“Shockwaves in Finance: New Fed Chair on Horizon as Powell Faces Ouster!”

Treasury Secretary announcement, Federal Reserve leadership change, Jerome Powell successor 2025

—————–

Breaking news: Potential Change in Federal Reserve Leadership

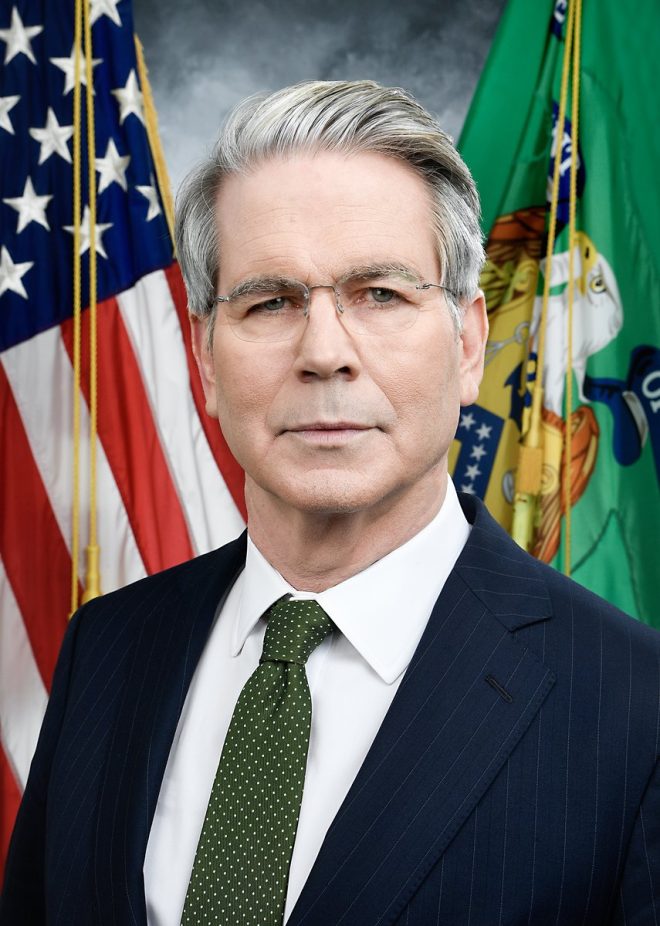

In a significant development for the U.S. financial landscape, Treasury Secretary Scott Bessent announced that the administration is in the process of selecting a new Federal Reserve Chair to replace Jerome Powell. This announcement comes as part of a broader strategy aimed at steering the economy in a new direction. As speculation mounts around who might take on this pivotal role, experts and analysts are weighing in on the potential implications for monetary policy and the markets.

The Importance of Federal Reserve Leadership

The Federal Reserve, often referred to as the Fed, plays a crucial role in shaping the U.S. economy through its control of monetary policy. The Chair of the Federal Reserve is a particularly influential position, responsible for making decisions that impact interest rates, inflation, and overall economic growth. Jerome Powell has led the Fed since February 2018, and his tenure has been marked by significant events such as the COVID-19 pandemic and its aftermath, which required unprecedented monetary interventions.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Timing and Context of the Announcement

Secretary Bessent’s announcement comes amid growing concerns about inflation and economic stability. As the nation grapples with the aftereffects of the pandemic and ongoing global economic challenges, the need for decisive leadership at the Fed is more critical than ever. The administration’s decision to seek a new Chair indicates a potential shift in monetary policy direction, which could have far-reaching consequences for consumers and businesses alike.

Speculations on Potential Candidates

With the search for a new Fed Chair underway, speculation is rife regarding who might be in the running. Candidates could include current Fed governors, prominent economists, or financial industry leaders. Each potential candidate brings different perspectives and approaches to monetary policy, which could influence the Fed’s stance on interest rates and inflation control.

Implications for the Financial Markets

The announcement has already begun to ripple through financial markets, as investors react to the uncertainty of leadership change at the Fed. Historically, transitions in Fed leadership can lead to volatility in stock and bond markets, as traders adjust their expectations based on the perceived direction of future policies. The new Chair’s approach to tackling inflation and stimulating growth will be closely monitored by market participants.

The Broader Economic Impact

The selection of a new Federal Reserve Chair is not just a matter of political interest; it carries significant implications for the broader economy. A change in leadership could signal a shift in policy priorities, affecting everything from consumer borrowing costs to business investment strategies. As the new Chair is appointed, their stance on key issues like interest rates, quantitative easing, and regulatory measures will be critical in determining the economic outlook for the nation.

