“US Housing Regulator Demands Congress Investigate Fed Chair Powell’s Actions!”

federal housing oversight, Jerome Powell investigation, Congress financial regulation

—————–

US Federal Housing Regulator Calls for Investigation into Fed Chair Jerome Powell

In a surprising turn of events, the United States federal housing regulator has urged Congress to launch an investigation into Federal Reserve Chair Jerome Powell. This announcement has sent ripples through financial markets, prompting discussions about the implications of such an inquiry on monetary policy and housing regulations. As stakeholders in the housing market and the broader economy react to this development, it is crucial to understand the context and potential consequences of this call for investigation.

Background on the Investigation

The call for an investigation stems from concerns regarding Powell’s leadership and decision-making at the Federal Reserve, particularly as it relates to housing policy and interest rates. The Federal Reserve plays a critical role in the U.S. economy, influencing everything from inflation to employment rates through its monetary policies. Powell, who has been at the helm since 2018, has faced scrutiny over his handling of interest rates and the Fed’s response to economic challenges.

Housing affordability has become a pressing issue for many Americans, and the regulator’s request suggests that there may be a belief that Powell’s policies are not adequately addressing these concerns. The investigation could focus on whether his decisions have inadvertently contributed to rising housing costs and limited access to affordable housing for low and middle-income families.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Implications for Monetary Policy

Should Congress proceed with an investigation, it could have significant implications for the Federal Reserve’s approach to monetary policy. An inquiry might lead to increased scrutiny of the Fed’s decision-making process, potentially affecting the independence of the central bank. If Powell is found to have acted inappropriately, it could lead to calls for reform within the Fed or a change in leadership.

Conversely, if the investigation clears Powell of wrongdoing, it could bolster his position and reinforce the Fed’s current strategies, particularly as the nation navigates ongoing economic challenges. The outcome of such an inquiry will undoubtedly be watched closely by economists, investors, and policymakers alike.

Market Reactions

Financial markets are sensitive to news regarding the Federal Reserve, as changes in monetary policy can have far-reaching effects on interest rates, stock prices, and overall economic stability. The announcement of an investigation has the potential to create volatility in the markets, with investors reassessing their positions based on anticipated changes to monetary policy.

In the housing sector, stakeholders may be particularly concerned about how potential shifts in interest rates could impact mortgage rates and housing affordability. Increased uncertainty surrounding Powell’s leadership could lead to hesitancy among buyers and sellers, further complicating an already challenging housing market.

Conclusion

The call for an investigation into Federal Reserve Chair Jerome Powell by a U.S. federal housing regulator underscores the complexities of monetary policy and its direct impact on housing affordability. As Congress considers the implications of this request, the outcomes could reshape the landscape of U.S. economic policy.

Stakeholders in the housing market, investors, and policymakers will need to stay informed as developments unfold, understanding that the potential investigation could lead to significant changes in how the Federal Reserve operates and addresses critical economic issues. The situation remains fluid, and its resolution could have lasting effects on the American economy.

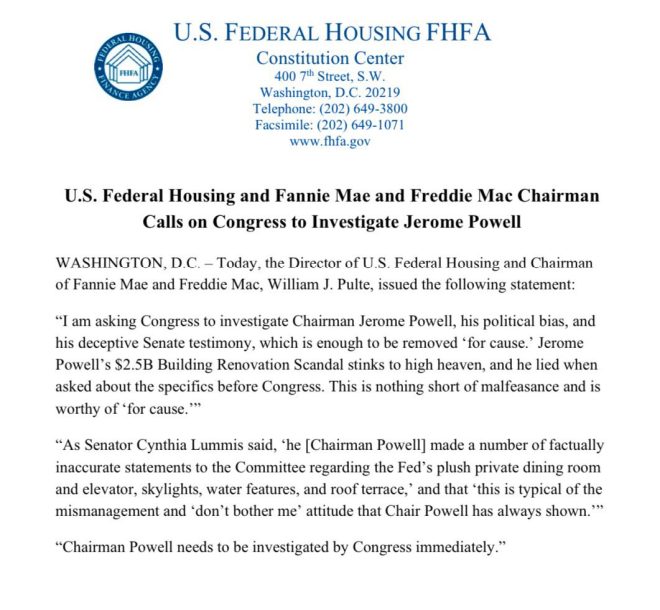

JUST IN: US federal housing regulator calls on Congress to investigate Fed Chair Jerome Powell. pic.twitter.com/v89CqszSz5

— Watcher.Guru (@WatcherGuru) July 2, 2025

JUST IN: US federal housing regulator calls on Congress to investigate Fed Chair Jerome Powell

Recently, the U.S. federal housing regulator made headlines by calling on Congress to investigate none other than the Federal Reserve Chair, Jerome Powell. This bold move has sparked discussions across the nation about the implications of such an investigation and what it means for the future of U.S. monetary policy. Let’s dive into the details and explore the potential ramifications of this unprecedented call for investigation.

