Trump’s Bold Warning: Tax Cuts vs. Increases—Will GOP Face Voter Backlash?

tax policy analysis, economic growth trends, voter sentiment shifts

—————–

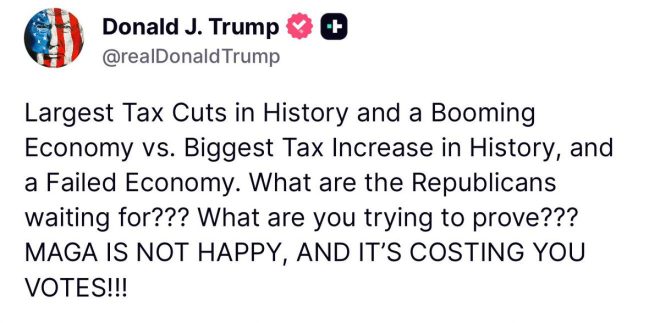

In a recent tweet, former President Donald J. Trump highlighted a stark political contrast between two economic scenarios: one characterized by significant tax cuts and economic growth, and the other marked by tax increases and economic failure. This statement, shared by The White house on July 3, 2025, reflects trump‘s ongoing critique of the current administration’s fiscal policies. The tweet emphasizes his belief that the republican Party should take decisive action to oppose what he perceives as detrimental economic policies.

### The Economic Debate: Tax Cuts vs. Tax Increases

Trump’s message underscores a pivotal theme in American politics: the role of tax policy in shaping the economy. He argues that the “Largest Tax Cuts in History” during his administration led to a “Booming Economy.” In contrast, he describes the current situation as the “Biggest Tax Increase in History” that has resulted in a “Failed Economy.” This framing taps into the longstanding Republican narrative that lower taxes stimulate economic growth, while higher taxes hinder prosperity.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

### MAGA’s Discontent

The tweet also conveys a sense of urgency regarding the dissatisfaction among Trump’s base, often referred to as “MAGA” supporters. Trump warns that if Republicans do not act decisively against what he views as harmful policies, they risk losing votes. This sentiment resonates with many voters who feel that tax increases disproportionately affect the middle class and small businesses, potentially stifling job creation and economic expansion.

### The Call to Action

Trump’s rhetorical question, “What are the Republicans waiting for?” serves as a rallying cry for party members to align with his vision of fiscal conservatism. He challenges them to prove their commitment to the principles that resonate with their constituents. By framing the issue in such stark terms, Trump seeks to galvanize support for a return to policies that prioritize tax cuts as a pathway to economic recovery and growth.

### The Broader Implications

This tweet not only reflects Trump’s focus on tax policy but also highlights the broader implications of economic management on political fortunes. As the 2024 elections approach, the Republican Party faces the challenge of unifying its base while appealing to undecided voters. The economic narrative presented by Trump may prove to be a double-edged sword, energizing his supporters while potentially alienating moderates who are concerned about the implications of tax cuts on public services and infrastructure.

### Conclusion

In summary, Trump’s recent comments encapsulate a critical moment in American political discourse. By contrasting tax cuts with tax increases, he aims to galvanize Republican support and emphasize the perceived failures of the current administration’s economic policies. As the political landscape continues to evolve, the effectiveness of this messaging will be tested in upcoming elections. The debate over tax policy remains a central issue, influencing both economic conditions and voter sentiment as Americans navigate the complexities of fiscal responsibility and growth.

This ongoing discourse not only shapes party strategies but also impacts the future direction of the U.S. economy, making it a pivotal issue for voters across the nation.

“Largest Tax Cuts in History and a Booming Economy vs. Biggest Tax Increase in History, and a Failed Economy. What are the Republicans waiting for??? What are you trying to prove??? MAGA IS NOT HAPPY, AND IT’S COSTING YOU VOTES!!!” —President Donald J. Trump pic.twitter.com/FNG9rvHOl2

— The White House (@WhiteHouse) July 3, 2025

Largest Tax Cuts in History and a Booming Economy vs. Biggest Tax Increase in History, and a Failed Economy. What are the Republicans waiting for??? What are you trying to prove??? MAGA IS NOT HAPPY, AND IT’S COSTING YOU VOTES!!! —President Donald J. Trump

In the ever-evolving landscape of American politics, few topics ignite as much passion and debate as tax policy. Just take a look at the bold statement from President Donald J. Trump, highlighting a stark contrast: “Largest Tax Cuts in History and a Booming Economy vs. Biggest Tax Increase in History, and a Failed Economy.” This fiery rhetoric captures the essence of the ongoing struggle between Republican and Democratic ideologies regarding taxation, economic growth, and voter sentiment. So, let’s dive deeper into this contentious issue and explore what it all means for the American public.

