Trump’s Controversial One Big Beautiful Bill: No Taxes for Millions of Seniors!

Social Security benefits, tax relief for seniors, One Big Beautiful Bill 2025

—————–

Summary of the One Big Beautiful Bill and Its Impact on Social Security Taxation

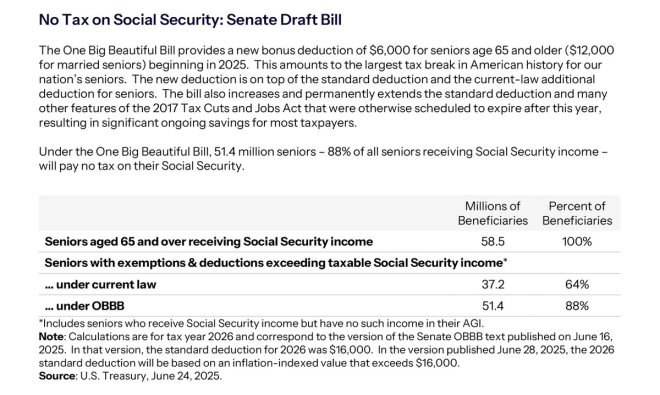

The "One Big Beautiful Bill" is a significant legislative proposal that aims to fulfill President trump’s commitment to exempt Social Security income from taxation. This initiative is particularly beneficial for seniors, as it targets the financial well-being of millions of retirees. According to data shared by the Council of Economic Advisors (@CEA47), approximately 51.4 million seniors—representing 88% of all individuals receiving Social Security—will not face any taxes on their Social Security income under this proposed legislation.

Understanding the Tax Exemption

The primary goal of the One Big Beautiful Bill is to alleviate the financial burdens faced by seniors who rely heavily on Social Security benefits for their livelihood. Historically, a portion of Social Security income has been subject to federal income tax, depending on the individual’s overall income level. This taxation can significantly diminish the financial resources available to retirees, particularly those on fixed incomes. By eliminating taxes on Social Security, the bill seeks to enhance financial security for the aging population in the United States.

The Broader Economic Implications

The decision to exempt Social Security from taxation not only supports seniors but is also expected to positively influence the economy. By increasing disposable income for millions of retirees, the bill encourages consumer spending, which is a vital driver of economic growth. When seniors have more money to spend, it can lead to increased demand for goods and services, boosting local businesses and stimulating job creation.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Support for the Legislation

Proponents of the One Big Beautiful Bill argue that this measure is a necessary step toward ensuring that seniors can live comfortably without the worry of tax implications on their essential income. Supporters highlight that this initiative aligns with the administration’s broader goals of tax reform and economic stimulation. It reinforces the idea that Social Security should be viewed as a fundamental right for seniors, rather than a taxable income source.

Public Response and Future Outlook

The announcement of the One Big Beautiful Bill has garnered significant attention on social media platforms, including Twitter, where discussions about its potential impact are prevalent. Many users express optimism about the bill’s promise, viewing it as a critical measure for protecting the financial interests of seniors. As the bill progresses through the legislative process, public support may influence its outcome, emphasizing the importance of community engagement in shaping policies that directly affect citizens’ lives.

In summary, the One Big Beautiful Bill represents a pivotal initiative aimed at exempting Social Security income from taxation, thereby providing financial relief to millions of seniors. With an emphasis on enhancing the economic security of the aging population, this legislative proposal seeks to foster a more supportive environment for retirees, promoting both individual well-being and broader economic growth. As discussions surrounding the bill continue, it remains to be seen how its implementation will unfold and how it will ultimately benefit the senior community across the nation.

The One Big Beautiful Bill delivers on President Trump’s NO TAX ON SOCIAL SECURITY promise.

Under the One Big Beautiful Bill, 51.4 million seniors — 88% of all seniors receiving Social Security income — will pay NO TAX on their Social Security, according to @CEA47. pic.twitter.com/0iQHNYEN7H

— Rapid Response 47 (@RapidResponse47) June 30, 2025

The One Big Beautiful Bill Delivers on President Trump’s NO TAX ON SOCIAL SECURITY Promise

When it comes to supporting our seniors, the topic of Social Security is a hot-button issue that garners a lot of attention. Recently, there has been significant buzz surrounding a legislative proposal known as “The One Big Beautiful Bill.” This bill is making waves because it promises to fulfill a key pledge made by President Trump: no taxes on Social Security benefits. This is particularly noteworthy because, under this new bill, an astonishing 51.4 million seniors, which is about 88% of all individuals receiving Social Security income, will not have to pay taxes on their benefits. This could mean a lot for those who rely on Social Security as their primary source of income.

