BREAKING : Michael Burry’s Bold Prediction Leads S&P 500 to Surge 54% – Investors Divided

Michael Burry stock market prediction, investment advice Michael Burry, S&P 500 performance analysis

—————–

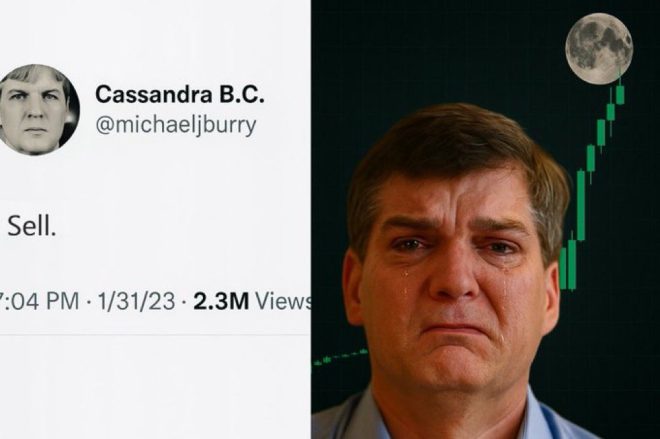

The tweet from Barchart reveals that the S&P 500 has seen a significant increase of 54% since Michael Burry advised to sell. Michael Burry is a well-known investor who famously predicted the housing market crash in 2008. His advice carries weight in the financial world, making this update particularly noteworthy.

The S&P 500 is a key benchmark index that tracks the performance of 500 of the largest publicly traded companies in the United States. A 54% increase is a substantial gain, indicating strong market performance over the period since Burry’s recommendation to sell. This news is likely to attract the attention of investors, analysts, and market observers who closely follow the movements of the stock market.

Burry’s reputation for making bold and accurate predictions adds credibility to his advice. His track record of foreseeing major market shifts has earned him a following of investors who value his insights. The fact that the S&P 500 has surged following his sell recommendation may prompt some to reconsider their investment strategies and assess the current market conditions.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The tweet includes a humorous emoji, suggesting a lighthearted take on the situation. It is common for financial news to be presented in a serious and formal manner, so the use of humor in this context adds a playful element to the discussion. This tone may help to engage a wider audience and make the information more accessible to those who may not be as familiar with financial terminology.

Overall, the tweet from Barchart provides a snapshot of the current state of the stock market, highlighting the impact of Michael Burry’s advice on the S&P 500. The significant increase in the index since his sell recommendation underscores the influence that prominent investors can have on market trends. As investors continue to monitor the performance of the S&P 500 and other key indices, the insights of figures like Michael Burry will remain valuable in shaping investment decisions.

BREAKING : Michael Burry

S&P 500 is now up 54% since Michael Burry told us to sell pic.twitter.com/VtXXT6hzBl

— Barchart (@Barchart) July 3, 2025

If you’ve been following the financial world lately, you may have heard about the recent tweet from Barchart that has everyone talking. The tweet, which was posted on July 3, 2025, announced that the S&P 500 is now up 54% since Michael Burry advised us to sell. This news has sparked a lot of discussion and speculation among investors and analysts alike. So, what exactly does this mean for the future of the stock market? Let’s dive in and explore this breaking news further.

Who is Michael Burry, and why is his advice so significant? Michael Burry is a well-known investor who gained fame for predicting the housing market crash of 2008. His story was famously portrayed in the movie “The Big Short,” where he was played by actor Christian Bale. Burry’s track record for making accurate predictions has earned him a reputation as a top financial mind in the industry.

In this latest turn of events, Burry’s advice to sell has seemingly backfired, as the S&P 500 has continued to climb despite his warning. The S&P 500 is a stock market index that measures the performance of 500 of the largest publicly traded companies in the United States. A 54% increase is no small feat, and it has left many wondering what the future holds for the market.

Some experts believe that Burry’s prediction may have been premature or based on incomplete information. Others speculate that external factors, such as government intervention or economic policies, may have influenced the market’s upward trajectory. Regardless of the reason, one thing is clear: the stock market can be unpredictable, and even the most seasoned investors can get it wrong from time to time.

As investors, it’s essential to stay informed and make decisions based on a combination of research, analysis, and intuition. While it’s tempting to rely solely on the advice of experts like Michael Burry, it’s crucial to remember that no one can predict the market with 100% accuracy. Diversifying your portfolio, staying up to date on market trends, and seeking advice from multiple sources can help you navigate the ups and downs of the stock market more effectively.

In conclusion, the recent news that the S&P 500 is up 54% since Michael Burry’s sell recommendation serves as a reminder of the unpredictable nature of the stock market. While it’s essential to consider the advice of experts, it’s equally important to do your own research and make informed decisions. The market will always have its twists and turns, but by staying informed and adaptable, investors can navigate these challenges with confidence. Stay tuned for more updates on this evolving story.