Trump’s Bold Note to Fed Chair Powell: “You’re Costing America Billions!”

Trump Fed Rate Criticism, Jerome Powell Monetary Policy, US Inflation Trends 2025

—————–

President trump Critiques Fed Chair Powell’s Rate Decisions

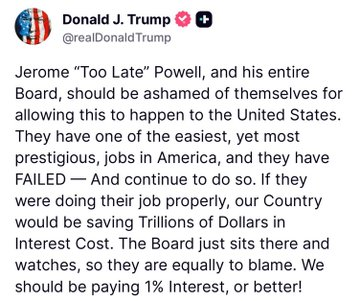

In a recent development that has captured significant attention, former President Donald Trump sent a hand-written note to Federal Reserve Chair Jerome Powell, expressing his dissatisfaction with the current interest rate policies. In the note, Trump stated, "Jerome — You are, as usual, ‘Too Late.’ You have cost the USA a fortune — and continue to do so. You should lower the Fed Rate — by a lot! Hundreds of billions of dollars lost! No inflation!" This candid message underscores the ongoing tensions between the former president and the Federal Reserve regarding monetary policy and its implications for the U.S. economy.

Background on Trump’s Economic Philosophy

Trump has long advocated for lower interest rates, arguing that they stimulate economic growth by making borrowing cheaper for consumers and businesses. His administration often criticized the Fed’s decisions to raise rates, claiming that such moves hindered economic progress. The former president’s reliance on low rates to boost the economy was a central theme during his time in office, and his recent remarks indicate that he believes the current economic environment still requires such measures.

The Impact of Interest Rates on the Economy

Interest rates play a crucial role in shaping the economic landscape. Lowering the Federal Reserve’s interest rates can lead to increased consumer spending and investment, ultimately fostering economic growth. However, Trump’s assertion that "No inflation" exists raises questions about the current economic climate. Historically, low-interest rates are associated with inflationary pressures, but the dynamics of the post-pandemic economy have led to unique challenges and debates among economists.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Powell’s Response and the Fed’s Position

Jerome Powell, as head of the Federal Reserve, has the challenging task of balancing inflation control with economic growth. The Fed’s decisions are based on comprehensive economic data, and any changes to interest rates are made with caution to prevent overheating the economy. Powell’s approach has often prioritized long-term stability over short-term gains, a strategy that has faced criticism from various political figures, including Trump.

The Future of U.S. Monetary Policy

As the U.S. economy continues to navigate recovery from the impacts of the COVID-19 pandemic, the debate over interest rates and monetary policy is more relevant than ever. Trump’s note illustrates a broader concern among some policymakers and business leaders who believe that the Fed’s current strategies may be insufficient to foster robust economic growth.

The tension between political figures and the Federal Reserve raises important questions about the independence of monetary policy and its intersection with political agendas. As economic conditions evolve, both the Fed and political leaders will need to consider the implications of their decisions on the American economy.

Conclusion

In summary, Trump’s recent hand-written note to Fed Chair Powell highlights ongoing frustrations regarding U.S. monetary policy and interest rates. His call for lower rates reflects a belief that such action is necessary to spur economic growth and mitigate financial losses incurred under the current policies. As the economic landscape continues to shift, the dialogue surrounding interest rates and their impact on the economy will remain a critical issue for both policymakers and citizens alike. The evolving relationship between political figures and the Federal Reserve will undoubtedly shape the future economic trajectory of the United States.

BREAKING – President Trump writes a hand-written note for Fed chair Powell: “Jerome — You are, as usual, ‘Too Late.’ You have cost the USA a fortune — and continue to do so. You should lower the Fed Rate — by a lot! Hundreds of billions of dollars lost! No inflation!” pic.twitter.com/j0oM5qPivt

— Insider Paper (@TheInsiderPaper) June 30, 2025

BREAKING – President Trump writes a hand-written note for Fed chair Powell: “Jerome — You are, as usual, ‘Too Late.’ You have cost the USA a fortune — and continue to do so. You should lower the Fed Rate — by a lot! Hundreds of billions of dollars lost! No inflation!”

When President Trump sent a hand-written note to Federal Reserve Chair Jerome Powell, the financial world took notice. This note, filled with strong language and pointed criticism, reflects Trump’s long-standing belief about monetary policy and its impact on the U.S. economy. But what does it all mean for everyday Americans? Let’s dive into the implications of this message and what it reveals about the current economic climate.

