors, this news is a wake-up call. It’s essential to consider how Musk’s political ambitions and the withdrawal of support from a major investment firm could affect Tesla’s stock performance. Diversifying investments and keeping an eye on market trends is more crucial than ever. Investors should also stay informed about upcoming developments related to the Azoria Tesla Convexity ETF and Musk’s political activities.

The Broader Implications for Corporate Leadership

This situation raises broader questions about the role of corporate leaders in politics. As business leaders increasingly step into political roles, the lines between corporate governance and political ambition become blurred. This could lead to new challenges and opportunities for companies like Tesla. Investors and consumers alike will need to navigate this evolving landscape with caution and consideration.

Looking Ahead

As we look ahead, the future of Tesla hangs in the balance. The decision of a major investment firm to withdraw support is significant, and the delay of the Azoria Tesla Convexity ETF public listing adds another layer of complexity. Elon Musk’s political aspirations may bring about changes in how investors approach Tesla and its leadership. Staying informed and adaptable will be key for anyone involved in the electric vehicle market.