“Shockwaves in Crypto: Mysterious Buyer Snags $270 Million in Bitcoin!”

Bitcoin investment news, cryptocurrency market trends, institutional buying strategies

—————–

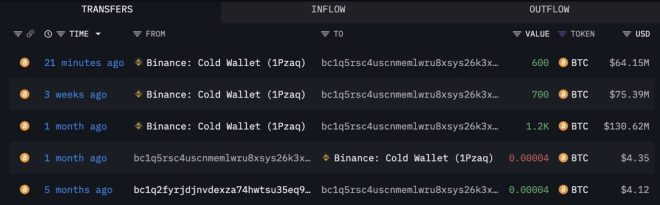

Breaking News: Massive Bitcoin Purchase of $270 Million

In an unprecedented move in the cryptocurrency market, a major player has just acquired a staggering $270 million worth of Bitcoin. This significant purchase has ignited discussions and speculation within the crypto community, leading to various implications for the future of Bitcoin and the broader market.

Understanding the Impact of the Purchase

The purchase of $270 million in Bitcoin is not just a financial transaction; it represents a pivotal moment for the cryptocurrency market. Such a large-scale acquisition can influence market dynamics, including price fluctuations, investor sentiment, and overall market stability. This particular transaction has been highlighted by Crypto Rover, a well-known figure in the crypto space, amplifying its visibility and importance.

Bitcoin’s Volatility and Market Dynamics

Bitcoin, the pioneer of cryptocurrencies, has always been known for its volatility. Major purchases like this one can cause significant price movements. When a substantial amount of Bitcoin is bought, it often leads to increased demand, which can drive prices up. Conversely, if the market perceives this as a signal of impending sell-offs or profit-taking, it could lead to price declines.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Role of Institutional Investors

This purchase raises questions about the role of institutional investors in the cryptocurrency market. Over the past few years, more institutional players have begun to enter the crypto space, viewing it as a legitimate asset class. This trend is likely to continue, with large-scale purchases becoming more common as institutions seek to diversify their portfolios and hedge against inflation.

Market Sentiment and Future Predictions

The sentiment within the crypto community following this announcement is mixed but largely optimistic. Many investors see this as a bullish sign, indicating confidence in Bitcoin’s long-term value. Others express caution, reminding peers of the inherent risks associated with cryptocurrency investments. As market sentiment evolves, it will be interesting to see how other investors react to this significant purchase.

The Future of Bitcoin: What Lies Ahead?

With this massive investment, the future of Bitcoin seems more promising than ever. As institutional interest grows, Bitcoin could solidify its position as a mainstream asset. However, challenges remain, including regulatory scrutiny and market volatility. Investors should stay informed and consider these factors as they navigate the ever-changing landscape of cryptocurrency.

Conclusion

The acquisition of $270 million worth of Bitcoin is a landmark event in the crypto world, reflecting growing institutional interest and the potential for Bitcoin’s future as a significant asset class. As the market reacts, investors should remain vigilant and informed about the implications of such large transactions on Bitcoin’s price and overall market dynamics. The coming days will likely bring further developments and insights as the cryptocurrency market continues to evolve.

BREAKING:

SOMEONE JUST BOUGHT $270 MILLION WORTH OF #BITCOIN. pic.twitter.com/1fgJ4ldpZD

— Crypto Rover (@rovercrc) June 27, 2025

RELATED VIDEO STORY: 2025-06-27 11:21:00

BREAKING:

SOMEONE JUST BOUGHT $270 MILLION WORTH OF #BITCOIN.

BREAKING:

Imagine waking up to the news that someone has just dropped a jaw-dropping $270 million on Bitcoin. Yes, you read that right! In a world where cryptocurrency is constantly evolving, this kind of news sends ripples through the market and catches everyone’s attention. But what does this huge purchase mean for Bitcoin and the broader crypto ecosystem? Let’s dive into the details.

