Trump Demands Powell’s Resignation: Is This the End for US Market Confidence?

Trump Fed Chairman controversy, investor confidence US dollar, market stability 2025

—————–

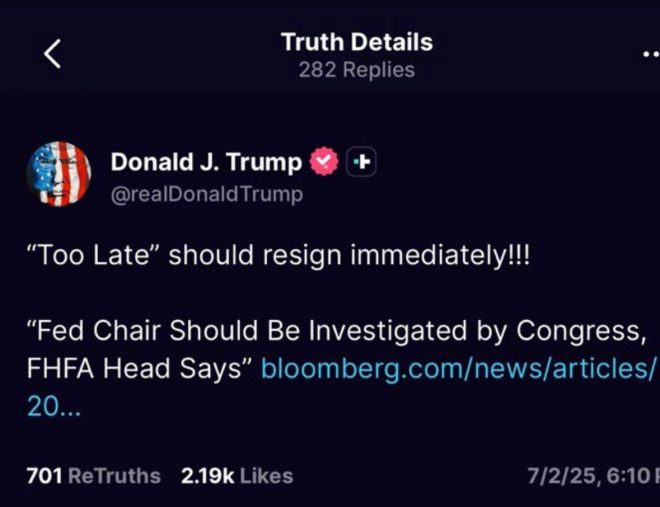

Trump Calls for Fed Chairman Jerome Powell’s Resignation: What It Means for the US Dollar and Markets

In a recent statement, former President Donald trump demanded the resignation of Federal Reserve Chairman Jerome Powell. This controversial declaration has stirred significant discussion among economists and investors alike, raising concerns about its potential impact on the U.S. economy and financial markets. As the economy navigates through a complex recovery phase, Trump’s remarks come at a critical junction, prompting questions about investor confidence in the U.S. dollar and the broader market landscape.

The Context of Trump’s Outburst

Trump’s call for Powell’s resignation is not entirely unexpected, given his history of critiquing the Federal Reserve. Throughout his presidency, Trump often expressed dissatisfaction with the Fed’s monetary policy decisions, particularly those related to interest rates. His latest remarks reflect a continued frustration with the central bank’s approach to managing inflation and economic growth. However, many financial analysts argue that such statements could undermine the stability of the financial markets and the credibility of the U.S. dollar.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Implications for Investor Confidence

Investor confidence is crucial for a healthy economy, particularly in times of uncertainty. Trump’s insistence on Powell’s resignation raises alarm bells among investors who value a stable and predictable monetary policy. Experts suggest that such public calls for leadership changes at the Federal Reserve can lead to increased volatility in the stock market and fluctuations in the currency value. A lack of confidence in the Fed’s leadership can exacerbate fears of economic instability, leading to potentially detrimental effects on investment strategies and market performance.

The Role of the Federal Reserve

The Federal Reserve plays a vital role in the U.S. economy, focusing on managing inflation, maximizing employment, and stabilizing prices. Under Powell’s leadership, the Fed has taken significant steps to address economic challenges, including implementing low-interest rates and quantitative easing measures. While these strategies have been effective in stimulating growth post-pandemic, criticism from political figures like Trump can create an atmosphere of uncertainty that complicates the Fed’s mission.

The Bigger Picture

In the broader context, Trump’s call for Powell’s resignation highlights the ongoing tension between political leadership and economic governance. As the U.S. grapples with inflationary pressures and potential recession fears, maintaining a strong and independent central bank is essential. The credibility of the Federal Reserve is paramount in ensuring that the U.S. dollar remains a trusted reserve currency and that investors feel secure in their investments.

Conclusion

Trump’s recent comments about Fed Chairman Jerome Powell’s resignation underscore the delicate balance between politics and economic policy. As investors closely monitor the implications of such statements, it becomes increasingly clear that fostering confidence in the U.S. dollar and financial markets is more crucial than ever. The interplay between political rhetoric and economic stability will continue to shape the landscape for investors and policymakers alike. As we move forward, the focus should remain on ensuring a stable economic environment that supports growth and maintains investor trust.

In summary, Trump’s call for Powell’s resignation may be seen as a misguided attempt to influence monetary policy, but it ultimately raises serious concerns about the future of the U.S. economy and the confidence of both domestic and international investors.

BREAKING: Trump has just called on Fed Chairman Jerome Powell’s resignation.

This is the most ignorant thing for him to say if he wants investors to have confidence in the US dollar as well as US markets. pic.twitter.com/ZZ8vCSAbKw

— Brian Krassenstein (@krassenstein) July 2, 2025

BREAKING: Trump has just called on Fed Chairman Jerome Powell’s resignation.

In a surprising twist in the world of finance and politics, former President Donald Trump has publicly called for the resignation of Federal Reserve Chairman Jerome Powell. This announcement, made on social media, has sent ripples through the financial markets and raised serious questions about the stability of the US dollar and investor confidence. But what does this mean for the average American and the broader economic landscape?

