Trump Demands Fed Chair Powell Resign Now: Economic Chaos or Political Move?

Trump calls for Federal Reserve change, Jerome Powell resignation demand, economic policy controversy 2025

—————–

Trump Calls for Jerome Powell’s Immediate Resignation: A Political Standoff

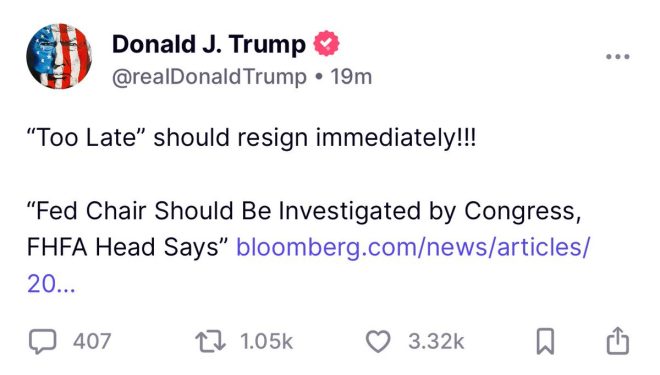

In a shocking announcement on July 2, 2025, former President Donald trump publicly urged Federal Reserve Chairman Jerome Powell to resign immediately. This bold statement, shared via Twitter by the account Libs of TikTok, has stirred significant political discourse and raised eyebrows within financial and political circles. The call for Powell’s resignation has sparked discussions about the Federal Reserve’s monetary policy and its impact on the economy.

Background on Jerome Powell and the Federal Reserve

Jerome Powell has served as the chair of the Federal Reserve since February 2018, succeeding Janet Yellen. Appointed by former President Donald Trump, Powell’s tenure has been marked by significant economic events, including the COVID-19 pandemic and subsequent recovery efforts. Under his leadership, the Federal Reserve implemented various monetary policies aimed at stabilizing the economy, including adjusting interest rates and engaging in asset purchase programs.

Trump’s Criticism of Powell

Trump’s call for Powell to resign is not entirely unexpected, given the former president’s long-standing criticism of the Federal Reserve’s policies. Trump has often expressed dissatisfaction with the Fed’s interest rate decisions, particularly when he believes they hinder economic growth. In his recent tweet, Trump did not provide specific reasons behind his demand, but his history of public criticism suggests a discontent with Powell’s approach to inflation and monetary tightening.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Implications for the Economy

The call for Powell’s resignation raises questions about the future direction of the Federal Reserve and its policies. Should Powell step down, the appointment of a new chair could lead to significant changes in monetary policy, potentially affecting interest rates, inflation, and overall economic stability. Investors and financial analysts are closely monitoring this situation, as any shift in leadership at the Federal Reserve can have far-reaching implications for global markets.

The Political Landscape

Trump’s demand for Powell’s resignation also highlights the ongoing political tensions surrounding economic policy in the United States. As the nation faces challenges such as rising inflation and market volatility, the relationship between political leaders and the Federal Reserve remains a contentious issue. Trump’s vocal stance may resonate with his supporters, who believe that the Fed’s policies have not adequately addressed their economic concerns.

Conclusion

As the political drama unfolds, the implications of Trump’s statement regarding Jerome Powell’s position as chair of the Federal Reserve are significant. Whether Powell will heed Trump’s call or remain in his role is uncertain, but the conversation surrounding monetary policy and its impact on the economy is sure to continue. Investors, policymakers, and the public alike will be watching closely as this situation develops, eager to understand how it may shape the future of economic governance in the United States.

In summary, Trump’s demand for Jerome Powell’s resignation underscores the intricate relationship between politics and economic policy. As discussions evolve, it is crucial to stay informed about the developments in this ongoing narrative, which has the potential to influence the economic landscape significantly.

JUST IN: Trump calls on FED chair Jerome Powell to RESIGN immediately pic.twitter.com/bxBzMDyguL

— Libs of TikTok (@libsoftiktok) July 2, 2025

JUST IN: Trump calls on FED chair Jerome Powell to RESIGN immediately

The financial world is buzzing today after former President Donald Trump made headlines by calling for the immediate resignation of Federal Reserve Chairman Jerome Powell. This unexpected demand has left many analysts and market watchers scratching their heads, wondering what implications this could have for the economy and the financial markets at large. Trump’s comments come at a time when the Federal Reserve is facing challenges in balancing inflation rates and economic growth, making this call to action even more significant.

Understanding the Context: Why Now?

To grasp the full impact of Trump’s statement, it’s essential to understand the current economic landscape. The Federal Reserve has been navigating a tricky path, focusing on controlling inflation while aiming to stimulate economic growth. Powell’s leadership has been both praised and criticized, especially given the challenges posed by the COVID-19 pandemic and the subsequent recovery. Trump’s demand for Powell’s resignation raises questions about confidence in the Federal Reserve’s direction and effectiveness.

