“Radical Tax Shift? NYC’s Socialist Muslim Candidate Sparks Fierce Debate!”

socialist mayoral candidate NYC, tax redistribution policy 2025, racial equity in urban planning

—————–

Breaking news: NYC Socialist Muslim Mayoral Candidate’s Controversial Tax Plan

In a recent bombshell revelation, Zohran Mamdani, a socialist Muslim candidate for mayor in New York City, has resurfaced with a controversial proposal that has ignited a firestorm of debate. The proposal advocates for a radical shift in the city’s tax structure, suggesting a redistribution of the tax burden from lower-income communities to wealthier, predominantly white neighborhoods. This plan has raised eyebrows and sparked intense discussions about race, wealth, and the role of government in economic redistribution.

Who is Zohran Mamdani?

Zohran Mamdani is a political figure representing the Democratic Socialists of America (DSA). He has gained significant attention for his progressive platform and advocacy for social justice, housing equity, and economic reform. Mamdani’s background as a socialist Muslim has positioned him uniquely in the political landscape of New York City, where issues of race and socioeconomic disparity are prevalent.

The Controversial Tax Proposal

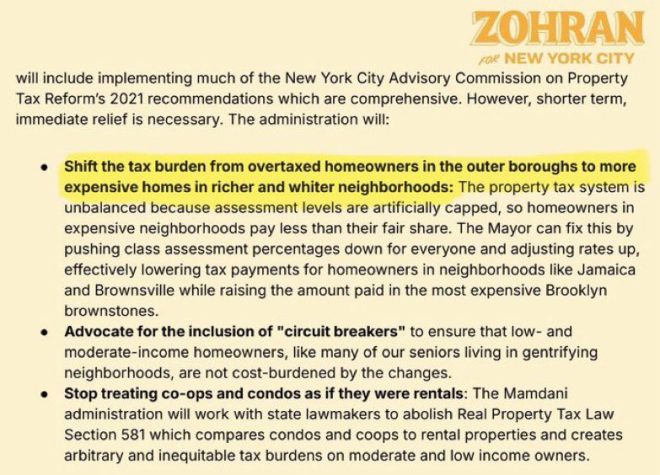

Mamdani’s controversial tax proposal aims to address systemic inequities in wealth distribution across the city. His plan suggests that wealthier neighborhoods, which are often predominantly white, should contribute more to the city’s coffers to support underfunded areas that have historically suffered from disinvestment. Mamdani argues that this redistribution is necessary to create a more equitable society where all residents have access to quality education, healthcare, and housing.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

This radical approach has sparked significant backlash from various groups, particularly those who view it as a form of reverse discrimination or an unfair burden on affluent communities. Critics argue that such a scheme could lead to further division and resentment among residents of different socioeconomic backgrounds.

The Racial Redistribution Debate

The heart of the controversy lies in the racial implications of Mamdani’s tax plan. By explicitly linking tax burdens to racial demographics, Mamdani has opened a Pandora’s box of discussions around race, privilege, and economic justice. Supporters of the plan argue that it acknowledges and seeks to rectify historical injustices faced by marginalized communities, while opponents contend that it perpetuates a cycle of division and does not address the root causes of poverty.

This debate is particularly relevant in a city like New York, where the wealth gap between affluent neighborhoods and low-income areas is stark. Proponents of Mamdani’s plan believe that addressing this gap through targeted taxation could lead to significant improvements in education and services for those most in need.

Community Reactions

Reactions to Mamdani’s proposal have been mixed, reflecting the city’s diverse political landscape. Some community leaders and activists have rallied behind the plan, viewing it as a necessary step towards achieving racial and economic equity. They argue that shifting the tax burden could fund essential services in underserved neighborhoods, ultimately benefiting the entire city.

Conversely, numerous residents from wealthier areas have expressed outrage, claiming that the plan unfairly targets them and undermines their contributions to the city. This divide has led to heated discussions at town hall meetings and on social media, with many residents voicing their concerns about the implications of such a plan.

