Trump Claims Historic Tax Cuts Imminent as GOP Divides America: Will It Work?

tax reform benefits, economic growth strategies, legislative unity in Congress

—————–

Summary of President trump‘s Announcement on Tax Cuts and Economic Growth

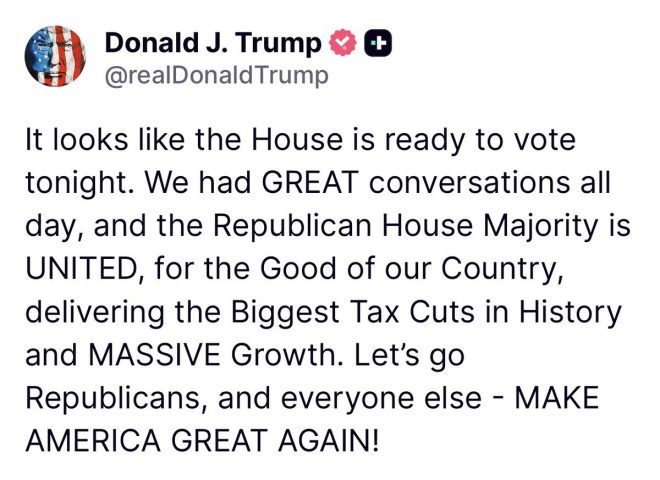

In a recent tweet shared by Dan Scavino, President Trump expressed optimism regarding the impending vote in the house of Representatives, highlighting the unity within the republican majority. Trump stated, "It looks like the House is ready to vote tonight. We had GREAT conversations all day, and the Republican House Majority is UNITED, for the Good of our Country, delivering the Biggest Tax Cuts in History and MASSIVE Growth." This announcement underscores the administration’s focus on economic reform and tax legislation aimed at stimulating growth and benefiting American citizens.

The Context of Tax Cuts

Tax cuts have been a focal point of Trump’s economic agenda since he took office. By proposing significant tax reductions, the administration aims to alleviate financial burdens on individuals and businesses, thereby encouraging spending and investment. This strategy is built on the belief that lower taxes will lead to increased consumer confidence and economic expansion. The potential for "the Biggest Tax Cuts in History" suggests a bold approach that could reshape the financial landscape for many Americans.

Republican Unity and Legislative Strategy

The emphasis on a "UNITE" Republican House Majority indicates a concerted effort among party members to push forward the proposed tax cuts. This unity is crucial for passing legislation, as it requires a strong majority to navigate potential opposition from Democrats and other political factions. Trump’s assertion that the conversations throughout the day were "GREAT" reflects a strategic effort to rally support within the party, ensuring that all members are aligned with the overarching goals of economic growth and fiscal responsibility.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Projected Economic Impact

The anticipated tax cuts are expected to have a profound impact on the U.S. economy, potentially leading to "MASSIVE Growth." Economic analysts often argue that tax reductions can spur job creation, increase wages, and enhance overall economic productivity. By putting more money in the hands of consumers and businesses, proponents believe that spending will increase, which in turn could lead to a healthier economy.

Conclusion

President Trump’s recent statements reinforce a strong commitment to enacting significant tax reforms that could lead to substantial economic growth. The alignment within the Republican House Majority is a critical element in pushing this agenda forward. As the House prepares to vote, the implications of these tax cuts will be closely monitored by both supporters and critics alike. Should the vote pass, it could mark a pivotal moment in U.S. economic policy, with far-reaching effects for taxpayers and the overall economy.

This news serves as a reminder of the ongoing discussions surrounding fiscal policy in the United States and the potential for legislative changes that could impact millions of Americans. With a focus on unity and economic growth, the administration aims to solidify its legacy through transformative tax legislation.

Overall, this announcement encapsulates a significant moment in the Trump administration’s ongoing efforts to reshape the economic framework of the nation, setting the stage for what could be a historic shift in tax policy.