This isn’t the first time Trump has publicly criticized Powell. During his presidency, he frequently expressed dissatisfaction with the Fed’s interest rate policies, suggesting that they were detrimental to economic growth. With the economy facing potential headwinds, Trump’s latest remarks are likely to fuel debates over monetary policy and the Fed’s role in fostering a stable economic environment.

The Reaction from Economists and Financial Markets

Economists and financial analysts have quickly responded to Trump’s call for Powell to resign. Many are concerned about the potential fallout from such a move. If Powell were to step down, it could lead to uncertainty in the markets, potentially impacting investments, interest rates, and overall economic stability. The Fed plays a crucial role in maintaining market confidence, and any disruption in leadership could shake investor sentiments.

Market reactions have been mixed. Some investors view Trump’s comments as politically motivated, while others worry about the implications for future monetary policy. The stock market has shown volatility in response to these developments, highlighting the intricate relationship between political statements and market performance.

What Does This Mean for Jerome Powell?

For Jerome Powell, this call for resignation is more than just a political statement. It places him under a spotlight, with increased scrutiny on his actions and decisions as Fed Chair. Powell has maintained a steady hand during turbulent times, but this public pressure could complicate his ability to lead effectively. The Fed’s independence is a cornerstone of its operations, and external calls for leadership changes can threaten that autonomy.

Furthermore, Powell’s term as Chair is not indefinite. He was appointed by Trump in 2018, and his current term is set to expire in 2022. This recent demand for his resignation could influence discussions about his potential reappointment, especially if Trump remains a significant voice in republican politics.

The Political Implications of Trump’s Statement

Trump’s call for Powell to resign is not merely an economic issue; it is also deeply political. The relationship between the executive branch and the Federal Reserve has historically been fraught with tension, particularly when it comes to monetary policy decisions. By publicly demanding Powell’s resignation, Trump is positioning himself as a key player in economic discussions, potentially rallying his base around a message of accountability and change within the Fed.

This political maneuvering may resonate with those who feel that the Federal Reserve’s policies have not adequately addressed the needs of everyday Americans. Trump’s rhetoric often emphasizes the disconnect between Wall Street and Main Street, and this latest statement could serve to amplify those sentiments, especially in an election year.

Analyzing the Future of Federal Reserve Leadership

Looking ahead, the future of Federal Reserve leadership is uncertain. If Powell were to resign, it would trigger a chain of events, including the selection of a new Chair. The Biden administration would have the opportunity to appoint someone whose policies align more closely with their economic agenda. This potential shift could lead to significant changes in monetary policy, affecting everything from interest rates to inflation control measures.

Moreover, if Trump were to regain political influence, he might advocate for a Fed Chair who aligns more with his vision, potentially steering the central bank in a different direction. This scenario raises questions about the balance of power and the independence of the Federal Reserve in the face of political pressure.

The Broader Economic Impact

In the grand scheme of things, Trump’s demand for Powell to resign could have far-reaching economic consequences. The Federal Reserve’s decisions influence not only interest rates but also employment, consumer spending, and overall economic growth. If leadership changes occur, it could lead to shifts in policy that may either stabilize or further complicate the economic recovery efforts.

Investors and consumers alike will be watching closely to see how this situation unfolds. The potential for increased volatility in the markets is real, particularly if uncertainty regarding the Fed’s leadership persists. The stakes are high, and the implications of political statements like Trump’s can ripple through the economy in unexpected ways.

Public Sentiment and Social Media Reaction

Social media platforms have been ablaze with reactions to Trump’s call for Powell’s resignation. Supporters of Trump argue that his criticism of the Fed is justified, claiming that Powell’s policies have not effectively addressed inflation or supported economic growth. Conversely, critics argue that Trump’s interference in the Fed’s operations undermines its independence and could lead to detrimental consequences for the economy.

The role of social media in shaping public opinion cannot be underestimated. Tweets and posts can amplify messages rapidly, leading to widespread discussions that influence political narratives. As Trump’s comments circulate, they will likely fuel debates not only among politicians and economists but also among everyday citizens who feel the impacts of monetary policy decisions.

Conclusion: A Call to Action or Political Posturing?

Trump’s call for Jerome Powell to resign immediately raises critical questions about the intersection of politics and economics. Whether this demand is a genuine call for change or merely a political strategy remains to be seen. What’s clear is that the implications of such statements extend far beyond the realm of politics, impacting the financial markets and the broader economy.

As we continue to navigate these turbulent times, the actions and decisions of leaders like Powell will be under intense scrutiny. The relationship between the Federal Reserve and political figures will undoubtedly evolve, and the potential for further calls for leadership changes looms large.

In this dynamic landscape, staying informed and engaged is more important than ever. Whether you’re an investor, a policy enthusiast, or just someone interested in the economic direction of the country, keeping an eye on these developments will help you understand the broader implications for the economy and society as a whole.