“Shocking Economic Collapse: Inflation Surges While Income Takes a Nosedive!”

inflation trends May 2025, economic downturn analysis, income reduction impact

—————–

Breaking news: Economic Indicators Signal Distress

In a shocking turn of events, recent economic reports have revealed distressing data regarding inflation, income, and GDP figures. This summary delves into the key findings from the report shared by Brian Krassenstein, which highlights significant challenges currently facing the economy.

Core Inflation Rate Surges to 2.7%

The core inflation rate, which excludes volatile food and energy prices, has risen to 2.7% in May. This figure is notably higher than economists had anticipated, raising concerns about the overall economic stability. Higher inflation rates can erode consumer purchasing power, leading to increased costs for everyday goods and services. This surge in inflation presents a challenge for policymakers who aim to maintain economic growth while keeping inflation in check.

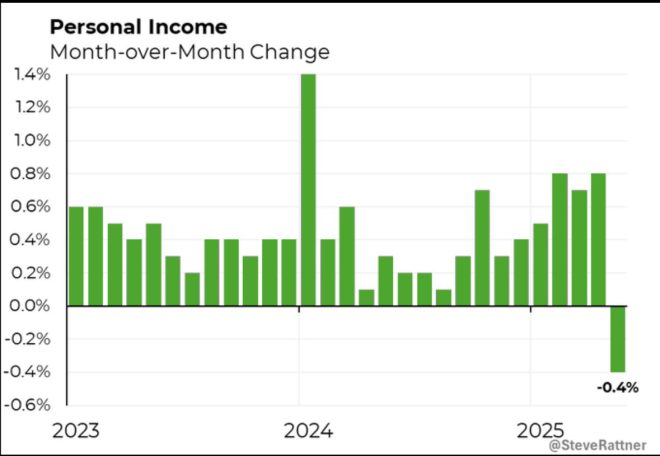

Income Declines by 0.4%

In addition to rising inflation, the report indicates a concerning decline in personal income, which has plunged by 0.4%. This drop in income can have cascading effects on consumer spending, which is a crucial driver of economic growth. When individuals earn less, their ability to spend on goods and services diminishes, potentially leading to decreased demand in the economy. This decline in income may also exacerbate financial stress for households, particularly for those already struggling to meet their expenses.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

GDP Contracts by 0.5%

Further compounding the bleak economic outlook is the reported contraction of the Gross Domestic Product (GDP) by 0.5%. A declining GDP is often viewed as a sign of an economy in recession, as it indicates a slowdown in economic activity. This contraction could raise alarms among policymakers and investors alike, prompting discussions about potential interventions to stimulate growth and stabilize the economy.

The Political Implications

The report’s findings have sparked intense political discourse, particularly concerning the state of the economy under previous administrations. Critics, including Krassenstein, have pointed to these economic indicators as evidence of a failing economic strategy, particularly during the trump administration. The narrative suggests that the policies implemented during this period have led to negative outcomes, prompting calls for accountability and reevaluation of economic strategies moving forward.

Industry Reactions

Reactions from various sectors of the economy have been swift. Business leaders and economists are voicing concerns about the implications of rising inflation and falling incomes on consumer behavior. Many industries, particularly those reliant on consumer spending, are likely to feel the pinch as households adjust their budgets in response to lower income levels and higher costs.

Future Outlook

Looking ahead, the economic landscape presents significant challenges. The combination of rising inflation, declining incomes, and contracting GDP could lead to a prolonged period of economic uncertainty. Economists and policymakers are faced with tough decisions regarding monetary policy and fiscal measures to mitigate these adverse effects.

Conclusion

The recent economic report paints a troubling picture of the current state of the economy, with rising core inflation, declining income, and a contracting GDP. These indicators suggest a need for immediate attention and action from policymakers to address the underlying issues affecting economic stability. As discussions unfold regarding the implications of these findings, it remains critical for stakeholders to engage in constructive dialogue aimed at fostering economic resilience and recovery.

In summary, the data released indicates a pressing need for a reassessment of economic policies and strategies. This moment calls for innovative solutions to combat inflation, support income growth, and stimulate GDP recovery, ensuring a more stable economic environment for the future.

Breaking: Horrendous Inflation and income report:

– Core inflation rate rose to 2.7% in May, more than expected

– Income plunged 0.4%

– GDP DOWN 0.5%.