Understanding the Impact of the One Big Beautiful Bill

The implications of the One Big Beautiful Bill are profound. For many seniors, even a small tax on their Social Security income can significantly affect their monthly budgets. By eliminating this tax, the bill directly addresses the financial stress that many seniors face. According to a report by [CEA47](https://twitter.com/CEA47?ref_src=twsrc%5Etfw), the bill will provide relief to a vast majority of Social Security beneficiaries. This financial relief can empower seniors to manage their expenses better and enhance their overall quality of life.

Imagine being a senior citizen living on a fixed income. Every dollar counts, and knowing that your Social Security benefits are safe from taxation can bring a sense of security and peace of mind. For the 51.4 million seniors who will benefit from this legislation, this promise may represent not just financial relief but also a recognition of their contributions to society throughout their working lives.

Why is This Tax Exemption Important?

Many people might wonder why a tax exemption on Social Security is such a big deal. To put it simply, Social Security benefits are meant to provide a safety net for those in their retirement years. These benefits are often the primary income for many seniors, and taxes on this income can create real hardships. When you consider that many seniors are living on fixed incomes, having a portion of their benefits taxed can be burdensome.

The One Big Beautiful Bill aims to alleviate this burden, ensuring that seniors can keep more of their hard-earned money in their pockets. The decision to exempt Social Security from taxation is not just a matter of financial strategy; it’s also about honoring the promises made to those who have contributed to the system over their lifetimes. This change could lead to a significant improvement in the lives of millions of Americans.

Understanding Social Security Taxes

To fully appreciate the significance of the One Big Beautiful Bill, it’s essential to understand how Social Security taxes currently operate. Currently, depending on their income level, retirees may have to pay taxes on a portion of their Social Security benefits. The rules can be quite confusing, as they depend on combined income levels, which include wages, pensions, interest, and other income sources.

For many seniors, this can be a frustrating experience, as they may not have anticipated that their benefits would be taxed. The introduction of the One Big Beautiful Bill could simplify the financial landscape for seniors, making it clear that their Social Security benefits are theirs to keep without the worry of taxation. This clarity is what many have been advocating for, and the bill seems to be a step in the right direction.

What Does This Mean for Future Policy?

The One Big Beautiful Bill is not just a one-time fix; it could represent a shift in how policymakers view Social Security and its importance in the lives of seniors. If this bill is passed, it may pave the way for further reforms aimed at enhancing the financial security of older Americans. This could include other measures such as increasing benefits or expanding eligibility.

Moreover, the bill’s passage could serve as a litmus test for future legislative efforts. If legislators see how positively this change impacts seniors, they might be more inclined to consider other policies that support our aging population. It’s a crucial moment for those advocating for senior rights, and the One Big Beautiful Bill could be a significant catalyst for change.

The Public’s Reaction to the Bill

Public sentiment surrounding the One Big Beautiful Bill is largely positive. Many people understand the financial challenges that seniors face and recognize the importance of preserving Social Security benefits. Social media platforms are buzzing with discussions about the bill, and many are expressing their support for the promise of a tax-free Social Security experience.

For example, a recent tweet from [Rapid Response 47](https://twitter.com/RapidResponse47/status/1939824948660273307?ref_src=twsrc%5Etfw) highlighted the potential relief that the bill could provide for millions of seniors, emphasizing the importance of delivering on promises made by elected officials. The enthusiasm is palpable, as many see the bill as a tangible way for the government to acknowledge and support the contributions of seniors.

How Can Seniors Prepare for Changes?

With the potential passage of the One Big Beautiful Bill, seniors should start preparing for a more favorable financial landscape. Here are some practical steps they can take:

1. **Stay Informed**: Keep up to date with news regarding the bill’s progress and any changes in Social Security policies. Knowledge is power!

2. **Evaluate Finances**: Seniors should review their financial situations to understand how a tax exemption could benefit them. This might involve budgeting or consulting with a financial advisor.

3. **Engage with Local Representatives**: Seniors should communicate with their local representatives about the importance of the bill. Advocacy can make a difference!

4. **Plan for the Future**: Consider long-term financial planning, whether it involves investments, savings, or other income sources to supplement Social Security.

The Future of Social Security and Seniors’ Financial Security

Ultimately, the One Big Beautiful Bill is more than just a piece of legislation; it represents a commitment to ensuring that seniors can live with dignity and financial security. By delivering on President Trump’s promise of no taxes on Social Security, the bill is addressing a critical need for many Americans.

As the bill moves through the legislative process, it will be crucial for all stakeholders—seniors, advocates, and policymakers—to stay engaged and informed. The future of Social Security and the financial well-being of millions of seniors depends on the success of this bill and others like it.

Embracing a future where seniors can enjoy their retirement without the burden of taxes on their Social Security benefits could be a monumental step forward. Here’s hoping that the One Big Beautiful Bill becomes a reality and makes a positive impact on the lives of millions of Americans!