“Controversial Proposal: NYC Mayoral Candidate Targets ‘Whiter Neighborhoods’ for Tax Shift!”

New York City tax reform, racial equity in urban policy, mayoral candidates 2025

—————–

Proposal to Shift Tax Burdens in NYC: A Controversial Perspective

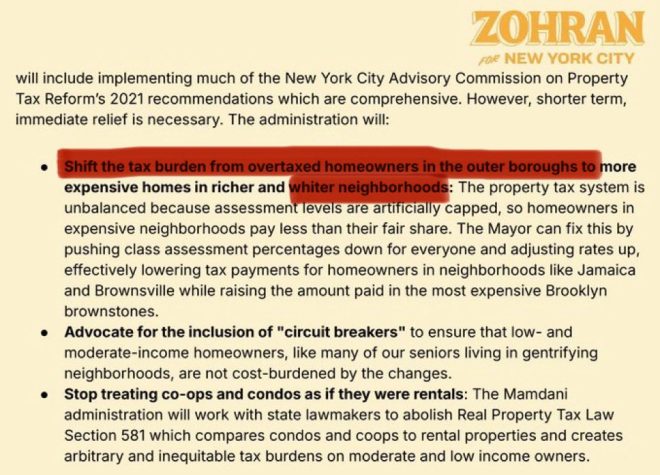

In a recent development that has sparked considerable debate, Zohran Mamdani, a democrat mayoral candidate in New York City, has put forth a provocative proposal aimed at redefining tax burdens within the city. This proposal suggests shifting tax responsibilities more heavily onto wealthier, predominantly white neighborhoods, as a means to address systemic inequalities and fund essential services in less affluent areas. The resurgence of this idea has ignited discussions about race, equity, and fiscal policy in one of the nation’s most diverse cities.

Understanding the Proposal

Mamdani’s proposal aims to recalibrate the distribution of tax burdens in New York City by advocating for a model that more equitably aligns financial responsibilities with community needs. He argues that wealthier neighborhoods, often characterized by higher property values and greater financial resources, should contribute a larger share of taxes to support public services in underfunded areas. This approach is rooted in the belief that the city’s tax system should reflect the socio-economic disparities that exist across different neighborhoods.

The Rationale Behind the Shift

The rationale for shifting tax burdens to wealthier neighborhoods is multifaceted. Proponents of the proposal, including Mamdani, contend that it is essential to address the historical and systemic inequalities that have marginalized certain communities. By reallocating financial resources, the goal is to ensure that all residents, regardless of their socio-economic status, have access to quality education, healthcare, and public safety services.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Moreover, Mamdani’s proposal underscores the need for a more progressive tax system that recognizes the disparities in wealth and resources across different demographics. Advocates believe that such an approach could lead to improved outcomes for residents in lower-income neighborhoods, ultimately fostering a more equitable society.

Public Reaction and Controversy

As expected, the proposal has elicited a wide array of reactions from the public and political commentators. Supporters argue that shifting tax burdens is a necessary step toward achieving social justice and equity in New York City. They emphasize the importance of investing in communities that have been historically underserved and underfunded.

Conversely, critics of Mamdani’s proposal express concern that it could exacerbate tensions between different neighborhoods and communities. Some opponents argue that the approach may be divisive, fostering resentment among residents of wealthier areas who may feel unfairly targeted. Additionally, there are concerns about the potential economic implications of such a policy, including the risk of displacing wealthier residents and businesses from the city.

Broader Implications for NYC

The implications of Mamdani’s proposal extend beyond just tax policy; they touch upon broader social and economic issues facing New York City. As the city grapples with challenges related to income inequality, housing affordability, and access to quality education and healthcare, proposals like this one spark critical conversations about how to create a more just and equitable society.

The ongoing discussions surrounding this proposal also highlight the importance of community engagement and dialogue in the policymaking process. As New York City continues to evolve, it is crucial for residents to participate in shaping the policies that impact their lives and communities.

The Role of Social Justice in Taxation

Mamdani’s proposal raises fundamental questions about the role of social justice in taxation. Advocates for a more equitable tax system argue that taxation should not only serve as a means of generating revenue but also as a tool for addressing social disparities. By prioritizing equity in tax policy, cities can work toward reducing income inequality and fostering a sense of community among residents.

In this context, the debate surrounding Mamdani’s proposal serves as a microcosm of larger societal discussions about race, privilege, and responsibility. As more individuals and communities advocate for social justice, the need for thoughtful and inclusive policies becomes increasingly apparent.

Conclusion: The Future of Taxation in New York City

As New York City continues to navigate its complex socio-economic landscape, proposals like Zohran Mamdani’s offer a glimpse into the future of taxation and public policy. While the idea of shifting tax burdens to wealthier neighborhoods may be polarizing, it also reflects a growing recognition of the need for systemic change.

In the pursuit of a more equitable society, it is essential for policymakers, community leaders, and residents to engage in open dialogues that consider diverse perspectives and experiences. By fostering collaboration and understanding, New York City can work toward creating a tax system that not only generates revenue but also promotes social justice and equity for all its residents.

