China’s BRICS Payment System: A Bold Move That Could Dethrone the Dollar!

global trade innovations, alternative currency systems, international financial alliances

—————–

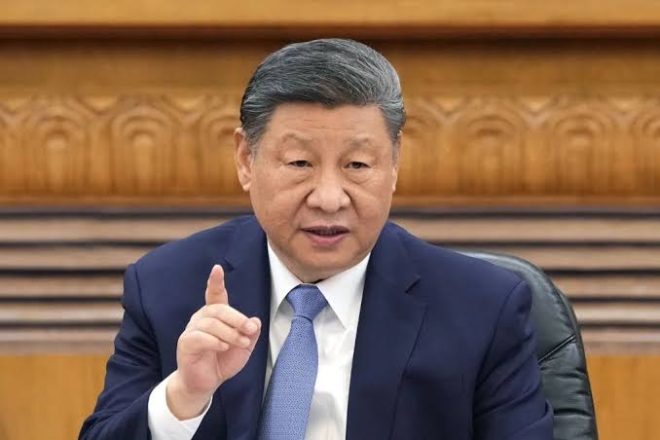

China’s New Payment System: A Potential Threat to the US Dollar

In a significant development that could reshape the global financial landscape, China is set to launch a new payment system through the BRICS nations, which may pose a substantial challenge to the dominance of the US dollar. This news was announced in a tweet by World Affairs on July 4, 2025, raising concerns among economists and policymakers regarding the implications for international trade and currency stability.

Understanding the BRICS Payment System

BRICS, comprising Brazil, Russia, India, China, and South Africa, is a coalition of emerging economies that aims to foster economic growth and cooperation. The introduction of a new payment system by China through this coalition signifies a strategic move to enhance economic collaboration among member states and reduce reliance on traditional Western financial systems, particularly the US dollar.

The potential impact of this initiative cannot be overstated. As the world’s primary reserve currency, the US dollar plays a crucial role in global trade, finance, and investment. A successful alternative payment system backed by BRICS could lead to the increased use of local currencies in trade between member states, diminishing the dollar’s influence and potentially destabilizing its value.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Implications for Global Trade

The launch of a BRICS-backed payment system could have far-reaching implications for global trade dynamics. With countries increasingly looking for alternatives to the US dollar, this new system may facilitate smoother transactions among BRICS nations and other countries seeking to engage with them. By providing a viable alternative, China aims to strengthen economic ties and promote trade in local currencies, which could ultimately lead to a shift in global commerce.

Moreover, this move is indicative of a broader trend towards de-dollarization, where countries are actively seeking to reduce their dependence on the US dollar. As nations look to diversify their foreign exchange reserves and trade practices, the introduction of a BRICS payment system could accelerate this trend, prompting more countries to consider alternatives.

Economic and Political Repercussions

The establishment of a new payment system by China through BRICS could lead to significant economic and political repercussions. For the United States, this development raises concerns about its ability to maintain influence over global financial markets. As countries increasingly engage in trade without the dollar, the US may face challenges in enforcing economic sanctions and controlling international monetary policy.

Furthermore, this initiative may strengthen China’s geopolitical position as it seeks to expand its influence on the global stage. By fostering closer economic ties among BRICS nations, China could bolster its leadership role within this coalition, challenging the existing order dominated by Western powers.

Conclusion

China’s plan to launch a new payment system through BRICS represents a pivotal moment in the evolution of global finance. As the world watches closely, the implications for the US dollar and international trade will unfold in the coming years. Stakeholders in the financial sector, policymakers, and businesses must stay informed and adapt to these changes, as the potential shift away from the dollar could reshape the future of global commerce and economic relations.

BREAKING:

China plans to launch a new payment system through BRICS which will pose a threat to the US dollar. pic.twitter.com/7QmWPJGsT6

— World Affairs (@World_Affairs11) July 4, 2025

BREAKING:

China has taken a bold step by announcing plans to launch a new payment system through BRICS, which many analysts believe could pose a significant threat to the dominance of the US dollar. This development is not just a minor blip on the radar; it has the potential to reshape global financial landscapes. In this article, we will explore what this new payment system entails, the implications for the US dollar, and how it could affect global trade.

Understanding BRICS and Its Role

BRICS, which stands for Brazil, Russia, India, China, and South Africa, is a coalition of emerging economies that have been collaborating to enhance their economic influence on the global stage. The group has been gradually moving away from reliance on Western financial systems, and China’s initiative to create a new payment system is a clear indication of this shift. By establishing a payment mechanism that bypasses the US dollar, BRICS aims to facilitate trade among its member countries more efficiently.

The New Payment System: What to Expect

China’s proposed payment system is designed to streamline transactions between BRICS nations, allowing for faster and more cost-effective trade. This system is expected to support local currencies, reducing the need for dollar conversions. For instance, if a Chinese company wants to buy goods from Brazil, the transaction could occur directly in yuan and reais, avoiding the dollar entirely. This could significantly lower transaction costs and time delays often associated with currency conversion.

Why the US Dollar is at Risk

Historically, the US dollar has been the dominant global currency, mainly due to its widespread use in international trade. However, as countries like China and those in the BRICS coalition seek alternatives, the dollar’s supremacy is being challenged. The launch of a BRICS payment system could accelerate this trend. If successful, it might lead to decreased demand for the dollar in global markets, which could ultimately weaken its value.

Historical Context: The Rise of Alternative Payment Systems

To understand the potential ramifications of this new payment system, it’s important to look at the history of alternative payment systems. In recent years, we’ve seen various countries exploring options to reduce their dependency on the dollar. For example, Russia has been pushing the idea of using the ruble for trade with its neighbors, while nations like Iran and Venezuela have sought to establish their own payment networks. China’s move could be seen as the culmination of these efforts, bringing together multiple nations under one unified payment system.

Global Trade Implications

As the BRICS payment system gains traction, the implications for global trade could be profound. For one, countries that are part of this coalition may find it easier to conduct business with one another, potentially leading to increased trade volumes. This could also encourage other nations to join BRICS or seek similar arrangements, further fragmenting the current dollar-centric system.

How This Affects Businesses

For businesses operating internationally, the emergence of a BRICS payment system could lead to new opportunities, but also new challenges. Companies that export goods to BRICS nations may benefit from lower transaction costs and reduced currency risks. However, businesses heavily reliant on the US dollar might need to rethink their strategies and consider diversifying their currency exposure.

The Political Landscape and Reactions

Of course, the launch of a new payment system won’t go unnoticed in Washington. The US government is likely to respond to this challenge in various ways, possibly through diplomatic channels or economic policies aimed at reinforcing the dollar’s position. Additionally, we may see increased scrutiny on BRICS nations and their financial transactions, as the US seeks to maintain its influence.

Conclusion: The Future of Global Finance

The future of global finance is at a crossroads, and China’s plans for a new payment system through BRICS could be a game-changer. As countries look for alternatives to the US dollar, the landscape of international trade and finance may evolve in ways we cannot yet fully predict. For now, all eyes are on BRICS and how this initiative unfolds.

“`

This article gives a comprehensive overview of the potential implications of China’s new payment system through BRICS, while also remaining informative and engaging to readers.