“Shocking $6.16 Trillion Budget Deficit: Is America’s Fiscal Future at Risk?”

federal budget analysis, social security funding crisis, individual income tax revenue trends

—————–

Mind-Blowing Federal Budget Breakdown: Understanding the 2023 Fiscal Year

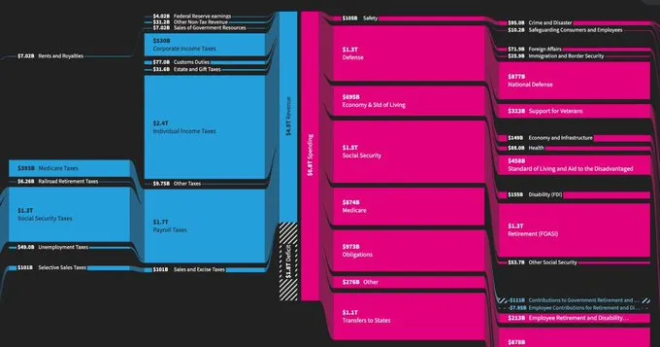

The federal budget for fiscal year 2023 has revealed a staggering financial landscape that raises significant concerns about the United States’ economic health. With total spending projected at an alarming $6.16 trillion, juxtaposed against revenue estimates of only $4.47 trillion, the resulting deficit highlights an unsustainable fiscal trajectory. This breakdown has garnered attention, with analysts suggesting that such a deficit would make even the most seasoned business owner rethink their fiscal strategies.

A Closer Look at the Numbers

The budgetary figures indicate a staggering gap of approximately $1.69 trillion, a deficit that could prompt serious discussions on government spending and revenue generation strategies. The predominant factor driving this immense expenditure is the Social Security program, which has become a significant component of federal spending. As the population ages and more individuals qualify for these benefits, the financial burden on the federal budget continues to increase.

In contrast, individual income taxes, a primary revenue source for the government, have not kept pace with rising expenditures. This disparity between income and spending raises critical questions about future fiscal policies and the sustainability of current programs.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Implications of Deficit Spending

Deficit spending, especially at such high levels, can have far-reaching implications for the economy. It not only increases national debt but also raises concerns about inflation, interest rates, and long-term economic stability. Critics argue that continued reliance on deficit financing may lead to increased taxes in the future, a burden that could stifle economic growth and innovation.

In the business world, a company operating at such a deficit would likely face severe scrutiny from investors and stakeholders. Similarly, many economists warn that government entities must adopt more prudent fiscal practices to avoid jeopardizing the long-term economic health of the nation.

The Future of Federal Budgeting

As the government navigates these financial challenges, it will be crucial to explore avenues for increasing revenue while controlling spending. Potential strategies could include tax reforms aimed at broadening the tax base or closing loopholes that allow for tax avoidance. Additionally, re-evaluating entitlement programs like Social Security may be necessary to ensure their sustainability without placing undue strain on the federal budget.

The budget breakdown serves as a wake-up call for policymakers, urging them to address the growing fiscal imbalance. Without a concerted effort to rein in spending and enhance revenue generation, the U.S. may find itself in a precarious fiscal position that could have long-lasting effects on future generations.

Conclusion

In summary, the federal budget for fiscal 2023 paints a concerning picture of the United States’ financial health. With a significant deficit driven by rising expenditures, particularly in Social Security, the government faces pressing challenges that demand immediate attention. As stakeholders analyze these numbers, the focus will likely shift toward finding sustainable solutions that balance spending and revenue for a more stable economic future. The implications of these fiscal decisions will resonate for years to come, making it imperative to act decisively and thoughtfully in addressing the nation’s budgetary concerns.

For more insights and detailed analysis, refer to the original tweet by Mario Nawfal here.

MIND-BLOWING FEDERAL BUDGET BREAKDOWN: $6.16 TRILLION SPENDING VS $4.47 TRILLION REVENUE

The government’s fiscal 2023 numbers reveal massive deficit spending that would make any sane business owner cringe.

Social Security dominates spending while individual income taxes… https://t.co/tEVOT9P18Q pic.twitter.com/oxwo1X2bLG

— Mario Nawfal (@MarioNawfal) July 1, 2025

MIND-BLOWING FEDERAL BUDGET BREAKDOWN: $6.16 TRILLION SPENDING VS $4.47 TRILLION REVENUE

There’s a lot of chatter going on about the latest federal budget breakdown, and honestly, it’s enough to make your head spin. With a staggering $6.16 trillion in spending against just $4.47 trillion in revenue, the numbers tell a story that should have every American paying attention. If you’re anything like me, you might be wondering how we even got here. Let’s dive into the details and break it all down.

