“NYC Politician Proposes Controversial Tax on ‘Whiter Neighborhoods’!”

tax policy reform, urban equity initiatives, progressive taxation strategies

—————–

Overview of Zohran Mamdani’s Proposal on Taxation in NYC

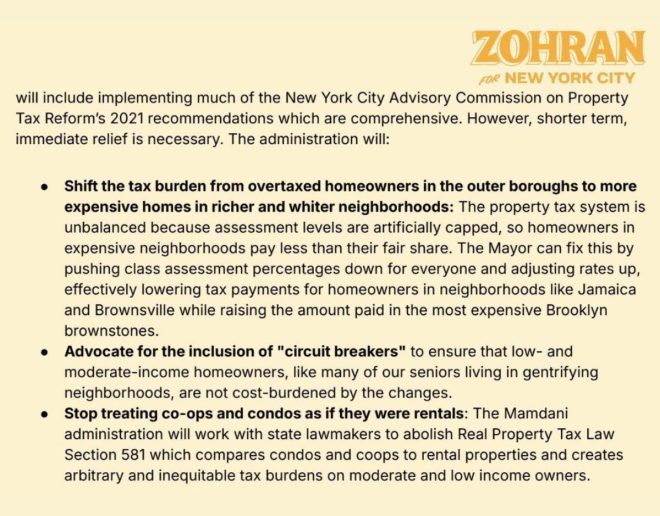

In a recent tweet that has sparked considerable debate, New York City politician Zohran Mamdani suggested implementing a tax system that would disproportionately affect wealthier, predominantly white neighborhoods. This controversial stance has ignited discussions about equity, taxation, and the socioeconomic landscape of New York City. In this summary, we will explore the implications of Mamdani’s proposal, the reactions it has generated, and the broader context of taxation and social equity.

Understanding Mamdani’s Proposal

Zohran Mamdani, a member of the New York state Assembly, advocates for a taxation model that aims to address systemic inequities in wealth distribution. By proposing to tax "whiter neighborhoods" more heavily, Mamdani seeks to generate revenue that could be redirected toward underfunded communities, particularly those with higher populations of people of color. The rationale behind this proposal hinges on the belief that wealthier neighborhoods have historically benefited from policies that maintain the status quo of socioeconomic disparities.

The Rationale Behind Targeted Taxation

Mamdani’s argument is rooted in the concept of social equity, which posits that resources should be allocated in a manner that rectifies historical injustices. In New York City, there is a stark contrast between affluent neighborhoods and those that are economically disadvantaged. By taxing wealthier areas at a higher rate, Mamdani believes it is possible to fund programs that uplift marginalized communities, including education, healthcare, housing, and infrastructure improvements.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Additionally, proponents of this approach argue that it can foster a sense of shared responsibility among residents. By ensuring that wealthier neighborhoods contribute more to the city’s overall welfare, Mamdani’s proposal aims to promote social cohesion and combat systemic inequities.

Public Reaction and Controversy

The tweet announcing Mamdani’s stance quickly garnered attention, eliciting a range of reactions from the public and political figures. Supporters applaud the initiative as a bold step toward rectifying long-standing injustices, emphasizing the need for a fairer taxation system that reflects the diverse needs of all communities. They argue that wealth redistribution is essential for fostering equity and that those who have benefitted from systemic advantages should contribute more to the collective good.

Conversely, critics of Mamdani’s proposal argue that such a tax system could lead to further division and resentment among residents. Detractors label the idea as discriminatory, suggesting that it unfairly targets individuals based on their race and geographic location. Some fear that this approach could exacerbate tensions between communities and undermine the social fabric of the city.

The Broader Context of Taxation and Equity in NYC

Mamdani’s proposal must be viewed within the broader context of ongoing debates surrounding taxation, equity, and social justice in urban settings. New York City has long grappled with issues of income inequality, housing affordability, and access to essential services. The COVID-19 pandemic has further highlighted these disparities, as marginalized communities have faced disproportionate challenges in terms of health, economic stability, and access to resources.

As cities across the United States search for solutions to address systemic inequities, proposals like Mamdani’s are increasingly coming to the forefront. Advocates for progressive taxation argue that it is a necessary tool for addressing the wealth gap and promoting social justice. They contend that cities should implement policies that prioritize the needs of the most vulnerable residents, even if it means imposing higher taxes on wealthier individuals and neighborhoods.

Potential Implications of Mamdani’s Proposal

If implemented, Mamdani’s taxation model could have far-reaching implications for New York City. One potential outcome is increased funding for public services in underprivileged neighborhoods, which could lead to improved education, healthcare, and social services. By reallocating resources, the city could work toward leveling the playing field for disadvantaged communities, ultimately fostering greater social mobility.

However, there are also potential risks associated with this approach. The implementation of a targeted tax could lead to a backlash from wealthier residents, potentially resulting in legal challenges or political opposition. Furthermore, if not carefully designed, such a tax system could inadvertently discourage investment and economic growth in the very neighborhoods that are being targeted, leading to unintended consequences.

Conclusion

Zohran Mamdani’s proposal to tax "whiter neighborhoods" in New York City has ignited a critical conversation about equity, taxation, and social justice. While supporters view it as a necessary step toward addressing historical injustices and promoting social cohesion, critics raise concerns about potential discrimination and division. As cities continue to grapple with issues of income inequality and resource allocation, Mamdani’s proposal serves as a focal point for broader discussions about the role of taxation in fostering a more equitable society.

