“US senator Lummis Sparks Controversy with Bold Pro-Crypto Tax Reform!”

crypto tax legislation, digital asset regulation, blockchain investment incentives

—————–

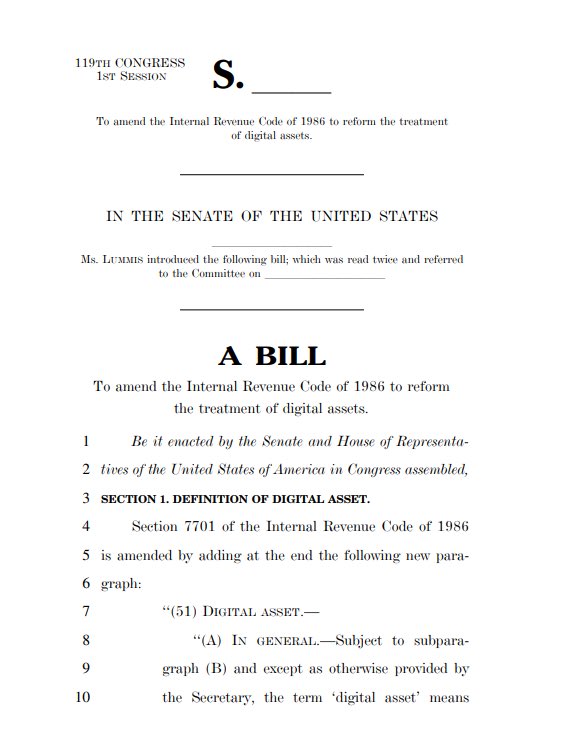

US Senator Cynthia Lummis Introduces Pro-Crypto Tax Reform Bill

In a significant development for the cryptocurrency community, U.S. Senator Cynthia Lummis has introduced a pro-crypto tax reform bill aimed at enhancing the regulatory framework for digital assets. This legislative move, which is garnering attention across the financial and crypto sectors, seeks to provide a clearer and more favorable tax environment for cryptocurrency transactions. The introduction of this bill is seen as a crucial step toward fostering innovation, encouraging investment, and solidifying the United States’ position as a leader in the burgeoning cryptocurrency market.

Understanding the Pro-Crypto Tax Reform Bill

Senator Lummis’s bill is designed to address several key issues that currently hinder the growth of the cryptocurrency industry. One of the primary objectives of the proposed legislation is to eliminate the tax burden on small transactions, which has long been a point of contention among crypto enthusiasts and investors. Under the existing tax code, every crypto transaction is treated as a taxable event, leading to potential tax liabilities for everyday users who engage in small trades or purchases.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The reform bill aims to raise the threshold for taxable transactions, allowing users to conduct small trades without incurring tax repercussions. This change is expected to encourage broader adoption of cryptocurrencies as a means of payment and investment, making it easier for more individuals to participate in the digital economy.

Implications for the Cryptocurrency Market

The introduction of this tax reform bill by Senator Lummis signals a growing acknowledgment of the importance of cryptocurrencies in the modern financial landscape. As cryptocurrencies like Bitcoin and Ethereum continue to gain traction, policymakers are recognizing the need to create a supportive regulatory environment that fosters innovation while ensuring consumer protection.

Moreover, the bill’s focus on creating a favorable tax environment may attract more institutional investors to the crypto space. With clearer regulations and reduced tax burdens, financial institutions and large investors may be more inclined to allocate resources toward crypto assets, further legitimizing the market.

Community Response and Future Prospects

The response to Senator Lummis’s pro-crypto tax reform bill has been overwhelmingly positive within the cryptocurrency community. Advocates argue that the bill represents a significant step toward establishing a more equitable and sustainable framework for digital assets. Influencers and stakeholders within the crypto space are expressing their support on social media platforms, amplifying the message of reform and urging other lawmakers to consider similar initiatives.

As the bill progresses through Congress, the potential for amendments and adjustments remains. Stakeholders are closely monitoring developments, advocating for a comprehensive approach that addresses various aspects of cryptocurrency regulation, including security, consumer protection, and market integrity.

Conclusion

Senator Cynthia Lummis’s introduction of a pro-crypto tax reform bill marks a pivotal moment in the ongoing evolution of cryptocurrency regulation in the United States. By addressing the tax implications of small transactions and fostering a more supportive environment for digital assets, this legislation has the potential to enhance the growth of the cryptocurrency market significantly. As industry stakeholders rally around this initiative, the future of cryptocurrency regulation looks promising, paving the way for increased adoption and innovation in the digital economy.

BREAKING: US Senator Cynthia Lummis Introduces Pro-Crypto Tax Reform Bill!$RLUSD #XRP pic.twitter.com/c9iuN23UEB

— JackTheRippler © (@RippleXrpie) July 4, 2025

BREAKING: US Senator Cynthia Lummis Introduces Pro-Crypto Tax Reform Bill!

