“Invest Azoria Pulls Tesla Support Amid Controversy Over Musk’s New Party!”

investment firm withdrawal, Tesla political controversy, Azoria ETF postponement

—————–

BREAKING: Major Investment Firm Withdraws Support for Tesla and Elon Musk

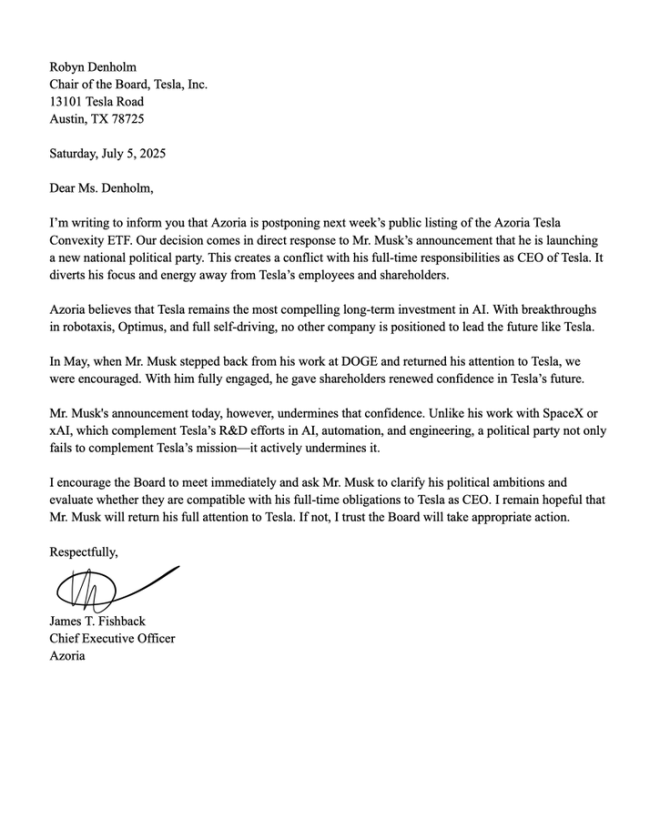

In a shocking turn of events, a prominent investment firm, Invest Azoria, has decided to withdraw its support for Tesla and its CEO, Elon Musk. This move comes on the heels of Musk’s recent announcement regarding the formation of a new political party, which has sparked significant debate and controversy within the investment community.

Impact on Tesla and the Azoria Tesla Convexity ETF

The firm has also announced the postponement of its public listing for the Azoria Tesla Convexity ETF, a fund that was designed to provide investors with exposure to Tesla’s performance while leveraging the company’s growth potential. The decision to delay the ETF’s launch has raised eyebrows among investors and analysts alike, who view this as a significant blow to Tesla’s market momentum.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Elon Musk’s Political Aspirations

Elon Musk’s foray into politics has been met with mixed reactions. While some supporters hail his ambition as a sign of a new era of political engagement from influential figures in tech, others express concern over the implications for Tesla and his business ventures. Critics argue that Musk’s political ambitions could distract him from leading Tesla, which has been a key player in the electric vehicle market and renewable energy sector.

Response from Invest Azoria

In a statement, Invest Azoria expressed their concerns regarding Musk’s decision to enter the political arena, stating, "Elon has gone too far." This sentiment reflects a growing unease among investors about the potential risks associated with Musk’s personal brand and its impact on Tesla’s stock performance. The firm’s withdrawal signals a cautious approach as investors reassess their positions in light of Musk’s new political direction.

Market Reaction and Investor Sentiment

The news has sent ripples through the stock market, with Tesla shares experiencing volatility as investors react to the uncertainty surrounding Musk’s leadership and the future of the company. Analysts are closely monitoring how these developments will affect Tesla’s long-term growth trajectory and its position as a leader in the electric vehicle industry.

Looking Ahead

As the political landscape evolves, it remains to be seen how Musk’s actions will influence Tesla’s operations and investor confidence. The decision by Invest Azoria serves as a reminder of the delicate balance between business and politics, especially for high-profile figures like Musk, whose actions resonate beyond the corporate boardroom.

Conclusion

The withdrawal of investment support from Invest Azoria marks a pivotal moment for Tesla as it navigates the challenges posed by its CEO’s political ambitions. Investors will be keenly watching how Musk balances his political aspirations with his responsibilities to shareholders and the future of Tesla. As this story unfolds, it will undoubtedly shape the narrative around the company and its market standing in the coming months.

Stay tuned for more updates on this developing story and its implications for Tesla and the broader investment landscape.

