“US Housing Chair Calls for Congress to Probe Powell’s Rate Manipulation!”

housing market investigation, Federal Reserve interest rates, Jerome Powell congressional inquiry

—————–

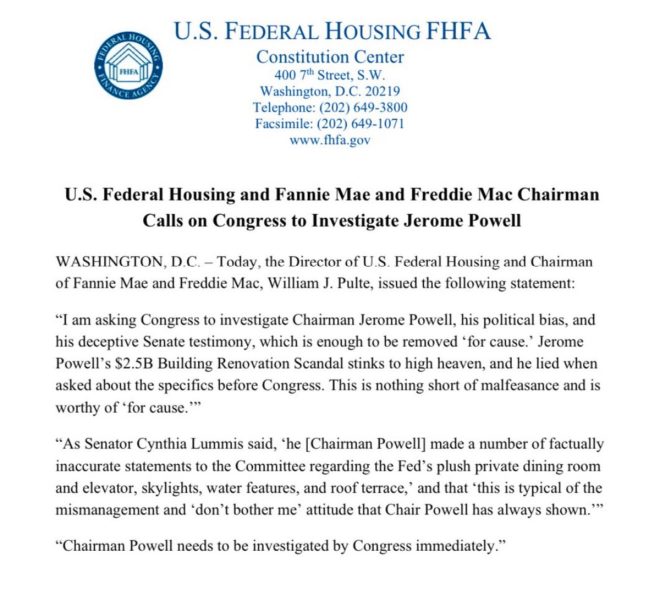

In a recent Twitter announcement, US Federal Housing Chair Bill Pulte has called for Congress to conduct an investigation into Jerome Powell, the current Chair of the Federal Reserve. This statement comes amid concerns regarding the impact of Powell’s monetary policy, particularly the prolonged high-interest rates that have been a focal point for many homeowners and potential buyers across the nation. Pulte’s assertion points to the belief that Powell’s decisions have not only been detrimental to the housing market but may also be politically motivated, suggesting that high rates have been maintained to spite former President trump.

### The Implications of High-Interest Rates

Pulte’s comments raise significant questions about the implications of high-interest rates on the housing market. Over the past few years, elevated rates have led to increased borrowing costs, making it more challenging for prospective homeowners to secure mortgages. As a result, many families have been priced out of the market, leading to a notable decline in home sales and affordability. The ongoing economic pressure from high-interest rates has left millions of homeowners in precarious financial situations, prompting calls for accountability from government officials.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

### A Call to Action for Congress

The urgency in Pulte’s message is evident as he implores Congress to “DO YOUR JOB” and investigate Powell’s actions. This call to action highlights a growing sentiment among some lawmakers and stakeholders who believe that the Federal Reserve’s policies should be scrutinized more closely. The idea is that the Fed’s decisions should not only reflect economic data but also consider the broader societal impacts, particularly in a crucial area like housing.

### The Political Undertones

The suggestion that Powell’s decisions may be influenced by political factors adds another layer of complexity to the discussion. Critics argue that central banking should remain apolitical, guided strictly by economic considerations. However, Pulte’s assertion suggests that political motivations may be playing a role in monetary policy, thereby affecting the lives of millions. This contention could lead to heightened scrutiny from both political leaders and the public, as the ramifications of such policies continue to unfold.

### The Broader Economic Context

As the housing market grapples with these high-interest rates, the broader economic context must also be considered. The Federal Reserve has a dual mandate to promote maximum employment and stable prices. However, the tension between these goals and the current monetary policy presents a challenging dilemma. With inflation rates fluctuating and economic growth showing signs of strain, the Fed’s approach will continue to be a topic of debate among economists, policymakers, and the public.

### Conclusion

Bill Pulte’s call for an investigation into Jerome Powell is indicative of the growing frustrations surrounding the Federal Reserve’s handling of interest rates and their impacts on the housing market. As Congress weighs its options, the need for transparency and accountability in monetary policy becomes increasingly crucial. Homeowners and prospective buyers are looking for solutions, and the dialogue surrounding interest rates and their implications will likely remain at the forefront of economic discussions in the coming months. The outcome of this investigation could shape the future direction of U.S. housing policy and economic stability.

BREAKING: US Federal Housing Chair Bill @Pulte calls for Congress to INVESTIGATE Jerome Powell

Powell has kept rates artificially high to spite President Trump, causing MILLIONS of homeowners and buyers great harm.

DO YOUR JOB, CONGRESS! Investigate Powell! pic.twitter.com/H9dS7sNPkZ

— Nick Sortor (@nicksortor) July 2, 2025

BREAKING: US Federal Housing Chair Bill @Pulte calls for Congress to INVESTIGATE Jerome Powell

In an unexpected twist in the housing market saga, US Federal Housing Chair Bill Pulte has thrown down the gauntlet, demanding Congress to investigate Jerome Powell, the current Chair of the Federal Reserve. This call to action has sparked a wave of discussions among lawmakers, economists, and the general public, all questioning the implications of Powell’s policies on the housing market and the broader economy.

