“BREAKING: Treasury Secretary Bessent’s Controversial Promise to the President!”

Treasury Secretary Appointment, Federal Reserve Leadership 2025, Scott Bessent Statements

—————–

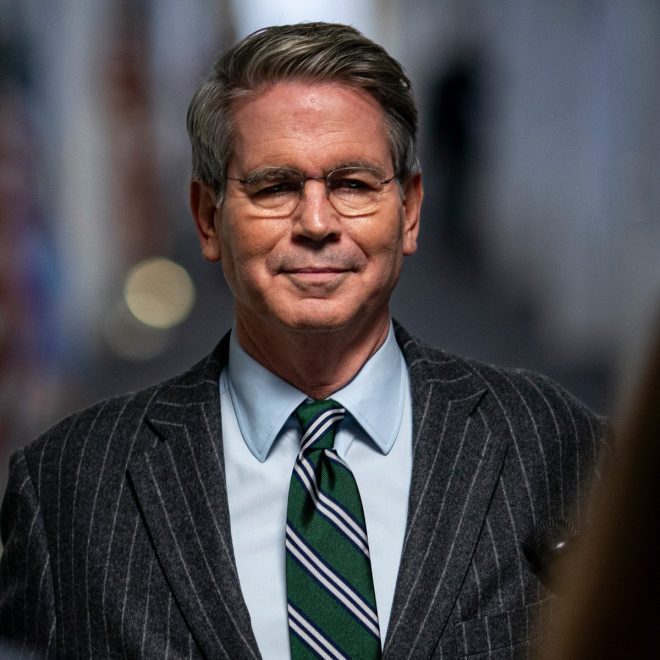

Treasury Secretary Scott Bessent Comments on Potential Federal Reserve Chair Role

In a recent tweet by Eric Daugherty, Treasury Secretary Scott Bessent addressed speculation regarding his potential appointment as the next chairman of the Federal Reserve. Bessent’s statement, "I will do what the president wants," suggests a willingness to align with presidential directives, raising questions about his views on Federal Reserve policies and economic management. This comment comes as the nation anticipates a pivotal transition in leadership at the Federal Reserve, an institution that plays a crucial role in shaping the U.S. economy.

Understanding the Role of the Federal Reserve

The Federal Reserve, often referred to as the Fed, is the central bank of the United States, responsible for monetary policy, regulating banks, maintaining financial stability, and providing financial services. The chairman of the Federal Reserve is a highly influential position, affecting interest rates, inflation, and overall economic growth. The selection of a new chair can significantly impact financial markets and economic policy direction.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Scott Bessent’s Background

Scott Bessent, who currently serves as the Treasury Secretary, has a robust background in finance and economic policy. His experience includes working in various capacities within the financial sector, which positions him as a knowledgeable candidate for the Federal Reserve chairmanship. His statement indicates a strong commitment to collaborating closely with the president, which may resonate well with those looking for cohesive economic leadership.

The Importance of Presidential Influence

Bessent’s remark highlights the interconnectedness of the Treasury and the Federal Reserve, particularly in times of economic uncertainty. As the president seeks to implement specific economic strategies, having a Fed chairman who aligns with these goals can enhance the effectiveness of monetary policy. This alignment is crucial, especially during periods of economic recovery or recession, where coordinated efforts can lead to more favorable outcomes.

Public and Market Reactions

The financial markets and the public are keenly watching developments regarding the Federal Reserve’s leadership. Bessent’s willingness to follow presidential directives may evoke mixed reactions among economists and investors. Some may view his approach as a sign of stability and continuity, while others may express concerns about the independence of the Federal Reserve. The balance between adhering to presidential policy and maintaining the Fed’s autonomy is a topic of ongoing debate.

Conclusion: The Future of Economic Policy

As the possibility of Scott Bessent stepping into the role of Federal Reserve chairman unfolds, the implications for U.S. economic policy are significant. His readiness to cooperate with the president suggests a potential shift towards a more integrated approach to economic management. Observers will be closely monitoring how this relationship develops and what it means for future monetary policy decisions.

In summary, Scott Bessent’s comments regarding the Federal Reserve chairmanship are pivotal in understanding the current economic landscape and the potential shifts in policy direction. As the nation moves forward, the intersection of Treasury and Federal Reserve leadership will undoubtedly play a critical role in shaping economic outcomes in the coming years.

JUST IN – Treasury Secretary SCOTT BESSENT on potentially becoming the Federal Reserve chairman next: “I will do what the president wants.”