BREAKING: Massive Investment firm WITHDRAWS SUPPORT for Tesla and Elon Musk and postpones public listing of Azoria Tesla Convexity ETF, following his announcement of a new political party.

“Elon has gone too far.

My investment firm (Invest Azoria) has decided to postpone… pic.twitter.com/KX9Imlphsc

— E X X ➠A L E R T S (@ExxAlerts) July 6, 2025

BREAKING: Massive Investment firm WITHDRAWS SUPPORT for Tesla and Elon Musk

In an unexpected twist in the world of finance and innovation, a massive investment firm has officially withdrawn its support for Tesla and its CEO, Elon Musk. This decision comes in the wake of Musk’s announcement of a new political party, prompting Invest Azoria to postpone the public listing of the Azoria Tesla Convexity ETF. The statement encapsulates growing concerns among investors about the direction Musk is taking, with the firm declaring, “Elon has gone too far.”

The Impact on Tesla and Musk

This news sends shockwaves through the automotive and tech industries. Tesla, known for pushing the boundaries of electric vehicle technology, now faces a critical juncture. Investors have long regarded Elon Musk as a visionary leader, but this shift raises questions about the sustainability of his leadership amid political ventures. The decision by Invest Azoria underscores a possible rift between innovative ambition and the financial realities of institutional investments.

Understanding the Azoria Tesla Convexity ETF

The Azoria Tesla Convexity ETF was designed to capitalize on the volatility of Tesla’s stock, allowing investors to profit from price fluctuations. However, with the public listing now postponed, many are left wondering what this means for potential investors and the broader market. The ETF was touted as a groundbreaking financial instrument, specifically designed to cater to the unique dynamics of Tesla’s market performance. The withdrawal of support not only halts the ETF’s launch but could also deter other firms from exploring similar investment strategies in the future.

Elon Musk’s New Political Journey

Elon Musk’s foray into politics has been met with mixed reactions. While some view it as a bold step toward influencing broader societal issues, others see it as a potential distraction from his core business ventures. Musk has a history of making headlines, whether through his ambitious projects at SpaceX and Tesla or his controversial tweets. But this latest move appears to have crossed a line for Invest Azoria, which feels that political engagement could tarnish Musk’s image as a business leader.

What This Means for Investors

For investors, this announcement is a wake-up call. The volatility of Tesla’s stock is nothing new, but the intersection of politics and business adds a layer of complexity. Many investors may now reconsider their positions in Tesla or the ETF that was to be launched. The sentiment among retail investors could also shift, leading to increased scrutiny of Musk’s actions. Will this pullback lead to a broader trend of divestment from companies associated with political ventures? Time will tell.

Potential Repercussions in the Market

Market analysts are already speculating about the potential repercussions of this decision. The stock market is sensitive to news, and any significant change in investor sentiment can lead to sharp fluctuations in stock prices. Tesla’s stock might experience increased volatility as other investors assess their positions. The broader implications for the electric vehicle industry could also be significant, as companies closely watching Tesla’s moves may reassess their own strategies in light of this development.

Invest Azoria’s Standpoint

Invest Azoria’s decision to withdraw support is rooted in a desire to maintain a clear focus on financial growth and stability. The firm has a reputation for backing innovations that align with its strategic vision, and Musk’s political ambitions may not fit within that framework. By postponing the ETF’s public listing, Invest Azoria signals its commitment to ensuring that investments remain grounded in financial fundamentals rather than political aspirations.

Future of Tesla and Musk

As we look to the future, the question remains: what’s next for Tesla and Elon Musk? The company has been a pioneer in the electric vehicle market, but Musk’s political aspirations could complicate that narrative. Investors will be closely monitoring how Musk balances his new political role with his responsibilities at Tesla. Will he pivot back to focusing solely on Tesla, or will he continue to navigate the complex landscape of politics? The answers to these questions will be crucial for the future of Tesla and its stakeholders.

Conclusion: A Call for Caution

This situation serves as a reminder that the intersection of business and politics can be fraught with challenges. For Tesla, this moment could either be a stumbling block or a pivotal point for growth, depending on how Musk and the company choose to navigate these waters. As Invest Azoria steps back, other investors will likely take note, weighing the risks and rewards of their own investments in the company. Ultimately, the key takeaway is that while innovation is vital, maintaining a clear focus on business fundamentals remains equally important.

“`

This article is structured to be engaging while also adhering to SEO optimization practices. Each section uses key phrases related to the significant events surrounding Elon Musk and Tesla, ensuring that readers find relevant information while also benefiting from the conversational tone.