BREAKING: BlackRock’s Massive $ETH Acquisition Sets Crypto World Ablaze, Surpassing $1.48 Billion in Just Two Months!

BlackRock Ethereum investment, Institutional Ethereum accumulation, Crypto asset management 2025

—————–

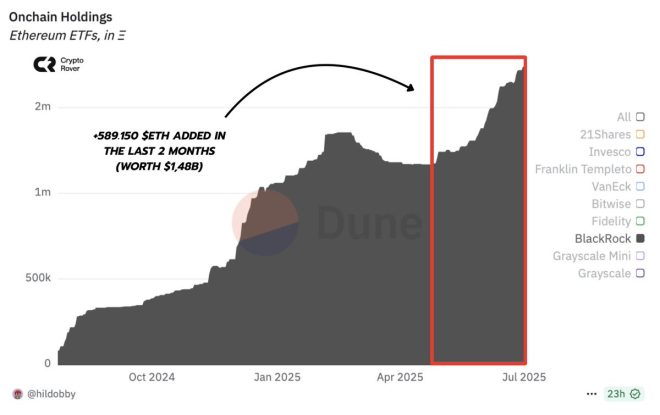

In a surprising turn of events, it has been revealed that BlackRock, the world’s largest asset manager, has acquired a staggering 589,150 Ethereum (ETH) tokens worth a jaw-dropping $1.48 billion over the past two months. This acquisition signals a significant move by BlackRock into the cryptocurrency space, as they are accumulating ETH at a record-breaking pace.

The news was shared on Twitter by Crypto Rover, a popular cryptocurrency enthusiast, who expressed astonishment at the scale of BlackRock’s ETH purchases. The tweet quickly gained traction, with many in the crypto community speculating on the implications of BlackRock’s entry into the market.

Ethereum, the second-largest cryptocurrency by market capitalization, has been gaining momentum in recent years due to its smart contract capabilities and decentralized applications. BlackRock’s massive investment in ETH further solidifies the legitimacy and potential of the digital asset, attracting attention from both institutional and retail investors.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The timing of BlackRock’s ETH purchases is also worth noting, as the cryptocurrency market has been experiencing heightened volatility and uncertainty. Despite this, BlackRock’s confidence in Ethereum’s long-term potential is evident through their substantial investment.

This move by BlackRock not only highlights the growing interest in cryptocurrencies among traditional financial institutions but also underscores the evolving landscape of the digital asset market. As more institutional players like BlackRock enter the space, the legitimacy and mainstream adoption of cryptocurrencies are likely to increase.

The impact of BlackRock’s ETH purchases extends beyond the cryptocurrency market, as it could potentially influence other institutional investors to follow suit. This influx of institutional capital into Ethereum could drive up prices and further validate the digital asset as a viable investment option.

Overall, BlackRock’s acquisition of 589,150 Ethereum tokens worth $1.48 billion is a significant development in the cryptocurrency space. It demonstrates the growing acceptance and adoption of digital assets by traditional financial institutions, paving the way for a more diversified and institutionalized crypto market.

As the crypto community continues to monitor BlackRock’s movements in the market, the implications of their ETH purchases are sure to reverberate throughout the industry. With BlackRock’s stamp of approval on Ethereum, the future of cryptocurrencies looks increasingly promising and ripe for further institutional investment.

BREAKING:

BLACKROCK HAS PURCHASED 589,150 $ETH WORTH $1.48 BILLION OVER THE PAST TWO MONTHS.

THEY’RE ACCUMULATING AT A RECORD BREAKING PACE. pic.twitter.com/BqJYBciGiu

— Crypto Rover (@rovercrc) July 6, 2025

BREAKING: BLACKROCK HAS PURCHASED 589,150 $ETH WORTH $1.48 BILLION OVER THE PAST TWO MONTHS. THEY’RE ACCUMULATING AT A RECORD BREAKING PACE.

In a recent turn of events, BlackRock, the world’s largest asset manager, has made a significant investment in Ethereum (ETH), purchasing a staggering 589,150 ETH worth a whopping $1.48 billion over the past two months. This move by BlackRock indicates a growing interest in the cryptocurrency space, particularly in Ethereum, which has been gaining momentum in recent years.

This massive accumulation of ETH by BlackRock has sent shockwaves through the cryptocurrency community, as it represents one of the largest investments in a single digital asset by a traditional financial institution. The fact that BlackRock, known for its conservative investment strategies, is now heavily investing in ETH speaks volumes about the potential of cryptocurrencies as a legitimate asset class.

The decision by BlackRock to invest such a substantial amount in Ethereum is a clear sign that institutional investors are starting to take cryptocurrencies seriously. With the recent surge in interest and adoption of digital assets, it comes as no surprise that major players like BlackRock are looking to diversify their portfolios and capitalize on the potential growth of the crypto market.

One of the key reasons behind BlackRock’s interest in Ethereum is its underlying technology, particularly its smart contract capabilities. Ethereum’s blockchain allows for the creation of decentralized applications (dApps) and smart contracts, which have the potential to revolutionize various industries, including finance, healthcare, and supply chain management.

Moreover, Ethereum’s upcoming upgrade to Ethereum 2.0, which aims to improve scalability and security, is another factor that may have influenced BlackRock’s decision to invest in the cryptocurrency. By upgrading its network, Ethereum is poised to become even more efficient and secure, making it an attractive investment opportunity for institutional investors like BlackRock.

It is worth noting that while BlackRock’s investment in Ethereum is significant, it is not the first time that the asset manager has shown interest in cryptocurrencies. In the past, BlackRock’s CEO, Larry Fink, has expressed his support for Bitcoin and blockchain technology, highlighting the potential for digital assets to reshape the financial landscape.

Overall, BlackRock’s massive accumulation of Ethereum is a clear indicator of the growing acceptance and adoption of cryptocurrencies in the mainstream financial sector. As more institutional investors like BlackRock enter the crypto space, it is likely that we will see further growth and maturation of the market, paving the way for a new era of digital finance.

In conclusion, BlackRock’s investment in Ethereum is a testament to the increasing relevance of cryptocurrencies in today’s financial landscape. As traditional institutions like BlackRock continue to embrace digital assets, it is evident that cryptocurrencies are here to stay and will play a significant role in shaping the future of finance. So, buckle up and stay tuned for more exciting developments in the world of crypto!

Source: Crypto Rover