Major Cryptocurrency Exchange BitGet Announces Delisting of $TAPS, $PIXFI, $CATS, and $MDOGS Tokens

BitGet delisting tokens, TG Projects tokens, BitGet token delisting

Token removal, cryptocurrency exchange, BitGet announcement

Crypto market news, delisted tokens, BitGet update

—————–

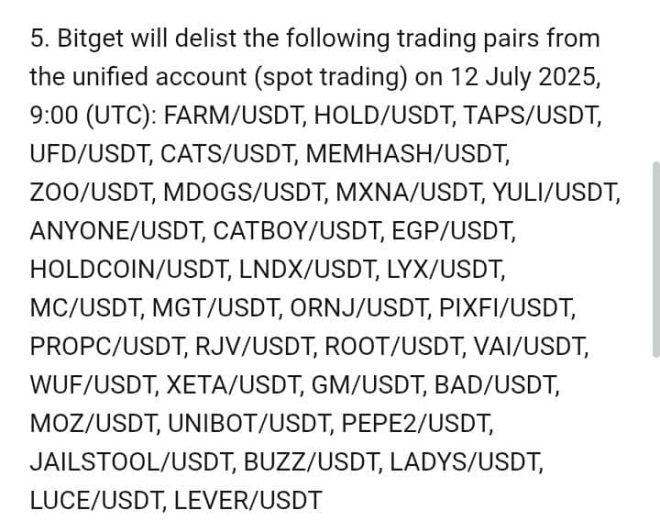

BitGet, a prominent cryptocurrency exchange, has announced its decision to delist several tokens associated with TG Projects. The tokens to be delisted include $TAPS, $PIXFI, $CATS, and $MDOGS. This move is set to take effect on July 12, 2025.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The announcement was made by Mr. C Billionaire, a well-known figure in the cryptocurrency community, through a tweet on his official Twitter account. The tweet has since garnered attention and sparked discussions within the crypto space.

The decision to delist these tokens comes as a surprise to many investors and traders who have been actively trading these assets on the BitGet platform. Delisting is a process through which an exchange removes a token from its list of tradable assets, typically due to concerns about the token’s performance, compliance issues, or other factors.

BitGet has not provided specific reasons for the delisting of these tokens, leaving many in the community speculating about the motives behind this move. Some believe that it may be related to regulatory concerns or the performance of these tokens in the market.

The delisting of tokens can have significant implications for investors, as it may impact the liquidity and value of the affected assets. Traders who hold these tokens are advised to take necessary actions to safeguard their investments before the delisting deadline on July 12, 2025.

It is essential for investors to stay informed about developments in the cryptocurrency market and be proactive in managing their portfolios. Delistings, like the one announced by BitGet, highlight the volatility and regulatory uncertainties that continue to impact the crypto industry.

As the crypto space evolves, exchanges like BitGet play a crucial role in maintaining market integrity and protecting investors. By delisting tokens that do not meet their criteria, exchanges aim to uphold standards and ensure a safe trading environment for users.

Overall, the delisting of tokens by BitGet underscores the importance of due diligence and risk management in the cryptocurrency market. Investors are encouraged to stay vigilant and stay informed about regulatory changes and market developments to make informed decisions about their investments.

In conclusion, the delisting of tokens by BitGet serves as a reminder of the dynamic nature of the cryptocurrency market and the need for investors to adapt to changes and uncertainties. By staying informed and proactive, investors can navigate the complexities of the crypto space and mitigate risks associated with market volatility and regulatory challenges.

BREAKING: BitGet set to Delist several TG Projects tokens including $TAPS, $PIXFI, $CATS, and $MDOGS

July 12, 2025. pic.twitter.com/1R2eQNQVjr

— 𝑴𝒓. 𝑩𝒊𝒍𝒍𝒊𝒐𝒏𝒂𝒊𝒓𝒆 (@mr_cbillionaire) July 5, 2025

In a recent announcement, BitGet revealed its decision to delist several TG Projects tokens, including $TAPS, $PIXFI, $CATS, and $MDOGS. This move is set to take effect on July 12, 2025, sending shockwaves through the cryptocurrency community. The decision to remove these tokens from the platform has sparked discussions and raised questions about the future of these projects.

The delisting of tokens is not an uncommon occurrence in the cryptocurrency world. Exchanges often review and reassess the projects they list based on various factors such as liquidity, trading volume, regulatory compliance, and community interest. In the case of BitGet, the decision to delist these tokens may have been influenced by a combination of these factors.

For investors holding these tokens, the news of delisting can be unsettling. It raises concerns about the liquidity of their assets and the potential impact on their investment portfolios. Additionally, it highlights the importance of conducting thorough research before investing in any cryptocurrency project. Understanding the fundamentals, team behind the project, roadmap, and market conditions can help investors make informed decisions and mitigate risks.

The delisting of tokens also serves as a reminder of the volatile nature of the cryptocurrency market. Prices of tokens can fluctuate dramatically based on various factors, including regulatory developments, market sentiment, and macroeconomic trends. Investors should be prepared for sudden changes in the market and have a risk management strategy in place to protect their investments.

As the cryptocurrency market continues to evolve, regulatory scrutiny is increasing, leading exchanges to take proactive measures to ensure compliance with laws and regulations. Delisting tokens that do not meet the exchange’s standards is one way for platforms to maintain a safe and secure trading environment for their users.

In conclusion, the delisting of tokens by BitGet underscores the importance of due diligence and risk management in the cryptocurrency market. Investors should stay informed about the projects they invest in, monitor market developments, and be prepared for unexpected changes. While delistings can be disruptive, they are part of the evolving landscape of the crypto industry, and investors should approach them with caution and a long-term perspective.

Source: Twitter

Remember to stay informed and stay safe in the ever-changing world of cryptocurrencies.