Michael Saylor Sparks Debate: Is Bitcoin the True Money, Not Credit?

cryptocurrency investment strategies, digital asset valuation techniques, monetary policy implications of Bitcoin

—————–

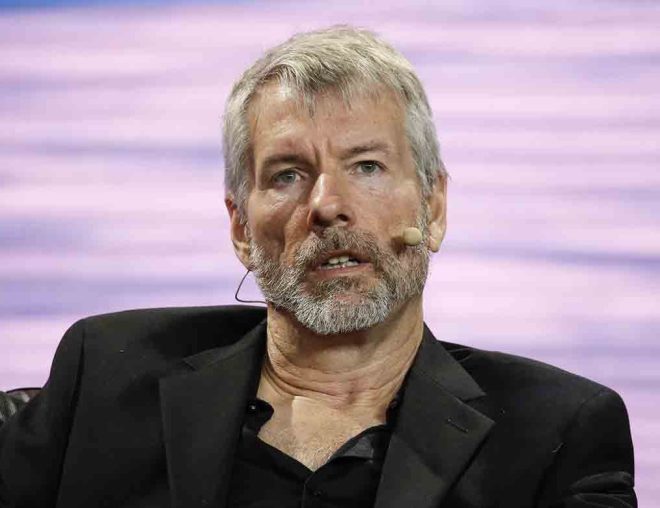

Michael Saylor Declares "Bitcoin is Money" in Latest Statement

In a recent tweet shared by Watcher.Guru, Michael Saylor, the co-founder and executive chairman of MicroStrategy, made a bold assertion regarding the role of Bitcoin in the financial landscape. He stated, "Bitcoin is money. Everything else is credit." This statement has reignited discussions among cryptocurrency enthusiasts and investors about the fundamental value and purpose of Bitcoin in contrast to traditional fiat currencies and other forms of credit.

Understanding Bitcoin as Money

Bitcoin, created in 2009 by an anonymous person or group known as Satoshi Nakamoto, was designed to be a decentralized digital currency. Unlike fiat currencies, which are issued and regulated by governments, Bitcoin operates on a peer-to-peer network, enabling transactions without intermediaries. Saylor’s proclamation reinforces the notion that Bitcoin serves as a store of value and a medium of exchange, similar to traditional forms of money.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Concept of Credit

Saylor’s statement that "everything else is credit" invites scrutiny of the current financial system, where many currencies are essentially debt instruments. Traditional money, issued by central banks, can be seen as a promise to pay, often backed by the economic stability of a nation. This reliance on credit can lead to inflation and economic instability, especially when central banks print money excessively. In contrast, Bitcoin’s scarcity, with a maximum supply of 21 million coins, positions it as a hedge against inflation and a stable value store.

Implications for Investors and the Financial Market

Saylor’s remarks come at a pivotal time when institutional interest in Bitcoin is on the rise. Companies like MicroStrategy have made significant investments in Bitcoin, and Saylor himself has become a prominent advocate for the cryptocurrency. His perspective that Bitcoin is the only true form of money challenges the traditional banking system and encourages investors to rethink their strategies in a rapidly evolving financial landscape.

The Future of Bitcoin

As Bitcoin continues to gain acceptance among both retail and institutional investors, its role as a viable alternative to fiat currencies becomes increasingly evident. Saylor’s statement underscores a broader movement towards recognizing Bitcoin not just as an asset, but as a legitimate form of currency. This shift has the potential to disrupt traditional financial systems and redefine the way we think about value and money in the digital age.

Conclusion

Michael Saylor’s assertion that "Bitcoin is money" encapsulates the growing sentiment within the cryptocurrency community that Bitcoin offers a more stable and reliable form of currency compared to traditional fiat options. As the landscape of finance continues to change, understanding the implications of Bitcoin’s role as money versus other forms of credit is crucial for investors and the general public alike. With ongoing discussions and increasing adoption, it is clear that Bitcoin is not just a passing trend; it is a fundamental shift in how we perceive and utilize money in the modern world.

For those interested in following the latest developments in cryptocurrency and the opinions of industry leaders like Saylor, staying tuned to platforms like Twitter and financial news outlets is essential. The conversation around Bitcoin’s legitimacy and its future continues to evolve, making it a topic of significant importance in today’s financial discourse.

JUST IN: Michael Saylor says “Bitcoin is money.”

“Everything else is credit.” pic.twitter.com/1HGFjgK7xC

— Watcher.Guru (@WatcherGuru) July 2, 2025

JUST IN: Michael Saylor says “Bitcoin is money.”

In a recent statement that’s making waves in the cryptocurrency world, Michael Saylor, the co-founder and executive chairman of MicroStrategy, declared, “Bitcoin is money.” This simple yet powerful assertion has sparked discussions across various platforms, especially as the crypto market continues to evolve. With Bitcoin often positioned as a revolutionary asset, Saylor’s comments add fuel to the ongoing debate about the role of digital currencies in our financial systems.

“Everything else is credit.”

