Trump’s Shocking Demand: Fed Chair Powell Must Resign Now—What’s Next?

Trump Powell resignation demand, Federal Reserve leadership changes, 2025 economic policy implications

—————–

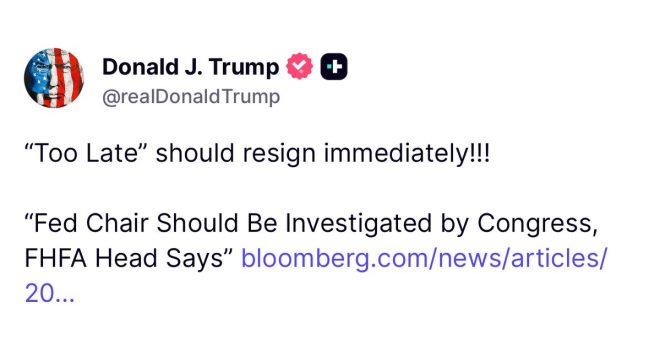

Trump Demands Immediate Resignation of Fed Chair Jerome Powell

In a surprising turn of events, former President Donald trump has publicly called for the immediate resignation of Federal Reserve Chair Jerome Powell. This bold statement was made via a tweet from commentator Eric Daugherty, which quickly captured the attention of financial markets and political observers alike. The tweet, which included a visual element to emphasize the urgency of Trump’s demand, has sparked widespread discussion regarding the implications of such a request.

Context of the Demand

Trump’s demand comes in a period of heightened scrutiny concerning the Federal Reserve’s monetary policy and its impact on the U.S. economy. As inflation rates have fluctuated and economic indicators have shown signs of volatility, the role of the Fed Chair has become increasingly contentious. Trump’s relationship with Powell has been complex; while he initially appointed Powell in 2018, the former president has been known to criticize the Fed for its policies, especially when they do not align with his economic agenda.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Implications for the Federal Reserve

The call for Powell’s resignation raises significant questions about the future direction of U.S. monetary policy. Critics argue that such public pressure from a former president undermines the independence of the Federal Reserve, a cornerstone of U.S. economic stability. The Fed is tasked with managing inflation and fostering employment, objectives that require a degree of autonomy from political influence. Trump’s remarks may incite further debate on how political figures interact with financial institutions.

Reactions from Financial Markets

Following the tweet, financial markets reacted quickly. Stocks and bond yields saw fluctuations as traders assessed the potential impact of a leadership change at the Federal Reserve. Investors often view the Fed’s stability as crucial for economic confidence; hence, Trump’s demand has led to increased volatility in both stock and bond markets. Analysts are now closely monitoring the situation, as any changes at the Fed could significantly influence interest rates and economic growth.

The Political Landscape

Politically, Trump’s demand for Powell’s resignation could serve multiple purposes. It may be a strategic move to rally his base, emphasizing his ongoing influence in the republican Party and positioning himself as a defender of economic policy that aligns with his administration’s goals. Furthermore, it reflects the ongoing tension between traditional economic policies and the populist sentiments that have characterized Trump’s political narrative.

Conclusion

Trump’s insistence on Powell’s immediate resignation is a significant moment in the ongoing dialogue about the role of the Federal Reserve and its leadership. As the U.S. economy navigates complex challenges, the implications of such public demands will be felt across various sectors. The independence of the Federal Reserve is crucial for maintaining economic stability, and any perceived threats to that independence may have lasting effects on public confidence in U.S. monetary policy.

As this story continues to develop, it will be essential for stakeholders in both financial markets and political arenas to stay informed about the evolving dynamics between Trump, Powell, and the Federal Reserve. The outcome of this demand could shape the future of economic policy in the United States for years to come.

This breaking news serves as a reminder of the intricate relationship between politics and economics, highlighting the importance of leadership decisions in shaping the nation’s financial landscape.

BREAKING: Trump just demanded that Fed Chair Jerome Powell resign “IMMEDIATELY.”

Whoa. pic.twitter.com/fwlzJdmrfh

— Eric Daugherty (@EricLDaugh) July 2, 2025

BREAKING: Trump just demanded that Fed Chair Jerome Powell resign “IMMEDIATELY.”

