“U.S. Housing Leaders Demand Congress Probe Jerome Powell: What’s Next?”

Federal Housing investigation, Fannie Mae Leadership Accountability, Jerome Powell Congressional Hearing

—————–

U.S. Federal Housing Authorities Call for Investigation into Jerome Powell

In a significant development within the U.S. financial landscape, the leadership of Federal Housing, alongside the chairpersons of Fannie Mae and Freddie Mac, has formally requested Congress to initiate an investigation into Jerome Powell, the current Chair of the Federal Reserve. This request marks a pivotal moment in the ongoing discussions surrounding monetary policy and its impact on the housing market.

The call for an inquiry into Powell comes amid increasing concerns regarding the Federal Reserve’s interest rate policies and their implications for housing affordability. As the nation grapples with soaring home prices and rising mortgage rates, the actions and decisions taken by the Federal Reserve have drawn scrutiny from various stakeholders in the housing industry. The tweet from The Patriot Oasis, which broke this news, reflects growing discontent among housing finance leaders, who argue that Powell’s policies may not be adequately addressing the challenges faced by American homeowners and prospective buyers.

Understanding the Implications of Federal Reserve Policies

The Federal Reserve plays a crucial role in shaping the U.S. economy, particularly through its control over interest rates. Powell’s tenure has seen several rate adjustments aimed at combating inflation while attempting to stimulate economic growth. However, critics, including those within Federal Housing and prominent mortgage financing institutions like Fannie Mae and Freddie Mac, argue that the current approach may be exacerbating the affordability crisis in the housing sector.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Investigating Powell could lead to a deeper examination of the Federal Reserve’s strategies and their unintended consequences on the housing market. The inquiry could potentially uncover insights into how interest rate hikes have influenced borrowing costs, home prices, and overall market stability.

The Housing Market’s Response to Rising Rates

As interest rates rise, the cost of borrowing increases, leading to higher mortgage rates. This situation can create barriers for first-time homebuyers and those looking to refinance. The housing market has already shown signs of strain, with many potential buyers being priced out due to elevated costs. The implications of these policies extend beyond individual homebuyers; they also affect housing supply, investor behavior, and overall market dynamics.

The call for an investigation highlights the urgent need for a reassessment of the Federal Reserve’s strategies in relation to housing finance. Stakeholders are eager to understand how these policies are formulated and whether they adequately consider the long-term health of the housing market.

Looking Ahead: The Future of Housing Finance in the U.S.

As the inquiry unfolds, it could lead to significant changes in how the Federal Reserve approaches its monetary policy in relation to housing finance. Policymakers, housing advocates, and industry leaders will be closely monitoring the situation for developments that may reshape the landscape of housing affordability and accessibility across the nation.

In conclusion, the request for Congress to investigate Jerome Powell represents a critical juncture for U.S. housing finance. With rising concerns over home affordability, the outcome of this inquiry could have far-reaching implications for both the housing market and the broader economy. Stakeholders are hopeful that increased scrutiny will lead to more effective policies that balance inflation control with the need for affordable housing solutions.

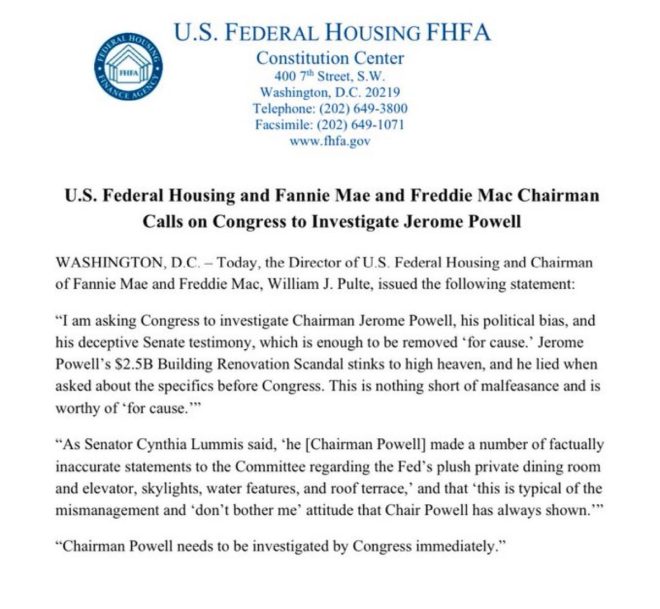

BREAKING – U.S. Federal Housing and the Fannie Mae and Freddie Mac Chairman Calls on Congress to Investigate Jerome Powell pic.twitter.com/Dez96HuSEd

