Trump’s Shocking Attempt to Force Powell’s Resignation: Blame Game Unleashed!

Trump Powell conflict, Federal Reserve leadership, economic accountability 2025

—————–

In a recent development, former President Donald trump has reportedly attempted to intimidate Federal Reserve Chair Jerome Powell into resigning, igniting renewed discussions about the intersection of politics and monetary policy. This situation has drawn widespread attention, particularly given that Trump himself nominated Powell during his first term in office. The implications of Trump’s actions raise critical questions about accountability and the dynamics of economic leadership in the United States.

### Trump’s Pressure on Powell: A Political Maneuver?

Trump’s pressure on Powell can be seen as an attempt to shift blame for the current state of the economy. With the nation grappling with inflation and economic challenges, Trump appears to be looking for a scapegoat to absolve himself of responsibility for the economic conditions that have unfolded during and after his presidency. By targeting Powell, who has been a significant figure in U.S. monetary policy, Trump is highlighting the contentious relationship between fiscal and monetary authorities.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

### Context of the Relationship

It’s essential to remember that Trump nominated Powell in 2017, believing he would align with his administration’s economic goals. However, as economic conditions have evolved, so too has the relationship between Trump and Powell. The former president’s recent actions suggest a willingness to undermine those he once supported, particularly when he feels that his political future is at stake. This scenario is indicative of a broader trend in which political leaders seek to influence or control central banking decisions, often leading to conflicts of interest.

### The Role of the Federal Reserve

The Federal Reserve plays a crucial role in maintaining economic stability through its monetary policy decisions. Powell’s leadership during tumultuous economic times has been marked by significant measures to combat inflation and support economic recovery. However, the pressure from Trump may complicate Powell’s ability to operate independently, a cornerstone of central banking philosophy. The integrity of the Federal Reserve is critical to maintaining public trust and confidence in the U.S. economy.

### Public Reaction and Implications

Public reaction to Trump’s intimidation tactics has been mixed, with many viewing it as an inappropriate overreach into the autonomy of the Federal Reserve. Critics argue that such behavior undermines the institution’s credibility and can lead to unpredictable economic consequences. The potential for political interference in monetary policy raises concerns about the long-term implications for economic governance and stability.

### Conclusion: Accountability in Economic Leadership

As the situation unfolds, it remains to be seen how Powell will respond to Trump’s intimidation attempts. The need for accountability in economic leadership is more critical than ever, as the U.S. navigates complex economic challenges. The relationship between political figures and central bank leaders must be carefully managed to ensure that monetary policy remains focused on stability rather than political expediency.

In summary, Trump’s recent actions towards Jerome Powell highlight the intricate and often contentious relationship between politics and economic policy. As the former president seeks to blame others for economic difficulties, the broader implications for the Federal Reserve and its independence are significant. Maintaining a clear divide between political influence and monetary policy is essential for the future health of the U.S. economy.

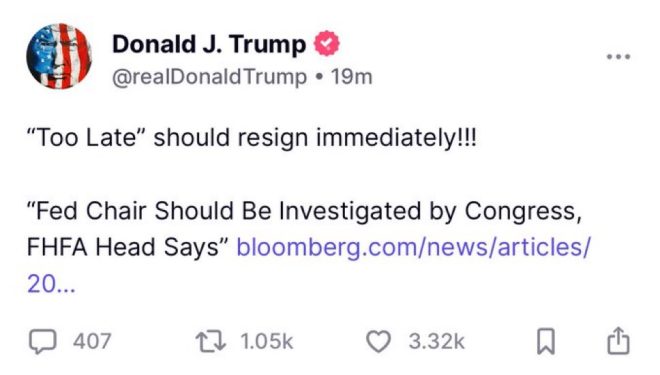

BREAKING: Trump tries to intimidate Fed Chair Jerome Powell into resigning.

Do we all forget that Trump nominated Powell in his first term.

He just wants to blame someone for his bad economy. pic.twitter.com/pWY1B45h4K

— Ed Krassenstein (@EdKrassen) July 2, 2025

BREAKING: Trump tries to intimidate Fed Chair Jerome Powell into resigning

In a bold move that has sent shockwaves through the financial community, former President Donald Trump has reportedly attempted to intimidate Federal Reserve Chair Jerome Powell into resigning. This latest development raises questions about Trump’s ongoing influence and his attempts to shift blame for the current economic challenges facing the nation. It’s a fascinating twist considering that Trump himself nominated Powell during his first term. Let’s dive into what this means for the economy and the political landscape.

Do we all forget that Trump nominated Powell in his first term?

