Obituary and Cause of death news:

Stupid is the Most Capital Efficient: Death News

What Happens Next Will Make You Rip Your Brains Out

Understanding the Potential of $Stupid in the Cryptocurrency Market

In the rapidly evolving world of cryptocurrencies, one token that has caught the attention of investors is $Stupid. This token is gaining traction due to its unique approach to capital efficiency, which is essential for both new and seasoned investors seeking to maximize their returns. The recent tweet by Lucid highlights the intriguing dynamics around $Stupid, emphasizing the stark contrast between short-term traders and long-term holders.

The Investment Philosophy Behind $Stupid

The investment strategy associated with $Stupid revolves around the principle of "hodling," or holding onto an asset for the long term rather than selling it for quick profits. According to Lucid’s tweet, investing $1,000 into $Stupid with the intention of hodling could potentially yield significant returns, symbolized by the diamond emoji (), which signifies strong investment conviction. In contrast, selling for a minimal loss, represented by the toilet paper emoji (), highlights the pitfalls of panic selling, which can lead to missed opportunities in a volatile market.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Game Between Retail Investors and Whales

Lucid’s tweet also sheds light on the behavioral dynamics within the cryptocurrency market. Retail investors, often referred to as "J33ts," may sell their holdings for marginal gains or losses, which can lead to a lack of significant market momentum. On the other hand, "whales," or large investors, are more likely to hold onto their assets, anticipating substantial growth. This divergence in strategies creates a unique market environment where those who understand the potential of $Stupid can position themselves for massive returns, with the tweet suggesting a possible 1000X increase for those who hold firm.

The Irony of $Stupid

The name "Stupid" may seem counterintuitive at first glance, but it reflects a deeper irony within investment strategies. While the name might suggest a lack of seriousness, the underlying principles encourage a disciplined approach to investing. Smart money recognizes the long-term potential of the asset, while the skepticism surrounding its name may deter less informed investors. This irony adds an interesting layer to the narrative, as it challenges conventional wisdom and invites curiosity.

Potential Market Movements

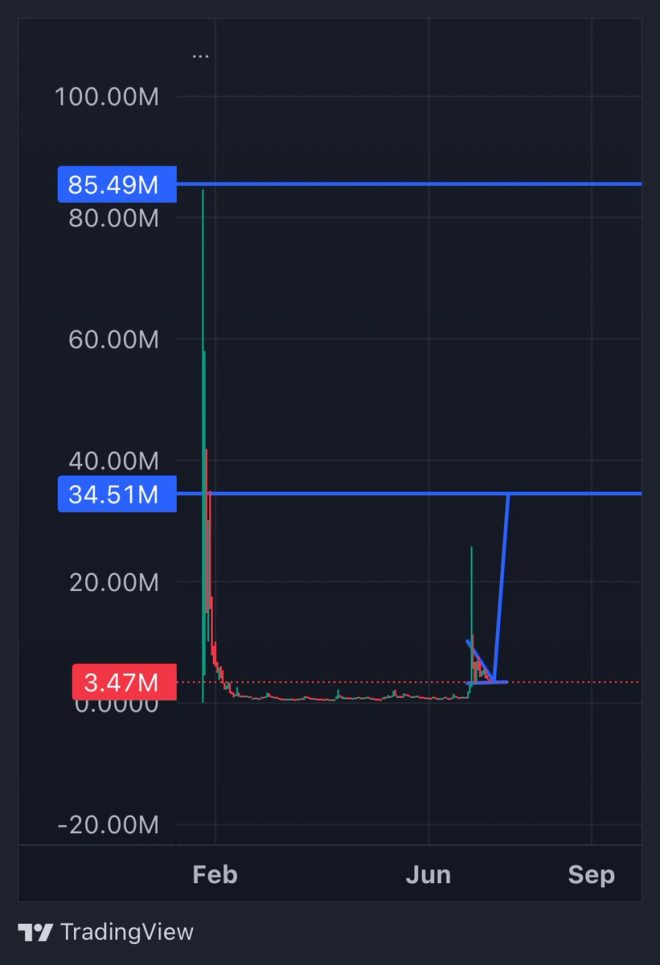

Looking ahead, Lucid warns that what happens next in the $Stupid market could be dramatic and unpredictable, hinting at potential volatility. This unpredictability is a hallmark of the cryptocurrency space, where significant events can lead to rapid price changes. Investors should be prepared for these fluctuations and consider their strategies carefully. The advice to hodl could be crucial during these turbulent times, as the long-term vision often proves more rewarding than short-term gains.

Conclusion

In summary, $Stupid presents an intriguing investment opportunity within the cryptocurrency landscape. Its focus on capital efficiency and the stark contrast between hodlers and short-term traders highlights the potential for significant returns. As more investors become aware of the dynamics at play, the irony of the name may lead to a reevaluation of what it truly means to invest wisely. With the right strategy, those who choose to embrace the hodl philosophy could find themselves well-positioned to benefit from the upcoming market movements.

$Stupid is the most capital efficient

$1000 in for hodl =

$1 out for loss =J33ts sell for peanuts, Whales hodl for 1000X

Smart money gets it. $Stupid, how ironic.