— Eric Daugherty (@EricLDaugh) June 30, 2025

JUST IN – Treasury Secretary SCOTT BESSENT on potentially becoming the Federal Reserve chairman next: “I will do what the president wants.”

The financial landscape in the United States is always shifting, and recently, all eyes have been on Treasury Secretary Scott Bessent. As a key player in the government’s economic strategies, Bessent has been making headlines with his candid remarks regarding the possibility of stepping into the role of Federal Reserve chairman. His statement, “I will do what the president wants,” has sparked discussions about the intersection of politics and monetary policy. This piece dives deep into what this could mean for the economy and the Federal Reserve’s future.

Understanding the Role of the Federal Reserve Chairman

Before we get into the implications of Bessent’s potential appointment, let’s take a moment to understand the role of the Federal Reserve chairman. The Federal Reserve, often referred to as the Fed, is the central bank of the United States. It plays a crucial role in managing the country’s monetary policy, regulating banks, maintaining financial stability, and providing financial services. The chairman of the Federal Reserve, who oversees these functions, is a powerful figure whose decisions can significantly influence the economy.

The Political Implications of Bessent’s Statement

Bessent’s remark about aligning with the president’s wishes raises questions about the independence of the Federal Reserve. Traditionally, the Fed is expected to operate free from political influence to ensure that monetary policy decisions are based on economic data rather than political pressures. With Bessent indicating his willingness to conform to the president’s agenda, it opens up a dialogue about the potential for a more politically influenced Fed, which could raise concerns among economists and investors alike.

Who is Scott Bessent?

Before diving deeper into the implications of his potential new role, let’s get to know Scott Bessent a bit better. Bessent has a robust background in finance and economics. He has served in various capacities within the government and the private sector, including positions at major financial institutions. His experience gives him a unique perspective on both market forces and government policy, making him a formidable candidate for the role of Fed chairman. His understanding of fiscal policy and market dynamics could bring a fresh approach to the Federal Reserve.

The Reaction from Economists and Analysts

The financial community has reacted with a mix of curiosity and concern regarding Bessent’s comments. Some analysts believe that a more politically aligned Fed could lead to increased volatility in financial markets. Others argue that if Bessent can effectively balance political pressures with economic realities, he could navigate the complex landscape successfully. It’s a tightrope walk that few have managed to perform without stumbling. Economists are particularly keen to see how this potential shift might affect interest rates, inflation, and overall economic growth.

Impacts on Monetary Policy

One of the most critical functions of the Federal Reserve is to set interest rates, which directly impacts borrowing costs for consumers and businesses. If Bessent becomes chairman and aligns closely with the president’s economic strategies, we could see significant changes in how interest rates are managed. This could either stimulate economic growth or lead to inflationary pressures, depending on the policies enacted. The Fed’s decisions on interest rates can have a ripple effect across the economy, influencing everything from mortgage rates to investment in businesses.

Challenges Ahead

Should Bessent step into the role of Federal Reserve chairman, he will undoubtedly face challenges. The ongoing economic recovery from the pandemic, supply chain disruptions, and inflationary pressures are just a few of the hurdles he may need to address. Balancing the Fed’s dual mandate of promoting maximum employment and stable prices will be a critical focus. Economists will be watching closely to see how Bessent plans to tackle these issues while maintaining the integrity of the Fed’s policies.

The Future of the Federal Reserve Under Bessent

The potential appointment of Scott Bessent as the Federal Reserve chairman could usher in a new era of monetary policy that reflects the current administration’s goals. However, the question remains: can he maintain the independence of the Fed while adhering to the president’s vision? This balance will be crucial for fostering trust among investors and ensuring economic stability.

The Importance of Public Confidence

Public confidence in the Federal Reserve is paramount. If Bessent is viewed as too aligned with political interests, it could undermine trust in the Fed’s ability to make impartial decisions based on economic conditions. This could lead to market instability, as investors may react negatively to perceived political interference. It’s essential for Bessent to communicate effectively and transparently about his policies and decisions to build and maintain that trust.

Conclusion

Scott Bessent’s comments about potentially stepping into the role of Federal Reserve chairman have generated significant buzz in the financial world. His willingness to align with the president raises important questions about the future of the Fed and its independence. As we await further developments, it’s clear that the landscape of U.S. monetary policy is poised for potential shifts that could impact the economy for years to come.

Whether Bessent can navigate the challenges of this role while upholding the principles of the Federal Reserve will be a focal point for economists and policymakers alike. The intersection of politics and central banking is always a delicate matter, and how Bessent handles this balance could define his tenure and the future direction of U.S. monetary policy.