“Top Asset Manager Ric Edelman Urges Advisors: Go 40% Crypto or Risk Failure!”

cryptocurrency investment strategies, Bitcoin portfolio diversification, financial advisor insights 2025

—————–

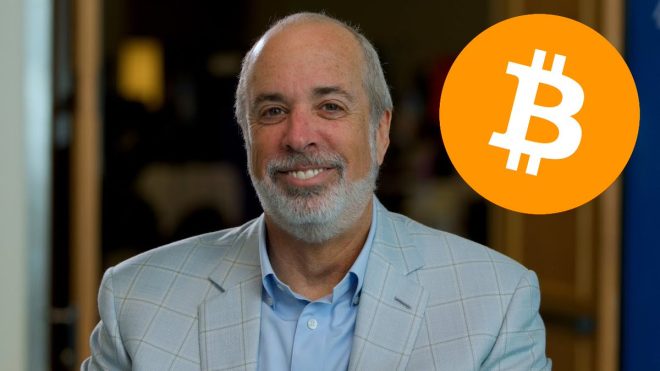

Ric Edelman Advocates for Significant Bitcoin Investment

In a groundbreaking statement on CNBC, Ric Edelman, the founder of a $290 billion asset management firm, made waves in the financial world by advocating for substantial investments in Bitcoin and cryptocurrency. Edelman suggested that financial advisors should consider recommending allocations of up to 40% in these digital assets. This bold stance is a significant endorsement for cryptocurrencies, particularly Bitcoin, which has been gaining traction as a legitimate financial asset.

Understanding Ric Edelman’s Position

Ric Edelman is a well-respected figure in the financial advisory sector, known for his insights and expertise in investment strategies. His recommendation for a 40% allocation to Bitcoin reflects a growing belief among financial experts that cryptocurrencies are not just a passing trend but a vital component of a diversified investment portfolio. Edelman’s comments highlight the increasing acceptance of Bitcoin as a mainstream investment option.

The Case for Bitcoin

Edelman’s endorsement comes at a time when Bitcoin and other cryptocurrencies continue to gain popularity among both institutional and retail investors. Here are several key reasons why Edelman and other experts believe in the potential of Bitcoin:

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

- Hedge Against Inflation: With rising inflation rates, many investors view Bitcoin as a hedge against traditional economic uncertainties. Unlike fiat currencies, Bitcoin has a capped supply, which contributes to its appeal as a store of value.

- Growing Institutional Adoption: Major financial institutions and corporations have begun to integrate Bitcoin into their portfolios. This trend suggests that Bitcoin is becoming increasingly recognized as a legitimate asset class.

- Technological Advancements: The underlying blockchain technology that supports Bitcoin is continuously evolving, which enhances its security and usability. Innovations in this space can lead to increased adoption and utility.

- Global Accessibility: Bitcoin provides an opportunity for people around the world to access financial systems, especially in regions where traditional banking is limited. This global reach is a significant factor in its growing popularity.

What a 40% Allocation Means

Allocating 40% of an investment portfolio to Bitcoin is a significant move that signals confidence in the cryptocurrency’s long-term viability. For investors, this means they would be placing a considerable portion of their capital into a highly volatile asset. Here are some considerations for such an allocation:

- Risk Management: While Bitcoin can offer substantial returns, it also comes with high volatility. Investors should carefully assess their risk tolerance and consider balancing their portfolios with more stable assets.

- Diversification: A 40% allocation to Bitcoin should be part of a broader diversification strategy. Investors should consider other asset classes, such as stocks, bonds, and real estate, to mitigate risks associated with cryptocurrency investments.

- Long-Term Perspective: Bitcoin has historically shown significant price fluctuations. Investors should adopt a long-term perspective to ride out market volatility and capitalize on potential growth.

The Future of Bitcoin and Crypto Investments

Edelman’s statements reflect a broader trend in the financial community, where more advisors are beginning to recognize the importance of including cryptocurrencies in investment strategies. As Bitcoin and other digital currencies continue to mature, their integration into traditional investment portfolios is likely to become more commonplace.

- Regulatory Landscape: The evolving regulatory environment surrounding cryptocurrencies is crucial. Clear regulations can enhance investor confidence and facilitate wider adoption.

- Market Trends: Watching market trends and technological advancements in the blockchain space will be essential for investors considering Bitcoin. Keeping an eye on developments in decentralized finance (DeFi) and non-fungible tokens (NFTs) can also provide insights into future opportunities.

- Education and Awareness: As more financial advisors like Edelman advocate for Bitcoin investments, there will likely be a growing emphasis on education and awareness. Investors will need to understand the intricacies of cryptocurrencies to make informed decisions.

Conclusion

Ric Edelman’s bold recommendation for financial advisors to allocate up to 40% of investment portfolios to Bitcoin and cryptocurrency marks a pivotal moment in the acceptance of digital assets in the financial landscape. With Bitcoin being viewed increasingly as a critical component of a diversified investment strategy, investors are encouraged to research thoroughly and consider their risk tolerance. As the cryptocurrency market continues to evolve, keeping informed and adaptable will be key for both individual and institutional investors aiming to navigate this dynamic environment successfully.

This endorsement from a prominent financial figure reinforces the idea that Bitcoin is not just a speculative asset but a genuine investment opportunity that could shape the future of finance. As more advisors and investors recognize the potential of cryptocurrencies, we may witness a significant shift in how wealth is managed and allocated in the coming years.

