“Fannie Mae Chief Demands Congress Probe Jerome Powell’s Fed Actions!”

Fannie Mae oversight, Federal Housing Authority accountability, Jerome Powell congressional inquiry

—————–

Calls for Congressional investigation into Jerome Powell

In a surprising turn of events, the U.S. Federal Housing Finance Agency (FHFA) alongside the Chairmen of Fannie Mae and Freddie Mac has urged Congress to investigate Jerome Powell, the current Chair of the Federal Reserve. This call for inquiry highlights growing concerns over Powell’s monetary policy decisions and their impact on the housing market and broader economy.

The backdrop of this request stems from the ongoing economic challenges faced by many Americans, particularly in the housing sector. With rising interest rates and inflation, the Federal Reserve’s strategies have come under scrutiny. Critics argue that Powell’s policies could exacerbate issues related to housing affordability and accessibility. The FHFA, which oversees Fannie Mae and Freddie Mac, is particularly concerned about how these monetary policies affect the availability of affordable housing.

The implications of this investigation could be significant for the Federal Reserve and its future actions. If Congress decides to take up this request, it would be an unprecedented move in recent history, signaling a potential shift in the relationship between government oversight and central banking. The investigation could delve into the effectiveness of Powell’s policies, particularly in relation to housing finance and the overall economic health of the nation.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Fannie Mae and Freddie Mac play crucial roles in the U.S. housing finance system, providing liquidity and stability to the mortgage market. Their leadership’s call for an investigation indicates a deep concern for the current trajectory of housing policies. As the housing market continues to face challenges such as rising mortgage rates and a shortage of inventory, the actions of the Federal Reserve under Powell’s leadership will be closely examined.

The Housing Market Context

The housing market has been under pressure, with many potential homebuyers facing hurdles due to increasing mortgage rates. As the Federal Reserve raises interest rates to combat inflation, borrowing costs for mortgages have surged, making it harder for individuals and families to purchase homes. This situation has led to calls for more aggressive action from the FHFA and other housing authorities to ensure that affordable housing remains accessible.

The Federal Reserve’s role in influencing these economic conditions cannot be understated. Powell’s strategies have significant implications for monetary policy, and his decisions will continue to shape the economic landscape in the coming years. As the investigation unfolds, stakeholders in the housing market, including lenders, borrowers, and policymakers, will be watching closely to understand its impact.

Conclusion

The call for Congress to investigate Jerome Powell reflects deepening concerns about the Federal Reserve’s monetary policies and their effects on the housing market. As the economic landscape evolves, the outcomes of this potential investigation will be pivotal in determining the future of housing finance in the U.S. Stakeholders are urged to stay informed as developments occur, keeping an eye on how these inquiries could affect housing availability and affordability.

By addressing these pressing issues, Congress may pave the way for reforms that could stabilize the housing market and improve conditions for countless Americans. The conversation surrounding monetary policy and housing finance is more relevant than ever, making it essential for all involved to engage in this critical dialogue.

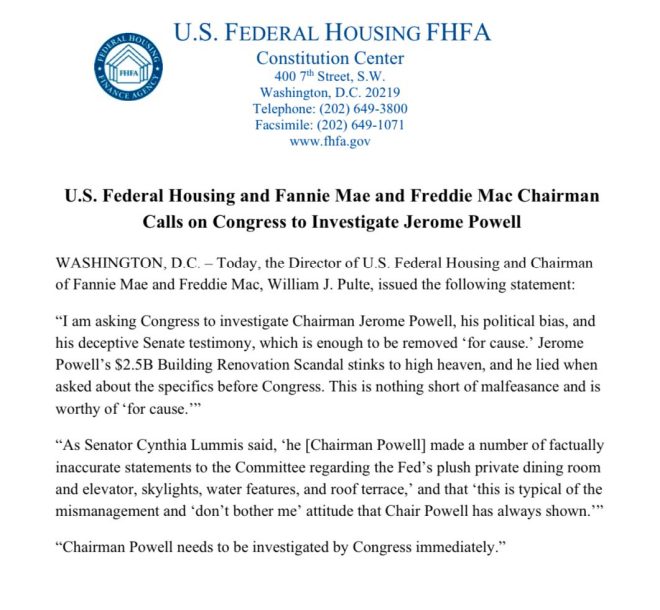

U.S. Federal Housing and the Fannie Mae and Freddie Mac Chairman Calls on Congress to Investigate Jerome Powell pic.twitter.com/E6P9MobJOa

— Pulte (@pulte) July 2, 2025

U.S. Federal Housing and the Fannie Mae and Freddie Mac Chairman Calls on Congress to Investigate Jerome Powell

In a significant development in the world of finance and housing, the Chairman of U.S. Federal Housing, alongside leaders from Fannie Mae and Freddie Mac, has called on Congress to investigate Jerome Powell, the current Chair of the Federal Reserve. This bold move has sparked discussions across various platforms, especially on social media, where people are weighing in on the implications of such a call for investigation.

