“Florida Housing Crash Prediction: Why Experts Are Now Taking It Seriously!”

Florida real estate market trends, housing market crash predictions, property value decline analysis

—————–

The Florida Housing Market: A Potential 60% Crash

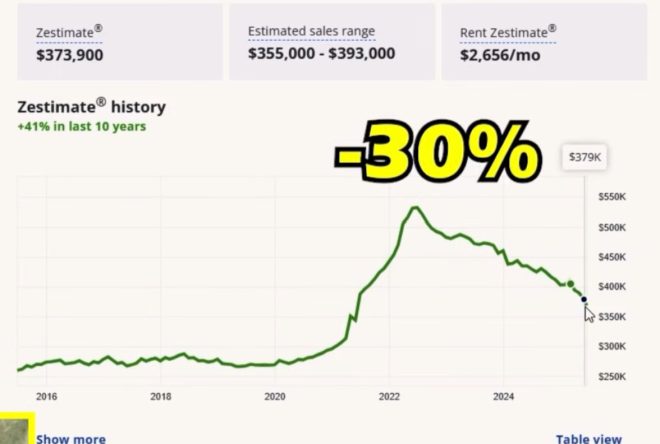

The Florida housing market has been a topic of heated discussion, especially following the bold predictions made by influential figures like Twitter user Darth Powell (@VladTheInflator). In a tweet that gained significant attention, he suggested that the Florida housing market might experience a staggering 60% crash. Initially met with skepticism and laughter, recent developments have led many to reconsider the implications of such a downturn.

Understanding the Florida Housing Market

Florida has long been a desirable destination for homebuyers, thanks to its warm climate, beautiful beaches, and vibrant lifestyle. However, the market has been characterized by rapid price increases and a surge in demand, raising concerns about sustainability. Many experts argue that the skyrocketing prices are not supported by fundamental economic indicators, such as income growth and job stability. As a result, the idea of a significant market correction is no longer just speculative; it is becoming a growing concern among economists and potential homebuyers alike.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Factors Contributing to the Housing Bubble

Several factors contribute to the potential for a housing crash in Florida. One of the most significant is the rise in interest rates, which directly impacts mortgage affordability. As borrowing costs increase, many potential homebuyers may be priced out of the market, leading to a decrease in demand. Additionally, the influx of new residents during the pandemic created a housing frenzy, but as remote work policies evolve and people reconsider their living situations, demand could diminish.

Moreover, Florida’s susceptibility to natural disasters, such as hurricanes, raises questions about long-term property values. Homeowners and investors alike must consider the risks associated with owning property in areas prone to extreme weather. As insurance costs rise and environmental concerns become more pronounced, the attractiveness of Florida real estate may wane.

The Impact of Economic Conditions

The broader economic landscape also plays a crucial role in the housing market’s stability. Signs of an impending recession, inflationary pressures, and changes in consumer spending habits all contribute to the uncertainty surrounding the housing market. If the economy takes a downturn, the housing market could be one of the first sectors to feel the impact, leading to a potential crash.

What Does This Mean for Homebuyers and Investors?

For potential homebuyers, the notion of a 60% crash in the Florida housing market may seem daunting. However, it also presents an opportunity for those looking to enter the market at a more favorable price point. Investors should carefully assess their strategies and consider the long-term implications of investing in a market that may be on the brink of a correction.

Conclusion

The warning of a potential 60% crash in the Florida housing market, once dismissed, is now a topic of serious discussion among experts and homebuyers alike. As economic conditions shift and market dynamics evolve, it is essential to remain informed and consider all factors before making real estate decisions. Whether you are a buyer, seller, or investor, understanding the intricacies of the Florida housing market will be key to navigating this uncertain landscape successfully.

People laughed when I said Florida housing might crash 60%.