Following his declaration that “Bitcoin is money,” Saylor elaborated by stating, “Everything else is credit.” This statement encapsulates a fundamental perspective on the differences between Bitcoin and traditional fiat currencies. In a world where credit plays a significant role in our financial transactions, Saylor’s claim invites us to consider the implications of relying on credit rather than a stable, decentralized form of money like Bitcoin.

The Rise of Bitcoin as a Form of Money

Bitcoin, launched in 2009 by an anonymous entity known as Satoshi Nakamoto, has steadily gained traction as a legitimate form of currency. Initially viewed with skepticism, Bitcoin has proven its resilience and appeal as a decentralized digital currency. Unlike traditional currencies regulated by governments and central banks, Bitcoin operates on a peer-to-peer network, making it less susceptible to inflation and manipulation.

Michael Saylor has been one of Bitcoin’s most vocal advocates. His company, MicroStrategy, has invested billions into Bitcoin, showcasing a strong belief in its potential as a digital store of value. By emphasizing that Bitcoin is money, Saylor aligns himself with a growing movement of individuals and organizations seeking to redefine the concept of currency in the digital age.

Understanding the Concept of Money

To fully grasp Saylor’s assertion, we need to understand what money really is. Traditionally, money serves three primary functions: a medium of exchange, a unit of account, and a store of value. Bitcoin, with its increasing adoption and limited supply, is beginning to fulfill these roles effectively, gaining recognition as a legitimate form of money.

In contrast, Saylor’s reference to “everything else is credit” highlights the reliance on traditional financial systems that often depend on credit for transactions. Credit, while useful, can lead to debt and financial instability. In contrast, Bitcoin offers a more stable and reliable alternative, free from the pitfalls associated with credit-based transactions.

The Importance of Decentralization

One of the most significant advantages of Bitcoin is its decentralized nature. Unlike traditional currencies that are controlled by central authorities, Bitcoin operates on a decentralized network of computers. This means no single entity can manipulate the currency or dictate its value. Saylor’s emphasis on Bitcoin as money underscores the importance of decentralization, especially in a world where trust in financial institutions is waning.

Bitcoin and Inflation

Inflation is another critical consideration when discussing Bitcoin as money. Central banks often respond to economic downturns by printing more money, leading to inflation and decreasing the purchasing power of the currency. Bitcoin, with its capped supply of 21 million coins, is inherently deflationary. Saylor’s assertion that Bitcoin is money aligns with the idea that it can serve as a hedge against inflation, protecting wealth in uncertain economic times.

The Future of Money

As we look ahead, the future of money seems to be gradually shifting towards digital currencies, with Bitcoin leading the charge. The idea of money is evolving, and Saylor’s perspective on Bitcoin being a true form of money resonates with many who are disillusioned by traditional financial systems. As more individuals and institutions adopt Bitcoin, its legitimacy as a currency will likely continue to grow.

The Role of Bitcoin in Everyday Transactions

One of the challenges Bitcoin faces is its adoption for everyday transactions. While it is increasingly being accepted by businesses, many still view it as an investment rather than a currency for daily use. However, as more companies begin to recognize the benefits of accepting Bitcoin, we may see a shift in how people perceive and use it in their daily lives.

Innovations in payment systems and technologies that facilitate Bitcoin transactions are also emerging, making it easier for consumers to spend their Bitcoin. This could pave the way for Bitcoin to become a more mainstream currency, aligning with Saylor’s vision of it being recognized as money.

Bitcoin vs. Traditional Financial Systems

Michael Saylor’s comments also invite a comparison between Bitcoin and traditional financial systems. The current banking system is often criticized for being slow, expensive, and riddled with fees. Bitcoin, on the other hand, offers a more efficient and cost-effective alternative, particularly for cross-border transactions.

As people become more aware of the limitations of traditional banking, they may be more inclined to explore Bitcoin and other cryptocurrencies as viable alternatives. Saylor’s assertion could be a catalyst for this shift, encouraging more individuals to consider Bitcoin as a legitimate form of money.

Community and Adoption

The strength of Bitcoin lies not only in its technology but also in its community. Advocates like Michael Saylor are crucial in promoting Bitcoin’s message and educating the public about its potential. As more people join the movement and share their experiences, the adoption of Bitcoin as money will likely gain momentum.

In addition to individual advocates, organizations and businesses are increasingly recognizing the benefits of adopting Bitcoin. From major corporations to small businesses, the acceptance of Bitcoin is growing, further solidifying its position as a form of money.

Conclusion: A New Era of Money

Michael Saylor’s declaration that “Bitcoin is money” encapsulates a broader trend towards digital currencies reshaping our understanding of money. With its decentralized nature, resistance to inflation, and growing adoption, Bitcoin is positioning itself as a formidable contender in the financial landscape. As we navigate this new era of money, Saylor’s insights serve as a reminder of the potential that lies within the world of cryptocurrencies.

Whether you’re a seasoned investor or just dipping your toes into the world of Bitcoin, it’s essential to stay informed and engaged. The discourse surrounding Bitcoin’s role as money is just beginning, and as more voices join the conversation, we’re likely to witness a transformative shift in how we perceive and use money in the digital age.