BlackRock’s Shocking $3.85B Bitcoin Buy: What It Means for the Future!

Bitcoin investment trends, institutional cryptocurrency adoption, BlackRock financial strategies

—————–

BlackRock’s Major Bitcoin Acquisition: A Game-Changer for Cryptocurrency

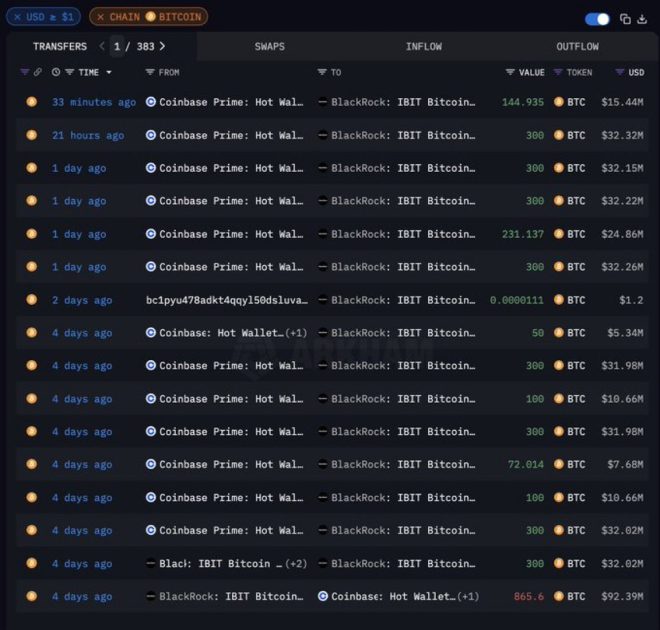

In a groundbreaking announcement, BlackRock, one of the largest investment management firms in the world, has acquired an astounding $3.85 billion worth of Bitcoin in June 2025. This significant investment underscores the increasing institutional interest in cryptocurrencies and could have far-reaching implications for the digital asset market.

The Rise of Bitcoin as an Institutional Asset

The acquisition by BlackRock is a clear indication that Bitcoin is no longer viewed merely as a speculative asset by institutional investors. As one of the first major financial institutions to embrace Bitcoin, BlackRock’s investment reflects a paradigm shift in how cryptocurrencies are perceived in the global finance landscape. With Bitcoin’s market capitalization soaring, this strategic move positions BlackRock at the forefront of the cryptocurrency movement, potentially paving the way for other institutions to follow suit.

Implications for the Cryptocurrency Market

The news of BlackRock’s acquisition sent shockwaves through the cryptocurrency market, causing Bitcoin prices to surge. This influx of institutional capital is expected to provide increased liquidity and stability to the market, which has historically been characterized by volatility. Moreover, BlackRock’s entry into the cryptocurrency space could enhance Bitcoin’s legitimacy as a mainstream asset class, encouraging more investors to consider digital currencies as a viable investment option.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

What This Means for Investors

For individual investors, BlackRock’s substantial investment in Bitcoin is a powerful signal of growing confidence in the cryptocurrency market. As traditional financial institutions continue to embrace digital assets, retail investors may feel more secure in allocating a portion of their portfolios to cryptocurrencies. The presence of established firms like BlackRock can also help mitigate some of the risks associated with investing in the often-volatile crypto space.

Future Outlook for Bitcoin and Other Cryptocurrencies

The acquisition by BlackRock raises important questions about the future of Bitcoin and the broader cryptocurrency ecosystem. As institutional adoption continues to expand, we can expect increased regulatory scrutiny and a push for more robust frameworks governing digital assets. This evolution could lead to greater transparency and security in the crypto market, further attracting institutional and retail investors alike.

Conclusion

BlackRock’s acquisition of $3.85 billion in Bitcoin is a landmark event that signifies the growing acceptance of cryptocurrency as a legitimate asset class. As institutional interest in Bitcoin and other digital currencies increases, the market could experience unprecedented growth and stability. Investors should keep a close eye on developments in this space, as BlackRock’s strategic move may herald a new era for cryptocurrencies, offering both opportunities and challenges.

In summary, BlackRock’s foray into Bitcoin not only reflects the firm’s bullish outlook on digital currencies but also sets the stage for a potential transformation in the investment landscape. As we move forward, the implications of this acquisition will likely resonate throughout the financial world, influencing trends and shaping the future of cryptocurrency investments.

BREAKING:

BLACKROCK ACQUIRED $3.85B OF BITCOIN IN JUNE. pic.twitter.com/N4N9WJrqiI

— Crypto Rover (@rovercrc) July 2, 2025

BREAKING: BLACKROCK ACQUIRED $3.85B OF BITCOIN IN JUNE.