Understanding Tax Cuts and Economic Growth

Tax cuts have long been a cornerstone of Republican economic policy. The argument is simple: by reducing the amount of taxes individuals and businesses pay, you put more money into their pockets. This, in turn, stimulates spending, boosts investment, and ultimately leads to economic growth. The notion is that when people have more disposable income, they’re more likely to spend it, thereby driving demand and creating jobs.

During Trump’s presidency, the implementation of the Tax Cuts and Jobs Act of 2017 was touted as the largest tax cut in history. Proponents claimed it led to a booming economy, with unemployment reaching record lows and stock markets soaring. However, critics argue that the benefits were unevenly distributed, disproportionately favoring the wealthy and corporations, while leaving middle and lower-income Americans behind.

The Other Side of the Coin: Tax Increases and Economic Struggles

On the flip side of the tax debate lies the argument for increased taxation, often linked to funding social programs and reducing the national deficit. Democrats have pushed for tax increases on the wealthy and corporations to redistribute wealth and provide essential services to those in need. But this brings us back to Trump’s provocative question: “What are the Republicans waiting for?”

As economic struggles emerge, particularly during downturns or crises, the call for tax increases often grows louder. Critics of increased taxation claim that it stifles growth, discourages investment, and may ultimately lead to a failed economy. The fear is that if individuals and businesses are taxed heavily, they will have less incentive to innovate, expand, or hire new employees, leading to stagnation.

The Impact on Voter Sentiment

In Trump’s statement, he emphasizes that “MAGA IS NOT HAPPY, AND IT’S COSTING YOU VOTES!!!” This sentiment speaks volumes about the importance of voter satisfaction in shaping political outcomes. When economic policies fail to resonate with the electorate, especially those who supported Trump and the MAGA movement, it can lead to significant political repercussions.

Voter sentiment is often tied to economic performance. If people feel their financial situations are deteriorating, they may look for alternatives, leading to a shift in party loyalty. This dynamic is particularly crucial as elections approach. The Republican party, facing pressure from its base, must balance tax policy with the need to maintain voter support. Failure to do so could lead to losses in crucial elections, as disillusioned supporters may choose to stay home rather than cast their votes.

What Are Republicans Waiting For?

The question posed by Trump—“What are the Republicans waiting for?”—is a rallying cry for many within the party who feel that bold action is needed. Some Republican leaders argue for a return to tax cuts, believing that this will reignite the economy and satisfy their voter base. However, there’s a palpable tension within the party regarding how best to approach taxation and economic policy moving forward.

Some factions advocate for maintaining the tax cuts, while others suggest a more moderate approach that includes targeted increases for the wealthy to fund infrastructure and social programs. This internal conflict may lead to indecision, which can be detrimental as the political landscape continues to evolve.

Economic Indicators: Are We Booming or Failing?

To assess whether America is experiencing a booming economy or a failing one, we need to look at key economic indicators. Metrics such as unemployment rates, GDP growth, wage increases, and inflation all play vital roles in painting a picture of economic health. After the pandemic’s initial shock, the economy showed signs of recovery, with many sectors rebounding. However, rising inflation has raised concerns about the sustainability of this growth.

Inflation affects purchasing power, and when prices rise faster than wages, it can lead to a decline in overall consumer spending. This is where the debate over tax policy becomes crucial. Should the government intervene with fiscal policies aimed at stabilizing prices? Or should it focus on encouraging growth through tax cuts? The answer to this question may ultimately determine the direction of the economy and the fate of the Republican party.

The Future of Tax Policy in America

As we navigate through these turbulent political waters, it’s essential to understand that tax policy will continue to be a hot-button issue. The contrasting views of tax cuts versus tax increases will shape future debates, legislative actions, and, ultimately, the economic landscape of the United States.

For Republicans, the challenge lies in addressing the concerns of their voter base while also being pragmatic about the realities of the economy. As Trump’s statement echoes through the halls of Congress and beyond, it serves as a reminder that the stakes are high. The actions taken—or not taken—by Republican leaders in the coming months will have lasting implications for both the party and the nation.

Engaging with Voters: The Key to Political Survival

Engagement is crucial for any political party, especially as we approach future elections. Republicans must actively listen to their supporters, understand their concerns about taxation and economic policy, and communicate effectively about the steps they are taking to address these issues. Being out of touch with the electorate can lead to isolation and political consequences that could be hard to recover from.

Ultimately, the dialogue surrounding tax cuts and economic growth will continue to evolve. The challenge for Republicans is to find a pathway that resonates with their base while also addressing the broader economic realities facing Americans today. The question remains: will they rise to the occasion, or will they falter in the face of growing discontent?