“Shockwaves in Housing Sector: Fannie Mae Chief Demands Congress Probe Powell!”

Fannie Mae oversight, Federal Housing investigation, Jerome Powell accountability

—————–

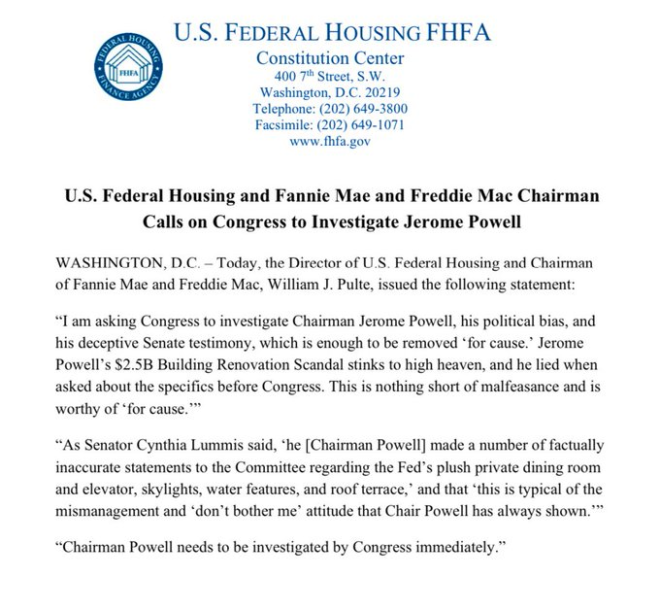

In a significant development within the U.S. financial landscape, the Federal Housing Finance Agency (FHFA) has called for an investigation into Jerome Powell, the Chairman of the Federal Reserve. This demand comes from the leadership of Fannie Mae and Freddie Mac, two pivotal government-sponsored enterprises (GSEs) that play a crucial role in the housing finance system. The call for an investigation is seen as a major move that could impact the future of U.S. monetary policy and housing finance.

### Background on Fannie Mae and Freddie Mac

Fannie Mae and Freddie Mac were established to enhance the flow of credit in the housing market. They buy mortgages from lenders, allowing these institutions to reinvest the capital into further lending. The FHFA oversees these GSEs, ensuring they operate efficiently and in a manner that supports the broader housing finance system. Tensions between these entities and the Federal Reserve, particularly regarding monetary policy decisions, have been mounting, especially in recent years characterized by fluctuating interest rates and economic uncertainty.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

### The Call for Investigation

The request for Congress to investigate Jerome Powell signals growing concern over the implications of the Federal Reserve’s policies on the housing market. Critics argue that Powell’s approach to managing interest rates and inflation may be detrimental to housing affordability and market stability. As interest rates rise, mortgage rates typically follow, which can significantly impact homebuyers’ ability to secure financing. This investigation could examine whether Powell’s decisions have adversely affected the operations of Fannie Mae and Freddie Mac, potentially limiting their capacity to support the housing market.

### Implications for Housing Finance

The outcome of this investigation could have wide-ranging implications for housing finance in the United States. If Congress finds evidence that Powell’s policies have had negative consequences for the housing sector, it could lead to calls for changes in the Federal Reserve’s approach to interest rates and monetary policy. Given the importance of affordable housing, any shifts in policy could influence housing availability, pricing, and overall market health.

### Potential Political Fallout

The political ramifications of this investigation are also significant. With housing being a critical issue for many Americans, the findings could become a focal point in upcoming elections. Politicians may leverage the investigation to rally support from constituents who are concerned about the rising costs of housing and the broader implications of Federal Reserve policies on everyday Americans.

### Conclusion

In conclusion, the call for an investigation into Jerome Powell by the FHFA and the leadership of Fannie Mae and Freddie Mac highlights a critical moment in the intersection of housing finance and monetary policy. As the investigation unfolds, stakeholders across the financial spectrum, including policymakers, homebuyers, and investors, will be closely watching for developments. The implications of this investigation could reshape the future of housing finance in the U.S. and influence the Federal Reserve’s approach to economic management. The outcome may not only affect monetary policy but could also have lasting effects on the housing market’s stability and affordability, making it a pivotal issue in the coming months.

BREAKING – U.S. Federal Housing and the Fannie Mae and Freddie Mac Chairman Calls on Congress to Investigate Jerome Powell pic.twitter.com/YrSFHdtIlb

— Insider Paper (@TheInsiderPaper) July 2, 2025

BREAKING – U.S. Federal Housing and the Fannie Mae and Freddie Mac Chairman Calls on Congress to Investigate Jerome Powell

In a significant development, the U.S. Federal Housing Authority, alongside the chairmen of Fannie Mae and Freddie Mac, has urged Congress to launch an investigation into Jerome Powell, the current chair of the Federal Reserve. This call for scrutiny comes amid growing concerns about the stability of the housing market and the broader implications of monetary policy on the economy.