The Political Landscape

Mamdani’s proposal comes at a time when New Yorkers are increasingly concerned about economic inequality and the effectiveness of government in addressing these issues. With the upcoming mayoral election, candidates are under pressure to present actionable solutions that resonate with voters across the spectrum. Mamdani’s radical approach may appeal to progressive voters who are seeking bold changes, but it could also alienate moderate constituents who prefer more centrist policies.

The political ramifications of this proposal could be significant. If Mamdani gains traction in the mayoral race, it could signal a shift towards more progressive policies in New York City, potentially influencing other cities across the nation. Conversely, if the backlash against his proposal grows, it could serve as a cautionary tale for other candidates considering similar radical changes.

Implications for Future Policies

Regardless of the outcome of Mamdani’s campaign, the discussions surrounding his tax proposal are likely to shape future policies in New York City and beyond. The conversation about racial equity and economic justice is crucial in today’s political climate, and candidates will need to address these issues thoughtfully to resonate with an increasingly diverse electorate.

As cities grapple with the challenges of inequality, housing crises, and systemic racism, the ideas put forth by candidates like Mamdani may inspire new approaches to governance. The debate over his plan will likely continue, prompting policymakers to consider innovative solutions that address both economic disparity and social justice.

Conclusion

Zohran Mamdani’s controversial tax proposal has sparked a vital conversation about race, wealth, and the role of government in addressing systemic inequities. While opinions on the plan are deeply divided, it highlights the urgent need for dialogue around these critical issues in New York City. As the mayoral race heats up, candidates will need to navigate these complex discussions, balancing the aspirations for social equity with the realities of governance. The outcome of this debate will undoubtedly influence the future of New York City and its approach to economic justice in the years to come.

BREAKING: Bombshell Resurfaces — NYC Socialist Muslim Mayoral Candidate Zohran Mamdani Pushed Plan to Shift Taxes to “Richer and WHITER Neighborhoods” in Radical Racial Redistribution Scheme! pic.twitter.com/BSuno4Q4Zy

— I Meme Therefore I Am (@ImMeme0) June 27, 2025

BREAKING: Bombshell Resurfaces — NYC Socialist Muslim Mayoral Candidate Zohran Mamdani Pushed Plan to Shift Taxes to “Richer and WHITER Neighborhoods” in Radical Racial Redistribution Scheme!

The political landscape in New York City has always been vibrant, with candidates often proposing bold ideas to tackle the city’s ongoing issues. Recently, a shocking resurfacing of a past proposal from Zohran Mamdani, a socialist and Muslim mayoral candidate, has stirred significant debate. This proposal aimed to redistribute tax burdens from poorer neighborhoods to “richer and whiter neighborhoods,” a move that some are calling an audacious attempt at racial and economic justice while others view it as a radical overreach.

Understanding the Proposal

Mamdani’s plan, which has come back into the spotlight, suggests reallocating tax resources to address the systemic inequalities that have plagued New York City for decades. This proposal is rooted in the belief that wealthier neighborhoods, often predominantly white, should bear a greater share of the tax burden to support less affluent areas, which are frequently home to communities of color. It raises critical questions about fairness, equity, and the role of government in addressing historical injustices.

By advocating for this shift, Mamdani intends to challenge the status quo and push for a more equitable distribution of resources. His supporters argue that this approach could lead to improved public services, better schools, and enhanced community resources in historically marginalized areas. On the flip side, critics view this as a divisive tactic that could exacerbate tensions between different racial and economic groups.

Reactions from the Public

The public reaction to Mamdani’s proposal has been mixed. While some hail it as a bold step towards equity, others express concerns over the potential repercussions of such a radical approach. The idea of targeting wealthier neighborhoods for tax increases has sparked debates about class warfare, economic viability, and the practical implications of implementing such a policy.