The outcome of this debate will likely shape New York City’s approach to taxation and social equity for years to come, highlighting the importance of engaging with diverse perspectives on such a complex issue. As the conversation continues, it remains essential for policymakers to seek solutions that balance the needs of all residents while fostering a spirit of collaboration and shared responsibility. In an era where social justice is at the forefront of public discourse, Mamdani’s proposal represents a significant moment in the ongoing struggle for equity in urban governance.

BREAKING

Zohran Mamdani supports taxing “whiter neighborhoods” more in NYC..

WTF!? pic.twitter.com/XFBB7d60r3

— American AF (@iAnonPatriot) June 27, 2025

BREAKING

In a bold and controversial statement, New York City council member Zohran Mamdani has proposed a new taxation policy that aims to address socioeconomic disparities across the city. His suggestion? To impose higher taxes on “whiter neighborhoods.” This has sparked a heated debate among residents, policymakers, and social activists. The topic has rapidly gained traction on social media, with many expressing their disbelief and outrage. The question on everyone’s lips: WTF!?

Zohran Mamdani Supports Taxing “Whiter Neighborhoods” More in NYC

Mamdani’s proposition is rooted in the idea of equity in taxation. He argues that wealthier, predominantly white neighborhoods should contribute more to city revenue, which can then be redistributed to support underserved communities. By targeting these neighborhoods, Mamdani seeks to tackle the systemic inequalities that have long plagued New York City. His supporters believe that this approach could lead to better funding for schools, infrastructure, and social services in areas that need it most.

However, critics of this proposal are quick to label it as divisive and overly simplistic. Many argue that taxing neighborhoods based on racial demographics is not the solution to the deep-seated issues of inequality. Instead, they suggest focusing on economic status rather than race when considering tax policies. This perspective raises valid points about the complexity of urban economics and the potential pitfalls of categorizing communities based on race.

Public Reaction to Mamdani’s Proposal

The response to Mamdani’s comments has been nothing short of explosive. Social media platforms have been flooded with reactions, memes, and discussions. Some users have expressed strong support for Mamdani, echoing the sentiment that wealthier neighborhoods should bear a greater burden in funding social programs. Others, however, have reacted with anger and disbelief, suggesting that such policies could further divide communities rather than unite them.

For instance, a tweet from American AF stirred the pot, questioning the rationale behind taxing neighborhoods based on race. This kind of polarizing discourse highlights the broader struggle in American society to reconcile issues of race, wealth, and community responsibility.

Understanding the Implications of Taxing Based on Demographics

When we dive into the implications of Mamdani’s proposal, it’s essential to consider its potential effects on both the wealthy neighborhoods and the communities intended to benefit from the increased revenue. Supporters argue that by taxing affluent areas, the city can create a more equitable society. They envision better-funded public services, improved schools, and enhanced infrastructure that would ultimately lift marginalized communities.

On the flip side, critics warn that such a tax may lead to unintended consequences. Wealthy residents might choose to relocate to avoid higher taxes, which could result in reduced funding for the very programs Mamdani seeks to bolster. This could create a cycle where the city loses its affluent tax base, ultimately harming the communities that depend on public funding the most.

The Broader Context of Taxation and Equity

Taxation has always been a contentious issue, particularly in a diverse city like New York. The debate often centers around who should pay for public services and how to ensure that all communities are treated fairly. Historically, tax policies have favored wealthy individuals and neighborhoods, leading to a widening wealth gap that many argue is unsustainable. Mamdani’s proposal can be seen as a response to this inequality, aiming to disrupt the status quo and push for a more equitable distribution of resources.

Moreover, this conversation isn’t happening in a vacuum. Cities across the United States are grappling with similar issues. From Brookings Institution studies to local government initiatives, the discussion on race, wealth, and taxation is at the forefront of urban policy debates. Mamdani’s comments resonate not just in New York but across the nation, reflecting a growing awareness of the need for systemic change.

Is Taxing “Whiter Neighborhoods” the Answer?

The question remains: is taxing “whiter neighborhoods” the right approach? While the intention behind Mamdani’s proposal may be to create equity, the execution and actual impact of such a policy are complex. Many believe that addressing economic disparities requires a more nuanced understanding of the issues at play rather than a one-size-fits-all solution.

This approach could risk alienating potential allies who might otherwise support efforts to improve conditions in underserved communities. Instead of focusing solely on race, a broader discussion about economic class and wealth distribution might yield more productive results. After all, many residents in affluent neighborhoods are not wealthy by virtue of their race alone; they may also be struggling to make ends meet.

Moving Forward: A Call for Inclusive Dialogue

As the debate surrounding Mamdani’s proposal continues, it is crucial for all stakeholders to engage in an inclusive dialogue. The focus should be on exploring all potential solutions to address income inequality and ensure that every community has access to the resources it needs to thrive. Collaboration between neighborhoods, local governments, and community organizations can pave the way for innovative solutions that benefit everyone.

Ultimately, the challenge lies in finding a balance that addresses the needs of all communities without fostering division. By emphasizing shared goals and mutual understanding, New York City can move towards a more equitable future where taxation serves as a tool for positive change rather than a source of contention.

The Future of Taxation in New York City

As we look ahead, the future of taxation in New York City will undoubtedly be shaped by ongoing discussions like the one sparked by Mamdani. Policymakers must be willing to think outside the box and consider new approaches that prioritize equity without compromising community cohesion. The challenge is significant, but with open minds and collaborative efforts, it is possible to create a tax system that benefits all New Yorkers.

In conclusion, the discourse surrounding Zohran Mamdani’s proposal to tax “whiter neighborhoods” has opened up critical conversations about race, wealth, and community responsibility. While the reactions have been mixed, one thing is clear: the need for a fair and equitable tax system is more pressing than ever. As New York City navigates these complex issues, the hope is that we can come together to find solutions that uplift all communities.

“`