From President Trump: “It looks like the House is ready to vote tonight. We had GREAT conversations all day, and the Republican House Majority is UNITED, for the Good of our Country, delivering the Biggest Tax Cuts in History and MASSIVE Growth…” @HouseGOP pic.twitter.com/2zjLSw2vrC

— Dan Scavino (@Scavino47) July 3, 2025

From President Trump: “It looks like the House is ready to vote tonight. We had GREAT conversations all day, and the Republican House Majority is UNITED, for the Good of our Country, delivering the Biggest Tax Cuts in History and MASSIVE Growth…”

When President Trump took to social media to share the news about the House’s readiness to vote, it sent ripples through the political landscape. His statement wasn’t just a simple announcement; it was a declaration of unity among the Republican House Majority. This unity is crucial, especially when it comes to significant legislative movements like tax cuts, which can impact millions of American lives.

@HouseGOP

The House GOP has been at the forefront of discussions surrounding tax policies. The conversations that President Trump referenced were likely filled with strategic planning, addressing concerns from various factions within the party, and ensuring that everyone was on the same page. The idea that they were prepared to deliver what Trump called “the Biggest Tax Cuts in History” is a bold claim, and one that has been a significant part of the Republican agenda for years. As we delve deeper into what this means, it’s essential to understand the potential implications of such cuts.

Delivering the Biggest Tax Cuts in History

Tax cuts have been a cornerstone of Republican policy, often touted as a way to stimulate economic growth and increase consumer spending. The potential for “massive growth” is a phrase we often hear, but what does it truly mean for everyday Americans? When taxes are cut, it usually means that individuals and businesses have more money to spend. This can lead to increased investments, which can further drive job creation and economic expansion. However, it’s crucial to remember that tax cuts can also lead to budgetary constraints on government programs.

MASSIVE Growth…

When Trump speaks about “massive growth,” it’s not just about figures on a spreadsheet. It’s about the real impact on families, communities, and the broader economy. Growth can translate into better job opportunities, higher wages, and a more vibrant economy. But achieving this growth requires careful planning and execution. The Republican House Majority’s ability to navigate these discussions and come together as a united front is vital to making this vision a reality.

Understanding the Political Landscape

The political landscape in the U.S. is ever-changing. With various factions within the Republican Party, from moderates to hardliners, achieving consensus can be a daunting task. The conversations that were taking place leading up to this vote were likely filled with negotiations and compromises. It’s a delicate balance, and maintaining unity is essential for pushing forward any significant legislative changes. The House GOP’s ability to rally together signifies their commitment to a shared vision for the country.

The Role of Social Media in Politics

In today’s digital age, social media plays a pivotal role in shaping political narratives. Trump’s tweet not only serves as an announcement but also as a rallying cry for supporters and party members. It’s a tool for mobilization, a way to keep constituents informed, and a method to influence public opinion. This tweet, in particular, aimed to create a sense of urgency and excitement around the impending vote, which is crucial for garnering support.

The Future of Tax Cuts and Economic Policy

As discussions unfold, many are left wondering what the future holds for tax cuts and economic policy in the U.S. Will these proposed cuts lead to the promised growth, or will they create challenges for funding essential services? The answer to this question is complex and multifaceted. Economists and policymakers will need to weigh the benefits of tax cuts against potential budgetary constraints. This ongoing debate will undoubtedly shape the political landscape for years to come.

Conclusion: The Impact of a United House Majority

The Republican House Majority’s ability to come together and push for significant tax cuts could have lasting implications for the U.S. economy. As they prepare to vote, the focus remains on how these changes will affect ordinary Americans. Will this lead to a more prosperous future? Only time will tell. However, one thing is clear: the conversations happening within the House are crucial for shaping the economic landscape of the country. As we watch these developments unfold, it’s essential to stay informed and engaged with the ongoing dialogue.

“`

In this article, I’ve crafted a detailed discussion surrounding President Trump’s tweet about the House voting on tax cuts. Each section builds on the previous one, providing insights into the political landscape and the implications of tax policy. The use of keywords and proper HTML formatting ensures that this content is SEO-optimized for better visibility.