US Dollar Plummets 11% in 2023: Is the American Dream in Jeopardy?

US Dollar depreciation trends, currency value fluctuations 2025, economic impact of dollar loss

—————–

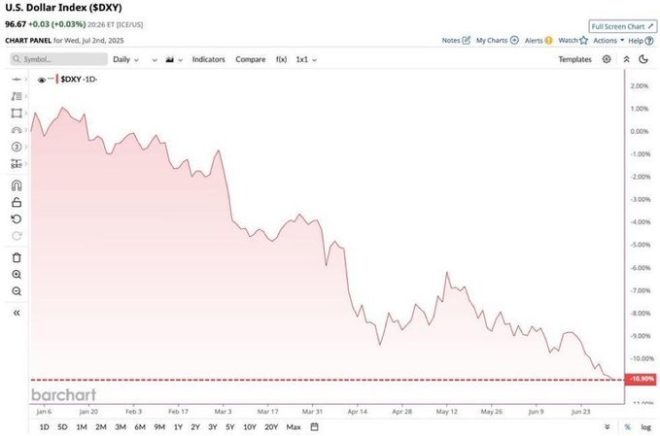

The recent tweet from Megatron highlights a significant economic development: the US Dollar has depreciated by nearly 11% in value this year. This alarming trend raises questions about the stability of the dollar and its implications for both domestic and global economies.

### Understanding the Dollar’s Decline

The US Dollar (USD) serves as the world’s primary reserve currency, making its value a critical indicator of economic health. A decline in the dollar’s value can result from various factors, including inflation, changes in interest rates, and shifts in investor confidence. In this case, the 11% drop signifies a potential weakening of the US economy, which could have far-reaching consequences.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

### Implications for the Economy

The depreciation of the US Dollar can lead to several economic repercussions. For consumers, a weaker dollar often translates to higher prices for imported goods, as it costs more to purchase products from other countries. This inflation can erode purchasing power and lead to increased costs of living. Moreover, businesses that rely on imported materials may face rising expenses, which could be passed on to consumers in the form of higher prices.

From an international perspective, a falling dollar can have mixed effects. While it may benefit US exporters by making American goods cheaper for foreign buyers, it can also lead to volatility in foreign exchange markets. Investors may become wary of holding assets denominated in dollars, leading to capital flight and potential instability in financial markets.

### Factors Contributing to Dollar Weakness

Several factors may contribute to the current decline of the USD. Increased government spending, low interest rates, and expansive monetary policies can devalue the currency. In recent years, the Federal Reserve has implemented measures to stimulate the economy, including maintaining low interest rates and engaging in quantitative easing. While these actions aim to promote growth, they can also lead to concerns about inflation and the overall fiscal health of the nation.

Furthermore, geopolitical tensions and uncertainty can also impact the dollar’s value. Investors often seek safe-haven assets during times of instability, and any negative news regarding US policy or international relations could prompt a sell-off of the dollar.

### The Future of the Dollar

As we move further into 2025, the trajectory of the US Dollar will depend on various factors, including economic recovery, inflation rates, and the Federal Reserve’s monetary policy. Investors and analysts will be closely monitoring these developments to gauge the dollar’s strength and the implications for the broader economy.

### Conclusion

The recent tweet indicating an 11% decline in the US Dollar’s value raises critical questions about the economic landscape in the United States. While the decline may provide some benefits for exporters, it poses significant challenges for consumers and businesses alike. Understanding these dynamics is essential for navigating the current economic climate and anticipating future trends. As the situation evolves, staying informed about changes in the dollar’s value will be crucial for individuals and businesses making financial decisions.

BREAKING:

The US Dollar has now lost almost 11% of its value this year pic.twitter.com/U6ZCHNM83J

— Megatron (@Megatron_ron) July 5, 2025

BREAKING:

The US Dollar has now lost almost 11% of its value this year. This news is sending ripples across the financial landscape and raising eyebrows among investors, economists, and everyday citizens alike. But what does this mean for you and the economy as a whole? Let’s dive into the details of this significant shift, exploring why this decline is happening, its potential implications, and what we can expect moving forward.

The Current Status of the US Dollar

As of mid-2025, the US Dollar has taken a considerable hit, dropping nearly 11% in value since the beginning of the year. This depreciation is not just a number; it affects everything from the cost of imported goods to your purchasing power at the grocery store. A weaker dollar means that it takes more dollars to buy the same amount of goods and services, which can lead to inflationary pressures.

The Factors Contributing to the Dollar’s Decline

Several factors are at play in this situation. One major contributor is the shift in monetary policy by the Federal Reserve. As rates change, so does the attractiveness of the dollar for foreign investors. If rates are low, as they have been, the dollar can lose its appeal, leading to a decline in its value. Additionally, economic uncertainty—whether due to geopolitical tensions or domestic issues—can lead to fluctuations in currency value.

For instance, the Federal Reserve’s monetary policy has historically played a crucial role in determining the strength of the dollar. Recent reports suggest that ongoing inflation and rising interest rates could be influencing investors’ confidence, leading them to seek alternatives to the dollar.

How the US Dollar’s Value Affects You

So, what does all this mean for your wallet? First off, if you’re planning on traveling abroad, you might find that your dollars don’t stretch as far as they used to. This can affect everything from flights to hotel prices.

Additionally, the cost of imported goods could rise, impacting everything from electronics to food prices. If you’re wondering why that new gadget or your favorite snack seems to be getting pricier, the dollar’s decline could be a big factor.

Global Implications of a Weakening Dollar

A weakening dollar doesn’t just impact the US economy; it has global repercussions as well. Many countries rely on the dollar for trade and reserves. When the dollar loses value, it can create instability in international markets, leading to currency fluctuations worldwide.

Emerging markets, in particular, may feel the pinch. A weaker dollar can lead to higher costs for countries that pay for imports in dollars. This situation can create a ripple effect, causing economic strain in nations that are dependent on US currency for trade.

Investors’ Reactions to the Dollar’s Decline

For savvy investors, a declining dollar can present both challenges and opportunities. Many are turning to commodities and foreign stocks as a hedge against currency depreciation. Gold, for instance, often sees increased investment when the dollar weakens, as it is viewed as a safe haven during economic uncertainty.

Investors should keep an eye on the US Dollar Index for trends and signals. This index measures the value of the dollar against a basket of foreign currencies and can provide insights into future movements in the dollar’s value.

Looking Ahead: What Can We Expect?

As we move further into 2025, the question on everyone’s mind is: what’s next for the dollar? Will it continue to decline, or is there potential for recovery? Analysts suggest that the answer lies largely in how the Federal Reserve navigates the current economic landscape.

Some experts predict that if inflation continues to rise, the Fed may be compelled to increase interest rates, which could strengthen the dollar. However, this approach comes with its own set of risks, including the potential for a recession.

Strategies to Mitigate the Impact of a Weak Dollar

In light of these developments, it’s wise to consider some strategies to protect your finances. Here are a few tips:

- Diversify Your Investments: Look into international stocks or commodities that may offer a buffer against dollar depreciation.

- Stay Informed: Keep an eye on economic indicators and Federal Reserve announcements to better anticipate changes in the dollar’s value.

- Consider Foreign Assets: If you’re looking to invest, consider assets denominated in currencies that are strengthening against the dollar.

Conclusion

The recent news regarding the US Dollar losing almost 11% of its value this year is a wake-up call for many. Whether you’re an investor, a consumer, or simply someone trying to make sense of the economic landscape, understanding the factors behind this decline and its implications is crucial. Keep your eyes peeled and stay informed, as the financial world is always changing, and being prepared can make all the difference.