Many residents in wealthier neighborhoods feel that they already contribute significantly to the city’s tax base and are wary of further financial obligations. They argue that such a redistribution scheme could lead to resentment and division among communities, further complicating the already intricate dynamics of New York City’s diverse population.

Historical Context

To fully grasp the implications of Mamdani’s proposal, it’s essential to understand the historical context of wealth and racial disparities in New York City. The city’s history is marked by systemic racism, redlining, and economic inequality, which have disproportionately affected communities of color. By attempting to address these injustices, Mamdani’s plan seeks to acknowledge and rectify past wrongs.

However, the challenge lies in crafting a policy that is both effective and politically feasible. Previous attempts at similar redistributive policies have often faced significant pushback, leading to questions about their practicality and long-term sustainability. This historical backdrop adds complexity to the current debate, as many are concerned about the potential ramifications of such a transformative approach.

The Broader Implications of Tax Redistribution

Mamdani’s proposal is not just about tax policy; it speaks to broader themes of social justice, equity, and community empowerment. Advocates for the plan argue that shifting the tax burden could lead to improved infrastructure, better healthcare access, and enhanced educational opportunities for those in need. These changes could ultimately benefit the city as a whole by fostering a more inclusive and equitable society.

On the other hand, opponents warn that such redistribution might lead to a decline in investment in wealthier neighborhoods, potentially harming property values and leading to economic downturns. The concern is that a backlash against the proposal could result in a political environment that is even more polarized, making it difficult to enact any meaningful reforms.

The Role of Social Media in Shaping the Narrative

Social media has played a significant role in amplifying the discussions surrounding Mamdani’s proposal. Platforms like Twitter have become hotbeds for debate, allowing individuals to express their opinions, share articles, and engage in discussions about the implications of this radical plan. In fact, the tweet that resurfaced this proposal has gone viral, highlighting the power of social media in shaping public discourse.

The rapid spread of information, both supportive and critical of Mamdani’s plan, illustrates the challenges candidates face in communicating their ideas effectively. In a digital age where opinions can be formed and expressed in seconds, the narrative around policies can shift dramatically, impacting public perception and political momentum.

Potential Outcomes of the Proposal

If Mamdani’s proposal were to gain traction, several potential outcomes could arise. On one hand, successful implementation could lead to a significant reduction in inequality and improved living conditions for marginalized communities. This could serve as a model for other cities grappling with similar issues, potentially sparking a nationwide conversation about tax reform and social equity.

Conversely, if the proposal fails to gain support or faces significant backlash, it could hinder Mamdani’s political career and diminish the broader movement for progressive policies in New York City. The polarized nature of the current political climate suggests that any attempt at radical change will encounter fierce resistance, making it crucial for advocates to build coalitions and engage in constructive dialogue with critics.

Engaging with the Community

For Mamdani’s proposal to succeed, it will be essential for him to engage with the communities most affected by his plans. Listening to the concerns and ideas of residents from both wealthier and poorer neighborhoods is vital for crafting a policy that resonates with the public. Building bridges between communities can foster understanding and collaboration, ultimately leading to more effective solutions.

By focusing on dialogue and inclusivity, Mamdani can work toward a vision of New York City that prioritizes equity and justice for all its residents. This engagement will not only strengthen his position as a candidate but also enhance the legitimacy of his proposed policies.

Conclusion

The resurfacing of Zohran Mamdani’s proposal to shift taxes from poorer neighborhoods to wealthier ones has ignited a passionate debate about equity, justice, and the role of government in addressing systemic inequalities. As New Yorkers grapple with the implications of this radical plan, the conversations sparked by this proposal could shape the future of the city’s political landscape.

Ultimately, the discussions around Mamdani’s plan reflect a broader struggle for social justice in America. As candidates like Mamdani push for transformative change, it will be crucial for them to navigate the complexities of public opinion and build coalitions that transcend traditional divides. The outcome of this debate will undoubtedly have lasting implications for New York City and beyond.