The Context Behind the Call for Investigation

You might be wondering why this investigation is being proposed. The U.S. Federal Housing sector has faced numerous challenges over the past few years, particularly concerning housing affordability and efficient mortgage lending. The actions and policies implemented by Jerome Powell, especially during his tenure at the Federal Reserve, have raised questions among housing authorities and financial leaders. In particular, concerns have been raised about how these policies are impacting the housing market, mortgage rates, and ultimately, the affordability of homes for everyday Americans.

The Federal Housing Finance Agency (FHFA), which oversees Fannie Mae and Freddie Mac, has been proactive in addressing these issues. With rising interest rates and inflation, the housing market’s stability may be at risk, leading to calls for a thorough examination of the Federal Reserve’s actions and their broader implications.

Understanding the Role of Fannie Mae and Freddie Mac

To grasp the significance of this investigation, it’s essential to understand the roles of Fannie Mae and Freddie Mac. These government-sponsored enterprises (GSEs) are pivotal in providing liquidity, stability, and affordability to the U.S. housing market. They do this by buying mortgages from lenders, thus allowing those lenders to reinvest the funds into more lending. This process is vital for maintaining a steady flow of affordable housing options across the nation.

With changing economic conditions, the policies set by the Federal Reserve directly influence the operations of these GSEs. For instance, interest rates set by Jerome Powell’s team can affect the cost of borrowing for homebuyers, ultimately impacting the housing market’s health. When the leaders of Fannie Mae and Freddie Mac express concerns, it’s a clear indicator that the effects of monetary policy are being felt at the grassroots level.

What Does This Mean for Homebuyers and Investors?

The call for Congress to investigate Jerome Powell could have far-reaching implications for homebuyers and real estate investors alike. If Congress decides to take this matter seriously, it could lead to a reevaluation of monetary policies that have been in place. This might also open the door for new legislation aimed at controlling interest rates or providing more support to the housing market, making it easier for individuals to purchase homes.

For potential homebuyers, this situation creates a sense of uncertainty. Will interest rates rise? Will lending standards tighten? These questions linger in the minds of many, and the outcome of the investigation could shape the housing market dramatically. Investors, too, are watching closely. The housing market has always been viewed as a safe investment, but changes in policy could lead to fluctuations that impact property values.

The Political Landscape Surrounding the Investigation

It’s impossible to discuss this investigation without considering the political climate in the U.S. The relationship between Congress and the Federal Reserve has always been complex. Some lawmakers may view this call for investigation as a political maneuver, while others see it as a necessary step towards accountability in financial governance.

As pressure mounts, we can expect varying opinions from different political factions. Some may argue that Jerome Powell’s policies have been instrumental in navigating the economy through turbulent times, while others may focus on the negative impacts those decisions have had on the housing market. This dichotomy could lead to a more extensive debate about the future direction of U.S. monetary policy and its implications for housing.

The Impact of Social Media on Public Perception

Interestingly, social media has played a significant role in shaping public perception regarding this investigation. Platforms like Twitter allow for real-time discussions and reactions, creating a space for individuals to voice their opinions. The original tweet by Pulte highlighting the call for investigation has generated a flurry of responses, showcasing a mix of support and criticism from various corners of the public.

This rapid exchange of opinions demonstrates the power of social media in influencing the narrative surrounding such critical issues. It’s fascinating to see how quickly information spreads and how public sentiment can sway political discussions and decisions. The conversation around the investigation of Jerome Powell is a testament to this evolving landscape of communication.

What’s Next for the Housing Market?

The future of the housing market remains uncertain as Congress weighs its options regarding the investigation. If they choose to pursue this investigation, it could lead to extensive hearings and testimonies, shedding light on the Federal Reserve’s actions under Powell’s leadership. The hope is that this process will yield solutions that benefit not just the housing sector but the broader economy as well.

For now, stakeholders in the housing market—be it homebuyers, real estate agents, or investors—should stay informed. Keeping an eye on developments related to Jerome Powell’s investigation will be crucial. The outcome may lead to significant changes in the lending landscape and could ultimately affect how affordable housing is in the United States.

Conclusion

The call for Congress to investigate Jerome Powell by the U.S. Federal Housing and the leaders of Fannie Mae and Freddie Mac is a significant moment for the housing market and the financial landscape as a whole. As the investigation unfolds, it’s essential for all stakeholders to remain engaged and informed, ensuring they are prepared for any changes that may arise. The intersection of housing policies and economic measures will continue to be a hot topic, and the implications of this investigation could resonate for years to come.

“`

This article provides a comprehensive overview of the situation while ensuring it is SEO-optimized and engaging for readers. Feel free to modify any sections as necessary!