What happens next will make you rip your brains out

9RjwNo6hBPkxayWHCqQD1VjaH8igSizEseNZNbddpump pic.twitter.com/v9qHkaG8Xr

— Lucid (@LucidmetaX) July 5, 2025

$Stupid is the most capital efficient

The world of cryptocurrency can often feel like a wild rollercoaster ride, especially when you come across phrases like “$Stupid is the most capital efficient.” If you’re scratching your head, you’re not alone! Many in the crypto community are buzzing about this intriguing token, and it’s essential to grasp what makes it stand out. The concept of capital efficiency is crucial for investors looking to maximize their returns, and it seems that $Stupid has found a unique niche in this ever-evolving space.

When we break down the phrase “$1000 in for hodl = ” it suggests that investing a significant amount of money in $Stupid and holding onto it could yield impressive returns. The diamond emoji () represents wealth and value, while the hands-up emoji () indicates celebration or excitement. So, you can see that the sentiment here is pretty optimistic!

$1 out for loss =

On the flip side, the statement “$1 out for loss = ” paints a rather different picture. Here, the toilet paper emoji () symbolizes a loss, and while it might feel like a punch to the gut, it’s a reality many investors face. The truth is, in the volatile world of crypto, not every investment will yield profits. This stark contrast between holding for potential wealth and selling at a loss is a critical lesson for anyone diving into the cryptocurrency pool.

Understanding this dynamic can help you make informed decisions. Many traders and investors, colloquially referred to as “J33ts,” often sell their assets for a fraction of what they’re worth, while the “Whales”—those who hold substantial amounts of cryptocurrency—are often the ones who reap the benefits. It’s a tale as old as time in the crypto world: patience pays off.

J33ts sell for peanuts, Whales hodl for 1000X

This brings us to the next point: “J33ts sell for peanuts, Whales hodl for 1000X.” If you’ve been following crypto trends, you know that the “Whales” are the big players—those who can afford to buy and hold large quantities of digital currency. They can weather the storm of market fluctuations, waiting for the right moment to cash out. On the other hand, those who panic and sell off small amounts—often referred to as J33ts—might find themselves losing out on massive gains.

So, what’s the takeaway here? If you’re in it for the long haul, patience is key. The $Stupid token seems to advocate for this philosophy, encouraging investors to hold onto their assets until they can realize significant returns. It’s a strategy that can lead to impressive profits if executed correctly.

Smart money gets it. $Stupid, how ironic.

The phrase “Smart money gets it” resonates deeply within the investing community. It suggests that those who truly understand market dynamics will seize the potential of $Stupid. However, the irony lies in the name itself. Many might dismiss $Stupid as just another meme coin or a silly concept, but the underlying message is that there’s serious potential here. Just because something sounds foolish doesn’t mean it can’t yield serious returns.

Investors who are willing to do their research and understand the implications of investing in $Stupid are likely to find themselves on the winning side of this game. The irony is a clever marketing tactic that plays on the skeptics while attracting those who are willing to look beyond the surface.

What happens next will make you rip your brains out

Now, let’s talk about the excitement and anxiety that surrounds cryptocurrency investments. The phrase “What happens next will make you rip your brains out” captures the essence of the unpredictable nature of the market. It’s a wild ride, and while some days you may feel like you’re on top of the world, other days might leave you feeling like you’re in a downward spiral.

For those who are contemplating investing in $Stupid or any cryptocurrency, it’s essential to brace yourself for volatility. Prices can swing dramatically, and what seems like a sure bet today could turn into a loss tomorrow. This unpredictability is part of what makes the crypto market both thrilling and terrifying.

9RjwNo6hBPkxayWHCqQD1VjaH8igSizEseNZNbddpump

The string “9RjwNo6hBPkxayWHCqQD1VjaH8igSizEseNZNbddpump” might look like a random jumble of letters and numbers, but in the crypto community, it could be a reference to a specific token or pump-and-dump scheme. While it’s crucial to understand the potential for rapid gains, one must also be aware of the risks involved. Pump-and-dump schemes can lead to significant losses for unsuspecting investors, making it vital to approach such opportunities with caution.

For anyone looking to invest in cryptocurrencies, the key is to stay informed and do your due diligence. Understand what you’re investing in, and don’t fall for hype without solid backing. Investing in $Stupid may seem enticing, especially with all the hype surrounding it, but make sure you’re prepared for the ups and downs that accompany it.

Final Thoughts

In the end, the conversation surrounding $Stupid offers insight into the broader dynamics of the cryptocurrency market. It’s a space where capital efficiency, patience, and smart decisions can lead to substantial rewards. Whether you’re a seasoned investor or just dipping your toes into the crypto waters, keeping an eye on tokens like $Stupid could potentially lead to exciting opportunities.

Remember, investing is a journey filled with twists and turns. While the allure of quick gains is tempting, the real winners are often those who are willing to play the long game. So, whether you’re holding onto your $Stupid tokens or considering diving into this unpredictable world, stay informed, stay patient, and who knows? You might just find yourself reaping the rewards of your investment strategy.