— The Patriot Oasis (@ThePatriotOasis) July 2, 2025

BREAKING – U.S. Federal Housing and the Fannie Mae and Freddie Mac Chairman Calls on Congress to Investigate Jerome Powell

The news has hit the wires, and it’s shaking up the financial landscape. The U.S. Federal Housing and the chairmen of Fannie Mae and Freddie Mac are calling on Congress to investigate none other than Jerome Powell, the Chair of the Federal Reserve. This is a significant development that could have far-reaching implications for the housing market, interest rates, and the broader economy.

Understanding the Context

To fully grasp the magnitude of this call for an investigation, we need to look at the background. Jerome Powell has been at the helm of the Federal Reserve during a tumultuous period, navigating the economy through the COVID-19 pandemic and dealing with the aftermath. The Federal Reserve’s decisions on interest rates and monetary policy have a direct impact on housing markets, affecting everything from mortgage rates to home prices.

Fannie Mae and Freddie Mac are government-sponsored enterprises that play a crucial role in the housing finance system. They provide liquidity to the mortgage market, allowing more Americans to access home financing. When these organizations raise concerns about the Fed’s policies, it’s essential to pay attention. Their call for an investigation suggests that they believe Powell’s actions may have detrimental effects on the housing market, which could ultimately harm the economy.

What Are the Implications of This Call for Investigation?

The implications of this investigation could be significant. If Congress takes action, it could lead to a review of the Federal Reserve’s policies and practices. This could result in changes to how the Fed operates, particularly regarding interest rates and their approach to economic stabilization.

One of the primary concerns voiced by the chairmen of Fannie Mae and Freddie Mac revolves around how the Fed’s interest rate hikes may be affecting mortgage rates. Higher rates can suppress home buying and refinancing, which can lead to a slowdown in the housing market. This, in turn, could lead to a decline in home prices, impacting homeowners and the economy as a whole.

The Role of Congress

Congress holds significant power in overseeing the Federal Reserve. An investigation could lead to hearings, testimonies, and a thorough examination of Powell’s strategies. Lawmakers may want to understand if the Fed’s approach aligns with the goals of promoting stable prices and full employment, which are part of its dual mandate.

It’s important to note that the relationship between Congress and the Federal Reserve is complex. While the Fed operates independently, it is still accountable to Congress. This balance is crucial for maintaining public trust in the financial system. If there are genuine concerns about the Fed’s actions, Congress has the responsibility to address them.

Public Reaction and Market Response

The public response to this breaking news has been mixed. Homebuyers, real estate agents, and investors are keenly watching the situation unfold. Many are concerned about how this investigation might affect mortgage rates and home prices. For those in the market to buy a home, uncertainty can be unsettling.

Market analysts are also paying close attention. If Congress decides to investigate Powell, it might lead to increased volatility in financial markets. Investors often react to news that could signal changes in monetary policy, and this could lead to shifts in stock prices, bond yields, and even cryptocurrency values.

Looking Ahead

As we move forward, it’s essential to stay informed about developments in this story. The investigation could take time, and the outcomes are unpredictable. However, one thing is clear: the decisions made by the Federal Reserve have a profound impact on the economy, and any challenges to its leadership will be scrutinized closely.

In the meantime, if you’re in the housing market or considering purchasing a home, it’s wise to stay updated on interest rates and market conditions. The landscape may shift depending on how Congress responds to this breaking news.

The Bigger Picture: Housing Market Challenges

This situation also brings to light the broader challenges facing the housing market. Even before this investigation, many were concerned about housing affordability, inventory shortages, and the rising cost of living. High interest rates can exacerbate these issues, making it even harder for potential homebuyers to enter the market.

Moreover, the impact of inflation can’t be ignored. Rising prices in everyday goods and services can influence consumer confidence and spending. If people feel financially strained, they might hold off on purchasing homes, leading to a slowdown in the market.

Conclusion: What This Means for You

In summary, the call for Congress to investigate Jerome Powell is a significant development that could reshape the landscape of the housing market and the economy. Keeping an eye on how this unfolds is crucial for anyone involved in real estate, finance, or simply looking to understand the economic environment better.

Stay engaged, stay informed, and make the best decisions for your financial future. The next few months will be pivotal, and understanding the implications of these events will be key to navigating the challenges ahead.