Canada Faces $310 Billion Deficit: Are Tax Cuts Worth the Financial Risk?

government budget analysis, Canadian deficit forecasting, fiscal policy implications

—————–

Canada’s Alarming Financial Outlook: $310 Billion Deficits

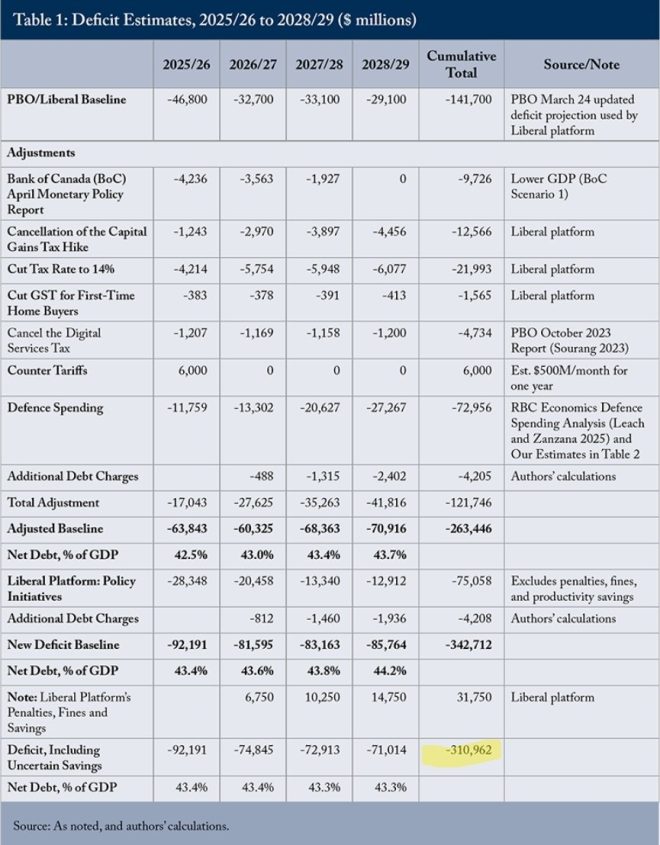

In a recent revelation by the CD Howe Institute, significant concerns have emerged regarding the financial future of the Canadian government. The institute has meticulously analyzed the government’s proposed spending promises and tax cuts, concluding that Canada is poised to face staggering deficits amounting to $310 billion over the next four years. This alarming figure raises critical questions about fiscal responsibility and the long-term implications for Canadian taxpayers.

Understanding the Deficit Projection

The CD Howe Institute, a respected think tank, has tallied up the government’s spending commitments and tax reductions, providing a comprehensive overview of Canada’s fiscal trajectory. The projected $310 billion in deficits highlights a growing trend of overspending that could have dire consequences for the country’s economic stability. This projection comes at a time when many Canadians are already feeling the pinch of rising costs and economic uncertainty.

Implications for Canadian Taxpayers

The projected deficits signify that the Canadian government may resort to increased borrowing to finance its budgetary commitments. This could lead to higher debt levels, which ultimately falls on taxpayers. A growing deficit may necessitate future tax increases or reductions in public services, impacting the quality of life for Canadians. The implications are far-reaching, affecting everything from healthcare funding to infrastructure projects.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Response from Economists and Politicians

Economists are sounding the alarm regarding the sustainability of such high deficits. Many argue that while some level of deficit spending can be justified during economic downturns, a prolonged period of excessive deficits may stifle growth and lead to a debt crisis. Politicians across the spectrum are also weighing in, with calls for a reassessment of fiscal policies to ensure that Canada remains on a path toward sustainable economic growth.

The Importance of Fiscal Responsibility

As the government faces mounting pressure to deliver on its promises while managing its budget, the importance of fiscal responsibility cannot be overstated. Policymakers must prioritize effective spending strategies and consider the long-term impact of their financial decisions. A balanced approach that fosters economic growth while keeping deficits in check will be crucial for Canada’s financial health.

Looking Ahead: What’s Next for Canada?

The $310 billion deficit projection serves as a wake-up call for the Canadian government and its citizens. As discussions around budgetary reforms and spending cuts begin to take center stage, it is essential for all stakeholders to engage in constructive dialogue. Ensuring Canada’s economic stability will require transparency, accountability, and a commitment to prudent fiscal management.

Conclusion

In summary, the recent findings from the CD Howe Institute present a concerning outlook for Canada’s financial future. With projected deficits reaching $310 billion over the next four years, the government must navigate the challenges of budgetary commitments while ensuring the economic well-being of its citizens. As Canada stands at a critical juncture, the path forward will require careful planning and a focus on sustainable fiscal policies that prioritize the needs of all Canadians. The urgency for responsible governance has never been more pronounced.