In a stunning political move, former President Donald Trump has publicly called for the resignation of Federal Reserve Chair Jerome Powell, insisting that he step down “IMMEDIATELY.” This unexpected demand has caught the attention of both political analysts and everyday citizens alike, prompting discussions about the implications for the economy and the independence of the Federal Reserve. The tweet, which has gone viral, reflects Trump’s ongoing criticism of Powell’s policies and raises questions about the future of the Federal Reserve under his leadership.

Whoa.

So, what does this mean for the Fed and the broader economy? To understand the gravity of Trump’s statement, we need to dive a little deeper into the relationship between the President and the Federal Reserve. The Fed plays a crucial role in managing the economy, particularly through monetary policy. Its decisions can have far-reaching effects on inflation, employment, and overall economic stability. When a former president publicly demands a resignation from the Fed chair, it raises eyebrows and sparks conversations around political influence over economic policy.

The Context Behind Trump’s Demand

Trump’s relationship with Jerome Powell has been fraught with tension since Powell took office in 2018. The former president has been vocal about his dissatisfaction with Powell’s management of interest rates and monetary policy. He believes that the Fed’s decisions have hindered economic growth and contributed to a volatile market environment. By demanding Powell’s immediate resignation, Trump is not just expressing a personal grievance; he’s signaling a desire for a shift in the Federal Reserve’s approach to economic management.

Implications for the Federal Reserve

When a president calls for the resignation of the Fed chair, it brings about a host of implications. One of the most significant concerns is the potential erosion of the Fed’s independence. The Federal Reserve was designed to operate independently of political pressures to ensure that monetary policy decisions are made based on economic data rather than political motivations. If Trump’s call for Powell’s resignation gains traction, it could set a precedent for future presidents to exert influence over the Fed, potentially compromising its independence.

The Economic Fallout

Trump’s tweet and the subsequent demand for Powell’s resignation could have immediate repercussions for the markets. Investors may react negatively to the uncertainty surrounding the Fed’s leadership, leading to volatility in stock prices and interest rates. Historically, markets thrive on stability and predictability, and the prospect of a leadership change at the Fed might trigger panic among investors.

Public Reaction and Political Ramifications

The public’s reaction to Trump’s demand has been mixed. Supporters of the former president may view this as a bold stand against a figure they believe has failed to deliver on economic promises. On the other hand, critics argue that such public demands undermine the credibility of the Fed and create unnecessary chaos in an already fragile economic environment. The political ramifications could extend beyond the immediate situation, affecting the dynamics of the upcoming election cycle as candidates position themselves on economic issues.

Historical Precedents

This isn’t the first time a president has publicly criticized the Federal Reserve or its leadership. Presidents from Franklin D. Roosevelt to Barack Obama have expressed their views on monetary policy and the Fed’s actions. However, the direct call for resignation is relatively rare, highlighting the unique nature of this situation. Historically, the Federal Reserve has maintained a careful balance between responding to political pressures and upholding its mandate to foster economic stability.

What Lies Ahead for Jerome Powell?

As the dust settles from Trump’s demand, all eyes will be on Jerome Powell. The Fed Chair has previously weathered political storms, but the continued public scrutiny may influence his decision-making moving forward. Powell will likely need to navigate these turbulent waters carefully, balancing the need for independent decision-making with the reality of political pressures.

The Role of the Federal Reserve in Today’s Economy

The Federal Reserve’s role in the economy is more critical than ever, especially in the wake of the COVID-19 pandemic. With inflation rates on the rise and supply chain issues impacting various sectors, the Fed’s decisions can make or break economic recovery efforts. As such, who leads the Fed matters greatly. Trump’s call for Powell’s resignation opens up discussions on whether a new leader could bring fresh perspectives or exacerbate existing challenges.

Conclusion: The Ongoing Debate

Trump’s demand for Jerome Powell to resign immediately serves as a reminder of the complex interplay between politics and economics. As the situation develops, it will be crucial for citizens and policymakers to engage in meaningful discussions about the independence of the Federal Reserve and the implications of political influence on economic policy. The coming weeks and months will undoubtedly reveal more about the potential outcomes of this unexpected demand, and how it shapes the future of the Federal Reserve and the economy as a whole.

As we continue to monitor this breaking news, it’s clear that the conversation surrounding the Federal Reserve and its leadership is far from over. The implications of Trump’s statement will resonate across various sectors, and it will be interesting to see how both the public and policymakers respond to this unfolding situation.