So, what does this all mean? Let’s break it down. The housing market has been a hot topic, especially with rising interest rates and inflation impacting home affordability and mortgage rates. With the Federal Reserve’s monetary policy being a critical factor in these dynamics, the relationship between the Fed and housing finance entities like Fannie Mae and Freddie Mac is under the microscope.

Understanding the Call for Investigation

The request for an investigation into Jerome Powell stems from various stakeholders who believe that the Federal Reserve’s monetary policies may not be adequately addressing the unique challenges faced by the housing sector. The Federal Housing Authority, Fannie Mae, and Freddie Mac have a vested interest in ensuring that the housing market remains stable and accessible to everyday Americans. When they express concern about the actions of the Federal Reserve, it’s essential to pay attention.

The crux of the matter lies in how interest rates set by the Federal Reserve affect mortgage rates. When the Fed raises rates to combat inflation, borrowing costs increase, making it harder for individuals to buy homes. This is particularly concerning in a time when housing prices are already high. Thus, the call to investigate Powell is not just about one individual but rather a demand for accountability regarding policies that impact millions of Americans.

The Implications for Homebuyers

For those looking to buy a home, the outcome of this investigation could have significant implications. If Congress takes action and examines the Federal Reserve’s policies, we might see changes that could lower interest rates or introduce new measures to stabilize the housing market. This would be a welcome development for homebuyers who are currently feeling the pinch of skyrocketing mortgage rates.

Moreover, the dialogue around the investigation could lead to greater transparency from the Federal Reserve. Homebuyers and industry stakeholders alike would benefit from clearer communication regarding monetary policy decisions and their potential impact on the housing market.

What This Means for Investors

Investors in real estate and mortgage-backed securities are watching this situation closely. The intersection of Federal Reserve policy and housing finance directly influences market performance. If the investigation leads to changes in policy, it could affect the profitability of investments tied to housing.

Real estate investors, in particular, should consider diversifying their portfolios and staying informed about potential legislative changes. The housing market is volatile, and shifts in interest rates can have ripple effects that alter investment landscapes.

Fannie Mae and Freddie Mac’s Role in the Housing Market

To fully grasp the significance of this situation, it’s essential to understand the roles of Fannie Mae and Freddie Mac. These government-sponsored enterprises (GSEs) play a crucial part in the U.S. housing finance system by ensuring that mortgage funds are available. They buy mortgages from lenders, allowing those lenders to free up capital to issue more loans, thus promoting homeownership.

When the chairmen of these organizations call for an investigation into Jerome Powell, it signifies a broader concern about how Federal Reserve policies are affecting their ability to operate effectively. If the GSEs struggle to function due to high-interest rates or restrictive monetary policies, it could lead to a slowdown in home purchases, further complicating the housing crisis.

The Broader Economic Context

This investigation is also taking place against the backdrop of a larger economic environment marked by uncertainty. Inflation rates have surged, and the Federal Reserve’s responses have been closely scrutinized. The delicate balance between controlling inflation and promoting economic growth is a tightrope walk, and housing is a pivotal part of that equation.

As Congress considers the call for an investigation, it will also need to weigh the implications of any actions taken. Policymakers must consider how the housing market interacts with employment rates, consumer spending, and overall economic health. The decisions made now could have long-lasting effects on the economy and the lives of everyday Americans.

The Response from Jerome Powell and the Federal Reserve

As the investigation unfolds, it will be interesting to see how Jerome Powell and the Federal Reserve respond. Historically, the Fed has maintained a careful stance regarding external pressures, focusing on its dual mandate of maximizing employment and stabilizing prices. However, with increased scrutiny from Congress and the public, Powell may need to address these concerns more openly.

Transparency will be critical in maintaining trust in the institution. If Powell can articulate a clear vision for how the Fed plans to navigate the current housing crisis while managing inflation, it could alleviate some concerns. However, if the investigation reveals inconsistencies or a lack of accountability, it could undermine confidence in the Federal Reserve’s leadership.

Potential Outcomes and Future Considerations

The call for an investigation into Jerome Powell is just the beginning. Depending on the findings, we could see a range of outcomes that could reshape the housing landscape. From changes in Federal Reserve policy to new legislative measures aimed at stabilizing the market, the implications of this investigation could be far-reaching.

As homebuyers, investors, and policymakers keep a close eye on this situation, it’s essential to stay informed. Engaging in discussions about the housing market’s future and advocating for policies that promote accessibility and affordability will be crucial as we navigate this uncertain terrain.

Conclusion

The investigation into Jerome Powell may seem like a political maneuver at first glance, but it touches on deeply rooted issues affecting the housing market and, by extension, the entire economy. As stakeholders await the outcome, the importance of clear communication and accountability cannot be overstated. The future of the housing market—and the millions of Americans who rely on it—hangs in the balance.