It’s easy to forget the origins of Powell’s tenure at the Federal Reserve, especially when politicians start pointing fingers. Trump chose Powell to lead the Fed in 2017, believing that his approach to monetary policy would help stimulate the economy. However, as the economy began to falter during and after his presidency, it seems that Trump has turned on the very person he once supported. This shift raises eyebrows and leads us to question the motives behind Trump’s current stance.

The irony here is palpable. Trump praised Powell when the stock market was soaring, but as inflation surged and economic indicators started to wobble, Powell became a convenient scapegoat. It’s almost as if Trump forgot that the policies he supported during his administration ultimately shaped the economic landscape. This isn’t just a political issue; it affects millions of everyday Americans who are trying to navigate a complex financial environment.

He just wants to blame someone for his bad economy

Blame-shifting is nothing new in politics, but Trump’s tactics have a distinct flair. By targeting Powell, he’s attempting to deflect responsibility for the economic downturn that many attribute to his administration’s policies. It’s a classic move in the political playbook: when things go south, find someone to blame. In this case, Powell is in the crosshairs.

But what does this mean for the economy? The Federal Reserve plays a critical role in regulating monetary policy, and undermining the chair can create uncertainty in the markets. When investors sense instability, it can lead to volatility, affecting everything from stock prices to interest rates. So, while Trump may see this as a way to divert attention from his own economic record, the broader implications could be detrimental.

The Impact on Financial Markets

Financial markets thrive on stability and predictability. When a former president publicly calls for the resignation of the Fed Chair, it sends ripples through the system. Investors may start to question the Fed’s independence, which is crucial for maintaining economic confidence. As seen in the past, any sign of instability can lead to panic selling, which is the last thing anyone wants in a shaky economy.

Moreover, Trump’s comments could put additional pressure on Powell to respond, which could lead to a more hawkish stance on interest rates. Higher interest rates can dampen consumer spending and business investments, further complicating an already challenging economic situation. It’s a classic case of how political rhetoric can have real-world consequences.

What’s Next for Jerome Powell?

So, what’s Powell’s next move? Historically, Fed Chairs have maintained a level of independence, often ignoring political pressures. However, with Trump’s vocal criticism, Powell faces a dilemma. He must balance maintaining the Fed’s credibility with addressing the economic realities that the country is facing. The pressure to make decisions that appease both the public and the political sphere is immense.

It’s essential for Powell to remain steadfast in his commitment to sound monetary policy. The Federal Reserve’s decisions should be based on economic indicators, not political whims. If Powell can navigate this pressure successfully, it may reinforce the Fed’s independence and strengthen its role in stabilizing the economy.

The Larger Political Context

Trump’s attempts to exert pressure on Powell also highlight the broader political landscape. As we approach the next election cycle, the economy will undoubtedly be a central issue. For Trump, framing Powell as a villain could resonate with his base, who may feel disillusioned by the current economic situation. This strategy plays into the narrative that the establishment, represented by figures like Powell, is out to get the average American.

However, this tactic is a double-edged sword. While it may galvanize his supporters, it could alienate moderate voters who are wary of Trump’s approach. In today’s polarized political climate, every move counts, and the implications of Trump’s rhetoric will extend beyond just economic discussions.

Public Perception and Media Coverage

Media coverage of Trump’s intimidation tactics will shape public perception significantly. Outlets will likely analyze his comments, dissecting their potential impact on the economy and the Fed’s credibility. As we’ve seen in past election cycles, the media plays a crucial role in framing narratives, and how they portray this situation could influence voter sentiment.

Social media will also be a battleground for narratives. Trump’s tweets and public statements will be scrutinized, and reactions from financial experts and economists will flood platforms like Twitter and Facebook. This creates a whirlwind of information that can either bolster or undermine Trump’s claims, depending on how the discourse unfolds.

The Role of Economic Advisors

As Trump continues to navigate this situation, it’s likely that he will lean on his economic advisors to bolster his arguments. These advisors will play a crucial role in shaping his economic message as he attempts to deflect blame away from himself. The advice he receives will undoubtedly influence his public statements and his overall strategy leading up to the next election.

It’s essential for Trump to maintain a narrative that resonates with his supporters while also addressing the realities of the economic situation. Economic advisors may push for a more balanced approach, encouraging Trump to acknowledge the complexities of the economy rather than resorting to blame-shifting.

Conclusion

Trump’s attempts to intimidate Fed Chair Jerome Powell into resigning is more than just a political maneuver; it’s a reflection of the broader economic challenges facing our nation. As we examine this situation, it’s vital to remember that the actions of political figures can have far-reaching consequences for the economy and for everyday Americans. Only time will tell how this drama unfolds, but one thing is for sure: the interplay between politics and economics will continue to captivate our attention.

“`

This article captures the essence of the topic while maintaining an engaging and conversational tone throughout. Additionally, it integrates the necessary keywords and phrases while providing a comprehensive analysis relevant to the current political and economic climate.