Economic Shockwave: US M2 Money Supply Hits Record High, Sparks Inflation Fears

record-breaking money supply growth, unprecedented inflation levels, economic implications for 2025

—————–

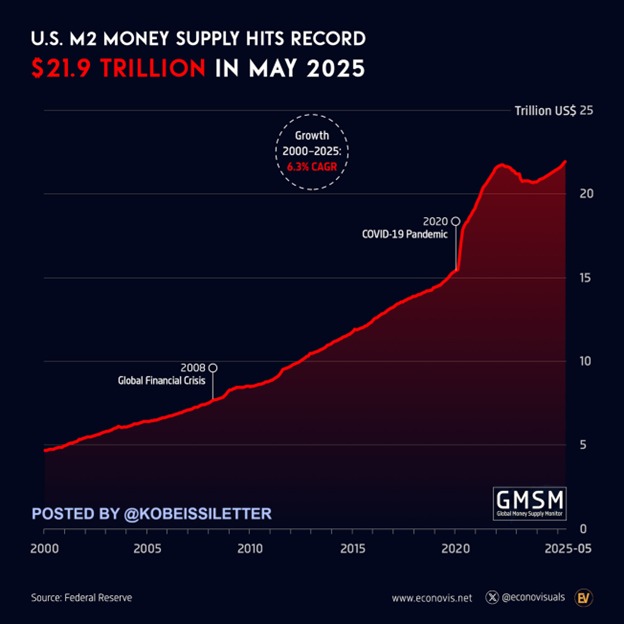

The US M2 money supply reached a new record high of $21.94 trillion in May, marking a 4.5% year-over-year increase. This surge represents the 19th consecutive monthly rise and surpasses the previous peak of $21.86 trillion set in March 2022. The inflation-adjusted M2 money supply continues to grow, reflecting the ongoing expansion of the US economy.

The M2 money supply is a key indicator of the amount of money circulating in the economy, including cash, checking deposits, and savings deposits. A growing money supply can indicate increased economic activity and consumer spending. However, it can also raise concerns about inflation and potential overheating of the economy.

The latest data on the M2 money supply underscores the ongoing strength of the US economy and the Federal Reserve’s efforts to support growth and stability. The central bank has been implementing various monetary policy measures, including lowering interest rates and implementing quantitative easing, to stimulate economic activity and mitigate the impact of the COVID-19 pandemic.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Inflation-adjusted M2 money supply takes into account the effects of inflation on the value of money. With inflation on the rise in recent months, it is crucial to monitor the real purchasing power of the money supply to assess its impact on consumer prices and overall economic conditions.

The Kobeissi Letter, a prominent financial newsletter, highlighted the latest M2 money supply data on Twitter, emphasizing the significance of the record-breaking increase. The tweet provides a link to further analysis and insights on the implications of the rising money supply for investors and policymakers.

As the US economy continues to recover from the pandemic-induced downturn, the growth in the M2 money supply signals optimism about the prospects for sustained economic expansion. However, policymakers will need to closely monitor inflationary pressures and ensure that monetary policy remains supportive of long-term growth and stability.

Overall, the record-high M2 money supply in May reflects the resilience and dynamism of the US economy, despite ongoing challenges and uncertainties. The latest data underscores the importance of monitoring key economic indicators to assess the health of the economy and make informed decisions about investment and policy priorities.

BREAKING: The US M2 money supply jumped +4.5% Y/Y in May, to a record $21.94 trillion.

This marks the 19th consecutive monthly increase.

It has now surpassed the previous all-time high of $21.86 trillion, posted in March 2022.

Furthermore, inflation-adjusted M2 money supply… pic.twitter.com/HsCLFZSgAT

— The Kobeissi Letter (@KobeissiLetter) July 1, 2025

Have you heard about the recent surge in the US M2 money supply? In May, the M2 money supply shot up by an impressive 4.5% year-over-year, reaching a new all-time high of $21.94 trillion. This significant increase marks the 19th consecutive monthly rise, surpassing the previous record set in March 2022. Let’s dive into what this means for the economy and inflation-adjusted M2 money supply.

The M2 money supply is a key economic indicator that includes cash, checking accounts, savings deposits, and other liquid assets. It serves as a measure of the total amount of money in circulation and is closely monitored by policymakers and economists. The recent jump in the M2 money supply reflects the ongoing economic recovery and the Federal Reserve’s efforts to stimulate growth through monetary policy.

One of the implications of the rising M2 money supply is the potential for increased inflation. When there is a surge in the money supply without a corresponding increase in goods and services, it can lead to higher prices as more money chases the same amount of goods. This phenomenon, known as demand-pull inflation, can erode purchasing power and reduce the value of savings.

However, it’s essential to consider the inflation-adjusted M2 money supply to get a clearer picture of the actual increase in the money supply. Adjusting for inflation provides a more accurate assessment of the purchasing power of the money supply over time. By accounting for changes in the price level, economists can better understand the real impact of monetary policy on the economy.

The Federal Reserve plays a crucial role in managing the money supply to achieve its dual mandate of price stability and maximum employment. By adjusting interest rates and implementing open market operations, the Fed can influence the money supply to support economic growth and stabilize inflation. The recent increase in the M2 money supply suggests that the Fed’s accommodative monetary policy is working to boost liquidity and stimulate spending.

As the economy continues to recover from the pandemic-induced recession, policymakers will closely monitor the M2 money supply to gauge the effectiveness of monetary policy. A sustained increase in the money supply could fuel inflationary pressures and prompt the Fed to tighten monetary policy to prevent overheating. On the other hand, a sharp contraction in the money supply could signal a slowdown in economic activity and necessitate additional stimulus measures.

In conclusion, the recent surge in the US M2 money supply highlights the dynamic nature of the economy and the importance of monitoring key indicators to inform policy decisions. By staying informed about developments in the money supply and inflation-adjusted metrics, investors and policymakers can better navigate the ever-changing economic landscape. Stay tuned for more updates on the M2 money supply and its implications for the economy.