“Is APT Ready to Soar? Early Reversal Signals Ignite Controversy!”

APT price prediction, cryptocurrency technical analysis, altcoin market trends

—————–

APT/USDT Analysis: Early Reversal Signals and Key Price Targets

In the world of cryptocurrency trading, timely analysis is crucial for making informed decisions. A recent analysis of the APT/USDT trading pair has provided traders with valuable insights, highlighting early reversal signals and key price targets. This summary will delve into the critical points of this analysis and offer a clearer understanding of potential trading strategies.

Current Market Sentiment

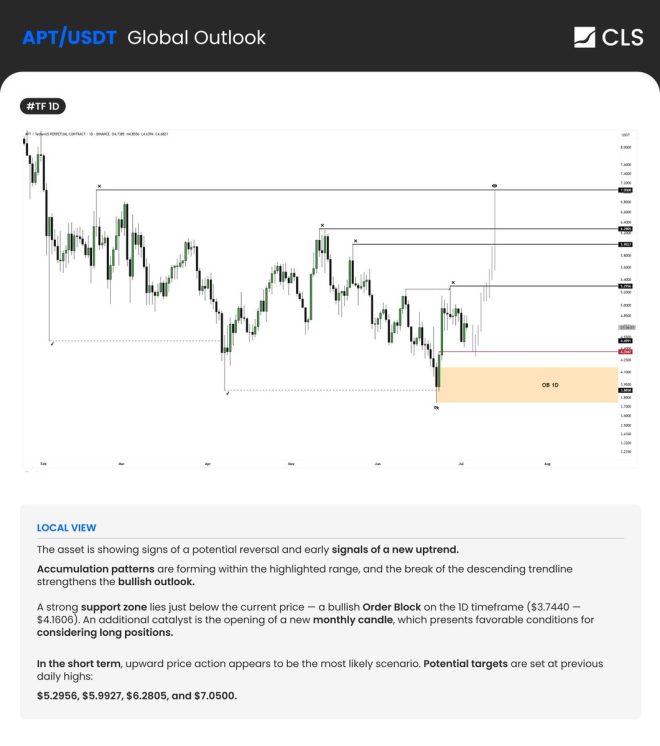

The analysis indicates that APT has found significant support within the price range of $3.74 to $4.16. This stability in the price zone suggests that buyers are stepping in, potentially leading to a reversal from the recent downtrend. The presence of early reversal signals is particularly encouraging for traders looking for entry points to capitalize on potential upward momentum.

Breaking the Descending Trendline

One of the standout observations from the analysis is the recent break of a descending trendline. This technical indicator often signifies a shift in market sentiment. When a cryptocurrency breaks above a descending trendline, it can indicate that bearish pressure is waning, and buyers are gaining control. For APT, this break is a positive sign that could lead to further price increases.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Testing Resistance at Former ATH Zone

As APT continues to progress, it is currently testing resistance levels around its former all-time high (ATH). This zone is critical, as it represents a psychological barrier for traders. If APT can successfully break above this resistance, it may pave the way for further price increases. Traders should closely monitor price action in this area, as a successful breakout could trigger significant buying interest.

Accumulation Patterns Forming

The analysis also notes the formation of accumulation patterns, which typically indicate that investors are building positions in anticipation of a price increase. Accumulation can be a bullish signal, suggesting that demand is increasing even as price action remains relatively stable. For traders, recognizing these patterns can provide valuable insights into future price movements.

Price Targets

Based on the current analysis, several key price targets have been identified for APT. The following price levels are of interest:

- Target 1: $5.30

- Target 2: $5.99

- Target 3: $6.28

- Target 4: $7.05

These targets represent potential milestones for traders to watch as APT navigates through its current market conditions. Setting these targets in advance allows traders to plan their strategies effectively and capitalize on upward price movements.

Conclusion

Overall, the APT/USDT analysis presents a promising outlook for traders. With early reversal signals, the breaking of a descending trendline, and the testing of significant resistance levels, there are multiple indicators suggesting that APT may be on the verge of a bullish breakout. For those interested in trading this cryptocurrency, it’s essential to stay informed about market developments and price movements, as the landscape can change rapidly.

For the latest updates and detailed analyses, following reputable sources like CLS Global can provide valuable insights into the cryptocurrency market. As always, practice due diligence and consider your investment strategy carefully before entering any trades.

$APT/USDT Analysis

Early reversal signals after finding support at $3.74-$4.16 zone.

Key Points:

– Breaking descending trendline

– Testing resistance at former ATH zone

– Accumulation patterns formingTargets: → $5.30 → $5.99 → $6.28 → $7.05

Follow CLS Global for… pic.twitter.com/oGl42y3JXR

— CLS GLOBAL (@CoinLiquidity) July 3, 2025

$APT/USDT Analysis

If you’re diving into the world of cryptocurrencies, you’ve probably heard of $APT. This token has been making waves lately, and for good reason. In this analysis, we’ll break down the recent movements, key insights, and what potential targets might look like.

