“Shock Call for Federal Reserve investigation: Housing Chief Targets Powell!”

Congress investigation, Federal Reserve accountability, housing policy oversight

—————–

Breaking news: Call for Investigation into Federal Reserve Chairman

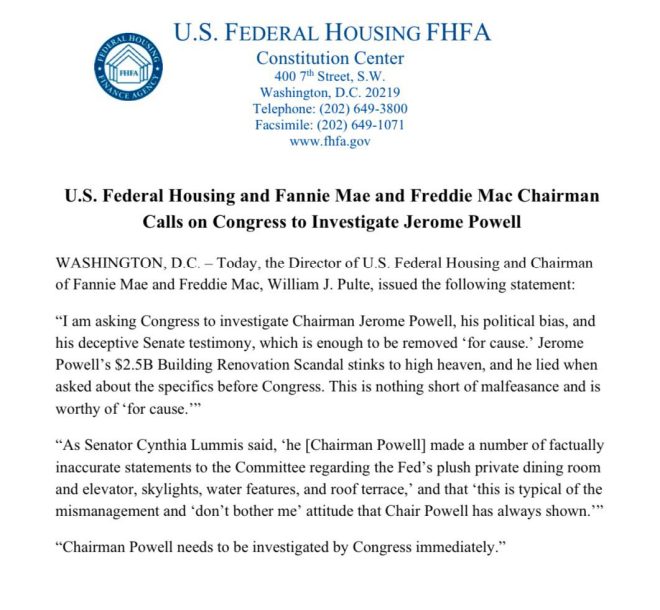

In a stunning development in the world of finance and housing, William J. Pulte, the Director of the U.S. Federal Housing and Chairman of Fannie Mae and Freddie Mac, has publicly called for Congress to investigate Jerome Powell, the Chairman of the Federal Reserve. This announcement marks a significant moment in U.S. economic policy, as the Federal Reserve plays a crucial role in shaping monetary policy that impacts the housing market and broader economy.

Pulte’s Demands for Accountability

William J. Pulte’s urgent request comes amid increasing scrutiny of the Federal Reserve’s actions and their implications for the housing market. In his statement, Pulte emphasized the need for immediate congressional oversight of Powell, suggesting that there may be concerns about the decisions made by the Federal Reserve that could affect millions of Americans. His call for investigation signals a growing sentiment among housing advocates and financial experts who believe that transparency and accountability are essential in regulatory bodies that impact economic stability.

The Role of the Federal Reserve

The Federal Reserve, led by Jerome Powell, is responsible for setting key interest rates and regulating the banking system. Its decisions directly influence mortgage rates, lending practices, and ultimately, the affordability of housing for American families. In recent years, the Fed’s policies have been under intense scrutiny, particularly in the wake of rising inflation and fluctuating interest rates that have significantly impacted the housing market.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Implications for the Housing Market

The call for an investigation into Powell raises critical questions about the Federal Reserve’s approach to economic recovery, especially in relation to housing affordability. As home prices continue to soar and access to homeownership becomes increasingly difficult for many, Pulte’s demand for accountability may resonate with lawmakers and constituents alike. The outcome of any congressional investigation could have far-reaching consequences for housing policy and economic stability in the United States.

Public Reaction and Next Steps

The news has generated a wave of reactions on social media, with many supporters backing Pulte’s call for transparency. Critics, however, caution against politicizing the Federal Reserve, arguing that it should operate independently of congressional influence to effectively manage monetary policy. As discussions unfold, the potential for bipartisan support or opposition to Pulte’s request remains to be seen.

Conclusion

In conclusion, William J. Pulte’s call for Congress to investigate Jerome Powell highlights the tensions between housing policy and monetary policy in the United States. As the Federal Reserve continues to navigate complex economic challenges, the demand for accountability underscores the importance of transparency in governance. This situation will undoubtedly develop further, and those interested in the future of the housing market and economic policy should stay tuned for updates. The implications of this investigation could shape the landscape of U.S. housing for years to come, making it a pivotal moment in the intersection of finance and legislation.

BREAKING: Director of U.S. Federal Housing and Chairman of Fannie Mae and Freddie Mac, William J. @Pulte, calls on Congress to investigate Chairman of the Federal Reserve, Jerome Powell.

“Chairman Powell needs to be investigated by Congress immediately” pic.twitter.com/TaRoddxhTF

— ALX (@alx) July 2, 2025

BREAKING: Director of U.S. Federal Housing and Chairman of Fannie Mae and Freddie Mac, William J. @Pulte, calls on Congress to investigate Chairman of the Federal Reserve, Jerome Powell.