In a significant move for the cryptocurrency community, US Senator Cynthia Lummis has officially introduced a pro-crypto tax reform bill. This legislation is poised to reshape how crypto taxation is handled in the United States, aiming to provide clarity and support for digital asset investors. The bill comes at a time when many crypto enthusiasts are navigating a complex and often confusing tax landscape.

$RLUSD #XRP

As the bill unfolds, it’s clear that assets such as $RLUSD and #XRP are at the forefront of discussions. Lummis’ initiative is not just about taxation; it represents a broader recognition of cryptocurrencies as legitimate financial instruments. The integration of these assets into mainstream finance continues to grow, and legislative changes like this are essential for their acceptance and stability.

The Importance of Pro-Crypto Tax Reform

Tax reform for cryptocurrencies is essential for several reasons. First, it helps to legitimize the digital asset market. By establishing clear guidelines on how cryptocurrencies are taxed, individuals and businesses can operate with greater confidence. This clarity can lead to increased investment and innovation within the crypto space.

Moreover, a pro-crypto tax reform bill could encourage more people to participate in the cryptocurrency market. Many potential investors shy away from crypto due to uncertainty regarding tax implications. By simplifying the tax process, Senator Lummis aims to lower these barriers and foster a more inclusive environment for crypto adoption.

Key Features of the Bill

While the specifics of Senator Lummis’ bill are still emerging, there are several anticipated features that could significantly impact the crypto community:

- Capital Gains Tax Adjustments: The proposal may include provisions to adjust how capital gains taxes are applied to crypto assets, potentially allowing for more favorable treatment for long-term holders.

- Tax-Free Transactions: There’s a possibility of introducing tax-free thresholds for small transactions, helping everyday users engage with cryptocurrencies without the burden of immediate tax implications.

- Clear Reporting Guidelines: The bill aims to provide straightforward reporting requirements for crypto transactions, making it easier for individuals to comply with tax regulations.

The Broader Crypto Landscape

Senator Lummis is not alone in her efforts. Many lawmakers recognize the growing significance of cryptocurrencies in the global economy. As digital assets continue to gain traction, regulatory frameworks are being developed worldwide. The United States, being a major player, must adapt to these changes to maintain competitiveness.

In fact, the introduction of this bill aligns with a wave of pro-crypto sentiments sweeping through various government branches. As cryptocurrencies evolve, so too must the legal structures governing them. This reform effort is a step in the right direction, reflecting a growing acknowledgment of the need for balanced regulation that fosters innovation while protecting consumers.

Impacts on Investors and Businesses

The immediate impact of Lummis’ bill will be felt by investors and businesses alike. For everyday investors, clearer tax policies mean less anxiety when buying, selling, or trading cryptocurrencies. It can also lead to better financial planning, as individuals will have a clearer understanding of their tax obligations.

For businesses, particularly those operating in the crypto space, the reform could provide much-needed stability. Companies are often hesitant to invest in new technologies or business models without a clear regulatory framework. By establishing a more supportive tax environment, Lummis’ bill could encourage businesses to explore innovative solutions within the cryptocurrency realm.

Community Reactions

The response from the cryptocurrency community has been overwhelmingly positive. Many advocates believe that this bill could be a game-changer for the industry. Tweets and discussions across social media platforms reflect a hopeful outlook for the future of crypto in the US.

For instance, proponents of cryptocurrencies like $RLUSD and #XRP are particularly excited. They see this legislation as a validation of their investments and a sign that cryptocurrencies are becoming a more integral part of the financial system.

Challenges Ahead

Despite the optimism, there are challenges that lie ahead. Legislative processes can be slow, and there may be pushback from various factions who are skeptical of cryptocurrencies. Concerns about security, fraud, and market volatility are often raised by critics. Addressing these issues will be crucial as the bill moves through the legislative process.

Additionally, as the crypto market continues to evolve, lawmakers must stay informed about new developments. This will require ongoing dialogue between industry experts, lawmakers, and regulators to ensure that the legislation remains relevant and effective.

The Future of Crypto Regulation

Looking ahead, the introduction of Senator Lummis’ pro-crypto tax reform bill signifies a pivotal moment for the future of cryptocurrency regulation in the United States. As more lawmakers recognize the importance of creating a balanced regulatory framework, we can expect to see further initiatives aimed at supporting the growth of digital assets.

The outcome of this bill could set a precedent for how cryptocurrencies are treated in the years to come. If successful, it could pave the way for a more robust and dynamic cryptocurrency market, ultimately benefiting investors and businesses alike.

Conclusion

In summary, Senator Cynthia Lummis’ introduction of a pro-crypto tax reform bill is a significant step forward for the digital asset community. With potential benefits for investors and businesses, this legislation could help create a more favorable environment for cryptocurrencies in the United States. As the bill progresses, it will be crucial for all stakeholders to engage in constructive dialogue to shape a future that embraces innovation while ensuring consumer protection.

Stay tuned for updates as this situation develops, and keep an eye on how this bill could influence the ever-changing landscape of cryptocurrency taxation.