Michael Saylor’s Bitcoin Strategy Joins Russell 200: Is This a Game-Changer?

Bitcoin investment strategy, Russell Top 200 Index impact, passive capital allocation 2025

—————–

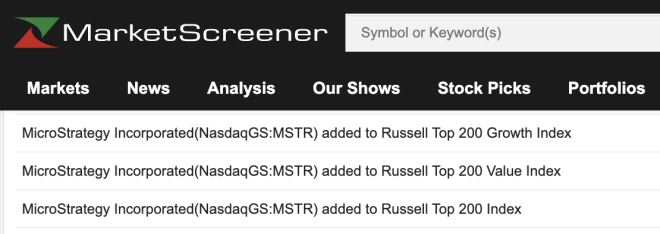

In a significant development for the cryptocurrency market, Michael Saylor’s investment strategy has been officially integrated into the Russell Top 200 Index, a move that is poised to bring substantial passive capital into Bitcoin. This announcement was made via a tweet by The Bitcoin Historian, adding to the growing excitement surrounding Bitcoin’s inclusion in mainstream financial indices.

## Understanding the Russell Top 200 Index

The Russell Top 200 Index is a benchmark that includes the largest 200 stocks in the Russell 3000 Index, which represents the largest companies in the U.S. equity market. With Michael Saylor’s strategy now part of this index, it signifies a robust endorsement of Bitcoin as a viable asset class. Investors often look to indices like the Russell Top 200 as indicators of market trends and investment opportunities, making this inclusion particularly impactful.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

### Michael Saylor’s Influence on Bitcoin

Michael Saylor, the co-founder and executive chairman of MicroStrategy, has been a prominent advocate for Bitcoin. Under his leadership, MicroStrategy has amassed significant Bitcoin holdings, viewing it as a long-term store of value and an inflation hedge. Saylor’s strategic approach and vocal support for Bitcoin have influenced both retail and institutional investors, potentially paving the way for wider acceptance of cryptocurrency in traditional finance.

### Implications for Passive Capital Flow

The integration of Saylor’s strategy into the Russell Top 200 Index is expected to catalyze passive capital inflows into Bitcoin. Passive investment strategies typically involve investing in assets that track an index, rather than attempting to outperform the market through active management. As more institutional investors seek exposure to Bitcoin through indexed products, the demand for Bitcoin is likely to increase, potentially driving its price higher.

### The Future of Bitcoin in Investment Portfolios

With the growing acceptance of Bitcoin among institutional investors and its inclusion in major indices, the cryptocurrency is becoming a staple in diversified investment portfolios. This shift is indicative of a broader acceptance of digital currencies as legitimate financial assets. Investors are increasingly recognizing Bitcoin’s potential not just as a speculative asset, but as a crucial component of a balanced investment strategy.

### Conclusion

The addition of Michael Saylor’s strategy to the Russell Top 200 Index marks a pivotal moment in the ongoing evolution of Bitcoin within the financial landscape. As passive capital flows into Bitcoin, the cryptocurrency is set to gain even more traction among institutional investors. This development not only reinforces Bitcoin’s legitimacy as an asset class but also signifies a potential shift in how cryptocurrencies are viewed by the broader financial community.

In summary, the integration of Saylor’s strategy into a major financial index underscores the growing acceptance of Bitcoin in traditional finance. As the landscape for cryptocurrencies continues to evolve, investors should pay close attention to these developments, as they may present new opportunities for growth and diversification in their investment portfolios.

BREAKING: MICHAEL SAYLOR’S STRATEGY JUST GOT ADDED TO THE RUSSELL TOP 200 INDEX

PASSIVE CAPITAL WILL FLOW INTO #BITCOIN pic.twitter.com/nrar97t0k6

— The Bitcoin Historian (@pete_rizzo_) June 30, 2025

BREAKING: MICHAEL SAYLOR’S STRATEGY JUST GOT ADDED TO THE RUSSELL TOP 200 INDEX

In a groundbreaking announcement that’s stirring excitement in the cryptocurrency world, @pete_rizzo_ shared on Twitter that Michael Saylor’s strategy has been officially added to the Russell Top 200 Index. This is a significant milestone for Bitcoin and cryptocurrency advocates, as it indicates a shift in how institutional investors view Bitcoin as a viable asset. Let’s dive into what this means and why it’s important for the future of Bitcoin.

PASSIVE CAPITAL WILL FLOW INTO #BITCOIN

With the addition of Saylor’s strategy to the Russell Top 200 Index, we’re about to see a wave of passive capital flowing into Bitcoin. This shift is crucial for the digital currency, as it signifies growing acceptance among institutional investors who are increasingly looking for innovative ways to diversify their portfolios. The Russell Top 200 Index consists of the largest companies in the U.S. stock market, and its inclusion of Saylor’s strategy is a strong endorsement for Bitcoin as an asset class.

Understanding Michael Saylor’s Strategy

Michael Saylor, the co-founder and executive chairman of MicroStrategy, has been a vocal proponent of Bitcoin. His strategy primarily revolves around the idea of Bitcoin as a hedge against inflation and a store of value. Saylor believes that Bitcoin is digital gold, and with the ongoing economic uncertainties, many investors are beginning to see the merit in that perspective.

By adopting Bitcoin as a core part of MicroStrategy’s treasury reserve strategy, Saylor has paved the way for other companies to explore similar paths. His firm has made headlines for its significant Bitcoin purchases, which currently total over 100,000 BTC. This bold move has not only increased MicroStrategy’s stock price but has also influenced other corporations and institutional investors to consider Bitcoin as a legitimate investment option.

The Impact of the Russell Top 200 Index

The Russell Top 200 Index is widely used as a benchmark for institutional investment strategies. When a strategy gets added to this index, it often leads to increased capital inflow as funds that track the index will invest in the included strategies. This means that more money will be funneled into Bitcoin, potentially driving the price higher and further legitimizing it as a valuable asset.

What This Means for Bitcoin’s Future

The inclusion of Michael Saylor’s strategy in the Russell Top 200 Index could be a game-changer for Bitcoin. It not only brings more visibility and credibility to Bitcoin but also encourages other institutional investors to reconsider their stance on cryptocurrency. As companies like MicroStrategy continue to lead the way, we may see a domino effect where more entities adopt Bitcoin as a treasury reserve asset.

Furthermore, as passive capital flows into Bitcoin, this could create a more stable and robust market for the cryptocurrency. This stability is essential for attracting even more institutional investors, which could lead to a positive feedback loop where increasing demand drives prices higher, attracting even more investment.

The Growing Trend of Institutional Investment in Bitcoin

Over the past few years, we’ve witnessed a noticeable shift in the cryptocurrency landscape. Institutional investors, once hesitant about Bitcoin, are now increasingly entering the market. Companies like Tesla, Square, and of course, MicroStrategy, have all made significant investments in Bitcoin, signaling a growing acceptance of cryptocurrency in mainstream finance.

As institutional investors recognize Bitcoin’s potential, the market is likely to mature. The volatility that has characterized Bitcoin’s price over the years may begin to stabilize as more institutional money enters the market. This could lead to a more sustainable growth trajectory for Bitcoin in the long term.

Competing Against Traditional Assets

One of the key arguments for Bitcoin as a legitimate asset class is its potential to compete against traditional investments like stocks and bonds. As more companies adopt Bitcoin as part of their treasury reserves, it could challenge the status quo of asset allocation. Investors may start to view Bitcoin not just as a speculative asset but as a fundamental part of a diversified investment strategy.

The Risks and Rewards of Bitcoin Investment

While the potential for Bitcoin’s growth is significant, it’s essential to remember that investing in cryptocurrency comes with its risks. The market is still relatively young, and prices can be highly volatile. However, those who are willing to navigate the risks may find substantial rewards as Bitcoin continues to establish itself in the financial landscape.

For those considering investing in Bitcoin, it’s crucial to do thorough research and understand the market dynamics. Following trends, staying updated on news, and understanding the underlying technology can provide valuable insights into making informed investment decisions.

Conclusion

The addition of Michael Saylor’s strategy to the Russell Top 200 Index is a monumental step for Bitcoin and the cryptocurrency ecosystem. It signals a growing acceptance of Bitcoin among institutional investors, which could lead to increased capital inflow and a more robust market. As we move forward, it will be fascinating to see how this development shapes the future of Bitcoin and its role in the broader financial landscape. The excitement is palpable, and the possibilities seem endless for Bitcoin enthusiasts and investors alike!

“`

Feel free to copy and paste the HTML code above directly into your website or content management system to create an engaging and SEO-optimized article about Michael Saylor’s strategy and its implications for Bitcoin.