The Massive Deficit Spending

Imagine running a business where your expenses are far higher than your income. Sounds like a recipe for disaster, right? Well, that’s essentially what’s happening with the federal budget. The fiscal year 2023 unveiled a massive deficit that would make any sane business owner cringe. When you see the numbers—$6.16 trillion spent and only $4.47 trillion brought in—you can’t help but think about the implications for future generations.

But what does this really mean? A deficit of approximately $1.69 trillion suggests that the government is borrowing money to cover its expenses. This is not sustainable in the long run, and it raises concerns about inflation and economic stability. To put it bluntly, the more money the government spends without corresponding revenue, the greater the risk we face as a nation.

Social Security Dominates Spending

One of the biggest contributors to this eye-popping budget is Social Security. In fact, Social Security spending continues to dominate the federal budget, accounting for a significant portion of the total expenditures. This program is essential for many Americans, especially retirees, but it comes at a hefty price.

According to reports, Social Security is projected to consume more and more of the budget as the population ages. With baby boomers retiring in droves, the strain on Social Security is only expected to increase. This creates a real challenge for policymakers, who must find ways to fund this critical program while also addressing other pressing needs like healthcare and education.

What’s interesting here is the conversation surrounding Social Security. Many argue that the program needs reform to remain viable. Others believe it’s a crucial safety net that must be preserved at all costs. Whatever your stance may be, it’s clear that Social Security is a significant factor in the federal budget that can’t be overlooked.

The Role of Individual Income Taxes

Now let’s talk about revenue. The federal government primarily relies on individual income taxes to fund its operations. However, with a revenue figure of $4.47 trillion, it’s clear that taxes alone aren’t enough to cover the expenses. The gap between what the government collects and what it spends is growing, and that’s a concern for all of us.

Many Americans feel the weight of taxes on their shoulders, and it’s hard to ignore the frustration that comes from seeing so much money taken out of our paychecks. Some argue that the wealthy should pay more, while others believe that tax reform is desperately needed to make the system fairer. Regardless of where you stand on this issue, the numbers point to a systemic problem that demands our attention.

The Future of Our Fiscal Policy

Looking ahead, what can we expect from our fiscal policy? The current budget situation raises serious questions about sustainability. With such massive deficit spending, it’s reasonable to worry about what this means for future government programs and services. Are we setting ourselves up for a fiscal crisis down the road?

To navigate these choppy waters, policymakers will need to make some tough decisions. Whether it’s cutting certain programs or finding new sources of revenue, something has to give. The ongoing debate about how to balance the budget is likely to become more heated in the coming years, especially as the political landscape continues to shift.

Public Sentiment and Accountability

Public sentiment around the federal budget is mixed. Many Americans are understandably frustrated with the way things are going. There’s a sense of accountability that is lacking, and citizens are demanding transparency in how taxpayer dollars are spent. The need for a more responsible fiscal policy is clearer than ever.

Organizations and advocacy groups are pushing for reforms that would lead to more responsible spending. These initiatives often focus on enhancing oversight and ensuring that government funds are allocated effectively. After all, if taxpayers are footing the bill, they deserve to know that their money is being used wisely.

The Importance of Budget Education

One of the biggest barriers to understanding the federal budget is that it can be downright confusing. Many people don’t have a clear grasp of how government spending works or what the implications of the deficit are. This is where education becomes crucial.

By engaging in conversations about the federal budget and making these numbers more accessible, we can empower citizens to take an active role in fiscal policy. Whether it’s through community forums, online resources, or educational programs, fostering a greater understanding of the budget is essential for building an informed citizenry.

Conclusion: A Call to Action

As we sift through the details of this mind-blowing federal budget breakdown, it’s essential to recognize that the implications extend far beyond just numbers on a page. They represent the future of our economy, the well-being of our citizens, and the sustainability of our nation’s programs.

This is a call to action for all of us. Whether you’re a concerned citizen, a business owner, or someone simply trying to make sense of it all, now is the time to pay attention. Engage with your community, stay informed about fiscal policies, and advocate for changes that promote a more sustainable budget.

The federal budget breakdown of $6.16 trillion spending versus $4.47 trillion revenue is not just a statistic; it’s a reflection of our priorities as a nation. Let’s make sure that those priorities lead us toward a brighter, more stable future.