“Record Drop in Social Security Payments Sparks Outrage Among Seniors!”

Social Security decline impact, monthly benefit adjustments 2025, economic factors affecting Social Security

—————–

Social Security Sees Record Monthly Decline: An Overview

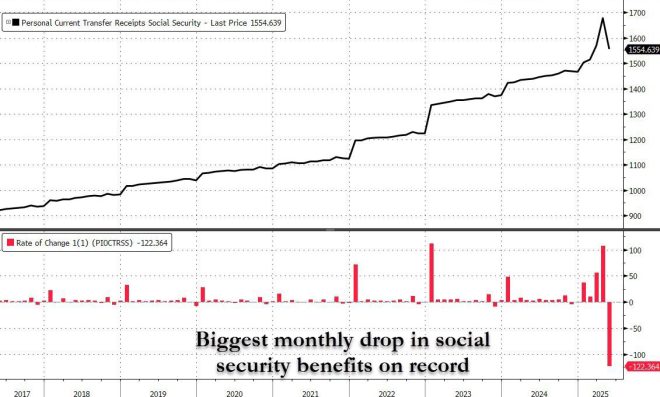

On June 28, 2025, a significant announcement regarding Social Security made headlines as social media influencer Benny Johnson highlighted a record monthly decline in the program. This decline raises critical questions about the future of Social Security and its impact on millions of Americans who rely on this vital financial support.

Understanding Social Security

Social Security is a federal program that provides retirement, disability, and survivor benefits to eligible individuals. Funded through payroll taxes, it plays an essential role in ensuring financial stability for retirees and those unable to work due to disabilities. As the population ages, the sustainability of Social Security has become a significant concern, which is further emphasized by the recent record decline reported.

The Implications of the Decline

The record monthly decline in Social Security benefits could have far-reaching implications. First and foremost, it raises concerns about the long-term viability of the program. With a growing number of beneficiaries and an aging population, the financial health of Social Security is at a critical juncture. A decline in benefits might lead to reduced financial security for retirees and disabled individuals, potentially increasing poverty rates among these vulnerable groups.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Moreover, this decline can also affect the broader economy. Social Security benefits contribute significantly to consumer spending, and any reduction could result in decreased economic activity. This is particularly concerning in times of economic uncertainty, where financial stability is paramount for many households.

Factors Contributing to the Decline

Several factors may contribute to the record decline in Social Security benefits. One significant factor is the increasing ratio of beneficiaries to workers contributing to the system. As the baby boomer generation continues to retire, there are fewer workers paying into the system, exacerbating the funding challenges.

Additionally, fluctuating economic conditions, such as inflation and changes in the job market, can impact the program’s financial stability. For instance, higher inflation rates can erode purchasing power, making it more challenging for beneficiaries to make ends meet.

Addressing the Challenges Ahead

In light of this decline, policymakers must consider various strategies to ensure the sustainability of Social Security. Potential solutions include adjusting the payroll tax rate, raising the retirement age, or modifying benefits to better reflect the current economic landscape. Engaging in open dialogue about the future of Social Security is crucial to finding a balanced approach that meets the needs of both current and future beneficiaries.

Conclusion

The recent record monthly decline in Social Security, as reported by Benny Johnson, serves as a wake-up call for policymakers and the public alike. As millions of Americans rely on this essential program for their financial well-being, addressing the challenges facing Social Security is more important than ever. With proactive measures and informed discussions, we can work towards a sustainable future for this critical social safety net, ensuring it continues to provide support to those in need for generations to come.

For more updates on Social Security and its implications for American families, follow trusted news sources and engage with community discussions on this pressing issue.

BREAKING: Social Security sees a record monthly decline. pic.twitter.com/MmxulXyOub

— Benny Johnson (@bennyjohnson) June 28, 2025

BREAKING: Social Security sees a record monthly decline.

Social Security is one of those programs that many of us take for granted, and for good reason. It’s been a staple of American life since its inception in the 1930s. However, recent reports indicate a significant shift in its stability, with a record monthly decline making headlines. This news has left many wondering about the implications for current and future beneficiaries. So, let’s dive into what this record monthly decline means and how it could affect millions of Americans.