Powell has kept rates artificially high to spite President Trump, causing MILLIONS of homeowners and buyers great harm.

It’s no secret that the Federal Reserve plays a crucial role in shaping the economic landscape of the United States. Jerome Powell’s tenure has been marked by significant challenges, especially in the wake of the pandemic and subsequent recovery efforts. Critics argue that Powell’s decision to maintain high-interest rates has been detrimental to millions of homeowners and potential buyers. The reasoning behind this move is hotly debated, with some suggesting it was a political maneuver aimed at undermining former President Trump’s economic policies.

High-interest rates can lead to increased mortgage costs, making it harder for people to buy homes. This situation has left many potential buyers on the sidelines, hoping for a shift in policy that could make homeownership more attainable. The consequences are far-reaching, affecting not only individual families but also the overall economy, as a stifled housing market can lead to decreased consumer spending and slow economic growth. According to a recent report by the Department of Housing and Urban Development, the rising interest rates have created a significant barrier for first-time homebuyers, further complicating an already challenging housing market.

DO YOUR JOB, CONGRESS! Investigate Powell!

With Pulte’s bold statement, the pressure is on Congress to take action. The phrase “Do your job, Congress!” resonates with many who feel that lawmakers need to step up and hold the Federal Reserve accountable. The potential investigation into Powell’s policies could uncover whether his actions were indeed politically motivated or if they were necessary steps to curb inflation and stabilize the economy.

This call to action is not just a political statement; it reflects a growing frustration among Americans who are directly impacted by these decisions. The housing market is a vital part of the economy, and any missteps can have domino effects across various sectors. From construction to retail, a thriving housing market is crucial for economic health.

The Broader Implications of High-Interest Rates

The implications of high-interest rates extend beyond just homebuyers. For homeowners, higher rates can mean increased monthly payments, making it challenging for families to manage their finances. This can lead to increased foreclosures, which not only affects individual families but also contributes to a downward spiral in housing prices. When homes lose value, it can discourage new construction and investments in communities, leading to a sluggish economy.

Moreover, the rental market is also feeling the pinch. As potential buyers hold off on purchasing homes due to high borrowing costs, the demand for rental properties can skyrocket, driving up rents. This scenario creates a vicious cycle where affordability becomes a significant issue for many Americans, especially those in lower-income brackets. According to a report by the Harvard Joint Center for Housing Studies, over 30% of renters are now spending more than 50% of their income on housing, a clear indicator of the crisis at hand.

Political Ramifications and Public Sentiment

Pulte’s demand for an investigation also highlights the intersection of politics and economic policy. The housing market has often been a hot-button issue, with different parties advocating for various solutions to address affordability and access. The perception that Powell’s policies are politically motivated only fuels the narrative that the Federal Reserve is not an independent entity, which can lead to a loss of public trust.

Public sentiment is crucial as we navigate these complex issues. Many Americans are looking for transparency and accountability from their leaders, particularly when it comes to policies that directly affect their livelihoods. As the investigation unfolds, it will be interesting to see how Congress responds and whether they can find common ground on such a polarizing issue.

What’s Next for the Housing Market?

The future of the housing market largely depends on the actions taken in response to Pulte’s call for an investigation. Should Congress take the allegations seriously and probe into Powell’s decision-making, we could see shifts in policy that may provide relief for homeowners and buyers alike. This could involve lowering interest rates or implementing measures aimed at increasing housing supply, both of which would be welcomed by many struggling families.

Moreover, the Federal Reserve’s response to potential scrutiny will also play a significant role. If Powell and the Fed decide to make changes based on the investigation’s findings, it could lead to a more balanced approach to monetary policy that considers the needs of homeowners and the economy as a whole.

The Role of the Public in Advocacy

As citizens, staying informed and engaged is crucial. The discussions surrounding housing policy and Federal Reserve actions are not just for politicians and economists; they affect everyone. By voicing concerns and advocating for change, individuals can play a part in shaping the future of the housing market. Whether through social media, community forums, or direct communication with elected officials, public engagement can drive meaningful change.

For those feeling the weight of high-interest rates and housing costs, it’s essential to remember that your voice matters. Engage in conversations, share your experiences, and push for accountability from your leaders. The more we talk about these issues, the more likely we are to see changes that benefit the community as a whole.

Conclusion

As we digest the implications of Bill Pulte’s demand for Congress to investigate Jerome Powell, it’s clear that the housing market is at a crossroads. The decisions made in the coming months will not only determine the fate of millions of homeowners and buyers but will also shape the broader economic landscape. The stakes are high, and it’s crucial for all of us to stay informed and engaged in this critical conversation.