When you hear the news that a financial giant like BlackRock has acquired a staggering $3.85 billion worth of Bitcoin, it’s hard not to pay attention. This landmark move is more than just a simple transaction; it’s a pivotal moment that might reshape the landscape of cryptocurrency investment and institutional involvement in digital assets. So, sit tight as we dive into what this acquisition means for the market, for Bitcoin itself, and for investors who are keenly watching these developments.

Understanding BlackRock’s Move into Bitcoin

BlackRock, the world’s largest asset manager, has made headlines for its strategic moves in various financial markets, but this acquisition is particularly noteworthy. By investing such a colossal sum into Bitcoin, BlackRock is signaling a strong belief in the future potential of cryptocurrencies. It’s not just about the numbers; it reflects a larger trend where institutional investors are beginning to recognize Bitcoin as a legitimate asset class.

Many analysts believe that this could lead to increased adoption of Bitcoin among other institutional investors. If BlackRock sees value in Bitcoin, others might follow suit. This could potentially result in a domino effect, propelling Bitcoin’s price and market capitalization to new heights.

The Implications of BlackRock’s Acquisition

What does a $3.85 billion investment in Bitcoin mean for the broader market? First off, it could enhance Bitcoin’s legitimacy in the eyes of traditional investors. Up until now, many have viewed Bitcoin as a speculative asset, but with BlackRock stepping in, it could pave the way for more conservative investors to dip their toes into the crypto waters.

Moreover, this acquisition can lead to increased liquidity in the Bitcoin market. When large institutions buy in, they often bring substantial capital that can stabilize prices and reduce volatility, something that has plagued Bitcoin for years. If Bitcoin becomes less volatile, it may become more appealing for both institutions and retail investors alike.

Market Reactions to the Acquisition

Reactions to this news within the crypto community and the financial world have been mixed but generally optimistic. Many crypto enthusiasts see this as a victory for Bitcoin and the broader cryptocurrency market. On social media platforms, discussions are rife with excitement and speculation about what this could mean for Bitcoin’s future value.

Conversely, traditional market analysts are cautious. While they recognize the potential upside, they also point out the inherent risks associated with investing in cryptocurrency. The market is still relatively young and can be influenced by a myriad of factors, including regulatory changes and market sentiment.

What This Means for Bitcoin Investors

For those invested in Bitcoin or considering jumping into the market, BlackRock’s acquisition could be a game-changer. It might be the validation that many have been waiting for. If institutional confidence continues to grow, it could lead to increased demand, driving the price of Bitcoin even higher.

However, it’s essential to remember that investing in Bitcoin is not without risk. The market is still highly speculative, and while institutional investment can provide some stability, it doesn’t eliminate volatility entirely. Investors should be mindful of their risk tolerance and consider diversifying their portfolios.

BlackRock’s Role in the Crypto Ecosystem

It’s worth noting that BlackRock’s involvement in cryptocurrency isn’t entirely new. The firm has been exploring digital assets for some time now, looking into blockchain technology and its implications for the finance sector. This acquisition is a logical next step in their strategy to adapt to changing market conditions and investor preferences.

By increasing its stake in Bitcoin, BlackRock is positioning itself as a leader in the merging worlds of traditional finance and digital assets. This could potentially inspire other asset managers to follow in their footsteps, leading to a more significant shift in how cryptocurrencies are viewed by the mainstream financial industry.

The Future of Bitcoin in Light of Institutional Interest

So, what does the future hold for Bitcoin now that BlackRock has made such a significant investment? While it’s challenging to predict the market’s direction, one thing is for sure: institutional interest is growing. As more companies like BlackRock enter the space, Bitcoin may become more integrated into the financial system, attracting more investors and driving innovation.

This increased institutional interest could also lead to more regulatory clarity around cryptocurrencies, which has been a significant concern for many investors. If regulations become more defined and favorable, it might further encourage investment in Bitcoin and other cryptocurrencies, solidifying their place in the financial ecosystem.

Conclusion: A Bright Future for Bitcoin?

In summary, BlackRock’s acquisition of $3.85 billion worth of Bitcoin is a monumental event for the cryptocurrency market. It signals a shift in how cryptocurrencies are perceived by institutional investors and could pave the way for a new era of legitimacy and acceptance.

As the market reacts to this news, it’s essential for both seasoned and new investors to stay informed and adapt their strategies accordingly. Whether you’re a long-time Bitcoin holder or just thinking about investing, keeping an eye on these developments will be crucial in navigating the ever-evolving landscape of cryptocurrency.

With all this in mind, the future does seem bright for Bitcoin, but as always, proceed with caution and do your research. The world of cryptocurrency can be thrilling and rewarding, but it’s essential to stay grounded and informed as the landscape continues to evolve.