“USA Hits Shocking $21.94 Trillion Money Supply—What Does This Mean for You?”

M2 Money Supply Increase, US Economic Trends 2025, Federal Reserve Monetary Policy

—————–

USA M2 Money Supply Reaches New All-Time High

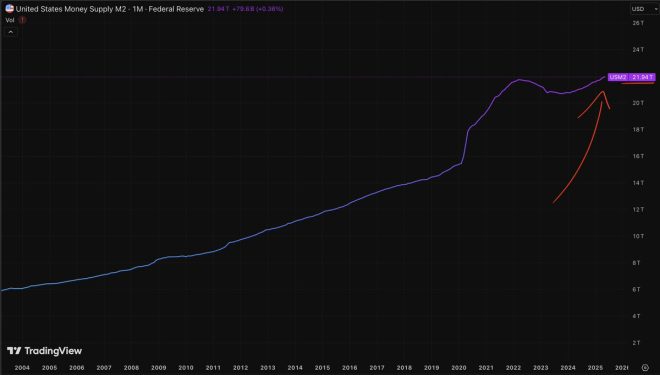

On July 2, 2025, the USA’s M2 Money Supply surged to a staggering $21.94 trillion, marking a new all-time high. This significant increase in the M2 money supply is a crucial indicator of the country’s economic health and monetary policy. M2 includes cash, checking deposits, and easily convertible near money, providing a broader view of the money available in the economy compared to M1, which only accounts for cash and checking deposits.

Understanding M2 Money Supply

The M2 money supply is a vital economic metric used by economists and policymakers to gauge the overall liquidity in the economy. It plays an essential role in influencing inflation, interest rates, and economic growth. An increase in the M2 money supply often suggests that more money is available for consumers and businesses to spend, which can stimulate economic activity. However, it can also raise concerns about inflation if the money supply grows too rapidly without a corresponding increase in economic output.

The Implications of Increased Money Supply

With the M2 Money Supply reaching $21.94 trillion, analysts are closely monitoring its implications for the economy. A growing money supply can lead to increased consumer spending, potentially driving economic growth. However, it also raises questions about inflationary pressures. If too much money chases too few goods, prices may rise, leading to inflation. Central banks, like the Federal Reserve, may respond by adjusting interest rates to control inflation and stabilize the economy.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Investor Reactions and Market Trends

The announcement of the M2 money supply hitting an all-time high has sparked significant discussion among investors and market analysts. Many are speculating on how this development will affect various asset classes, including stocks, bonds, and cryptocurrencies. Investors often look to the M2 money supply as an indicator of future market trends, as it can influence liquidity and investment strategies.

As a result, some analysts are predicting a bullish trend for equities, as increased liquidity typically encourages investment in the stock market. Conversely, concerns about inflation could lead to a shift in investment strategies, with more investors seeking assets that traditionally hold value during inflationary periods, such as precious metals or real estate.

Conclusion

The recent announcement regarding the USA’s M2 Money Supply reaching $21.94 trillion is a significant economic milestone that warrants attention from both policymakers and investors. Understanding the implications of this increase is crucial for navigating the evolving economic landscape. As the economy continues to adapt to changes in monetary policy and consumer behavior, stakeholders must remain vigilant in monitoring these developments. The dynamics of the M2 money supply will undoubtedly play a pivotal role in shaping the future of the U.S. economy and its financial markets.

For more insights and updates on economic trends and their impact on various sectors, stay tuned to trusted financial news sources and analysis platforms.

BREAKING: USA M2 Money Supply hits a new all-time high of $21.94 trillion. pic.twitter.com/KvkXYIjiz2

— Altcoin Daily (@AltcoinDaily) July 2, 2025

BREAKING: USA M2 Money Supply hits a new all-time high of $21.94 trillion

In an exciting development for the U.S. economy, the M2 Money Supply has reached a staggering $21.94 trillion, marking a new all-time high. This figure is significant as it represents a critical indicator of the money supply in the economy, influencing everything from inflation to interest rates. But what exactly does this mean for everyday Americans and the broader financial landscape?

The Importance of M2 Money Supply

The M2 Money Supply includes all physical cash, checking deposits, and easily convertible near money. Essentially, it’s a measure of the money that is readily available for spending and investment. Tracking this figure is crucial for economists and policymakers alike because it helps them gauge the overall health of the economy.

When M2 increases, it often suggests that consumers and businesses have more money to spend, which can spur economic growth. However, a rapid rise can also lead to higher inflation if the increase in money supply outpaces economic output. It’s a delicate balance that the Federal Reserve closely monitors.

What Does $21.94 Trillion Mean for You?

With the M2 Money Supply hitting a new high, you might be wondering how this impacts your finances. For starters, more money in circulation typically means that interest rates might remain low, at least for the time being. This can be a boon for borrowers, making loans for homes, cars, or businesses cheaper.

On the flip side, if the increase in money supply leads to inflation, you might find that your dollar doesn’t stretch as far as it once did. Prices for goods and services could rise, which is something to keep an eye on. It’s a classic case of “good news, bad news.”

Analyzing the Recent Spike

Many factors contribute to the recent spike in the M2 Money Supply. The ongoing impacts of the pandemic, government stimulus measures, and monetary policy from the Federal Reserve have all played a role. For instance, during the pandemic, the government injected a significant amount of money into the economy through stimulus checks and other relief measures. This influx of cash has led to the current numbers we see today.

Moreover, the Federal Reserve has maintained a low-interest-rate environment to encourage borrowing and spending. This environment has made it easier for consumers and businesses to access funds, further contributing to the increase in the M2 Money Supply.

The Future of the M2 Money Supply

As we look ahead, it’s essential to consider how the M2 Money Supply will evolve. Will it continue to rise, or will we see a stabilization? Economists are divided on what the future holds, but many agree that monitoring this figure is essential for understanding economic trends.

Some experts suggest that if the M2 continues to grow unchecked, it could lead to inflationary pressures that might prompt the Federal Reserve to take action—such as raising interest rates. On the other hand, if the economy grows at a healthy rate, the increase in money supply might be manageable and beneficial.

Impact on Investments

For investors, the surge in the M2 Money Supply can signal various opportunities and risks. Stock markets often react positively to increased liquidity, as companies may find it easier to expand and invest. However, potential inflation could lead to volatility in both stock and bond markets. Investors should stay informed and consider diversifying their portfolios to hedge against these risks.

Moreover, cryptocurrencies like Bitcoin and Ethereum are also influenced by broader monetary policies. As traditional money supply increases, some investors look to digital currencies as a hedge against inflation, which could impact their market dynamics.

Conclusion: Stay Informed

In summary, the breaking news about the M2 Money Supply hitting an all-time high is a crucial indicator of economic health. While it presents opportunities, it also carries risks that can affect everything from your personal finances to the stock market. Keeping an eye on these developments and understanding their implications can help you navigate the financial landscape more effectively.

For further insights and up-to-date news, you can follow sources like Altcoin Daily and financial news outlets to stay informed about the ongoing changes in the M2 Money Supply and what they could mean for you.