SOMEONE JUST BOUGHT $270 MILLION WORTH OF #BITCOIN

This monumental transaction, highlighted by Crypto Rover on Twitter, showcases the confidence that some investors have in Bitcoin’s future. Such significant investments often indicate a bullish market sentiment. But before we dissect the implications, let’s take a step back and understand what Bitcoin is all about.

What is Bitcoin?

Bitcoin is the original cryptocurrency, created in 2009 by an anonymous person or group known as Satoshi Nakamoto. Unlike traditional currencies issued by governments (like the US Dollar or the Euro), Bitcoin operates on a decentralized network using blockchain technology. This means that transactions are verified and recorded across multiple computers, making it secure and resistant to fraud.

The Rise of Bitcoin

Bitcoin started off as a niche project, but over the years, it has gained immense popularity. Initially valued at just a few cents, it skyrocketed to nearly $65,000 in 2021. The meteoric rise has attracted not only individual investors but also institutional players. Companies like Tesla and Square have invested heavily in Bitcoin, further legitimizing it as a valid asset class.

What Does a $270 Million Purchase Mean?

A purchase of this magnitude can signify several things. First, it shows that the investor (or group of investors) believes in Bitcoin’s long-term value. With such a hefty investment, they are likely betting on future price increases. Often, large purchases like these can influence market trends, encouraging others to invest as well.

The Impact on the Market

Whenever a major transaction occurs in the crypto space, it can lead to increased volatility. Generally, a large buy can push prices up as it signals demand. Conversely, if the market perceives that the purchase might be a part of a larger sell-off or manipulation, it could lead to panic selling. The impact of this $270 million purchase will depend on how the market reacts in the coming days and weeks.

Institutional Interest in Bitcoin

Institutional interest in Bitcoin has been a game-changer. Before 2020, Bitcoin was primarily seen as a retail investment. However, as institutions began to enter the space, it brought a level of legitimacy that had previously been absent. This latest purchase is another sign that big players are still very much interested in Bitcoin. With hedge funds, asset managers, and even pension funds looking to diversify their portfolios with cryptocurrencies, Bitcoin remains at the forefront.

Why Invest in Bitcoin?

There are several reasons why investors are flocking to Bitcoin. For one, it is seen as a hedge against inflation. With central banks printing money at an unprecedented rate, many investors are looking for alternative stores of value. Bitcoin’s capped supply of 21 million coins gives it scarcity, setting it apart from fiat currencies.

Risks Associated with Bitcoin Investments

While Bitcoin has its advantages, it is not without risks. The market is incredibly volatile, with prices fluctuating dramatically in short periods. Regulatory concerns are also prevalent, as governments worldwide grapple with how to handle cryptocurrencies. Additionally, the security of exchanges and wallets is paramount; many investors have lost significant sums due to hacks or scams.

Bitcoin’s Future Outlook

The outlook for Bitcoin continues to be optimistic, especially with increasing adoption and mainstream acceptance. As more businesses begin to accept Bitcoin as a form of payment and more financial products centered around cryptocurrencies are developed, the demand is likely to rise. However, it’s essential for investors to remain cautious and do their due diligence.

Community and Culture around Bitcoin

Bitcoin is not just a financial tool; it’s also a cultural phenomenon. The community surrounding Bitcoin is passionate and dedicated, often engaging in lively discussions about its future and the philosophy behind decentralized finance. This community support can play a crucial role in Bitcoin’s resilience as it faces challenges.

Conclusion: What’s Next for Bitcoin?

As we reflect on the news of this monumental $270 million purchase, it’s clear that Bitcoin continues to capture the imagination of investors worldwide. Whether you’re a seasoned crypto enthusiast or just dipping your toes into the waters, keeping an eye on such significant transactions can provide insights into market trends. The excitement surrounding Bitcoin is palpable, and with its dynamic nature, there’s always something new to learn and explore.

“`

This article provides a detailed overview of the recent Bitcoin purchase, its implications, and the broader context of cryptocurrency investments. It engages readers by using a conversational tone and personal pronouns while ensuring that the information is informative and relevant, making it suitable for SEO purposes.