JUST IN: $290 billion asset manager founder Ric Edelman told CNBC financial advisors should be recommending up to 40% allocations to Bitcoin & crypto pic.twitter.com/0ZSa1toivB

— Bitcoin Magazine (@BitcoinMagazine) June 27, 2025

JUST IN: $290 billion asset manager founder Ric Edelman told CNBC financial advisors should be recommending up to 40% allocations to Bitcoin & crypto

The world of finance is buzzing, and it’s about to get even more exciting with the recent statements made by Ric Edelman, the founder of a $290 billion asset management firm. In an interview with CNBC, Edelman emphasized that financial advisors should consider recommending up to a staggering 40% allocation of their clients’ portfolios to Bitcoin and other cryptocurrencies. This bold statement has raised eyebrows and sparked discussions among investors, financial advisors, and crypto enthusiasts alike. Let’s dive deeper into what this means for the financial landscape and why it’s time to pay attention to crypto investments.

Understanding Ric Edelman’s Perspective

Ric Edelman is a well-respected figure in the finance community, known for his forward-thinking approach to investment. His firm, Edelman Financial Engines, has been a leader in asset management for years, and his endorsement of significant crypto allocations signals a pivotal shift in investment strategies. Edelman believes that with the rapid evolution of digital currencies, particularly Bitcoin, traditional asset allocation models may need to be re-evaluated.

In the CNBC interview, Edelman pointed out that Bitcoin and other cryptocurrencies have proven their resilience and potential for growth. He noted that many institutional investors are already integrating crypto into their portfolios, and individual investors should consider doing the same. This perspective challenges the conventional wisdom that has historically viewed cryptocurrencies as speculative investments rather than serious assets.

Why 40% Allocation to Bitcoin and Crypto?

So, why exactly is Ric Edelman suggesting such a hefty allocation to Bitcoin and crypto? The rationale rests on several key factors:

1. **Market Maturity**: Over the past few years, the cryptocurrency market has matured significantly. Bitcoin, in particular, has established itself as a store of value akin to gold, often referred to as “digital gold.”

2. **Inflation Hedge**: With rising inflation rates and economic uncertainties, many investors are looking for assets that can withstand inflation. Cryptocurrencies, especially Bitcoin, have a finite supply, making them an attractive alternative for those seeking to protect their wealth.

3. **Increased Adoption**: The adoption of cryptocurrencies by major companies and financial institutions has been on the rise. From Tesla accepting Bitcoin for vehicle purchases to institutional investments from firms like MicroStrategy, the legitimacy of cryptocurrencies is becoming more widely recognized.

4. **Diversification**: A well-balanced portfolio should include a variety of assets to mitigate risk. By allocating a portion of investments to Bitcoin and crypto, investors can diversify their holdings and potentially enhance returns.

5. **Technological Advancements**: The underlying technology of cryptocurrencies, blockchain, continues to evolve and improve. Innovations such as decentralized finance (DeFi) and non-fungible tokens (NFTs) are expanding the use cases for cryptocurrencies, making them more appealing to a broader audience.

Advice for Financial Advisors

For financial advisors, Edelman’s advice presents both an opportunity and a challenge. Advisors must educate themselves about cryptocurrencies to effectively guide their clients. This involves understanding the risks and rewards associated with crypto investments, as well as staying updated on regulatory changes and market trends.

Edelman advocates for financial advisors to take a proactive approach in discussing crypto with their clients. Many investors may be hesitant to explore cryptocurrencies due to the volatility and uncertainty surrounding them. Advisors can play a crucial role in demystifying these assets and providing insights into their potential benefits.

Addressing the Risks

While there are compelling reasons to consider a significant allocation to Bitcoin and crypto, it’s essential to acknowledge the risks involved. Cryptocurrencies are known for their price volatility, and substantial fluctuations can occur within short periods. Investors should be prepared for the possibility of losing a portion of their investment.

Furthermore, the regulatory landscape surrounding cryptocurrencies is still evolving. Changes in government policies or regulations can impact the market dynamics significantly. Advisors and investors must stay informed about these developments to make educated decisions.

Real-World Implications of Crypto Adoption

The implications of increased crypto allocation extend beyond individual portfolios. If financial advisors begin recommending substantial investments in Bitcoin and other cryptocurrencies, we could witness a significant shift in market dynamics.

Increased demand for cryptocurrencies could lead to further price appreciation, attracting more investors into the space. This influx of capital could stimulate innovation within the industry, encouraging the development of new technologies and applications.

Moreover, as more individuals and institutions embrace cryptocurrencies, the narrative around digital assets will continue to evolve. Crypto may shift from being viewed as a speculative investment to a more accepted and integral part of the financial system.

The Future of Bitcoin and Crypto Investments

As we look ahead, the future of Bitcoin and cryptocurrencies appears promising. With influential figures like Ric Edelman advocating for crypto adoption, the conversation around digital assets is gaining traction.

For those considering allocating a portion of their portfolios to Bitcoin and crypto, it’s wise to start small and gradually increase exposure as they become more comfortable with the asset class. Diversification remains key, and investors should ensure they’re not overly reliant on any single asset.

Additionally, keeping an eye on the evolving regulatory landscape and technological advancements will be crucial for informed decision-making.

In Conclusion

The financial world is undoubtedly changing, and Ric Edelman’s recommendation for a significant allocation to Bitcoin and crypto could be a game-changer for investors and financial advisors alike. With the right knowledge and approach, embracing cryptocurrencies may provide unique opportunities for growth and diversification in investment portfolios.

As we navigate this exciting landscape, staying informed and educated will be essential for making sound investment decisions. Whether you’re a seasoned investor or just starting, the world of cryptocurrencies is worth exploring—and it could very well be the future of finance.