BREAKING

CD Howe has done the budget for the government

…and added up ALL the spending promises and tax cuts

..and has determined the Gov. Of Canada will run 310 BILLION $ in deficits over the next 4 years!!! pic.twitter.com/8ZYnGTKfhr

— Tablesalt (@Tablesalt13) July 5, 2025

BREAKING

In a shocking turn of events, the CD Howe Institute has just released a comprehensive analysis of the government’s budgetary outlook. This isn’t just a run-of-the-mill report; it’s essential reading for anyone interested in Canadian politics, economics, or public policy. The findings reveal that the Government of Canada is poised to run a staggering 310 billion dollars in deficits over the next four years, a figure that is likely to raise eyebrows and spark heated debates across the nation.

CD Howe has done the budget for the government

The CD Howe Institute, a renowned think tank, has undertaken the immense task of evaluating the federal budget. Their analysis is based on a thorough examination of all spending promises made by the government, along with anticipated tax cuts. What does this mean for Canadians? It suggests that the government is embarking on a financial path that may have long-term implications for the economy and public services.

…and added up ALL the spending promises and tax cuts

So, what exactly did the CD Howe Institute find? Their calculations included every spending proposal and tax cut the government has put forth. This means they examined everything from infrastructure spending to social programs, and they didn’t shy away from the implications of these financial decisions. The numbers paint a clear picture: the government’s approach is aggressive, and while it aims to stimulate growth and provide relief to Canadians, it also raises significant questions about fiscal responsibility and sustainability.

..and has determined the Gov. Of Canada will run 310 BILLION $ in deficits over the next 4 years!!!

The most eye-catching figure? That whopping 310 billion dollars in projected deficits over the next four years. This is not just a number; it’s a trend that could influence everything from interest rates to public services and tax policies. The implications are profound, and they deserve our attention.

What Does This Mean for Canadians?

For the average Canadian, this information could mean several things. On one hand, the increased deficit spending could lead to more jobs and improved infrastructure, which is crucial for a growing economy. On the other hand, it raises concerns about the long-term viability of such spending. Will this lead to higher taxes down the road? Will essential services face cuts to balance the budget in the future? These are legitimate questions that need answers.

Economic Implications

Economists are buzzing about what this could mean for the future. The idea of running such high deficits can be a double-edged sword. While it can stimulate short-term economic growth, there’s a risk that it could lead to inflation or higher interest rates in the long run. High deficits could mean that the government will have to borrow more, which can crowd out private investment. If you’re a business owner or an entrepreneur, this could affect your ability to secure funding.

Public Services at Risk?

One area that often feels the pinch during deficit-driven policies is public services. As deficits grow, governments may need to make tough choices about where to allocate funds. This could mean cuts to healthcare, education, or social programs that many Canadians rely on. It’s a balancing act that could have real-life consequences for families across the country.

The Role of Tax Cuts

Tax cuts are often touted as a way to stimulate economic growth by putting more money into the hands of consumers. But with the government projecting such high deficits, one has to wonder how sustainable these tax cuts really are. Could we see a reversal of these cuts in the future to help balance the books? It’s a possibility that Canadians should consider seriously.

Political Reactions

The political landscape is also likely to shift as a result of these revelations. Opposition parties may use this information to challenge the government’s fiscal policies. Expect debates in Parliament to heat up, with critics arguing that the government is being reckless and irresponsible with taxpayer money. The political ramifications could be significant, especially heading into upcoming elections.

Public Opinion and Engagement

As Canadians digest this information, public opinion will be crucial. Will people support continued high spending in the face of growing deficits, or will there be a push for more conservative fiscal policies? Engaging with your local representatives and voicing your opinion on these matters could have a real impact on future policies. It’s essential for citizens to be informed and active participants in the democratic process.

Staying Informed

In times like these, staying informed is more important than ever. Understanding how the government’s fiscal policies impact your life and the economy can empower you to make informed decisions, whether you’re a voter, a business owner, or simply a concerned citizen. The CD Howe Institute’s findings are just the beginning; there will be plenty of discussions, analyses, and debates to follow.

Conclusion

The CD Howe Institute’s report on the Government of Canada’s budget paints a complex picture of the financial landscape. With projected deficits reaching 310 billion dollars over the next four years, it’s clear that Canadians need to pay attention to what this means for their future. Whether it leads to economic growth or raises concerns about fiscal responsibility, one thing is certain: this is a conversation that is far from over.

“`

This article covers the implications of the CD Howe Institute’s findings regarding the Canadian government’s budget, engaging readers with clear, informative content while also optimizing for SEO.