Understanding Social Security

Before we unpack the recent decline, it’s essential to understand what Social Security is and how it works. Essentially, Social Security is a federal program that provides financial assistance to retirees, disabled individuals, and survivors of deceased workers. Funded through payroll taxes, it’s designed to be a safety net for those who’ve paid into the system throughout their working lives.

For many people, Social Security benefits are a critical source of income during retirement. In fact, according to the Social Security Administration (SSA), nearly 9 out of 10 individuals aged 65 and older receive Social Security benefits. With such dependence on this program, a decline in its reliability raises serious concerns.

The Details Behind the Decline

So, what exactly is causing this record monthly decline in Social Security? According to a [report by Benny Johnson](https://twitter.com/bennyjohnson/status/1938970675495989729?ref_src=twsrc%5Etfw), various factors contribute to this alarming trend, including economic shifts and demographic changes. As the baby boomer generation continues to retire, the ratio of workers contributing to the system compared to those drawing benefits is becoming increasingly imbalanced.

Moreover, inflation has been impacting the purchasing power of Social Security benefits. With rising costs for healthcare, housing, and everyday expenses, many beneficiaries find that their benefits no longer stretch as far as they once did. This has resulted in a troubling scenario where recipients are facing tougher financial conditions.

Impact on Current and Future Beneficiaries

The ramifications of this record monthly decline are significant. For current beneficiaries, it could mean a tighter budget with less financial security. Many older adults rely solely on Social Security for their income, and a decline in benefits can force them to make difficult choices, such as forgoing medical treatments or reducing essential living expenses.

Future beneficiaries, including younger generations, might face even more uncertainty. If the trend continues, there could be serious implications for the sustainability of the program. Some experts warn that without substantial reforms, future payouts could be significantly lower than what current workers expect to receive upon retirement.

What Does This Mean for Policy Reform?

Given the challenges facing Social Security, many policymakers are calling for urgent reforms. Discussions are ongoing about how to address the funding shortfall and ensure the program’s longevity. Some proposals include raising the retirement age, increasing payroll taxes, and adjusting the way benefits are calculated.

These changes often stir public debate, as they directly affect millions of Americans. Many people worry that increasing taxes or delaying benefits could place an even heavier burden on working families. However, others argue that without reform, the program could face insolvency, leading to even more drastic cuts in benefits.

Potential Solutions on the Table

While the situation seems dire, there are potential solutions that could help stabilize Social Security. For instance, some advocates suggest implementing a more progressive tax system where higher earners contribute more to the fund. Additionally, adjusting the benefit formula to better account for inflation could help ensure that benefits keep pace with rising costs.

Another idea gaining traction is the introduction of a “minimum benefit” for low-income retirees, ensuring that everyone receives a livable income in their golden years. These proposals would need broad bipartisan support to be implemented, but they could significantly improve the outlook for Social Security.

The Importance of Staying Informed

As we navigate these challenging times, staying informed about the state of Social Security is more important than ever. Whether you’re a current beneficiary or just starting your career, understanding how these changes might impact you can help you make better financial decisions.

Regularly checking resources like the [Social Security Administration](https://www.ssa.gov/) website can provide valuable insights into updates and changes to the program. Additionally, engaging with your elected officials can help ensure that your voice is heard in discussions about the future of Social Security.

Community Impact and Support

Beyond individual concerns, the record monthly decline of Social Security affects communities as a whole. Many local economies rely on the spending power of retirees and disabled individuals who receive Social Security benefits. When these benefits decline, it can lead to a ripple effect, impacting local businesses and services.

Community organizations and non-profits often step in to support those most affected by these changes. They provide resources, advocacy, and education to help individuals navigate financial challenges. If you or someone you know is struggling, seeking assistance from these organizations can be a lifeline.

Conclusion: What Lies Ahead?

The record monthly decline in Social Security signals a pivotal moment for the program and its beneficiaries. While there are challenges ahead, there’s also the potential for meaningful reform that could strengthen the program for future generations. By staying informed, advocating for necessary changes, and supporting one another, we can navigate these tumultuous waters together.

The future of Social Security is uncertain, but it’s a conversation that needs to continue. Whether you’re a retiree, a worker, or somewhere in between, understanding the implications of this decline is crucial. After all, Social Security is not just a program; it’s a foundational part of the American dream for millions. Let’s keep the dialogue going and advocate for a Social Security system that’s sustainable and fair for everyone.