BREAKING: Enormous Hyperliquid Whale Holds $1.49M Bitcoin Short, Faces Liquidation at $108,630BTC

Hyperliquid whale, $1.49 million bitcoin short, leverage 40x

Crypto trading, liquidation risk, BTC price $108,630

Whale investor, high stake, cryptocurrency market volatility

—————–

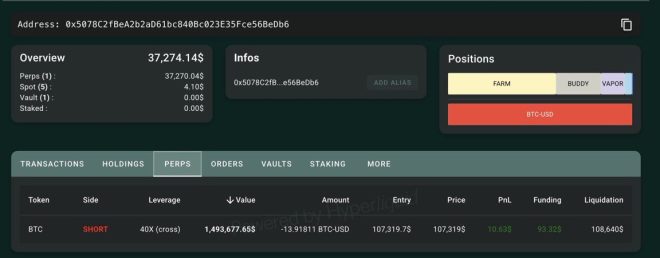

In a recent tweet by Crypto Rover, it was revealed that a hyperliquid whale has returned to the scene with a massive $1.49 million Bitcoin short at 40x leverage. This bold move puts the whale at risk of liquidation if Bitcoin were to hit $108,630.

The cryptocurrency market is known for its volatility, and leveraging positions can lead to significant gains or losses. In this case, the whale’s position is particularly risky due to the high leverage used. With a short position, the whale is betting on the price of Bitcoin decreasing, but if the price were to rise instead, they would face liquidation.

The tweet has caused a stir in the crypto community, with many speculating on the potential outcome of this high-stakes trade. Traders and enthusiasts alike are keeping a close eye on the price of Bitcoin, as it could have a significant impact on the market if it were to reach the liquidation price.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

This news serves as a reminder of the risks involved in trading cryptocurrencies, especially when using leverage. While leverage can amplify profits, it can also lead to substantial losses if the market moves against the trader’s position.

As the crypto market continues to evolve and attract more institutional investors, moves like this one by the hyperliquid whale are becoming more common. These large trades can have a ripple effect on the market, influencing the price of Bitcoin and other cryptocurrencies.

Overall, the return of the hyperliquid whale with a massive Bitcoin short has captured the attention of the crypto community. It is a stark reminder of the risks and rewards of trading in the volatile cryptocurrency market. Traders will be watching closely to see how this trade plays out and what impact it may have on the broader market.

BREAKING:

A HYPERLIQUID WHALE HAS RETURNED WITH A MASSIVE $1.49 MILLION BITCOIN SHORT AT 40X LEVERAGE, FACING LIQUIDATION IF BTC HITS $108,630. pic.twitter.com/QbGm8FrkGE

— Crypto Rover (@rovercrc) June 29, 2025

In the fast-paced world of cryptocurrencies, the news of a hyperliquid whale making a massive $1.49 million Bitcoin short at 40x leverage has sent shockwaves through the industry. This bold move has captured the attention of traders and investors alike, as the whale now faces potential liquidation if Bitcoin hits $108,630.

The term "hyperliquid whale" refers to an individual or entity with a significant amount of capital who is able to make large trades that can impact the market. In this case, the whale has taken a substantial short position on Bitcoin, betting that the price will decrease. With 40x leverage, the potential profits or losses from this trade are amplified, adding an extra layer of risk to the already volatile cryptocurrency market.

The fact that this whale is facing liquidation if Bitcoin hits $108,630 highlights the high-stakes nature of leveraged trading. If the price of Bitcoin were to rise to this level, the whale’s position would be automatically closed, resulting in a significant loss. This adds an element of tension to the situation, as traders watch closely to see how the market will move.

The news of this massive short position has sparked discussion and debate within the cryptocurrency community. Some see it as a bold and strategic move, while others view it as a risky gamble that could backfire. Regardless of the outcome, it serves as a reminder of the unpredictable nature of the cryptocurrency market and the potential rewards and pitfalls that come with trading.

As traders and investors navigate the ups and downs of the cryptocurrency market, it is essential to stay informed and make well-informed decisions. Keeping up with the latest news and developments, such as the actions of hyperliquid whales, can help individuals stay ahead of the curve and adapt their strategies accordingly.

In conclusion, the return of the hyperliquid whale with a massive Bitcoin short position at 40x leverage is a significant development in the world of cryptocurrencies. It highlights the high-risk, high-reward nature of leveraged trading and the impact that large players can have on the market. Traders and investors should pay close attention to these developments and adjust their strategies accordingly to navigate the ever-changing landscape of cryptocurrencies.

Sources: