“Shocking $316 Billion Deficit: Is the US Economy on the Brink of Collapse?”

US budget deficit analysis, government spending trends 2025, tariff revenue increases

—————–

Understanding the U.S. Treasury’s Budget Deficit: May 2025 Overview

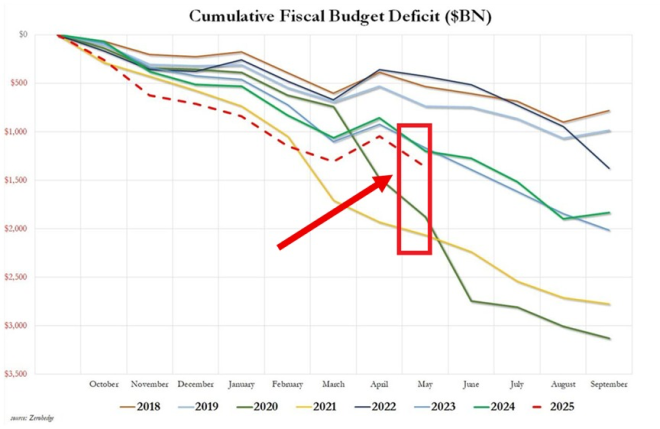

In May 2025, the U.S. Treasury reported a staggering budget deficit of $316 billion, marking it as the third-largest deficit on record. This significant financial shortfall raises questions about government spending, economic health, and revenue generation amidst rising expenditures.

Breakdown of Government Spending

In May, total government outlays reached $687 billion, reflecting a 3% increase year-over-year. This upward trend in spending can be attributed to various factors, including increased funding for social programs, infrastructure projects, and interest payments on national debt. As the government continues to invest in critical areas, the rise in expenditures highlights the ongoing challenges in managing the federal budget effectively.

Tariff Revenue Surge

Interestingly, while the budget deficit soared, tariff revenue saw a remarkable surge of 270% year-over-year, reaching a record $23 billion. This increase in tariff revenue can be linked to the government’s trade policies and efforts to bolster domestic industries. However, despite this impressive growth in tariff income, it barely made a dent in the overall budget deficit, underscoring the enormity of the financial challenges faced.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Implications of the Deficit

The $316 billion budget deficit in May 2025 has significant implications for the U.S. economy. A persistent deficit can lead to increased national debt, which may impact interest rates and economic growth in the long run. Furthermore, ongoing budget shortfalls raise concerns about the sustainability of government programs and the ability to fund future initiatives without accruing further debt.

Economic Context

It’s essential to place this deficit within the broader economic context. The U.S. economy has been navigating a complex landscape characterized by fluctuating inflation rates, changes in consumer behavior, and evolving global trade dynamics. These factors can affect government revenue and spending patterns, contributing to the overall fiscal situation.

Future Outlook

As we look ahead, the challenge for policymakers will be to address the structural issues contributing to the budget deficit. This may involve a combination of strategies, including reevaluating spending priorities, enhancing revenue generation methods, and exploring fiscal reforms. The goal will be to create a more balanced budget that supports economic growth while ensuring the sustainability of government programs.

In summary, the U.S. Treasury’s reported budget deficit of $316 billion in May 2025 reflects significant spending increases and revenue challenges. The sharp rise in tariff revenue is noteworthy but insufficient to counterbalance the overall deficit. Understanding these dynamics is crucial for evaluating the future fiscal health of the nation and the potential impacts on the economy.

BREAKING: The US Treasury posted a $316 billion budget deficit in May, the third-largest on record.

This comes as total government outlays rose 3% from YoY, to $687 billion, per ZeroHedge.

And, while tariff revenue surged 270% YoY, to a record $23 billion, it barely made a dent… pic.twitter.com/o7Ac7DvfgA

— The Kobeissi Letter (@KobeissiLetter) June 25, 2025

BREAKING: The US Treasury Posted a $316 Billion Budget Deficit in May

It’s hard to ignore the latest financial headlines coming out of the US Treasury, and this one is a doozy. The US Treasury posted a staggering $316 billion budget deficit in May, marking it as the third-largest deficit on record! The numbers are enough to make anyone sit up and take notice—especially with the current economic climate.

This Comes as Total Government Outlays Rose 3% from YoY, to $687 Billion

The financial landscape is shifting, and part of that shift is attributed to the increase in government spending. Total government outlays rose 3% year-over-year, bringing the total to an eye-watering $687 billion. This uptick in spending raises a few eyebrows, especially when you consider the implications it may have on the national debt and future economic stability.

Tariff Revenue Surged 270% YoY, to a Record $23 Billion

Now, let’s talk about tariffs. While we’ve all heard of the ongoing trade battles, the recent numbers show that tariff revenue has surged by an incredible 270% year-over-year, reaching a record $23 billion. That’s a significant jump! However, it’s almost ironic that despite this remarkable increase, it barely made a dent in the overall budget deficit. This begs the question: how sustainable is this reliance on tariffs?

The Broader Economic Impact

When examining these numbers, it’s crucial to understand their broader implications. A budget deficit of $316 billion doesn’t just impact government spending; it can also affect everything from interest rates to inflation. The rise in government outlays suggests increased spending on social programs, defense, and various governmental operations. But can the economy sustain such a trajectory?

Moreover, the surge in tariff revenue implies that the government is attempting to leverage trade policies to its advantage. However, trade wars often lead to unintended consequences, such as retaliatory tariffs from other countries, which can hurt American businesses and consumers alike.

Understanding the Deficit

So, why should you care about a budget deficit? Well, budget deficits occur when a government’s expenditures exceed its revenues. This situation often leads to increased borrowing, which can raise national debt levels. As someone who is financially savvy (or at least trying to be), you know that high national debt can lead to higher taxes and reduced public services in the long run.

The fact that this deficit is the third-largest on record is alarming. It indicates that we’re not just dealing with a temporary issue; this could potentially lead to long-lasting economic challenges if not addressed properly. With the government spending more than it brings in, it raises concerns about fiscal responsibility.

Future Projections

Looking ahead, one can’t help but wonder how these numbers will play out in the coming months and years. Will the government continue to increase spending? Or will there be a pushback against such deficits? Economic experts are divided on this issue, and the future remains uncertain. What we do know is that these trends can shape policy decisions and economic strategies.

The Role of Tariffs

Tariff revenue is a fascinating point of discussion. While the $23 billion collected is substantial, how does it fit into the bigger picture? Tariffs are taxes imposed on imported goods, which can protect domestic industries but can also lead to higher prices for consumers. If the government relies heavily on this revenue stream, it may deter free trade, which has historically contributed to economic growth.

Moreover, the volatility of tariff revenue can be problematic. It’s subject to change based on trade agreements, international relations, and economic conditions. So, while the government may be celebrating record tariff collections today, what happens if those numbers drop tomorrow?

Public Sentiment and Political Ramifications

Public sentiment about government spending and budget deficits is a mixed bag. Many Americans are concerned about national debt and fiscal responsibility, while others see the value in increased government spending to stimulate the economy, especially during turbulent times. This divide can lead to political ramifications, influencing elections and policy-making.

Politicians often use budget deficits as talking points, either advocating for stricter spending controls or pushing for increased investments in public services. As a voter, it’s essential to stay informed about these issues, as they directly impact your life and the economy as a whole.

Your Takeaway

The recent news of the US Treasury posting a $316 billion budget deficit in May is a wake-up call. With total government outlays rising and tariff revenues soaring yet not significantly alleviating the deficit, there are many layers to unpack. Understanding these financial dynamics is key to grasping how they affect our economy, government policies, and ultimately, your pocketbook.

As we navigate this complex financial landscape, staying informed and engaged with economic issues is more important than ever. Whether you’re an investor, a business owner, or a concerned citizen, these developments are worth your attention. Keep an eye on the trends, and remember that knowledge is power in today’s ever-changing economic environment.