Understanding the Context of Trump’s Note

To fully grasp the significance of Trump’s note, we need to consider the broader economic landscape. The Federal Reserve plays a crucial role in managing the economy by controlling interest rates and regulating money supply. When interest rates are high, borrowing becomes more expensive, which can slow down economic growth. Conversely, lower interest rates can stimulate spending and investment.

In his note, Trump accused Powell of being “too late,” suggesting that the Fed Chair’s decisions are not timely enough to benefit the economy. This sentiment echoes Trump’s previous criticisms of the Fed, where he has consistently called for lower interest rates to spur growth.

The Urgency Behind Lowering Interest Rates

Trump’s demand that the Fed lower the interest rate “by a lot” stems from his belief that such a move could prevent significant economic losses. He mentions “hundreds of billions of dollars lost,” highlighting a sense of urgency that many Americans can relate to. When rates are low, businesses can invest more, consumers can afford homes, and overall economic activity can surge.

The message is clear: Trump believes that the Fed’s current policies are hindering economic growth and costing the nation dearly. The assertion of “no inflation” adds another layer to his argument, suggesting that there’s room to maneuver without risking runaway price increases.

What This Means for Everyday Americans

So, what does all this mean for you, the average American? If the Fed takes Trump’s advice and lowers interest rates, we could see a variety of positive outcomes. For starters, mortgage rates might drop, making homeownership more attainable for many. Lower rates also typically lead to cheaper loans for cars and education, which can relieve some financial pressure on families.

However, it’s not all sunshine and rainbows. Lowering interest rates can have consequences, such as potential asset bubbles and increased debt levels. It’s a balancing act that requires careful consideration from the Fed.

The Broader Economic Implications

Trump’s comments come at a time when the economy is recovering from the impacts of the pandemic. As businesses reopen and consumer confidence grows, the Fed’s decisions will play a pivotal role in shaping the recovery. The tension between maintaining low rates to stimulate growth and preventing inflation is a tightrope that Powell and his team must navigate.

Additionally, Trump’s note raises questions about the independence of the Federal Reserve. Historically, the Fed has operated free from political pressure to maintain its credibility. When a sitting president publicly criticizes the Fed, it can create uncertainty about its future decisions.

What’s Next for the Federal Reserve?

As we move forward, all eyes will be on the Federal Reserve. Will Powell heed Trump’s advice? The upcoming Federal Open Market Committee (FOMC) meetings will be critical in determining the direction of monetary policy.

Investors, economists, and everyday citizens alike will be watching closely for signs of any shifts in policy. Any changes in interest rates can significantly impact the stock market and other financial instruments, influencing retirement accounts and savings.

The Role of Communication in Monetary Policy

The way monetary policy is communicated can greatly affect market perceptions and economic realities. Trump’s hand-written note is a clear example of how communication can influence public opinion and market expectations. The tone and urgency of his message signal to both the public and investors that he believes immediate action is necessary.

Communication is key in economics. When the Fed signals its intentions, whether through official statements or actions, it shapes market behavior. Trump’s direct approach could be seen as an attempt to sway public sentiment in favor of lower rates, putting pressure on Powell.

The Historical Context of Presidential Influence on the Fed

It’s worth noting that the relationship between the presidency and the Federal Reserve has always been complex. Previous presidents, including Obama and Bush, have had their own frustrations with the Fed. However, Trump’s approach has been particularly vocal and direct, which raises questions about the future of this relationship.

Historically, the Fed has maintained a level of independence to ensure that monetary policy is based on economic data rather than political pressures. The current climate, influenced by social media and public opinion, challenges this traditional dynamic.

Public Reaction to Trump’s Note

Public reaction to Trump’s note has been mixed. Supporters of lower interest rates applaud his call for action, seeing it as a necessary step for economic growth. Critics, however, argue that such an approach could lead to long-term economic instability and risks associated with excessive debt.

Social media platforms, including Twitter, have been abuzz with opinions. Some users express agreement with Trump’s criticism of Powell, while others highlight the potential dangers of lowering rates too quickly.

Conclusion: The Path Forward

As we navigate this complex economic landscape, Trump’s hand-written note serves as a reminder of the intricate relationship between politics and monetary policy. Whether Powell will respond to Trump’s call for lower interest rates remains to be seen, but one thing is clear: the stakes are high.

In the coming weeks and months, we will witness how this dynamic unfolds and what it ultimately means for the economy and the American people. The interplay between leadership decisions, economic data, and public sentiment will shape the financial future of the nation. Keep an eye on the Fed, because their decisions could have lasting impacts on your wallet and the economy as a whole.