This is the most ignorant thing for him to say if he wants investors to have confidence in the US dollar as well as US markets.

When Trump made this statement, many financial experts and analysts were quick to label it as an “ignorant” move. The implication is clear: calling for the resignation of a figure as pivotal as the Fed Chairman can undermine trust in the US dollar and the overall market. For those not in the know, the Federal Reserve plays a crucial role in managing the country’s monetary policy, which directly impacts interest rates, inflation, and employment levels.

In recent years, the Fed has faced significant challenges, especially amid the fluctuating economic conditions brought about by the pandemic and subsequent recovery phases. Powell’s leadership has been characterized by efforts to stabilize the economy through low interest rates and quantitative easing. However, Trump’s call for resignation raises eyebrows about the political influence on such a critical institution.

Understanding the Role of the Federal Reserve

The Federal Reserve, often referred to as the Fed, is the central bank of the United States and is responsible for implementing the country’s monetary policy. It aims to promote maximum employment, stable prices, and moderate long-term interest rates. The Fed’s decisions can have widespread implications, affecting everything from mortgage rates to job growth.

By calling for Powell’s resignation, Trump is not just challenging one man; he’s questioning the very framework of monetary policy that has been designed to foster economic stability. It raises the question: how would such a shift affect the confidence of both domestic and international investors in the US dollar?

The Potential Impact on Markets

Investor confidence is a delicate balance. When political figures, particularly former presidents, make bold statements about key economic players, it can lead to uncertainty in the markets. This uncertainty can manifest in various ways, such as increased volatility in stock prices, fluctuations in currency exchange rates, and an overall sense of unease among investors.

Consider this: when Trump made his statement, it coincided with a time when many were already concerned about inflation rates and potential economic slowdowns. If investors start to doubt the leadership of the Fed, they may become more hesitant to invest in US assets, which could lead to a decrease in the value of the dollar and a ripple effect throughout the global economy.

Political Influences on Economic Stability

Political rhetoric can significantly influence economic policies and investor behavior. Trump’s call for Powell’s resignation is a prime example of how political discourse can intersect with financial markets. While it’s common for politicians to critique economic policies, openly calling for the resignation of a key figure like Powell is rare and can be perceived as destabilizing.

Moreover, this situation brings up the broader issue of how much political influence should be exerted over the Federal Reserve. Many economists argue that the Fed should operate independently of political pressures to maintain its credibility and effectiveness in managing the economy.

What Should Investors Do?

For investors, the current climate calls for caution. With political statements like Trump’s echoing in the financial world, it is essential to stay informed and consider how such developments might impact financial strategies. Diversification remains a key strategy for mitigating risk, so consider spreading investments across various asset classes to weather potential market volatility.

Additionally, keeping an eye on Fed announcements and economic indicators can provide valuable insights into how the market might react to political statements. Understanding the interplay between politics and economics is crucial for making informed investment decisions.

The Broader Economic Implications

Beyond the immediate impact on investor confidence, Trump’s comments could have long-term implications for US economic policy. If political figures continue to challenge the authority of the Fed, it may lead to changes in how monetary policy is implemented. This could result in a more reactive Fed that might feel pressured to change course based on political feedback rather than economic data.

This shift could destabilize long-term economic strategies and lead to unpredictable market conditions. For everyday Americans, this could translate into higher mortgage rates, increased costs of borrowing, and a general sense of economic instability.

Public Opinion and the Federal Reserve

Public opinion on the Federal Reserve can be quite polarized, especially in politically charged environments. Trump’s remarks reflect a segment of the population that may feel disillusioned with traditional economic governance. However, it’s essential to recognize the complexities of monetary policy and the expertise required to navigate these turbulent waters.

Many Americans may not fully understand the role of the Fed, leading to misinformed opinions about its operations and decisions. As such, it is crucial for educational efforts to help the public grasp the importance of the Federal Reserve in maintaining economic stability.

The Future of the US Dollar

The US dollar has long been considered a global reserve currency, a status that has significant implications for international trade and finance. However, if political instability continues to undermine confidence in the dollar, we could see a shift in how the world perceives US currency. This could lead to a decline in its dominance, giving rise to alternative currencies and economic systems.

For now, the future of the dollar remains uncertain as we navigate the implications of political statements and their impact on economic policies. Investors should remain vigilant and adapt to the changing landscape while keeping an eye on both domestic and global economic indicators.

Conclusion

In essence, Trump’s call for Jerome Powell’s resignation is more than just a political statement; it’s a reflection of the intricate relationship between politics and economics. As we move forward, understanding this relationship will be crucial for investors, policymakers, and the general public. The stability of the US dollar and the confidence in US markets depend on it.

“`

This article provides a comprehensive overview of the implications of Trump’s call for Jerome Powell’s resignation, engaging the reader while utilizing the specified keywords and maintaining an informal, conversational tone.