In a recent development that has sent ripples through the financial and political landscape, William J. Pulte, the Director of U.S. Federal Housing and the Chairman of both Fannie Mae and Freddie Mac, has issued a bold statement calling for an investigation into the actions of the Federal Reserve Chairman, Jerome Powell. Pulte declared, “Chairman Powell needs to be investigated by Congress immediately.” This statement raises significant questions about the direction of U.S. monetary policy and the accountability of those at the helm of financial institutions.

The Context of Pulte’s Statement

To truly understand the gravity of Pulte’s call for investigation, it’s essential to grasp the broader economic landscape. The Federal Reserve has been under immense scrutiny in recent years, especially during tumultuous times marked by inflation, fluctuating interest rates, and the ongoing impacts of the COVID-19 pandemic. With Powell at the forefront, many have questioned the effectiveness and transparency of monetary policy decisions. Pulte’s statement comes at a critical juncture, where the public and lawmakers alike are eager for clarity and accountability in financial governance.

Why Does This Matter?

When a key figure like Pulte, who oversees significant housing and financial entities, makes such a statement, it signals potential issues within the Federal Reserve’s leadership. The implications of an investigation could be far-reaching, potentially leading to changes in policy, leadership, and public trust in the Federal Reserve. The housing market, which is already feeling the pinch of rising interest rates, could be directly affected by the outcomes of such an investigation.

The Role of the Federal Reserve

The Federal Reserve plays a crucial role in shaping the economic landscape of the United States. Its decisions impact everything from inflation rates to employment levels and economic growth. Under Powell’s leadership, the Fed has taken unprecedented steps, such as lowering interest rates to near-zero levels and implementing large-scale asset purchases, known as quantitative easing. However, these measures have not come without criticism. Pulte’s call for an investigation suggests that there may be underlying issues or decisions made by Powell that warrant further examination.

Public Sentiment and Political Reactions

Public sentiment regarding the Federal Reserve has been mixed. Some view Powell as a steady hand in turbulent times, while others criticize him for not doing enough to curb inflation. Pulte’s statement echoes the frustrations of many who feel that the Fed’s policies have contributed to economic instability. Lawmakers from both sides of the aisle will likely respond to this statement, as it raises questions about accountability and transparency within the Federal Reserve.

What Could an Investigation Entail?

If Congress decides to pursue an investigation into Chairman Powell, several aspects will likely be examined. These could include the decision-making processes behind key monetary policy shifts, the effectiveness of these policies in achieving desired economic outcomes, and the overall transparency of the Federal Reserve’s operations. Investigations of this nature can lead to substantial changes in how the Federal Reserve operates and is held accountable to the public and Congress.

Implications for Housing and Financial Markets

The implications of this investigation could be profound for housing and financial markets. As the Chairman of Fannie Mae and Freddie Mac, Pulte’s interests are directly aligned with the stability of the housing market. If the Federal Reserve is found to have acted irresponsibly or without proper oversight, it could lead to a ripple effect that impacts housing prices, mortgage rates, and the overall economy. Investors and homebuyers alike are likely watching this situation closely, as any changes in monetary policy could affect their financial decisions.

Looking Ahead: The Future of Monetary Policy

As discussions surrounding Pulte’s call for an investigation unfold, the future of monetary policy in the U.S. remains uncertain. Will Congress take action? Will Powell face scrutiny that leads to changes in leadership or direction within the Federal Reserve? These questions linger in the minds of economists, lawmakers, and everyday citizens. Monitoring how this situation develops will be crucial for understanding the trajectory of the U.S. economy.

Calls for Greater Accountability

Pulte’s remarks resonate with a growing movement advocating for greater accountability in financial governance. Many believe that leaders in financial institutions should be held to higher standards, especially when their decisions have widespread implications for the economy. This sentiment is not just confined to the Federal Reserve; it extends to various financial entities and organizations tasked with overseeing the economic wellbeing of the nation.

The Importance of Transparency

Transparency in decision-making processes is vital for maintaining public trust in financial institutions. Pulte’s call for an investigation emphasizes the need for clearer communication from the Federal Reserve regarding its policies and decisions. By fostering an environment of transparency, the Federal Reserve can rebuild trust and confidence among the American public, which is essential for economic stability.

The Potential for Change

If Congress acts on Pulte’s request, we might see significant changes in the way the Federal Reserve operates. This could include reforms aimed at enhancing oversight, improving communication, and ensuring that monetary policies align more closely with the needs of the American people. Such changes could pave the way for a more balanced approach to economic governance, one that prioritizes stability and growth.

Conclusion: The Road Ahead

The unfolding situation surrounding Pulte’s call for an investigation into Chairman Powell is a crucial moment for U.S. economic policy. As discussions continue, it’s essential for stakeholders across the board to remain engaged and informed. The outcome of this investigation could shape the trajectory of monetary policy and the future of the U.S. economy for years to come. Whether you’re a homeowner, investor, or concerned citizen, staying informed about these developments will be key to understanding their impact on your financial future.

“`