They aren’t laughing anymore. pic.twitter.com/MI9RjashDm

— Darth Powell (@VladTheInflator) June 28, 2025

People laughed when I said Florida housing might crash 60%

When it comes to the real estate market, predictions can be a double-edged sword. Everyone has an opinion, but not all opinions are created equal. Recently, a tweet from Darth Powell sparked quite a discussion. He boldly stated, “People laughed when I said Florida housing might crash 60%. They aren’t laughing anymore.” This claim has left many scratching their heads and reconsidering their stance on Florida’s housing market.

Understanding the Florida Housing Market

Florida has long been a hotbed for real estate investment. With its beautiful beaches, warm weather, and no state income tax, it attracts people from all over the U.S. and beyond. However, the market dynamics can shift rapidly due to various factors, including economic conditions, interest rates, and demographic shifts. The question on everyone’s mind is whether Florida’s housing market is truly on the brink of a significant crash.

The Factors Behind the Potential Crash

Several elements could contribute to a potential crash in the Florida housing market. One of the most significant factors is the rising interest rates. As the Federal Reserve continues to increase rates to combat inflation, mortgage rates have surged. This spike can hamper affordability for potential homebuyers, leading to a decrease in demand.

Additionally, the influx of remote workers during the pandemic created a temporary surge in housing demand. As companies embrace hybrid or fully remote work models, some people are reconsidering their living situations. If remote work trends shift back to a more traditional office environment, Florida could see an exodus of new residents, further impacting demand.

Predicting the Future: Is a 60% Crash Possible?

While the thought of a 60% crash might seem extreme, it’s not entirely out of the realm of possibility. Historical data shows that real estate markets can experience dramatic fluctuations. For instance, during the 2008 financial crisis, many markets saw declines that exceeded 50%. If economic conditions worsen, we could see a similar scenario unfold in Florida.

Moreover, with the rising costs of living and inflation affecting many households, it stands to reason that buyers may pull back on purchases. As demand decreases, home prices may inevitably follow suit. Additionally, if developers continue to build at a rapid pace without sufficient demand, it could create an oversupply, which might exacerbate the situation further.

What Experts Are Saying

Real estate experts and analysts have mixed opinions on the future of Florida’s housing market. Some believe that while a crash may be possible, it won’t be as catastrophic as 60%. They argue that Florida’s population growth and economic resilience will help stabilize the market. On the other hand, there are those who echo the sentiments of Darth Powell, highlighting that the signs are there for a potential downturn.

Sources like National Association of Realtors frequently publish reports indicating shifts in buyer behavior and market conditions, making it essential for potential buyers and investors to stay informed.

How to Prepare for Market Changes

If you’re considering buying or selling in the Florida housing market, it’s crucial to stay ahead of the curve. Here are a few tips to navigate the uncertain waters:

- Stay Informed: Regularly check reliable sources for updates on interest rates, market trends, and economic indicators. Websites like Zillow provide current market insights.

- Consult Professionals: Engage with real estate experts who can offer personalized advice based on your specific situation.

- Evaluate Your Financial Health: If you’re looking to buy, ensure your finances are in order to withstand potential market fluctuations.

- Consider Timing: If you’re a seller, you might want to assess whether now is the right time to list your property before any drastic changes occur.

The Emotional Impact of a Housing Market Crash

Beyond the financial implications, there’s an emotional toll to consider. People don’t just invest money in homes; they invest dreams, lives, and futures. The idea of a significant housing market crash can evoke feelings of anxiety and uncertainty. It’s important to remember that while markets do fluctuate, they also recover over time. Staying grounded and making informed decisions can help mitigate stress during volatile times.

In Summary: Keeping an Eye on the Florida Market

As we navigate the complexities of the Florida housing market, it’s crucial to keep an eye on both macroeconomic trends and localized factors. The statement made by Darth Powell about a potential 60% crash may have been met with skepticism at first, but as the market evolves, it’s vital to remain open to various possibilities.

Whether you’re a homeowner, investor, or potential buyer, understanding the dynamics at play can empower you to make informed decisions. Keep the conversation going, stay engaged with experts and market trends, and remember that the housing market, like all markets, is subject to change.

“`

This article is structured to engage the reader while being optimized for search engines with relevant keywords throughout the text.