US Money Supply Surges to $21.94 Trillion: Is Inflation Around the Corner?

M2 money supply trends, US inflation impact 2025, Federal Reserve monetary policy

—————–

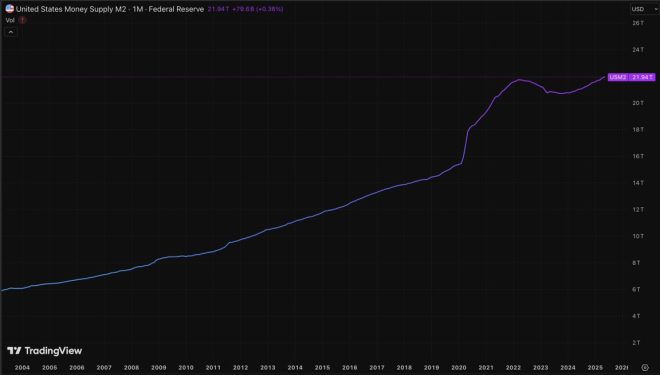

US M2 Money Supply Reaches Record High of $21.94 Trillion

In a significant economic development, the US M2 money supply has surged to an unprecedented level of $21.94 trillion. This news was highlighted in a tweet by Crypto Rover, showcasing the latest figures that reflect a major milestone in the country’s monetary policy and economic landscape. Understanding the implications of this record-high M2 money supply is crucial for investors, economists, and anyone interested in the financial markets.

M2 is a critical measure of the money supply that includes cash, checking deposits, and easily convertible near money. It serves as an important indicator of the economy’s liquidity and can influence inflation, interest rates, and overall economic growth. The recent rise in the M2 money supply signals that the Federal Reserve continues to pursue aggressive monetary policies to stimulate economic recovery, especially in the wake of global economic challenges.

The Implications of Increased M2 Money Supply

The climb to $21.94 trillion in M2 money supply raises various questions about inflation and the purchasing power of the dollar. As the money supply increases, there is a risk of inflation if the growth in money outpaces economic output. This scenario can lead to higher prices for goods and services, impacting consumers and businesses alike. Inflationary pressures may prompt the Federal Reserve to adjust interest rates, which can have a cascading effect on borrowing costs and investment decisions.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Moreover, a higher M2 money supply can affect the stock market and cryptocurrency trends. Investors may flock to assets that traditionally serve as hedges against inflation, such as real estate and precious metals, or they may turn to cryptocurrencies like Bitcoin as alternative investments. As the dynamics of the financial markets shift, understanding the interplay between the money supply and asset valuations becomes essential for making informed investment choices.

Market Reactions and Future Outlook

The news of the M2 money supply hitting a new high has already started to influence market sentiment. Investors are keenly observing the Federal Reserve’s next moves, as any changes in monetary policy can create ripples across various asset classes. The potential for increased inflation and higher interest rates could lead to volatility in the stock market, while cryptocurrencies may experience heightened activity as traders seek to capitalize on changing economic conditions.

Looking ahead, economists will continue to monitor the M2 money supply closely, as it serves as a barometer for economic health and policy effectiveness. The Federal Reserve’s approach to managing the money supply will play a pivotal role in shaping the economic landscape, influencing everything from consumer spending to business investment.

In conclusion, the record-high M2 money supply of $21.94 trillion is a critical development that reflects ongoing monetary policy efforts to bolster economic recovery. As this situation unfolds, it is vital for stakeholders to remain informed about the implications for inflation, interest rates, and investment strategies. Keeping an eye on these trends will be essential for navigating the complex financial environment ahead.

BREAKING:

US M2 MONEY SUPPLY HITS A NEW ALL-TIME HIGH OF $21.94 TRILLION. pic.twitter.com/KCzvYjqtwI

— Crypto Rover (@rovercrc) July 2, 2025

BREAKING:

US M2 MONEY SUPPLY HITS A NEW ALL-TIME HIGH OF $21.94 TRILLION.

If you’ve been keeping up with the financial news, you might have stumbled upon some pretty eye-popping figures lately. One such figure is the astonishing **US M2 money supply**, which recently hit a whopping **$21.94 trillion**. This isn’t just a number to toss around; it represents a critical aspect of the economy that affects our daily lives, from inflation rates to interest rates and everything in between.

So, what does it all mean? Let’s dive into the details and implications of this record-breaking figure.

