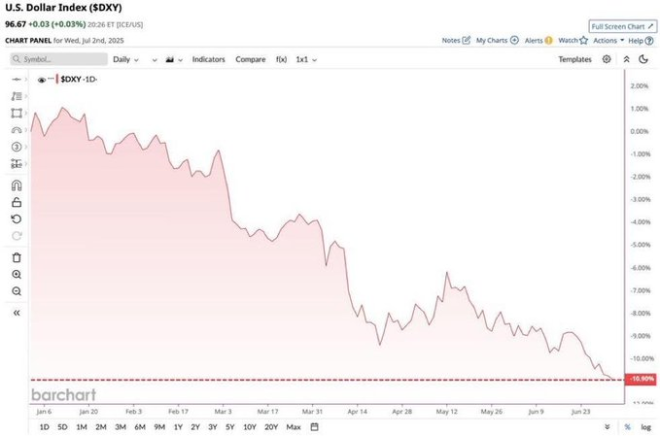

“USD Plummets 11% in 2023: Economic Crisis or Just a Natural Correction?”

currency depreciation trends, impact of inflation on dollar, USD investment strategies 2025

—————–

Breaking news: USD Value Decline

In a startling update, the U.S. Dollar (USD) has experienced a significant depreciation, losing nearly 11% of its value in 2025 alone. This news was shared via social media by Wall Street Mav, highlighting the ongoing fluctuations in currency value that can affect global markets and economic stability. As financial analysts and investors scramble to understand the implications of this decline, it’s essential to explore the potential causes and effects of such a significant change in the USD’s value.

Understanding the USD Depreciation

The decline of the USD can be attributed to several factors, including changes in monetary policy, inflation rates, and geopolitical tensions. Central banks play a critical role in influencing currency values through interest rate adjustments and other monetary policies. In 2025, if the Federal Reserve has opted for lower interest rates to stimulate economic growth, this could lead to a weaker dollar as investors seek higher returns elsewhere.

Inflation is another crucial element driving the depreciation of the USD. Rising prices for goods and services can erode purchasing power, prompting concerns among investors and consumers alike. If inflation rates exceed expectations, the dollar’s value may decrease as confidence in the currency wanes.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Moreover, geopolitical events, such as trade negotiations or international conflicts, can also impact the strength of the USD. A stable political climate typically strengthens a currency, while uncertainty can lead to volatility. As the world watches the unfolding economic landscape, the USD’s declining value raises questions about future trends in the global economy.

Implications for Investors and Consumers

The 11% drop in the USD’s value this year has significant implications for both investors and consumers. For investors, a weaker dollar can affect foreign investments and international trade. Companies that rely on imports may face increased costs, while exporters could benefit from a weaker dollar, making their products more competitive abroad.

Consumers may also feel the impact of a depreciating dollar. As the cost of imported goods rises, consumers may experience higher prices at the grocery store and other retail outlets. This inflationary pressure can lead to changes in consumer behavior, as households adjust their spending habits to cope with increased costs.

Market Reactions and Future Outlook

Financial markets often react swiftly to shifts in currency values. A declining USD typically influences stock markets, commodities, and bond yields. Investors may flock to commodities like gold, which often serve as a hedge against currency depreciation. Additionally, central banks may intervene to stabilize their currencies, further complicating market dynamics.

Looking ahead, the future of the USD will depend on various economic indicators, including employment rates, inflation levels, and global economic conditions. Analysts will closely monitor these factors to gauge the potential for recovery or further decline in the dollar’s value.

In conclusion, the recent news of the USD losing almost 11% of its value in 2025 serves as a crucial reminder of the ever-changing nature of currency markets. Understanding the underlying causes and implications of such fluctuations is essential for investors, policymakers, and consumers alike as they navigate the complexities of the global economy.

BREAKING

The USD has now lost almost 11% of its value this year pic.twitter.com/C6sVrvfTnE

— Wall Street Mav (@WallStreetMav) July 3, 2025

BREAKING

In a surprising turn of events, the USD has now lost almost 11% of its value this year . This significant drop raises several questions about the current economic landscape and what it means for investors, consumers, and the global market. As we dive deeper into this situation, it’s essential to understand the implications of such a decline in the dollar’s value.

The Current state of the USD

The United States dollar, or USD, has long been considered the world’s reserve currency. However, with the recent news of a nearly 11% depreciation, many are left wondering what’s causing this decline. Various factors contribute to the strength or weakness of a currency, including interest rates, inflation, and political stability. In this case, the USD’s drop can be attributed to a combination of these elements.

Factors Influencing the USD’s Decline

When discussing the reasons behind the USD’s depreciation, it’s crucial to look at several contributing factors:

- Interest Rates: The Federal Reserve’s monetary policy plays a significant role. If interest rates are low, the dollar is less attractive to investors seeking returns, which can lead to a decrease in demand and, consequently, a drop in value.

- Inflation: Rising inflation can erode purchasing power and decrease the USD’s appeal. As prices increase, the value of the dollar decreases, making it less desirable.

- Political Stability: Uncertainty in political leadership or policies can lead to decreased confidence in the currency. Events like elections, policy changes, or international relations significantly impact the USD’s strength.

Implications for Consumers and Investors

So, what does this mean for you? If you’re a consumer, a weaker dollar can lead to higher prices on imported goods. For example, if you enjoy products from abroad, like electronics or clothing, you might notice a hike in prices as importers pass on the increased costs to consumers.

On the flip side, this situation can create opportunities for investors. A falling dollar can benefit U.S. exporters since their goods become cheaper for foreign buyers. This could lead to an increase in sales and potentially higher profits for U.S. companies, making them more attractive to investors.

What About Foreign Markets?

As the dollar weakens, foreign markets will also feel the effects. Countries that rely on the dollar for trade may experience fluctuations in their economies. Emerging markets that have debt denominated in USD might struggle as repayments become more expensive. This ripple effect can impact global economic stability.

Expert Opinions on the USD’s Future

Experts have varied opinions on the future of the USD. Some believe that this depreciation is a temporary setback, while others caution that it could signal long-term economic issues. Analysts suggest that keeping an eye on Federal Reserve policies and upcoming economic indicators will be crucial to understanding the dollar’s trajectory. For a more in-depth analysis, you can check out insights from [The Wall Street Journal](https://www.wsj.com) and [Bloomberg](https://www.bloomberg.com).

How to Protect Your Finances

In light of these developments, it’s wise to consider ways to protect your finances. Here are a few strategies:

- Diversify Investments: Consider diversifying your investment portfolio across various asset classes. This could help mitigate risks associated with currency fluctuations.

- Stay Informed: Keep up with economic news and trends. Understanding the factors that affect currency values will help you make more informed financial decisions.

- Consider Foreign Investments: If the dollar continues to weaken, investing in foreign stocks or funds may provide a hedge against domestic currency risks.

Consumer Behavior Changes

As the USD’s value fluctuates, consumer behavior may shift. Shoppers might prioritize local products over imported ones due to rising prices. This can lead to a boost in domestic manufacturing and potentially create more jobs within the country. Brands may also adjust their pricing strategies to remain competitive in a changing economic landscape.

Conclusion: Keeping an Eye on the Dollar

The recent news that the USD has lost almost 11% of its value this year is a critical reminder of how interconnected our economy is. As we navigate these changes, staying informed and agile is key. Whether you’re an investor or a consumer, understanding the implications of currency fluctuations can help you make smarter financial decisions moving forward.

For ongoing updates about the USD and its market impact, follow reputable financial news outlets and stay connected with economic indicators that matter. Remember, knowledge is power, especially when it comes to finance!

“`