As the debate unfolds, it will be crucial for all stakeholders to remain informed and engaged, ensuring that the voices of both wealthy and marginalized communities are heard in the pursuit of a fairer and more just society. The future of taxation in New York City may very well depend on the ability to balance the interests of diverse communities while prioritizing the overarching goal of equity and social justice.

BREAKING – A proposal by NYC Democrat mayoral candidate Zohran Mamdani to shift tax burdens to “Whiter neighborhoods” has resurfaced. pic.twitter.com/UUcDluxI4A

— Right Angle news Network (@Rightanglenews) June 27, 2025

BREAKING – A proposal by NYC Democrat mayoral candidate Zohran Mamdani to shift tax burdens to “Whiter neighborhoods” has resurfaced.

In the dynamic landscape of New York City politics, proposals that seek to address systemic issues often generate intense discussions. One recent topic that has taken center stage is the controversial proposal by Democrat mayoral candidate Zohran Mamdani. His plan aims to shift tax burdens to “Whiter neighborhoods,” a phrase that has sparked debate across the city. This proposal not only sheds light on economic disparities but also highlights the ongoing conversation around race and equity in urban environments.

Understanding the Proposal

Zohran Mamdani, a candidate who has been vocal about social justice issues, is advocating for a restructuring of the tax system in New York City. By proposing to transfer some of the tax burdens to wealthier, predominantly white neighborhoods, Mamdani is calling attention to the inequities in how tax revenues are currently distributed. He argues that this shift could provide much-needed resources to underfunded communities of color, thereby addressing long-standing inequalities.

This proposal is more than just a fiscal strategy; it’s a reflection of the broader socio-economic challenges facing many urban areas. The intention behind this move is to ensure that neighborhoods with greater financial resources contribute more significantly to the welfare of those that are marginalized.

The Rationale Behind the Proposal

Mamdani’s rationale is rooted in the belief that tax policies should promote equity rather than reinforce existing disparities. In many urban settings, wealthier neighborhoods tend to have better access to resources, excellent schools, and infrastructure. Conversely, communities of color often face systemic barriers that hinder their growth and development.

By shifting tax burdens, Mamdani aims to create a more balanced distribution of resources. This approach seeks to fund essential services like education, healthcare, and public safety in areas that have historically been neglected. The hope is that by investing in these communities, the city can foster a more equitable environment for all its residents.

The Response to the Proposal

As expected, the proposal has elicited a wide range of reactions from both supporters and critics. Advocates of the plan argue that it’s a bold step towards rectifying historical injustices and promoting social equity. They believe that a fair tax system is essential for building a more inclusive society where everyone has access to opportunities.

On the other hand, critics express concerns about the feasibility and potential backlash of such a proposal. Some worry that shifting tax burdens could lead to resentment among residents of wealthier neighborhoods, potentially exacerbating divisions rather than healing them. The conversation surrounding this proposal is a microcosm of the larger national dialogue about race, class, and social justice.

Historical Context of Taxation in NYC

To truly understand the implications of Mamdani’s proposal, it’s essential to consider the historical context of taxation in New York City. The city has long been a melting pot of cultures and communities, but it has also grappled with deep-seated inequalities. Over the decades, the taxation system has often favored wealthier neighborhoods, leaving low-income areas struggling to meet basic needs.

For instance, property taxes and funding for public education have historically been tied to local wealth, creating a cycle where affluent neighborhoods thrive while poorer areas lag behind. This systemic issue has prompted various movements and discussions aimed at reforming the tax system, and Mamdani’s proposal is a continuation of that legacy.

Implications for New Yorkers

The potential implications of this proposal are significant for New Yorkers across the board. If implemented, it could lead to an influx of funding for schools, healthcare, and public services in areas that desperately need it. This could help bridge the gap between affluent and underprivileged neighborhoods, fostering a more equitable society.

However, the proposal also raises questions about the practicality of such a shift. How would residents of wealthier neighborhoods respond to increased tax burdens? Would it lead to gentrification or displacement in the areas that receive increased funding? These are complex questions that require careful consideration from policymakers and community leaders.

Engaging in the Conversation

It’s crucial for New Yorkers to engage in the conversation surrounding Mamdani’s proposal. Discussions about taxation and equity are not just political; they affect the daily lives of residents throughout the city. Whether you support the idea or have reservations, voicing your opinions can contribute to a more informed and constructive dialogue.

Community forums, social media platforms, and local news outlets are all avenues for residents to express their thoughts and concerns. By participating in these discussions, you can help shape the future of your city and advocate for policies that reflect your values and priorities.

Looking Ahead

As the political landscape continues to evolve, proposals like Mamdani’s will remain at the forefront of discussions about equity and justice in New York City. The outcome of this proposal could set a precedent for how cities across the nation approach issues of taxation and social equity.

Ultimately, the focus should be on creating a system that benefits all residents, regardless of their socio-economic status. By addressing the root causes of inequality, cities can work towards a more just and equitable future for everyone.

In summary, Zohran Mamdani’s proposal to shift tax burdens to “Whiter neighborhoods” may be controversial, but it opens up important dialogues about race, equity, and community investment. As New Yorkers navigate these discussions, it’s vital to consider the implications for all residents and strive for solutions that promote fairness and opportunity across the board.