Understanding M2 Money Supply

Before we get too deep into the implications of this new high, let’s clarify what the M2 money supply actually is. M2 is a measure of the total amount of money in circulation within an economy. It includes cash, checking deposits, and easily convertible near money. Think of it as a broader measure of the money supply that captures not just the cash in your wallet but also the money in your bank accounts.

The M2 metric is crucial because it gives us a sense of how much liquidity is available in the system. When people talk about the money supply, they are often referring to M2 because it reflects the funds available for spending and investment.

Why the Spike in M2?

You might wonder, what has caused this spike to **$21.94 trillion**? Several factors contribute to such an increase, but let’s break down the most significant ones:

1. **Government Spending:** The U.S. government has been on a spending spree, especially in response to economic challenges like the pandemic. Stimulus packages and other financial support measures have pumped a significant amount of money into the economy.

2. **Low-Interest Rates:** The Federal Reserve has maintained low-interest rates to encourage borrowing and spending. When borrowing is cheap, businesses and consumers are more likely to take out loans, which adds to the money supply.

3. **Quantitative Easing:** This monetary policy tool involves the Fed buying financial assets to inject liquidity into the economy. The aim is to promote increased lending and investment. It’s an effective way to increase the M2 money supply.

Each of these factors plays a role in how we reached this historic high, and the implications of this increase are significant for everyone.

Implications of a High M2 Money Supply

Now that we have a grasp on what M2 is and how we got here, let’s talk about the implications of this record-high number.

1. **Inflation Concerns:** One of the primary concerns with a burgeoning money supply is inflation. When there’s more money circulating, the value of that money can decrease, leading to higher prices for goods and services. If you’ve noticed your grocery bills creeping up, you’re not alone. The relationship between money supply and inflation is something economists watch closely.

2. **Interest Rate Adjustments:** The Federal Reserve may need to respond to this increase by adjusting interest rates. If inflation rises too quickly, the Fed may hike rates to cool down the economy. Higher interest rates can affect everything from mortgage rates to credit card interest, making it more expensive to borrow.

3. **Investment Behavior:** A high M2 money supply can lead to increased investment in the stock market and other assets. Investors may be more willing to put their money into stocks when they see plenty of liquidity in the market. However, this can also lead to market bubbles if investors are overly optimistic.

4. **Consumer Confidence:** On the flip side, a robust money supply can boost consumer confidence. When people feel that money is readily available, they are more likely to spend. Increased consumer spending can stimulate economic growth, so it’s a double-edged sword.

The Global Perspective

The implications of the US M2 money supply extend beyond just American borders. The US dollar is the world’s reserve currency, meaning it’s held by many countries as part of their foreign exchange reserves. When the US increases its money supply, it can have ripple effects throughout the global economy.

Countries that rely on exports to the US may find themselves affected by changes in demand driven by the M2 increase. Additionally, fluctuations in the dollar’s value can impact global trade balances. For instance, if inflation rises significantly, the dollar could weaken, affecting international purchasing power.

What Should You Do?

With all this talk about economic indicators, you might be wondering what you can do to safeguard your finances. Here are a few tips:

1. **Stay Informed:** Keep an eye on financial news and trends. Understanding the broader economic context can help you make informed decisions about your money.

2. **Reevaluate Investments:** If you have investments, consider whether you need to adjust your strategy in light of potential interest rate hikes or inflation. Diversifying your portfolio can help mitigate risks.

3. **Budget Wisely:** With rising prices, it’s essential to keep an eye on your spending. Create a budget that allows for flexibility but also takes into account potential increases in costs.

4. **Emergency Fund:** Having an emergency fund is more crucial than ever. It can provide a cushion against unforeseen economic shifts, such as job loss or sudden expenses.

Future Outlook

Looking ahead, we can expect the Federal Reserve to closely monitor the M2 money supply. As we’ve seen, there are numerous factors at play, and the situation can change rapidly. Keeping a pulse on these developments will be essential for anyone looking to understand the economic landscape.

The M2 money supply hitting **$21.94 trillion** is more than just a number; it’s a signal of the current economic climate and a precursor to potential future changes. Whether you’re a casual observer or someone deeply invested in the financial world, staying informed will help you navigate these uncertain waters.

In summary, the record-breaking US M2 money supply has far-reaching implications that touch on inflation, interest rates, and consumer behavior. By understanding these dynamics, you can better prepare for what’s to come and make informed decisions about your finances.