The Context Behind the Call for Investigation

To understand the gravity of the situation, it’s essential to grasp the role of the Federal Reserve and Jerome Powell’s influence over the U.S. economy. The Federal Reserve, often referred to as the Fed, is the central bank of the United States, responsible for regulating monetary policy. Jerome Powell has been at the helm since 2018, navigating the complexities of interest rates, inflation, and economic recovery.

Given the current economic climate, characterized by fluctuating inflation rates and the ongoing recovery from the COVID-19 pandemic, the actions taken by the Fed under Powell’s leadership have come under scrutiny. Critics argue that the Fed’s policies may not have adequately addressed housing affordability, which has become a pressing issue for many Americans. As housing prices continue to soar, many are questioning whether the Fed, led by Powell, is doing enough to control this vital aspect of the economy.

The Role of the Federal Housing Regulator

The federal housing regulator, which oversees various aspects of the housing market, has a vested interest in the interplay between monetary policy and housing affordability. With the rising costs of homes and rental properties, the regulator’s call for investigation suggests a deep concern regarding how Powell’s policies may be impacting everyday Americans. This move highlights a growing frustration among housing advocates, who argue that the rising costs are directly linked to the Fed’s monetary policies.

In a statement, the federal housing regulator emphasized the need for accountability and transparency in how the Fed conducts its monetary policy, particularly as it relates to housing. The regulator believes that an investigation could shed light on whether Powell’s decisions align with the best interests of the American public, especially those struggling to find affordable housing.

Potential Implications of the Investigation

The implications of an investigation into Jerome Powell are significant. For one, it could lead to increased scrutiny of the Fed’s policies. Congress could call for hearings, where Powell would be expected to explain his decisions and their effects on the housing market. This level of scrutiny is unusual for a sitting Fed chair, who typically operates with a degree of independence.

Additionally, the investigation could have ramifications for the broader economic landscape. If Congress finds that Powell’s policies have negatively impacted housing affordability, it could lead to calls for changes in how the Fed approaches monetary policy. This could range from altering interest rates to implementing new measures aimed specifically at stabilizing the housing market.

Public Reaction and Media Coverage

The public reaction to the news has been mixed. Many Americans, particularly those struggling with housing costs, welcome the investigation as a necessary step toward accountability. They view it as an opportunity to address systemic issues that have plagued the housing market for years. On the other hand, some economists and financial experts warn that such an investigation could undermine the Fed’s independence, potentially leading to more volatility in the markets.

Media coverage of the situation has been extensive, with various outlets analyzing the potential consequences of the federal housing regulator’s decision. As discussions unfold, it will be interesting to see how public opinion shifts and how lawmakers respond to the calls for investigation.

The Broader Impact on Monetary Policy

One of the critical concerns surrounding the investigation is its potential to impact broader monetary policy. If Congress decides to pursue this investigation vigorously, it could set a precedent for future oversight of the Federal Reserve. This could lead to a shift in how monetary policy is crafted, with more emphasis placed on public accountability and less on the traditional independence of the Fed.

For many, the investigation raises the question of whether the Fed should be more responsive to the public’s needs, particularly in areas like housing. This could lead to a fundamental rethinking of the Fed’s role in the economy and how it balances its dual mandate: to promote maximum employment and stable prices.

Looking Ahead: What’s Next for Jerome Powell?

As the investigation unfolds, all eyes will be on Jerome Powell. How he responds to the scrutiny will be crucial. Will he provide the transparency that Congress and the public are demanding? Or will he maintain the Fed’s traditional stance of operating independently, free from political pressures?

Powell’s next moves will not only affect his reputation but could also have lasting implications for the Federal Reserve. If he can successfully navigate the investigation and address the concerns surrounding housing affordability, it may bolster public confidence in the Fed. However, a poor response could lead to a significant loss of trust among the public and lawmakers alike.

Conclusion: The Importance of Accountability in Economic Policy

This moment serves as a reminder of the importance of accountability in economic policy. As the federal housing regulator calls for an investigation into Jerome Powell, it emphasizes a growing sentiment that those in positions of power should be held responsible for their decisions. The outcome of this situation could shape the future of the Federal Reserve and its role in addressing critical issues like housing affordability.

In the coming weeks, as Congress deliberates on the next steps, it’s essential for all stakeholders to remain informed and engaged. This investigation is more than just about one man; it’s about the future of monetary policy and its impact on everyday Americans.