Conclusion

As Secretary Scott Bessent and the administration move forward with their search for a new Federal Reserve Chair, the financial world watches closely. The decision will have lasting consequences for U.S. monetary policy and the economy at large. Stakeholders are advised to stay informed as developments unfold in the coming weeks, as the implications of this leadership change could reshape the economic landscape for years to come.

For those interested in the financial markets and economic policy, this is a pivotal moment worth watching closely.

BREAKING: Treasury Secretary Scott Bessent says they are working to select NEW Fed Chair to REPLACE Jerome Powell in coming weeks. pic.twitter.com/1151c3L5ms

— The Patriot Oasis (@ThePatriotOasis) June 30, 2025

BREAKING: Treasury Secretary Scott Bessent says they are working to select NEW Fed Chair to REPLACE Jerome Powell in coming weeks.

Big news is swirling around the financial world as Treasury Secretary Scott Bessent has announced that they are moving forward with the process of selecting a new Fed Chair to replace Jerome Powell. This is more than just a routine decision; it’s a pivotal moment that could reshape monetary policy and financial markets in the coming months. With Powell’s tenure coming to an end, many are wondering what this change means for the economy and the American people.

Understanding the Role of the Fed Chair

The Federal Reserve Chair is one of the most powerful positions in the U.S. government, wielding significant influence over the nation’s monetary policy. This position involves making critical decisions regarding interest rates, inflation, and overall economic stability. The Fed Chair’s actions can have far-reaching implications for everything from employment rates to the stock market. With Powell stepping down, the new chair will have the monumental task of navigating a complex economic landscape that includes rising inflation, fluctuating unemployment rates, and the ongoing recovery from the pandemic.

The Impacts of Jerome Powell’s Leadership

Jerome Powell’s leadership has been defined by extraordinary challenges, most notably the COVID-19 pandemic and its aftermath. Under his tenure, the Fed implemented various measures to stabilize the economy, including lowering interest rates and purchasing government securities. These actions were crucial in providing liquidity and confidence to the markets during a time of unprecedented uncertainty. However, as the economy gradually recovers, the new Fed Chair will need to reassess these strategies and potentially pivot to a more hawkish stance to combat inflation, which has been on the rise.

What to Expect with a New Fed Chair

As the search for a new Fed Chair begins, speculation is rife about who might take on this critical role. The new chair will need to balance various competing interests: maintaining economic growth while keeping inflation in check. This balance is tricky and will require a leader who is not only skilled in economic theory but also adept at communicating with the public and policymakers. The selection process will be closely watched by financial markets, as any signs of instability or indecision could lead to volatility.

The Potential Candidates

While no official names have been released, there are several individuals who are often mentioned as potential candidates. These include current members of the Federal Reserve Board, experienced economists from academia, and financial executives with a deep understanding of monetary policy. Each candidate brings a unique perspective to the table, and their views on key issues like interest rates and inflation could significantly influence the direction of U.S. monetary policy.

The Importance of Communication

A crucial aspect of the Fed Chair’s role is effective communication. The new chair will need to articulate their vision and plans clearly to the public and financial markets. Miscommunication can lead to market shocks, so it’s essential that the selected individual is not only knowledgeable but also skilled in public speaking and engagement. The public’s trust in the Fed hinges on its ability to convey its policies and decisions coherently.

Looking Ahead: Economic Challenges

As we look towards the future, the incoming Fed Chair will face numerous challenges. Inflation rates are fluctuating, and there’s ongoing debate about the best approach to address this issue. Additionally, the labor market is still in recovery, and the new chair will need to consider how monetary policy can support job growth without fueling inflation. The balance between these competing objectives will define the new chair’s legacy.

Public Reaction and Market Response

Public reaction to the announcement of a new Fed Chair will likely be mixed. Some may welcome the change as an opportunity for fresh ideas and new strategies, while others may express concern about potential instability during the transition. Financial markets will also be closely monitoring any developments, and analysts will be quick to assess how the new chair’s policies might impact investment strategies and market dynamics.

Conclusion: A Pivotal Moment for the Federal Reserve

The decision to select a new Fed Chair represents a pivotal moment for the Federal Reserve and the broader economy. With challenges ahead and a demand for effective leadership, the incoming chair will play a crucial role in shaping the future of U.S. monetary policy. As we await further updates on the selection process, it’s essential to stay informed about the implications this change may have on the economy and our everyday lives.