Let’s hear the spin MAGA! Trump’s economy is an absolute disaster. pic.twitter.com/Orzme2eYhy

— Brian Krassenstein (@krassenstein) June 27, 2025

Breaking: Horrendous Inflation and Income Report

There’s been a lot of chatter lately about the state of the economy, and it’s not exactly good news. The recent report shows some alarming trends that could make anyone sit up and take notice. With the core inflation rate rising to 2.7% in May, income plunging by 0.4%, and GDP down by 0.5%, it’s clear that we’re facing some serious economic challenges. Let’s dig a little deeper into each of these factors and see what they mean for everyday Americans.

Core Inflation Rate Rose to 2.7% in May, More Than Expected

First off, let’s talk about that core inflation rate. A rise to 2.7% in May caught many economists off guard. You might be wondering, “What does this even mean for me?” Well, inflation affects the prices of goods and services, which means your dollar doesn’t stretch as far as it used to. Higher inflation usually signals that the cost of living is on the rise, which can be a real headache for families trying to make ends meet.

When inflation numbers go up, it often leads to discussions about interest rates and monetary policy. The Federal Reserve might have to make some tough decisions to combat this rise in inflation. According to [CNBC](https://www.cnbc.com), inflation rates like this can lead to increased costs in essential goods, such as food and gasoline, putting more strain on household budgets.

Income Plunged 0.4%

Next, we have the income report, which is equally troubling. A 0.4% drop in income means that, on average, people are earning less than they did before. This can have cascading effects throughout the economy. When people have less disposable income, they tend to cut back on spending, which can hurt local businesses and lead to even more job losses.

Imagine being at the grocery store and noticing that your paycheck just doesn’t cover your usual shopping list. This is the reality for many Americans right now. The drop in income can be attributed to various factors, including job losses and stagnant wages. As reported by [MarketWatch](https://www.marketwatch.com), when people earn less, it leads to a cycle of reduced spending and further economic decline.

GDP DOWN 0.5%

Now, let’s discuss the GDP, or Gross Domestic Product, which is a measure of all goods and services produced in a country. A decline of 0.5% is indicative of an economy that’s contracting. This is concerning because GDP growth is often viewed as a sign of economic health. When GDP falls, it usually means businesses are struggling, investments are declining, and the overall economic outlook is dim.

The implications of a downturn in GDP can ripple through various sectors. For instance, companies may start laying off workers, which can exacerbate the income drop we just discussed. It’s a vicious cycle that’s hard to break out of. According to [The Wall Street Journal](https://www.wsj.com), a declining GDP could prompt policymakers to intervene, but it raises the question of whether those interventions will be effective.

Let’s Hear the Spin MAGA!

With all this bad news, it’s natural to wonder how different political factions will respond. The phrase “Let’s hear the spin MAGA!” reflects the skepticism that many feel about the narratives being pushed by political leaders. Supporters of the former president might argue that these economic challenges are a result of external factors, like global supply chain issues or the lingering effects of the pandemic.

However, it’s hard to ignore the fact that these issues are happening on the watch of the current administration. Critics argue that claiming “Trump’s economy is an absolute disaster” is not merely political rhetoric but a reflection of real economic struggles faced by ordinary Americans today. This divide in perception can often lead to heated debates about policies and their effectiveness.

The Broader Economic Landscape

When we take a step back and look at the broader economic landscape, it’s clear that these numbers don’t exist in a vacuum. The pandemic has left a lasting impact on the economy, and many businesses are still trying to recover. The labor market is also in a state of flux, with many workers reassessing their job situations, leading to what some have called the “Great Resignation.”

Moreover, as inflation rises, the purchasing power of consumers diminishes, forcing everyone to rethink their budgets. According to [Forbes](https://www.forbes.com), the combination of rising costs and decreasing income creates a tough environment for many families.

What’s Next for the Economy?

So, what does the future hold? It’s tough to say for sure. The government and policymakers are likely to respond to these troubling economic indicators. There may be discussions around fiscal stimulus or changes in monetary policy to combat rising inflation.

However, the effectiveness of these measures can vary, and many people remain skeptical. The ongoing economic challenges highlight the need for thoughtful and proactive measures that focus on sustainable growth and support for those hardest hit.

In the end, keeping an eye on these economic indicators is crucial for understanding where we’re headed. Whether you’re a business owner, a worker in the gig economy, or a family trying to make ends meet, the state of the economy affects us all.

In Conclusion

While the current economic report paints a grim picture, it’s essential to stay informed and engaged. Understanding these dynamics can help us all make better decisions, whether in our personal finances or in the voting booth. The conversation surrounding these issues is vital, and it’s up to us to ensure that we’re advocating for policies that truly support the American people.

The numbers are alarming: core inflation at 2.7%, income down 0.4%, and GDP falling by 0.5%. If these trends continue, we might be in for a rocky ride ahead. So, let’s keep the conversation going and demand accountability and action from our leaders. After all, the economy affects us all.