Early Reversal Signals After Finding Support at $3.74-$4.16 Zone

The $APT token is showing some promising signs after recently finding support in the $3.74-$4.16 zone. This area has become a crucial pivot point for traders, indicating that there might be a shift in momentum. When a cryptocurrency finds support, it generally signals that buying pressure is starting to outweigh selling pressure, which can lead to a price reversal.

This support level has attracted a lot of attention, and many traders are closely monitoring this range. If you’re considering getting into the $APT market, this could be a key area to watch.

Key Points

When analyzing $APT/USDT, there are several key points to consider:

Breaking Descending Trendline

One of the most significant developments is the breaking of the descending trendline. For those who are familiar with technical analysis, this is a very bullish sign. A descending trendline indicates that the price has been in a downtrend, and breaking above it suggests a potential trend reversal. This could be a good time for traders to look for entry points as the market may be gearing up for a rally.

Testing Resistance at Former ATH Zone

Another crucial aspect is that $APT is currently testing resistance at its former all-time high (ATH) zone. This zone is often a battleground for bulls and bears. If the price can break through this resistance, it could unleash a wave of buying pressure, pushing the price higher. On the flip side, if it fails to break this resistance, it could lead to a pullback. Therefore, watching how $APT behaves around this zone is essential for making informed trading decisions.

Accumulation Patterns Forming

We are also seeing some promising accumulation patterns forming. Accumulation occurs when investors are buying more of a specific asset, indicating confidence in its future price. This could mean that larger players in the market are positioning themselves for a potential breakout. If you see accumulation patterns, it signifies a good chance that the price may increase in the near future.

Targets: → $5.30 → $5.99 → $6.28 → $7.05

Now, let’s talk about targets. After analyzing the current market conditions and price action, some potential targets for $APT include $5.30, $5.99, $6.28, and $7.05. Each of these levels represents key psychological and technical resistance points where traders might look to take profits or set new buy orders.

Setting realistic targets is crucial for any trading strategy. It helps you stay disciplined and avoid emotional decision-making. When you have clear price levels in mind, you can make more calculated moves.

Follow CLS Global for More Insights

If you’re looking for regular updates and deeper insights into the cryptocurrency market, consider following [CLS Global](https://twitter.com/CoinLiquidity). They provide valuable information and analysis that can help inform your trading decisions. Keeping up with expert opinions can give you an edge, especially in the fast-moving world of crypto.

Understanding Market Sentiment

Market sentiment plays a significant role in the price movements of cryptocurrencies like $APT. Traders often rely on various tools, including social media and news outlets, to gauge whether the market is bullish or bearish. The recent buzz around $APT suggests that there’s increasing interest, which could contribute to upward price movement.

Engaging with the community on platforms like Twitter can provide real-time insights into how investors are feeling. Pay attention to discussions and sentiment shifts, as these can often precede price movements.

Risk Management Strategies

While the potential for gains in $APT is enticing, it’s crucial to implement risk management strategies. The cryptocurrency market is known for its volatility, and prices can swing dramatically in short periods. Here are a few tips to manage your risk effectively:

– **Diversify Your Portfolio**: Don’t put all your eggs in one basket. Diversifying your investments across various assets can help mitigate risk.

– **Set Stop-Loss Orders**: A stop-loss order automatically sells your asset if it reaches a certain price. This can help you limit losses if the market takes a downturn.

– **Only Invest What You Can Afford to Lose**: This is a fundamental rule in trading. Only invest money that you can afford to lose without affecting your financial stability.

Keeping an Eye on Market Trends

Staying informed about broader market trends is essential for anyone trading in cryptocurrencies. Price movements are often influenced by macroeconomic factors, regulatory developments, and technological advancements within the crypto space. For $APT, keeping an eye on related cryptocurrencies and market sentiment can provide valuable context.

For instance, if Bitcoin or Ethereum experiences significant price movements, it can impact altcoins like $APT. Understanding these dynamics can help you make more informed trading decisions.

Conclusion: The Future of $APT

The $APT/USDT analysis presents a mixed but optimistic outlook. While there are signs of potential recovery and upward movement, it’s essential to remain cautious and informed. By keeping an eye on support levels, resistance zones, and market sentiment, you can navigate the volatility of the crypto market more effectively.

As you consider your next steps in trading $APT, remember the importance of having a strategy, managing your risks, and continuously educating yourself. With the right approach, $APT could be an exciting addition to your portfolio. Happy trading!